- Home

- »

- Medical Devices

- »

-

India Spectacles Market Size & Share, Industry Report, 2030GVR Report cover

![India Spectacles Market Size, Share & Trends Report]()

India Spectacles Market (2025 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Hospitals & Clinics, Online Stores, Retail Stores, Others), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-499-0

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Spectacles Market Size & Trends

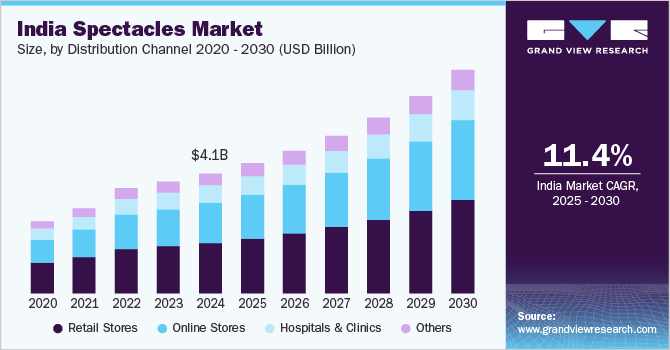

The India spectacles market size was estimated at USD 4.1 billion in 2024 and is expected to grow at a CAGR of 11.4% from 2025 to 2030. Urbanization and screen-related eye strain boost demand for corrective lenses. Fashion trends and affordable eyewear options encourage adoption among younger demographics. Government initiatives for vision health and corporate collaborations with optometry programs improve accessibility. Expanding e-commerce platforms simplify eyewear purchases, particularly in rural areas. The surge in demand for prescription glasses and blue-light blocking lenses due to digital device usage further propels growth. Innovations in lens technology and customizable frames also enhance consumer appeal in this evolving market.

The increasing prevalence of ocular conditions such as cataracts, glaucoma, dry eye syndrome, macular degeneration, and conjunctivitis is driving growth in India’s spectacles market. Cataracts, a leading cause of curable blindness, impact millions, with programs like NPCBVI offering subsidies and free surgeries, though high out-of-pocket expenses persist. Glaucoma remains underdiagnosed, affecting 11.2 million people over 40, with only 20% aware of their condition. Dry eye syndrome, linked to rising screen time, and macular degeneration, seen in 2.7%-4.7% of individuals over 40, further fuels demand for corrective eyewear.

Conjunctivitis cases have surged, driven by adenovirus outbreaks. Gujarat reported 2.17 lakh cases since June, and Maharashtra recorded 87,761 in July, with Buldhana worst-hit (13,550 cases). AIIMS Delhi treats over 100 cases daily. A LocalCircles survey of 14,000 respondents in Delhi, Maharashtra, and Karnataka found 27% of Delhi NCR households were recently affected. Health advisories aim to curb the spread in cities like Mumbai, Pune, and Nagpur.

NGOs play a pivotal role in addressing these challenges, particularly in underserved and rural areas. Their initiatives bridge gaps in access to affordable, high-quality eye care by focusing on innovation and community outreach. In June 2024, the Tamil Nadu-based Coimbatore Sankara Eye Foundation, supported by G.D. Naidu Charities, unveiled India’s first Innovation Lab for Eye Care. This groundbreaking facility is dedicated to advancing eyecare through research, development, and training. By leveraging innovative approaches, the center aims to serve remote rural villages, enhancing diagnoses, prevention, and treatment for the underserved population.

Technological innovations are playing a crucial role in the growth of India’s spectacles market by offering solutions that cater to the evolving needs of consumers. Key advancements like smart eyewear, digital lenses, and enhanced coatings are transforming the industry. Leading brands such as Lenskart, Titan Eyeplus, and players like EssilorLuxottica and Carl Zeiss are at the forefront of this evolution, delivering state-of-the-art products and personalized services. The In-Optics exhibition, held in March 2024, highlighted India's growing influence in the optical market, with over 200 exhibitors and 12,000 attendees. The event underscored India’s role as a hub for manufacturing and R&D in the eyewear sector, fostering trade, collaboration, and innovation. The expressions that support our sayings are,

"Indian Eyewear market is growing at a very fast rate. This growth is driven by an increasing number of people requiring vision correction due to aging populations, increasing screen time, and changing consumer preferences, such as an increasing focus on health and wellness, and a growing awareness of the importance of preventive eye care. Furthermore, the market is being impacted by changing fashion trends, with consumers looking for eyewear products that are both functional and fashionable. Also, the rising e-commerce sector has led to the growth,"

-Harish Kumar, CEO, RSD Expositions.

India is experiencing rapid aging, with the elderly population projected to rise from 153 million in 2023 to 347 million by 2050, constituting over 20% of the population. This demographic shift fuels demand for spectacles, as age-related vision impairments like presbyopia and cataracts increase. Government initiatives like the National Programme for Health Care of the Elderly (NPHCE) and Elderline are addressing seniors' healthcare needs, while the "Silver Economy" offers growth opportunities. The “silver economy” presents a lucrative market for businesses to cater to aging consumers, emphasizing tailored healthcare products and services. Investments in elder-centric innovations, including spectacles designed for enhanced comfort and usability, align with the demographic’s unique needs. Specialized geriatric care, digital literacy, and disaster preparedness are vital strategies for inclusivity and well-being.

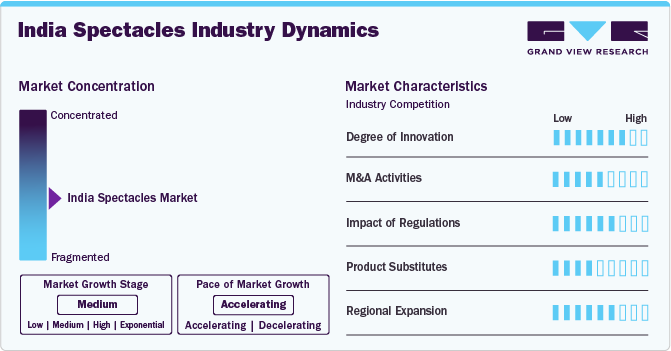

Market Concentration & Characteristics

India's spectacles industry is fragmented, featuring numerous local manufacturers alongside established global brands. Growing awareness of eye health, urbanization, and increased screen exposure drive demand for prescription glasses, fashion eyewear, and protective lenses. The sector benefits from rising disposable incomes and innovation in lens technology, such as blue-light filtering and lightweight materials. Organized retail chains and e-commerce platforms are expanding, enhancing accessibility and convenience. However, the industry faces challenges like price sensitivity and limited access in rural areas. A shift toward branded products and advanced designs reflects evolving consumer preferences, highlighting growth potential in this competitive and diverse market.

The India spectacles industry is seeing significant innovation, particularly in addressing specific vision needs. EyeMyEye introduced India’s first range of Color-Blind Glasses in July 2023, designed using advanced technology to enhance color contrast and vibrancy for those with Red-Green Color Blindness. These glasses, available as eyeglasses and sunglasses, improve the color spectrum for 80% of color-blind individuals, offering a richer visual experience. Innovations like these cater to niche markets while meeting evolving consumer demands. With a focus on affordability and technology, the industry continues to introduce cutting-edge solutions, driving growth and improving accessibility for diverse consumer segments.

Mergers and acquisitions (M&A) in the India spectacles industry are gaining momentum as companies seek to expand market share, enhance technological capabilities, and streamline operations. Notable deals, such as Lenskart's acquisition of Tango Eye in 2023, highlight the focus on integrating AI for improved customer experiences. Global brands entering the Indian market often partner with or acquire local firms to leverage established networks and cater to regional demands. Consolidation among smaller players is also emerging to compete with organized retail and e-commerce platforms. These activities reflect the industry's push for innovation, scalability, and market leadership amidst growing consumer demand.

Regulations significantly impact the India spectacles industry, ensuring product quality, safety, and consumer protection. Standards for lenses, frames, and coatings are governed by agencies like the Bureau of Indian Standards (BIS), ensuring compliance with global norms. Import policies and taxation affect pricing and the availability of advanced eyewear technologies. Stricter guidelines on advertising claims promote transparency, fostering consumer trust. E-commerce regulations, such as mandatory labeling and return policies, enhance online sales credibility. However, unregulated local manufacturers pose challenges to maintaining uniform quality standards. Overall, regulatory frameworks encourage innovation, consumer confidence, and market competitiveness while addressing affordability and accessibility concerns.

The India spectacles market faces competition from various product substitutes, including contact lenses, intraocular lenses (IOLs), and corrective eye surgeries like LASIK. Contact lenses offer convenience and aesthetic appeal, particularly among younger consumers. Innovations like Alcon's Clareon IOLs, launched in 2024, provide advanced solutions for vision correction, challenging traditional spectacles. Corrective surgeries, though costly, attract consumers seeking permanent vision correction. Additionally, advancements in augmented reality (AR) and smart glasses may divert demand from conventional eyewear. Despite these alternatives, affordability, accessibility, and the non-invasive nature of spectacles ensure their continued relevance, especially in rural and price-sensitive markets across India.

In October 2024, Lenskart marked a significant expansion by opening its first store on Mall Road in Mussoorie, Uttarakhand. Covering 580 square feet, the store offers trendy eyewear along with complimentary eye tests for local residents. This brings the total number of Lenskart stores in Uttarakhand to 25, including 15 in Dehradun. The move underscores Lenskart’s dedication to enhancing eyewear accessibility in regional areas. By strengthening its presence in Tier 2 and 3 cities, the company taps into the rising demand for affordable, high-quality eyewear. As online shopping grows, Lenskart's physical store network boosts customer engagement and market reach.

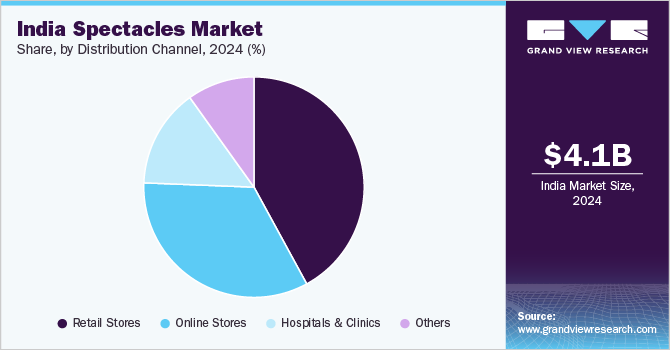

Distribution Channel Insights

The retail stores segment dominated the market and accounted for the largest revenue share of around 42.1% in 2024. This significant share can be attributed to the widespread presence of optical retail chains and independent stores across urban and rural areas. Physical stores provide customers with the advantage of personalized services, including eye tests, frame fittings, and immediate product access. Furthermore, the growing demand for trendy eyewear and premium brands has driven foot traffic to retail outlets. While e-commerce continues to grow, brick-and-mortar stores remain a critical touchpoint for consumers seeking a tangible, in-person shopping experience.

The online stores segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the increasing penetration of e-commerce platforms, convenience, and wider product selection available to consumers. Online stores offer competitive pricing, easy home delivery, and the ability to explore a variety of eyewear options, including branded and customizable products. With the rise in digital literacy, improved payment systems, and a growing preference for online shopping, more consumers are opting for online purchases. This shift is further accelerated by digital marketing and targeted advertisements.

Key India Spectacles Company Insights

Some of the key providers in the market are Lenskart and Titan. These are the pioneering companies offering a range of spectacles. These companies have leveraged their technological expertise to establish a foothold in this emerging market. Both companies focus on affordability, ease of use, and accessibility.

Key India Spectacles Companies:

- Carl Zeiss

- Titan

- Lenskart

- Glaze Opticals.

Recent Developments

-

In April 2024, Dr. Basu Eye Hospital and Jagat Pharma plans to expand with five new hospitals across metro cities, including Maharashtra and Bangalore. To enhance accessibility, they aim to strengthen their online presence, offering Ayurvedic treatments and products online. Their unique approach blends traditional Ayurvedic methods with modern diagnostics, addressing conditions like cataracts (up to 70% maturity), diabetic retinopathy, and glaucoma.

-

In July 2023, Voyage Eyewear, a leading online luxury brand, launched a new sunglasses collection, emphasizing craftsmanship and individuality. It partnered with Bollywood actor Aditya Seal to launch a campaign showcasing top-selling designs. This collaboration included social media initiatives and exclusive launches, boosting brand awareness and redefining eyewear fashion.

-

In November 2023, Sunglass Hut opened its 85th store in India at DLF Cyber Hub, Gurugram, known for the latest trends in functional eyewear, Sunglass Hut continues to bolster its market presence both offline and online.

India Spectacles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.4 billion

Revenue forecast in 2030

USD 7.6 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel

Region scope

India

Key companies profiled

Carl Zeiss; Titan; Lenskart; Glaze Opticals.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Spectacles Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India spectacles market report based on distribution channe:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Online Stores

-

Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The India spectacles market size was estimated at USD 4.1 billion in 2024 and is expected to reach USD 4.4 billion in 2025.

b. The India spectacles market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 7.6 billion by 2030.

b. Retail stores dominated the India spectacles market with a share of 42.1% in 2024, driven by their wide accessibility and personalized customer experience.

b. Some key players operating in the India spectacles market include: Carl Zeiss, Titan, Lenskart, Glaze Opticals.

b. The India spectacles market is driven by rising awareness of vision care, increasing cases of refractive errors, and expanding access to affordable eyewear. Growing urbanization and fashion trends boost demand for stylish spectacles. Retail and e-commerce advancements further enhance market growth through accessibility and convenience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.