- Home

- »

- Beauty & Personal Care

- »

-

India Sunscreen Market Size & Share, Industry Report, 2030GVR Report cover

![India Sunscreen Market Size, Share & Trends Report]()

India Sunscreen Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Lotion, Cream, Spray, Gels, Sticks), By Type (Mineral/Physical, Chemical), By SPF, By End-use, By Distribution Channels, And Segment Forecasts

- Report ID: GVR-4-68040-595-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Sunscreen Market Size & Trends

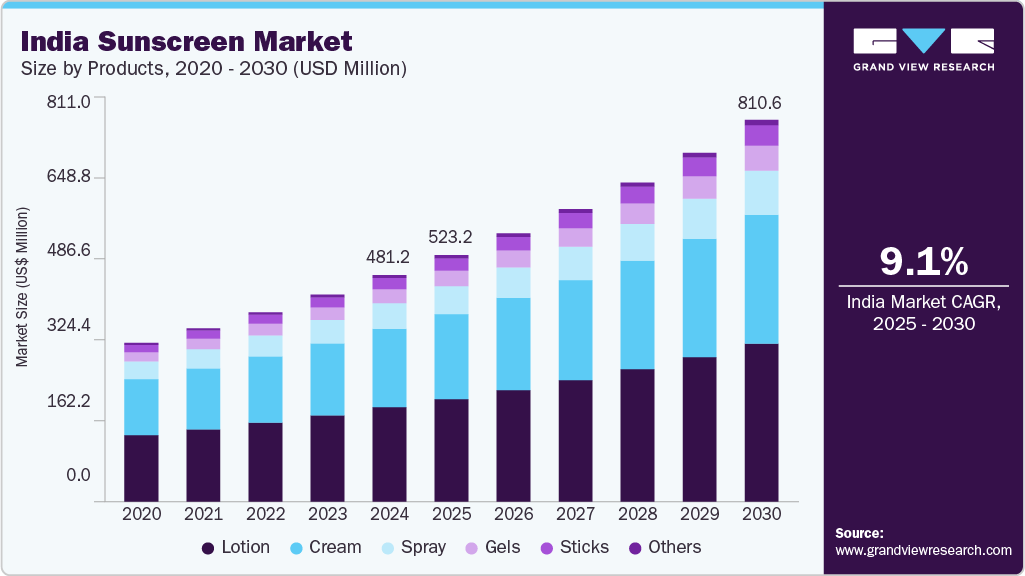

The India sunscreen market size was estimated at USD 481.2 million in 2024 and is expected to grow at a CAGR of 9.1% from 2025 to 2030. The Indian sunscreen industry is experiencing significant growth, driven by increasing awareness of skin health and a rising preference for sun protection products. Due to rapid urbanization, individuals spend more time outdoors for work and leisure. The increased sun exposure has heightened awareness about the harmful effects of UV rays, leading to a surge in sunscreen usage as a protective measure.

Consumers are now seeking products that combine skincare benefits with sun protection. Sunscreens enriched with ingredients like vitamin C, niacinamide, and squalene are gaining popularity, catering to the demand for multifunctional beauty products. For instance, India's leading makeup brand, Lakmé, has introduced a collection of new suncare products this summer, acknowledging that a major barrier preventing users from trying regular sunscreens is how they feel or appear on the skin - often oily, dull, sticky, sweaty, or leaving a white residue. Lakmé Sun Expert 1% Hyaluronic Complex Aqua Sun Gel employs hydro-gel technology for a lightweight formula that feels almost like water on the skin to overcome this issue. The Lakmé Sun Expert Invisible SPF 50 Sunscreen Stick is completely invisible on the skin. Unlike typical sunscreens that often create a visible cast, it can be used over makeup. The brand's Sun Tinted Spray offers sun filters and skin emollients in a water-based formulation.

Innovations such as spray sunscreens and stick formulations have made sun protection more convenient, appealing to busy-conscious consumers. These formats offer easy application without rubbing, making them ideal for on-the-go use. The expansion of online and offline channels has boosted brand accessibility, reaching tier 2 and tier 3 markets. E-commerce leads this growth, while many brands adopt omnichannel strategies to maximize reach. Strategic partners like Nykaa have been crucial in driving scalability.

The industry is rapidly expanding due to social media, beauty influencers, and increasing endorsements from dermatologists. As more consumers prioritize skin health and recognize the dangers of UV radiation, sunscreen has transformed from a seasonal item to a crucial product for year-round use. This change in consumer habits, particularly among younger and health-aware audiences, has led to a thriving market. The enhanced awareness of skincare, along with increased online discussions and promotions, has increased the demand for sunscreen among diverse demographic groups.

In light of this growth, beauty and skincare brands emphasize innovation within the sunscreen category. Companies such as The Derma Co, Aqualogica, Mamaearth, etc. are launching new product types, including tinted sunscreens and lightweight options, to accommodate shifting consumer preferences. Alongside these product advancements, brands are implementing more focused and precise marketing strategies to take advantage of the rising demand during the summer months. The alignment of social media trends, endorsements from dermatologists, and well-planned product releases positions sunscreen as a rapidly expanding segment within India’s beauty sector, suggesting continued growth in the years ahead.

Consumer Surveys & Insights

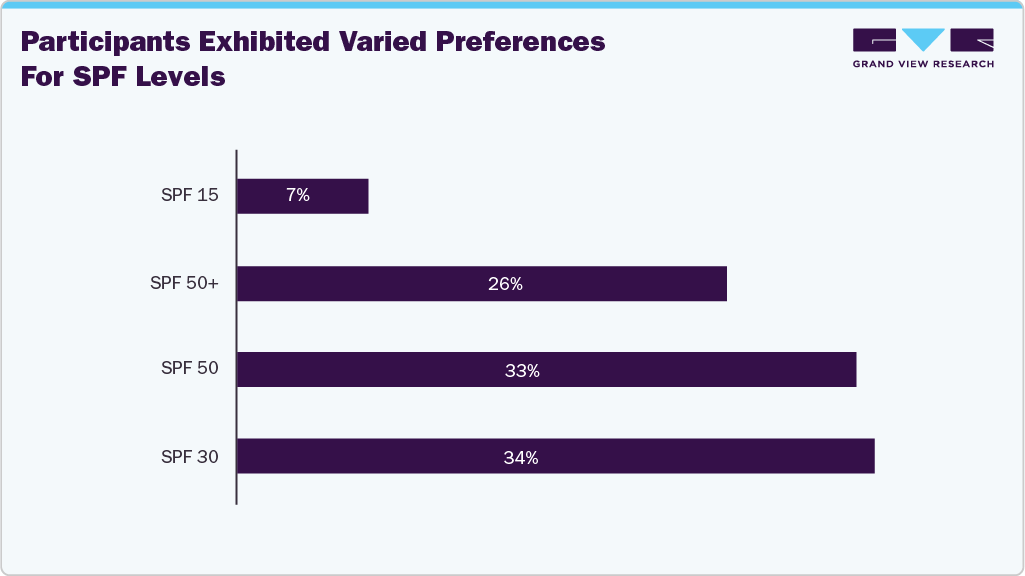

The demand for sunscreen is increasing among all age groups in India. Consumers are influenced by rising skincare awareness, dermatological education, and lifestyle shifts. Indian consumers increasingly prioritize sunscreens that offer broad-spectrum protection (UVA and UVB), with a strong preference for higher SPF values, typically SPF 30 and above.

These results indicate diverse preferences in SPF levels among respondents, suggesting a range of considerations such as sun exposure intensity and personal sun protection needs.

A survey of 500 consumers was conducted by Grand View Research, Inc. to understand the consumer preferences for SPF values. According to the survey published in 2024, approximately 7% of respondents typically look for SPF 15, while around 34% opt for SPF 30. Similarly, approximately 33% of participants usually seek SPF 50, and approximately 26% prefer SPF 50+.

India's beauty and personal care sector is transforming as consumers emphasize skincare more than cosmetics. Indian buyers know about the advantages of sunscreen, leading to a significant increase in the demand for broad-spectrum, lightweight, and non-greasy options. Nonetheless, some challenges persist, including worries about cost, the presence of a white cast, and the requirement for reapplication in humid weather. Moreover, urban consumers, especially those from millennials and Gen Z, are propelling the use of sunscreens due to greater exposure to social media influencers, dermatologists, and skincare brands. In addition, rural and semi-urban populations are slowly adopting sun protection as awareness campaigns emphasize the hazards of excessive sun exposure.

Product Insights

Lotion sunscreen accounted for a revenue share of 41.66% of the India sunscreen industry in 2024, fueled by strong consumer demand and evolving skincare preferences. This product segment continues outperforming due to its broad market appeal, offering multifunctional benefits such as UV protection, hydration, and skin nourishment in a single formulation. Key growth drivers include rising consumer awareness around sun-related skin damage, increased adoption of skincare routines among urban and semi-urban populations, and a surge in demand for dermatologically tested and SPF-certified products.

Demand for stick sunscreen is expected to grow at a CAGR of 10.8% from 2025 to 2030. Driven by shifting consumer preferences toward convenience, portability, and mess-free application. Stick is increasingly favored by on-the-go consumers, particularly in urban areas, for its compact packaging and targeted application. It is ideal for high-exposure areas like the face, lips, and ears. Growing awareness of sun protection among younger demographics and the rise of outdoor and travel-related activities are further propelling demand. Additionally, innovations in formulation, such as water-resistant, non-greasy, and reef-safe options, are enhancing the appeal of stick sunscreens. Premium positioning, influencer marketing, and strategic product placement in lifestyle and travel retail channels also increase adoption.

SPF Insights

Sunscreen with 30 SPF accounted for a revenue share of 34.02% of the India sunscreen industry in 2024, underscoring its strong market position as the preferred SPF level among mainstream consumers. Driven by its optimal balance between effective sun protection and daily wear ability, SPF 30 is suitable for various skin types and usage scenarios. Dermatologists widely recommend it for everyday protection against UVA and UVB rays, particularly in urban environments with moderate sun exposure. Its broad consumer appeal is further supported by affordability, availability across multiple formats (lotions, creams, sprays), and strong presence in mass and premium product lines.

Sunscreen with 50 SPF is expected to grow at a CAGR of 9.8% in India sunscreen market from 2025 to 2030, reflecting increasing consumer demand for higher levels of sun protection. The growth is fueled by heightened awareness of the long-term risks of sun exposure, including premature aging and skin cancer, which is leading consumers to opt for products offering more defense against UVA and UVB rays. SPF 50 sunscreens are particularly favored by individuals with sensitive skin, those engaging in outdoor activities, and consumers living in regions with intense sunlight.

End-use Insights

The Indian sunscreen market for women accounted for a share of 70.43% in 2024. Increasing importance of sun protection as a key element of daily skincare routines among female consumers. The segment expansion is fueled by greater awareness of the harmful effects of UV radiation, including premature aging, dark spots, and skin cancer, leading to higher sunscreen adoption. Women, especially in urban areas, are placing greater emphasis on skincare products that shield against sun damage and provide added benefits such as hydration, anti-aging, and brightening.

The men segment is expected to grow at a CAGR of 9.9% from 2025 to 2030. supported by shifting grooming habits and rising awareness of skincare among male consumers. This upward trend is influenced by increased exposure to outdoor environments, pollution, and UV radiation, prompting men to seek targeted sun protection solutions. Brands like Beardo, Mancode, etc. are responding with male-specific formulations that offer non-greasy textures, quick absorption, and multifunctional benefits, such as sweat resistance and oil control.

Distribution Channel Insights

Sales of sunscreen through specialty stores held a share of 33.16% of the India sunscreen market in 2024. This channel benefits from a curated retail experience, knowledgeable staff, and access to premium and dermatologist-recommended brands, making it particularly attractive to consumers seeking expert guidance and high-quality formulations. Specialty stores also provide an ideal platform for product education, sampling, and in-store promotions, enhancing customer engagement and driving conversion. As consumers become more skincare-conscious and demand for targeted sun protection grows, specialty retail continues to serve as a trusted point of purchase. Moreover, expanding modern retail formats in Tier I and Tier II cities further strengthens the reach of specialty stores.

Sales of sunscreen through online channels are expected to grow at a CAGR of 10.1% in India sunscreen industry from 2025 to 2030. Online shopping offers a wide variety of sunscreens, allowing consumers to compare prices, read reviews, and access expert advice without the pressure of in-store sales. Moreover, the rise of mobile shopping, promotions, and discounts on e-commerce platforms, along with fast delivery options, has made online retail a more attractive channel for consumers seeking convenience and value. As the penetration of internet users and online payment options continues to expand across Tier I, II, and III cities, the online channel is becoming an increasingly important avenue for sunscreen brands.

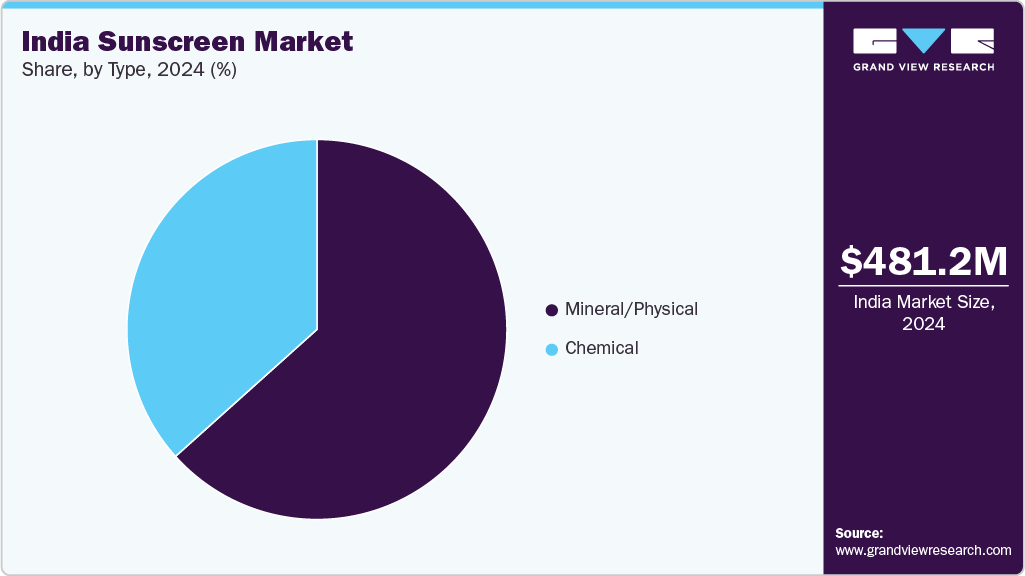

Type Insights

Mineral/physical sunscreen accounted for a revenue share of 63.36% in 2024, reflecting a strong consumer shift toward clean, skin-friendly formulations. The growth is primarily driven by increasing awareness of ingredient safety, particularly among health-conscious and sensitive-skin consumers who prefer non-comedogenic, hypoallergenic products. The demand for zinc oxide and titanium dioxide-based sunscreens has surged due to their broad-spectrum protection and minimal skin irritation compared to chemical alternatives. Rising concerns about long-term exposure to synthetic chemicals, along with the influence of dermatologists and clean beauty movements, have further accelerated the adoption of mineral sunscreens.

Chemical sunscreen is expected to grow at a CAGR of 8.8% in the Indian sunscreen market. Fueled by increasing consumer demand for lightweight, fast-absorbing formulations that integrate seamlessly into daily skincare routines. These products are gaining attraction, particularly among younger, urban consumers who prioritize cosmetic elegance, such as invisible finish, non-greasy texture, and compatibility with makeup. The segment also benefits from continuous product innovation, including multi-functional offerings that combine sun protection with anti-aging, hydration, or brightening benefits. Additionally, growing UVA/UVB protection awareness, rising disposable incomes, and broader distribution across online and offline retail channels enhance accessibility and market penetration.

Key India Sunscreen Companies Insights

Key players operating in the India sunscreen market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key India Sunscreen Companies:

- The Derma Co

- Dr. Sheth's

- Dot & Key

- Minimalist

- Cetaphil

- Lakmē

- Neutrogena

- Re'equil

- Foxtale

- Aqualogica

Recent Developments

-

In April 2025, Lakmé launched a consumer-first campaign to drive SPF transparency in India’s sun care market. In a category where SPF claims often go unregulated and unverified, Lakmé is driving awareness, encouraging greater transparency, scientific credibility, and accountability in sun care products. This campaign goes beyond a single product; it represents Lakmé’s mission to set a gold standard for sun protection in India. The campaign will roll out across social media platforms, including Instagram, YouTube, and OTT platforms. At the heart of this campaign is an IN VIVO test conducted in an independent, accredited clinical research lab, showcasing the rigorous testing behind Lakmé Sun Expert SPF 50, reinforcing the brand’s promise: When Lakmé Sun Expert SPF 50 claims SPF 50, it delivers SPF 50.

-

In April 2025, Supergoop! officially entered the Indian market through an exclusive tie-up with Nykaa, India’s leading omnichannel retailer in beauty and fashion. The partnership marks Supergoop!’s first foray into the country, aiming to make sunscreen a staple in Indian skincare routines. As part of this omnichannel launch, Supergoop!’s wide range of sun protection products will now be available across Nykaa.com, Nykaa Luxe, and select Nykaa retail stores, offering consumers greater accessibility to the brand’s innovative SPF-led skincare products.

-

In February 2025, The Derma Co. expands offline presence with 4 EBOs. An active ingredient brand under the Honasa Consumer Limited portfolio has expanded its offline footprint with the launch of four exclusive brand outlets in Gurgaon, Bengaluru, Lucknow, and Guwahati.

India Sunscreen Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 523.3 million

Revenue forecast in 2030

USD 810.6 million

Growth rate (revenue)

CAGR of 9.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, SPF, end-use, distribution channel

Country scope

India

Key companies profiled

The Derma Co.; Dr. Sheth's; Dot & Key; Minimalist; Cetaphil; Lakmē; Neutrogena; Re equil; Foxtale; Aqualogica

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Sunscreen Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India sunscreen market report based on product, type, SPF, end-use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lotion

-

Cream

-

Spray

-

Gels

-

Sticks

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mineral and Physical

-

Chemical

-

-

SPF Outlook (Revenue, USD Million, 2018 - 2030)

-

15

-

30

-

50

-

50<

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarket

-

Specialty Store

-

Pharmacy & Drugstore

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The India sunscreen market was estimated at USD 481.2 million in 2024 and is expected to reach USD 523.3 million in 2025.

b. The India sunscreen market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 810.6 million by 2030.

b. Sunscreen with 30 SPF accounted for a revenue share of 34.02% of the India sunscreen industry in 2024, underscoring their strong market position as the preferred SPF level among mainstream consumers. Driven by its optimal balance between effective sun protection and daily wear ability, SPF 30 is suitable for various skin types and usage scenarios.

b. Some of the key players operating in the India sunscreen market include The Derma Co.; Dr. Sheth's; Dot & Key; Minimalist; Cetaphil; Lakmē; Neutrogena; Re equil; Foxtale; Aqualogica

b. Key growth drivers include strong consumer demand and evolving skincare preferences. Sunscreen lotions continue outperforming due to their broad market appeal, offering multifunctional benefits such as UV protection, hydration, and skin nourishment in a single formulation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.