- Home

- »

- Homecare & Decor

- »

-

India Tech Toys Market Size & Share, Industry Report, 2030GVR Report cover

![India Tech Toys Market Size, Share & Trends Report]()

India Tech Toys Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Robotic Toys, Coding & STEM Toys), By Age Group (Infants & Toddlers, Preschooler), By Distribution Channel (Hypermarket/Supermarket, Specialty Toy Stores), And Segment Forecasts

- Report ID: GVR-4-68040-568-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Tech Toys Market Size & Trends

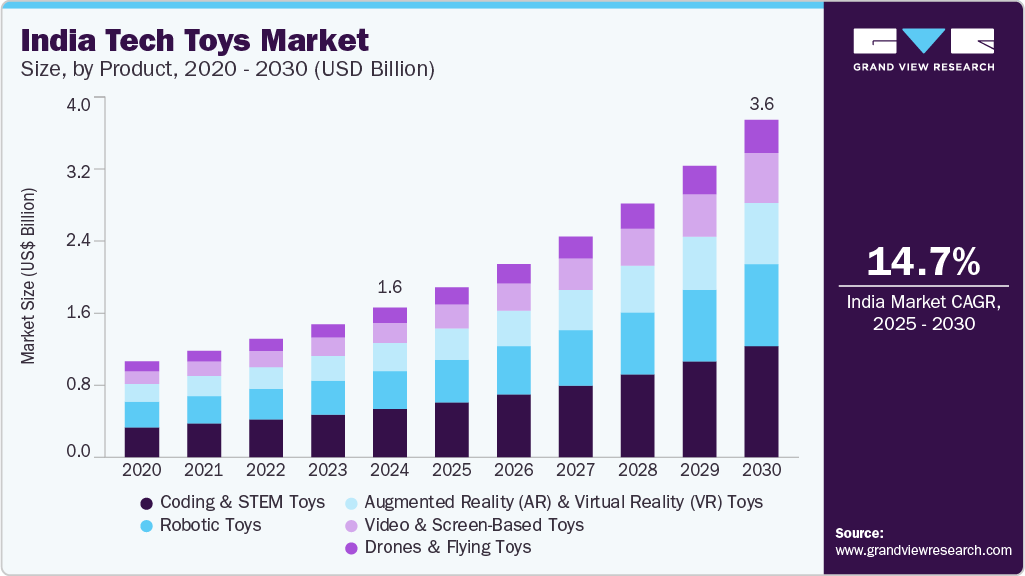

The India tech toys market size was estimated at USD 1606.5 million in 2024 and is projected to grow at a CAGR of 14.7% from 2025 to 2030. The market growth is attributed to the increasing digital literacy and rising adoption of educational technology among parents and schools. Tech toys that support Science, Technology, Engineering, and Mathematics (STEM) learning are in high demand among Indian parents. With increasing awareness about future-ready skills, parents are turning to educational toys that foster problem-solving, coding, robotics, and logical reasoning. These toys often include programmable robots, circuit-building kits, and app-connected puzzles.

Indian consumers are showing a preference for high-quality, feature-rich tech toys over low-cost alternatives. Rising disposable incomes and a greater focus on durability, safety, and multifunctionality drive this trend. Products with coding capabilities, modular expansions, and AI-driven learning features are commanding higher prices and gaining traction in urban markets. The integration of advanced technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) is transforming the tech toys landscape. These features provide immersive experiences, further fueling interest and adoption among tech-savvy consumers.

The Indian government has boosted domestic toy manufacturing and reduced dependence on Chinese imports. According to the report, the basic customs duty on toys was raised from 20% to 60% in February 2020, and further to 70% in March 2023, to discourage imports and promote local manufacturing. The Production Linked Incentive (PLI) Scheme incentivizes companies that manufacture toys domestically. Quality control regulations have also been enforced to ensure safety and encourage local production of innovative toys, including tech toys. India's toy exports grew remarkably, climbing from US$96.17 million in 2014-15 to US$325.72 million in 2022-23. At the same time, toy imports dropped by 52%, falling from US$332.55 million to US$158.7 million over the same period.

Furthermore, the growing influence of social media and e-commerce platforms has made tech toys more accessible to a wider audience. Online marketplaces and targeted marketing strategies are facilitating awareness and enhancing the visibility of these products, contributing to market growth.

Consumer Survey & Insights

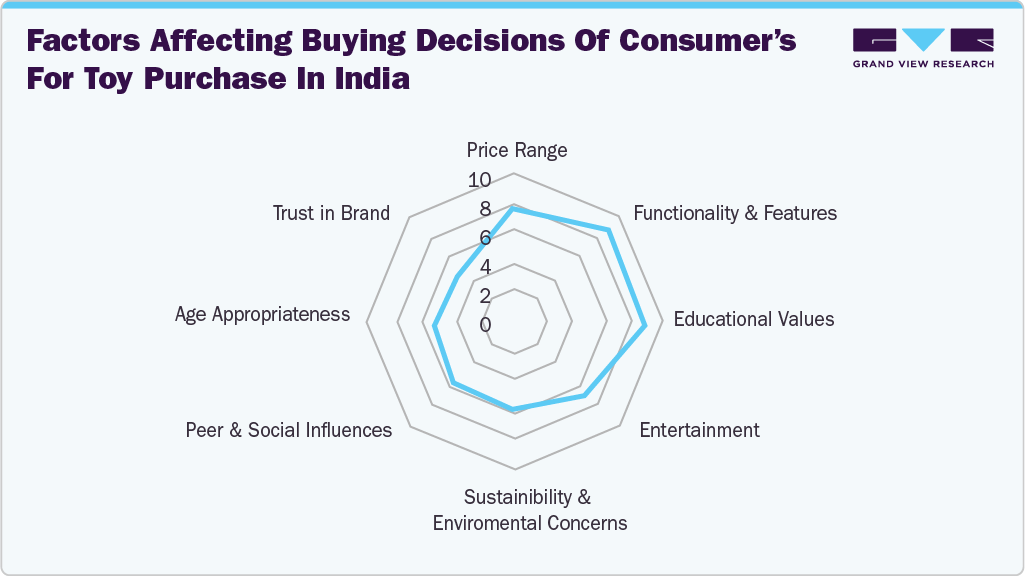

The toy industry is experiencing significant transformations driven by evolving consumer preferences and societal trends. Beyond children, the “kidults” segment, individuals aged 12 and above, now constitutes a major part of annual toy sales and influences growth, fueled by the popularity of superhero media. Sustainability is gaining prominence as leading companies such as LEGO and Bandai Namco adopt eco-friendly materials and aim for carbon neutrality. Additionally, STEM-based toys are increasingly valued for their role in enhancing children’s creativity, problem-solving skills, and education, even being integrated into school curriculums. These trends highlight the industry's shift towards innovation, learning, and environmental responsibility.

According to survey conducted by Anna University in 2022, in Chennai of total 577 respondents, the data reveals that frequency analysis discovers that nearly 41.9% of the shoppers those who have visited the selected organized stores are in the age group of 31- 40 years, around one-third (29.8%) of them are aged 41-50 years, whereas slightly less than one-fifth (18.4%) of them are below 30 years and around one-tenth of them are aged above 50 years.

According to a survey conducted by Anna University in 2022, in Chennai, of a total 577 respondents, the survey reveals that malls and convenience stores are shoppers' most favored venues for toy purchases, suggesting that customers value the variety, ambiance, and opportunity for physical inspection that malls offer. Convenience stores come close, likely due to their accessibility, time efficiency, and widespread presence in urban and suburban areas. Hypermarkets and supermarkets occupy a middle ground, reflecting moderate preference, possibly because they provide toys as part of a broader shopping experience rather than a focused offering. Interestingly, despite its growing prominence, online shopping ranks below physical formats, which may be due to consumers' preference for seeing and testing toys in person, especially when buying for children. Specialty stores, though likely to offer higher-quality or niche toys, rank the lowest, possibly due to limited availability, higher prices, or less brand awareness.

Consumers in India are increasingly attracted to tech toys that offer interactive features like AR, AI, and robotics, especially those with educational benefits such as STEM learning. Price is key, with buyers seeking value-for-money options across income groups. Parents prioritize safety, durability, and age-appropriate functionality, often favoring toys that combine entertainment with cognitive and motor skill development. Eco-friendly materials and energy-efficient designs are gaining traction due to rising environmental awareness. Social influence, local cultural appeal, and trust in established brands significantly impact purchasing decisions.

Product Insights

Coding and STEM toys accounted for a share of 31.93% of the India tech toys industry in 2024. The growing demand for educational experiences that go beyond the classroom is a key driver for the market. Parents actively seek toys that encourage problem-solving, creativity, and critical thinking. The appeal of STEM toys lies in their ability to nurture curiosity and practical skills, making them a preferred choice for many families. In addition, retailers and subscription services are amplifying their focus on the educational toys industry, providing a wide range of innovative products that align with evolving consumer preferences. In March 2024, Playtime Engineering launched its latest product, MyTracks, a kid-friendly electronic music production device designed to simplify beat-making for children. The device, which combines a drum machine, synthesizer, microphone for audio sampling, and sequencer, was introduced through a Kickstarter campaign in April, with an expected retail price of USD 349. MyTracks aimed to make music exploration more accessible to kids by featuring chunky control knobs, levers, and a randomized function. The product adhered to rigorous child safety standards, ensuring it was BPA-free and free of choking hazards.

Demand for video and screen based toys is projected to rise at a CAGR of 15.9% from 2025 to 2030 of the India tech toys industry. Video and screen-based toys are witnessing the fastest growth in India’s toy market due to digital accessibility, changing consumer behavior, and an increasing emphasis on interactive learning. The rise of e-commerce platforms has expanded the reach of tech-enabled toys, making them more accessible even in smaller cities. These toys appeal to modern parents and children by offering immersive experiences through augmented reality (AR), virtual reality (VR), and gamified learning content. As families seek toys that combine entertainment with education, screen-based toys that teach language, logic, or problem-solving are becoming highly preferred. Moreover, the popularity of youth electronics and video gaming is fueling demand for toys that simulate digital experiences. This shift reflects broader lifestyle and technological trends, making screen-based toys a rapidly growing segment in the Indian toy industry.

Age Group Insights

Early elementary age group accounted for a revenue share of 28.04% in 2024. India has a substantial young population, with over 300 million children aged 0 to 14, the highest globally. This demographic trend naturally leads to increased demand for toys catering to early childhood. Parents increasingly prioritize early childhood development, seeking toys that foster cognitive, motor, and social skills. Educational toys, especially those with STEM components, are popular in this age segment as they blend fun with foundational learning. Additionally, the rapid expansion of organized retail and e-commerce platforms has made a wider range of toys available even in non-metro areas, further boosting the market. These factors together make the early elementary age group the most dominant segment in India’s growing toy market.

The demand for toys for preschoolers is projected to rise at a CAGR of 15.8% from 2025 to 2030, due to increasing awareness around early childhood development and learning. Indian parents are now more inclined toward investing in educational toys that promote cognitive, sensory, and motor skill development for children aged 3 to 5. This shift is supported by rising disposable incomes, allowing families to prioritize quality and purposeful play materials.

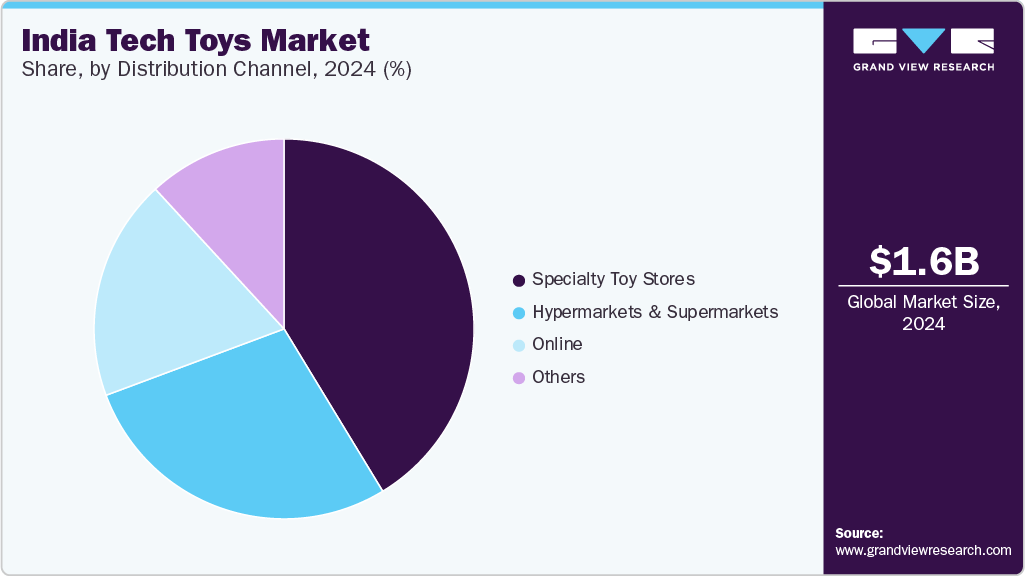

Distribution Channel Insights

Specialty toys store-driven sales accounted for a share of 41.31% in 2024. These stores cater to discerning consumers by providing a wide range of high-quality, branded, and educational toys that meet specific developmental and safety standards. Parents often prefer these outlets for their assurance of quality and the availability of toys that align with their children's learning and growth needs. Additionally, specialty stores offer a personalized shopping experience, with knowledgeable staff who can guide purchases based on age appropriateness and educational value. This level of service and product specialization has contributed to specialty toy stores becoming the primary sales channel in the Indian toy market. For instance, Funskool, an Indian brand that operates specialty outlets and collaborates with global brands like LEGO and Hasbro. Funskool stores focus on quality, safety, and educational value, making them a preferred choice among Indian parents looking for reliable and enriching toys for their children. Hamleys, known for its premium and diverse toy collection, provides an immersive in-store experience with demonstrations, interactive play zones, and staff trained to assist parents in selecting developmentally appropriate toys.

The online sales segment is projected to grow at a CAGR of 15.8% from 2025 to 2030 in the Indian tech toys industry. Quick commerce platforms like Blinkit, Swiggy Instamart, and Zepto are rapidly becoming the most popular channels for toy purchases. These on-demand delivery services typically guarantee delivery within 10 minutes, offering a significant speed advantage over traditional e-commerce platforms like FirstCry, Amazon, and Flipkart, which often take 3-4 days, depending on the delivery location. Toys are frequently bought on impulse rather than through planned purchases. Quick commerce meets this demand effectively by allowing parents to place orders effortlessly and receive products almost instantly. This speed and convenience help parents cater to their children's immediate desires-whether it's rewarding good behavior or buying a gift on the way to visit friends or family.

Key India Tech Toys Company Insights

The dominance of major toys market companies such as The Lego Group, Funskool India Ltd., Mattel, Inc., continues to define the upper tier of the competitive spectrum.

-

The LEGO Group is a Danish toy production company best known for its iconic interlocking plastic bricks. Founded in 1932 by Ole Kirk Christiansen in Billund, Denmark. LEGO's mission is to "inspire and develop the builders of tomorrow" through creative play. It also runs educational programs through LEGO Education and the LEGO Foundation, which focuses on learning through play. It has a strong global presence and continues to innovate by integrating technology, sustainability initiatives and immersive experiences into its offerings.

-

Mattel, Inc. is a leading global toy company headquartered in El Segundo, California, founded in 1945 by Harold "Matt" Matson and Elliot Handler. It is best known for creating and marketing some of the world’s most iconic toy brands, including Barbie, Hot Wheels, Fisher-Price, American Girl, Thomas & Friends, and UNO. Mattel has a global footprint, with its products sold in over 150 countries, and continues to evolve by blending traditional play with emerging technologies and entertainment.

Key India Tech Toys Companies:

- The Lego Group

- Hasbro, Inc.

- Mattel, Inc.

- Sphero, Inc.

- VTech Holdings Limited

- PlayShifu, Inc.

- Funskool India Ltd.

- Smartivity Labs Pvt. Ltd.

- Butterfly Edufields Pvt. Ltd.

- Thinkerplace Education Pvt. Ltd.

Recent Developments

-

On February 4, 2025, the LEGO Group announced a commitment of DKK 19 million (approximately USD $2.75 million) to support four carbon removal projects as part of its broader sustainability strategy. This initiative, carried out in collaboration with Climate Impact Partners and ClimeFi, is aimed at delivering verified carbon removal credits between 2024 and 2026. The projects include engineered solutions like biochar production and enhanced rock weathering, while improving soil health.

-

In October 2023, The LEGO Group launched its inaugural build experience inspired by the Dune universe in collaboration with Legendary Entertainment and based on Denis Villeneuve's film adaptation of Frank Herbert's renowned masterpiece. Introducing the LEGO Icons Dune Atreides Royal Ornithopter, this set brings to life one of the most iconic aircraft from the sci-fi epic in intricate LEGO brick form.

-

In July 2022, Mattel partnered with SpaceX to develop a line of toys and collectibles aimed at sparking children's interest in space exploration. The product line featured figures, plush toys, and building sets. This collaboration is built on Mattel's past work with Elon Musk on remote-controlled cars.

India Tech Toys Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 1,822.4 million

Revenue forecast in 2030

USD 3,623.5 million

Growth rate (Revenue)

CAGR of 14.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age group and distribution channel

Country scope

India

Key companies profiled

The Lego Group; Hasbro, Inc.; Mattel, Inc.; Sphero, Inc.; VTech Holdings Limited; PlayShifu, Inc.; Funskool India Ltd.; Smartivity Labs Pvt. Ltd.; Butterfly Edufields Pvt. Ltd.; Thinkerplace Education Pvt. Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options India Tech Toys Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India tech toys market based on product, age group, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Robotic Toys

-

Coding & STEM Toys

-

Augmented Reality (AR) and Virtual Reality (VR) Toys

-

Drones and Flying Toys

-

Video and Screen-Based Toys

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Infants & Toddlers (0 - 3 Years)

-

Preschooler (3 - 4 years)

-

Early Elementary (5 - 7 years)

-

Tweens (8 - 12 years)

-

Teens (Above 13 years)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket/Supermarket

-

Specialty Toy Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The India tech toys market was estimated at USD 1606.5 million in 2024 and is expected to reach USD 1822.4 million in 2025.

b. The India tech toys market is expected to grow at a compound annual growth rate of 14.7% from 2025 to 2030 to reach USD 3623.5 million by 2030.

b. Coding and STEM toys accounted for a share of about 31.93% of the India tech toys industry in 2024. Parents actively seek toys that encourage problem-solving, creativity, and critical thinking. The appeal of STEM toys lies in their ability to nurture curiosity and practical skills, making them a preferred choice for many families.

b. Coding and STEM toys accounted for a share of about 31.93% of the India tech toys industry in 2024. Parents actively seek toys that encourage problem-solving, creativity, and critical thinking. The appeal of STEM toys lies in their ability to nurture curiosity and practical skills, making them a preferred choice for many families.

b. The market growth is attributed to the increasing digital literacy and rising adoption of educational technology among parents and schools. The integration of advanced technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) is transforming the tech toys landscape.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.