- Home

- »

- Paints, Coatings & Printing Inks

- »

-

India Pearlescent Pigment Market Size Report, 2030GVR Report cover

![India Pearlescent Pigment Market Size, Share & Trends Report]()

India Pearlescent Pigment Market Size, Share & Trends Analysis Report By Product, By Application (Paint & Coatings, Plastics, Printing Inks, Cosmetics, Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-567-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Report Overview

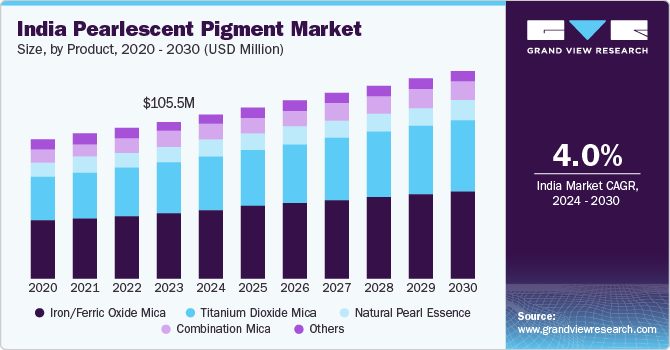

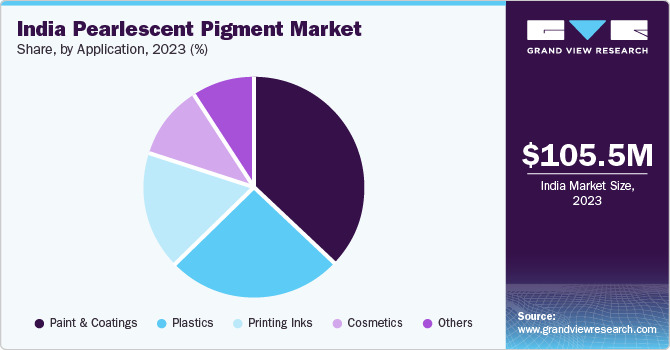

The India pearlescent pigment market size was valued at USD 105.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030. The market growth is driven by its widespread use in various industries such as cosmetics, plastics, paints & coatings, and others. Increasing disposable income levels and shifting consumer preferences towards more stylish and aesthetically appealing products also contribute to the growth of this market. The expanding use of iridescent pigments in the automotive industry is a major factor fueling the market growth. These pigments give vehicles a luxurious and high-end appearance in car exteriors and interiors. Advancements in pigment technology, such as developing eco-friendly and more durable pigments, are expected to influence demand during the forecast period.

A significant factor fueling the growth of the market is the increasing demand from the automotive sector. Over the past few years, India's automotive industry has shifted towards more sophisticated and aesthetically appealing designs, with pearlescent pigments playing a key role in achieving luxurious finishes owing to consumer demand. This is increase is primarily driven by the growing accessibility and availability of personalization and customization services in the country. Rapidly growing cosmetics industry is another significant factor contributing to the growth of this market. Customers have been preferring products that offer radiant and glowing results. Cosmetics companies and renowned brands operating in the cosmetics industry are expanding their product portfolios while featuring pearlescent pigments to cater to the growing market demand prioritizing premium and high-quality cosmetics.

Furthermore, advancements in pigment technology has been a crucial factor in market growth. Key market participants are continuously investing in research and development to create new and improved pearlescent pigments that cater to growing demand in both domestic and international markets. For instance, In March 2024, Sudarshan Chemical Industries launched Sudatherm Jet Black 6462K jet black copper chromite-based pigment designed to offer advanced pigment solutions with enhanced performance characteristics.

Product Insights

The iron/ferric oxide mica segment dominated the market and accounted largest revenue of 42.2% in 2023. The growth of this segment is driven by product's ability to create a range of colors and effects. This feature has made it a preferred choice among manufacturers and customers, leading to increased demand. The iron/ferric mica pigments have high temperature and chemical resistance capacities. This makes it relatively suitable for outdoor applications, ensuring the color and effect remain stable even in harsh environments. Furthermore, the pigment's non-toxic and environmentally friendly properties make it suitable for cosmetics, food packaging, and pharmaceuticals, thus driving segment growth.

The titanium dioxide mica segment is anticipated to witness the fastest CAGR during the forecast period. Titanium dioxide mica is widely used in various industries such as paints and coatings, plastics, and packaging materials owing to its unique properties create a luxuriousness and premium appearance. Furthermore, the growing demand for eco-friendly and sustainable products is fueling titanium dioxide mica's growth, as it is a more environmentally friendly alternative to traditional pearlescent pigments.

Application Insights

The paint & coatings segment dominated the India pearlescent pigment market in 2023. Rising income levels and increasing growth for industries such as automotive, infrastructure and others are fueling the demand. Paints & coatings are extensively used in various applications including, automotive, industrial, and architectural designs. The pigments are highly valued owing to their ability to create a range of colors, effect and radiant aesthetic appeals, enhancing the final product's value for customers. Furthermore, the growing trend of customization and differentiation in the automotive and industrial sectors has led to an increased demand for paint and coatings offering pearlescent effects, driving the growth of the market.

The plastics segment is expected to experience the fastest CAGR over the forecast period. The increasing popularity of high-end plastics and polymers in various industries, including automotive, electronics, and consumer goods, is a major growth factor, fueling the segment growth. Furthermore, advancements in technology have made it possible to use pearlescent pigments in a wider range of plastic applications that enhance the durability and application of the product. Moreover, the increasing focus on sustainable and innovative packaging solutions, including the use of visually striking pearlescent effects, is expected to generate greater growth for this segment in approaching years.

Key Companies & Market Share Insights

Some key companies involved in the India pearlescent pigment market include Sudarshan Chemical Industries Ltd., Plasti Pigments Pvt. Ltd., BASF, Merck KGaA and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Sudarshan Chemical Industries Ltd. is a renowned Indian company producing high-performance pigments and agrochemicals. The company markets its products under several brands, primarily in the pigment sector. Some of the notable brands are SUDAPERM, SUDAJET, SUDASOL and others.

-

Plasti Pigments Pvt. Ltd. is an Indian company established in 1967, specializing in the plastic and polymer industry. The company produces a wide range of products such as pigment powders, additives, organic peroxides, etc. Plasti Pigments company serves a wide range of industries including automotive, packaging, textiles, and consumer goods.

Key India Pearlescent Pigment Companies:

The following are the leading companies in the india pearlescent pigment market. These companies collectively hold the largest market share and dictate industry trends.

- Sudarshan Chemical Industries Ltd.

- Merck KGaA

- BASF

- FX Pigments

- Dev Tech (India) Pvt. Ltd

- Valspar

- Kolortek Co., Ltd.

- Kuncai

- Plasti Pigments Pvt. Ltd.

- DIC CORPORATION

- Premier Pigments & Chemicals

Recent Developments

-

In July 2024, LBB Specialties and Sudarshan Chemical Industries joined forces in latest partnership where LBB Specialties is going to become the channel partner for Sudarshan's effect offerings exclusively in United States and Canada. Sudarshan’s pigment line entail the Sumicos, Prestige, Sudacos and Sumicair ranges, which cater to the latest trends in color cosmetics.

-

In February 2024, BASF Coatings signed a preferred partnership agreement with INEOS Automotive to develop a global body and paint program, focusing on sustainable refinish solutions and exceeding industry standards. This long-term strategic collaboration aims to enable both companies to innovate and provide premium services to their customers.

India Pearlescent Pigment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 110.4 million

Revenue Forecast in 2030

USD 139.3 million

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Unit Kilotons, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, and region

Key companies profiled

Sudarshan Chemical Industries Ltd.; Merck KGaA; BASF; FX Pigments; Dev Tech (India) Pvt. Ltd; Valspar; Kolortek Co., Ltd.; Kuncai; Plasti Pigments Pvt. Ltd.; DIC CORPORATION; Premier Pigments & Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India pearlescent pigment market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, Unit Kilotons, 2018 - 2030)

-

Paint & Coatings

-

Plastics

-

Printing Inks

-

Cosmetics

-

Others

-

-

Application Outlook (Revenue, USD Million, Unit Kilotons, 2018 - 2030)

-

Natural Pearl Essence

-

Titanium Dioxide Mica

-

Iron/Ferric Oxide Mica

-

Combination Mica

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."