- Home

- »

- Animal Health

- »

-

India Veterinary Medicine Market Size, Industry Report, 2030GVR Report cover

![India Veterinary Medicine Market Size, Share & Trends Report]()

India Veterinary Medicine Market Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Animal Type, By Route Of Administration (Oral, Injectable, Topical), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-227-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

India Veterinary Medicine Market Trends

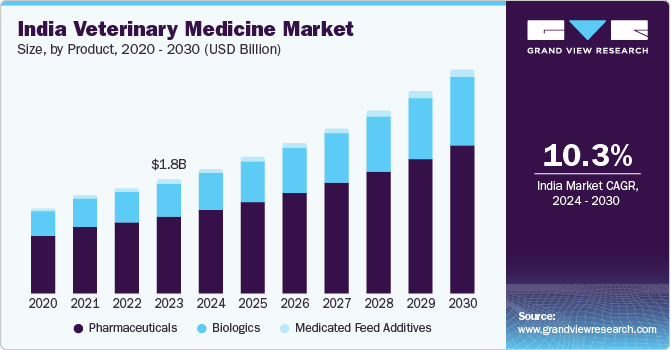

The India veterinary medicine market size was estimated at USD 1.80 billion in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2030. The market growth is driven by increasing awareness of the importance of animal healthcare, the incidence of disease outbreaks in animals, increasing demand for animal protein, and product launches. Other factors fueling market growth include advancements in veterinary medicine, regulatory support, and schemes by the Indian government, such as the National Programme for Dairy Development, Rashtriya Gokul Mission, and the Animal Husbandry Infrastructure Development Fund.

The 2022 lumpy skin disease outbreak in India affected over 2 million animals, including 100,000 deaths across 15 states and 251 districts in three months. The disease was caused by a Capripoxvirus, which led to a sharp decline in milk production and sterility in bulls. Rajasthan was the most affected, with over 65% of cases. The Indian Veterinary Research Institute India and the National Centre for Veterinary Type Cultures in Hisar developed a live-attenuated LSD vaccine called Lumpi-ProVacInd to control the outbreak. According to the last livestock census report by the Department of Animal Husbandry and Dairying, India's cattle population was around 192.5 billion.

The Indian government has been actively promoting the development of the veterinary medicine market through various initiatives. One of these initiatives includes the establishment of the National Animal Disease Control Program (NADCP), which aims to control and eradicate major animal diseases in the country. Additionally, the government has launched several schemes to encourage the use of modern veterinary practices and technologies, driving market growth. For instance, in June 2023, the Indian government launched the Nandi portal, a tool developed by the Central Drugs Standard Control Organization and in collaboration with the Department of Animal Husbandry and Dairying (DAHD) to streamline the regulatory approval process for veterinary products, aiming to enhance transparency and efficiency in assessing and examining proposals for veterinary drugs and vaccines.

Veterinary medicines are thus essential in maintaining livestock's health and well-being, preventing disease outbreaks, and supporting the production of safe and abundant animal-derived food products. However, zoonotic and animal illnesses impede the sector's expansion, with low biosecurity and traditional husbandry techniques offering a significant risk of human transmission owing to intimate contact with animals. The existence of several small and large enterprises fosters competition in the market. These businesses provide a broad selection of veterinary medications for various target species and market sectors.

In August 2023, the G20 Pandemic Fund approved India's proposal worth USD 25 million to improve animal health security for pandemic preparedness and response. The collaboration between the South Asia Sub-regional Economic Cooperation and the Indian Ministry of Animal Husbandry aims to enhance animal health security through investment and co-financing. The funding supports India's One Health Mission strategy, boosted by increased pet adoption, veterinary visits, and pet humanization in India.

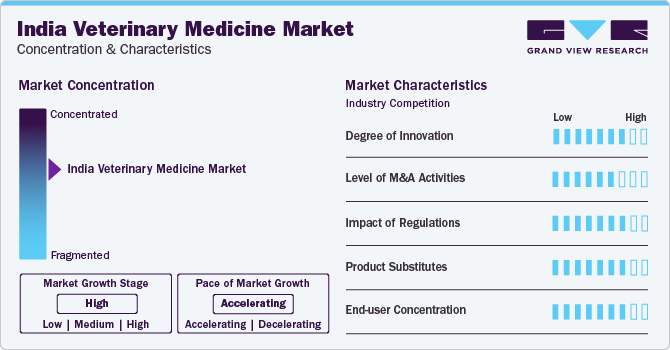

Market Concentration & Characteristics

India held around 4% revenue share of the global veterinary medicine market. Innovation in animal treatments, including new procedures and drugs, is driven by ongoing research & collaboration between various organizations, regulatory frameworks, and the evolving needs of animal owners and veterinary communities. New advancements in veterinary medicine are anticipated to improve the standard of animal care as technological and scientific progress. For instance, In June 2022, the Kerala Cooperative Milk Marketing Federation (Milma) launched Ayurveda veterinary medicines to treat cattle diseases such as indigestion, diarrhea, and fever.

The market players engage in M&A activities driven by the desire to expand operational efficiency and achieve economies of scale or gain access to new markets and reinforce market presence. For instance, in June 2022, Boehringer Ingelheim entered into a research partnership with CarthroniX, a biopharma company, to develop small molecule therapeutics in dog oncology.

Regulations in the Indian veterinary medicines market play a critical role. These regulations by the Indian government are designed to ensure the safety and efficiency of veterinary products. Regulatory bodies, such as the Indian Veterinary Council Act of 1984, are legislation that governs the practice of veterinary medicine in India. It outlines the qualifications and responsibilities of veterinarians and the standards for veterinary products and services. The impact of strict regulatory requirements on the market is medium to high, as they ensure products meet safety and efficacy standards, affecting the time and cost of new product introduction.

There are a limited number of direct product substitutes for veterinary medicine. However, one alternative that has gained popularity is holistic veterinary care. It offers a different perspective than traditional veterinary medicine by emphasizing preventive measures and natural treatments. This approach often involves alternative therapies such as acupuncture, chiropractic care, herbal medicine, and nutritional supplements. While it may not completely replace traditional veterinary medicine, holistic care can complement or substitute for specific conditions or individuals who prefer a more natural approach to animal health.

End-user concentration is a significant factor in the veterinary medicine market since several end-user industries are driving demand for veterinary medicine. The market caters to a diverse range of end users, including pet owners, livestock producers, veterinary hospitals, clinics, and research institutions.

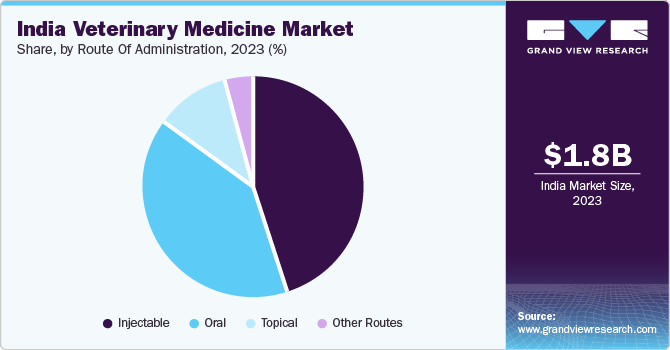

Route of Administration Insights

The injectable segment dominated the market with a revenue share of around 45% in 2023. This segment includes drugs administered via intramuscular, intravenous & sub-cutaneous route. Injectable medications route offer sustained-release formulations, providing prolonged therapeutic effects compared to other dosage forms like oral medications. This extended duration of action can be beneficial in certain treatment scenarios. The benefits associated with the injectable route and the availability of numerous injectable medicines are some of the key factors driving the market growth. In May 2023, Zoetis received FDA clearance for Librela-its injectable anti-nerve growth factor (NGF) monoclonal antibody (mAb) for osteoarthritic dogs.

Other routes of administration include controlled-release implants and inhalational routes. This segment is predicted to increase at the fastest compound annual growth rate (CAGR) from 2024 to 2030, with the increasing accessibility of goods and the growing use of alternate means of delivery by pet owners and livestock producers.

Product Insights

The pharmaceuticals segment dominated the market with a revenue share of over 65% in 2023. This can be attributed to increasing animal health expenditure, product portfolio expansion, R&D activities, and new product launches by key companies. Pharmaceuticals primarily include anti-infective, anti-inflammatory drugs, parasiticides, and other drugs. For instance, in December 2023, KVM Research Labs, a manufacturer, and exporter of Ayurvedic products since 1988, launched the Mruga Ayurveda division of veterinary Ayurvedic products with the aim of addressing the impact of anti-microbial resistance on cattle and domesticated pets, and the reduced lifespan of dogs due to overuse of antibiotics.

The biologics segment is expected to grow at the fastest CAGR of 11.2% from 2024 to 2030. The rising prevalence of diseases in animals and the risk caused to humans propel the segment’s growth. Zoonotic conditions constitute a worldwide health risk caused by intricate interactions between animals, humans, and the environment. More than 1400 different infectious agent species are harmful to humans. According to the report by the World Health Organization, 36% of rabies-related fatalities worldwide occur in India. Additionally, India is also responsible for 65% of the rabies-related deaths in South-East Asia. The National Rabies Control Program documented 6644 clinically suspected cases and deaths of human rabies throughout 2012 and 2022.

Animal Type Insights

The production animal segment accounted for the largest revenue share of around 60% in 2023. With a growing population and rising disposable incomes, there is an increasing demand for meat, dairy, and other animal-derived products in India. According to the Ministry of Fisheries, Animal Husbandry and Dairying, India is ranked first in milk production, contributing 24.64% of global milk production. Moreover, egg production in the country has increased from 78.48 billion in 2014 - 15 to 138.38 billion in 2022 - 23. This has led to a greater focus on improving the health and productivity of production animals through the use of veterinary medicines.

Moreover, the Indian government has promoted animal husbandry and agriculture through various initiatives and schemes. These initiatives aim to improve the livestock sector's overall productivity and efficiency, including providing access to quality veterinary medicines for production animals. For instance, The Rashtriya Gokul Mission (RGM) is a scheme to develop and conserve indigenous bovine breeds. It aims to boost milk production and productivity by fulfilling the rising demand and making dairying more profitable for rural farmers. The scheme is continued under the name Rashtriya Pashudhan Vikas Yojna.

The companion animal segment is expected to grow at the fastest CAGR of 12.1% from 2024 to 2030, owing to increasing pet ownership, pet expenditure, pet humanization, and awareness about pet health & nutrition. Pets, especially dogs, are becoming common in urban Indian households, providing companionship and emotional support to their owners. They have become an integral part of many households in India, leading to a rising demand for companion animal segments and awareness regarding veterinary medicines for their safety and well-being. For instance, in April 2022, Boehringer Ingelheim introduced RenuTend, a novel stem cell therapy for horses intended to treat tendon and suspensory ligament problems.

Distribution Channel Insights

The veterinary hospitals & clinics segment accounted for the largest revenue share in 2023. This can be attributed to the availability of a wide range of healthcare services, including routine check-ups, surgeries, vaccinations, and specialized treatments. This comprehensive approach attracts many pet owners and livestock farmers, contributing significantly to the segment’s revenue share. Veterinary clinics and hospitals also develop strong relationships with pet owners or breeders. This promotes trust & communication by creating an environment where the client can follow the prescribed treatment plan.

The e-commerce segment is expected to grow at the fastest CAGR of 11.5% during the forecast period. E-commerce platforms are convenient for pet owners and veterinarians as they offer a wide range of veterinary medicines in one place. India's digitization trend has led to an increase in the acceptance of online shopping in various sectors, including healthcare. As more and more consumers adapt to doing business online, the demand for veterinary medicines through electronic channels is expected to increase.

Online retailers often offer competitive prices on veterinary drugs because overhead costs are lower than brick-and-mortar stores. This affordability appeals to price-conscious consumers who want to save on pet costs. For instance, in May 2023, a Gurugram-based startup Animpet Ecomm Pvt Ltd introduced an online marketplace for transacting livestock, poultry-meat products, dairy products, animal feed, medications, and nutrients alongside veterinary services.

Key India Veterinary Medicine Company Insights

The competitive market of veterinary medicines is dominated by numerous small and large companies offering a diverse range of products across various segments and target species. These players are implementing initiatives such as R&D, mergers, collaborations, and partnerships. Some of the key players operating in the market include Zoetis Inc.; Ceva Santé Animale; Virbac; and Boehringer Ingelheim International Gmbh.

-

Ceva Santé Animale is a veterinarian pharmaceutical company with expertise in various therapeutic areas. Their areas of expertise encompass all facets of animal husbandry, including conventional (ruminants) and industrial (poultry, swine).

-

Zoetis Inc. is an animal health company that develops, produces, markets, and licenses vaccinations, medications, and other technologies for livestock and companion animals

Key India Veterinary Medicine Companies:

- Zoetis Inc.

- Ceva Santé Animale

- Virbac

- Boehringer Ingelheim International Gmbh

- Biovet

- Sarabhai Chemicals

- Growel Agrovet

- LE Mantus Pharmaceuticals

- Vetneeds Labs

Recent Developments

-

In November 2023, Virbac acquired a majority stake in a leading Indian poultry vaccines company- Globion. This strengthened the company’s position as a leading animal health player in the Indian poultry vaccines market by extending Virbac India’s poultry portfolio.

-

In August 2023, Boehringer Ingelheim launched NexGard (afoxolaner) S and M in India to expand animal health portfolio. NextGard is indicated for the consumption in puppies and dogs from 8 weeks of age and is delivered as a periodic treatment in vastly palatable flavored chewable that kill fleas before they can lay eggs.

-

In May 2021, Boehringer Ingelheim India announced the launch of its poultry vaccine VAXXITEK HVT+IBD. It is a single shot vaccine, ensuring life-long protection for all types of production chickens, namely broiler, layer and breeder.

India Veterinary Medicine Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.55 billion

Growth rate

CAGR of 10.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, route of administration, distribution channel

Country scope

India

Key companies profiled

Zoetis Inc.; Ceva Santé Animale; Virbac; Boehringer Ingelheim International Gmbh; Biovet; Sarabhai Chemicals; Growel Agrovet; LE Mantus Pharmaceuticals; Vetneeds Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India veterinary medicine market report based on product, animal type, route of administration, and distribution channel:

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Production Animals

-

Poultry

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Route Of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Other Routes

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The India veterinary medicine market size was valued at USD 1.80 billion in 2023.

b. The India veterinary medicine market size is projected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030 to reach USD 3.55 billion by 2030.

b. Based on product, the pharmaceuticals segment dominated the market with a revenue share of over 65% in 2023. The growth of this market can be attributed to increasing animal health expenditure, product portfolio expansion, R&D activities, and new product launches by key companies.

b. Zoetis Inc.; Ceva Santé Animale; Virbac; Boehringer Ingelheim International Gmbh; Biovet; Sarabhai Chemicals; Growel Agrovet; LE Mantus Pharmaceuticals; Vetneeds Labs are some of the key players operating in the India veterinary medicine market.

b. The India veterinary medicine market is driven by increasing awareness of the importance of animal healthcare, the incidence of disease outbreaks in animals, increasing demand for animal protein, and product launches.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."