- Home

- »

- Digital Media

- »

-

India Virtual Production Market Size & Share Report, 2030GVR Report cover

![India Virtual Production Market Size, Share & Trends Report]()

India Virtual Production Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Pre-production, Post-production), By End-use (Commercial Ads, Online Videos), And Segment Forecasts

- Report ID: GVR-4-68040-131-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

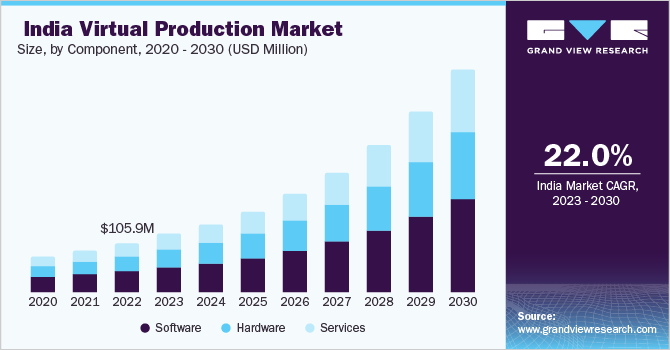

The India virtual production market size was estimated at USD 105.9 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 22.0% from 2023 to 2030. The rising popularity of virtual production fuels substantial growth within India's virtual production sector. As Indian filmmakers increasingly adopt this innovative technology, it transforms the country's virtual production landscape, presenting a cost-effective and imaginative approach to creating visually captivating and immersive content. This surge of interest is elevating the caliber of virtual production in India and establishing it as a formidable contender on the global stage.

The Indian virtual production market is on the rise, primarily fueled by advancements in domestic technology. India's expanding access to cutting-edge technology, combined with a burgeoning talent pool skilled in animation, visual effects (VFX), and digital technology, has solidified its position as a formidable contender in the global virtual production arena. For instance, in September 2021, Cineom partnered with Bridge Postworks, a media and entertainment solutions provider, to create an advanced 4K-HDR post-production facility. This collaboration reflects Cineom's commitment to staying at the forefront of technology in the post-production landscape.

India's virtual production sector is experiencing growth, partly due to the influence of e-commerce. E-commerce platforms and businesses have recognized the value of immersive and visually compelling content to engage customers. As a result, they increasingly turn to virtual production techniques to create captivating product visuals, interactive virtual showrooms, and augmented reality (AR) experiences. For instance, Myntra, an e-commerce platform specializing in fashion and apparel, introduced Myntra Fashion Superstar, a reality TV series that blends virtual production with the fashion world. In the show, budding fashion influencers and designers use virtual production to create innovative content such as virtual photoshoots, digital runways, and interactive fashion challenges.

Component Insights

Based on component, the software segment dominated the market with a revenue share of 44.3% in 2022. The dominance of the software segment is attributed to its crucial role as the technological foundation for virtual production processes. This segment provides crucial tools for creating virtual environments, rendering CGI, and managing data integration, offering filmmakers high customization and flexibility. India's growing access to advanced virtual production software and its skilled professionals in animation and digital technology have contributed significantly to the software segment's dominance. Virtual production software's continuous innovation and adaptability further solidify its central position in the Indian virtual production landscape.

The services segment is expected to grow with the fastest CAGR of 23.5% from 2023 to 2030. As the adoption of virtual production techniques expands across the country, there is an increasing demand for specialized expertise and services such as virtual set design, motion capture, and post-production integration. This growth is further fueled by collaborations with international production service providers, facilitating the delivery of high-quality virtual production projects that adhere to global standards. The versatility of virtual production, extending beyond filmmaking to various industries such as gaming and architecture, broadens the scope of services required.

Type Insights

Based on type, the post-production segment dominated the market with a revenue share of 54.4% in 2022. The post-production segment is thriving due to its crucial role in enhancing visual quality. Post-production activities, such as CGI integration, compositing, color correction, and the seamless integration of virtual elements with live-action footage, have become essential for achieving a polished and immersive final product. Skilled post-production professionals in India contribute to this growth by ensuring a polished final product. This segment remains pivotal in delivering visually compelling and immersive content as virtual production gains prominence in India and globally.

The production segment is expected to grow with the fastest CAGR of 23.6% from 2023 to 2030. The production segment is growing in the market primarily due to the increasing adoption of virtual production techniques across the country's film and entertainment industry. As filmmakers embrace these innovative technologies, they are turning to production services that offer advanced virtual set design, motion capture, and real-time rendering capabilities. Moreover, collaborations between Indian studios and international production service providers contribute to the expansion of this segment, enabling the delivery of high-quality virtual production projects that meet global standards.

End-use Insights

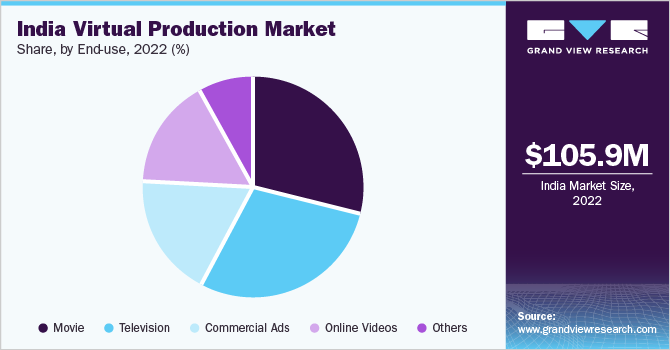

Based on end-use, the movie segment dominated the market with a revenue share of 30.8% in 2022. India's thriving film industry is a natural epicenter for integrating virtual production techniques into cinematic storytelling, capitalizing on the country's rich cinematic traditions. This segment aligns with the industry's penchant for creating visually spectacular productions, enabling filmmakers to elevate their narratives with realistic CGI and immersive virtual environments. Collaborations between Indian studios and international production service providers have further propelled the Movie segment, facilitating the creation of high-quality virtual production projects with global appeal. As audience expectations for visual engagement continue to rise, virtual production remains an enticing tool for filmmakers to meet these demands.

The television segment is projected to grow with the fastest CAGR of 23.2% from 2023 to 2030. The television segment is flourishing in India's virtual production market, driven by the nation's extensive and varied television industry. Virtual production techniques empower TV producers to enhance visual quality, craft immersive virtual sets, and meet the demand for high-quality content on digital platforms. Moreover, its cost-effectiveness appeals to TV networks and production houses with budget constraints. Virtual production enables creative experimentation and interactive storytelling, redefining television production in India. The rise of digital platforms and streaming services has intensified the need for visually captivating content, making virtual production a crucial tool for staying competitive in the digital age.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players. For instance, in May 2023, Annapurna Studios collaborated with Qube Cinema to establish an advanced virtual production stage in Hyderabad, India. This In-Camera Visual Effects (ICVFX) facility is poised to transform filmmaking in the country. Some prominent players in the India virtual production market include:

-

Adobe

-

Annapurna Studios

-

Cineom

-

Green Rain Studios LLP

-

Intellistudios (DB Productions)

-

Liminal – VR/AR Agency

-

Media.Monks (S4 Capital)

-

Qube Cinema

-

TILTLABS

-

Toonz Media Group

India Virtual Production Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 126.2 million

Revenue forecast in 2030

USD 507.1 million

Growth rate

CAGR of 22.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Market revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, end-use

Key companies profiled

Adobe; Annapurna Studios; Cineom; Green Rain Studios LLP; Intellistudios (DB Productions); Liminal – VR/AR Agency; Media.Monks (S4 Capital); Qube Cinema; TILTLA; Toonz Media Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Virtual Production Market Report Segmentation

This report forecasts revenue growth on the country level and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the India virtual production market report based on component, type, and end-use:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Pre-production

-

Production

-

Post-production

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Movie

-

Television

-

Commercial Ads

-

Online Videos

-

Others

-

Frequently Asked Questions About This Report

b. The India virtual production market size was estimated at USD 105.9 million in 2022 and is expected to reach USD 126.2 million in 2021.

b. The India virtual production market is expected to grow at a compound annual growth rate of 22% from 2023 to 2030 to reach USD 507.1 million by 2030.

b. The movies segment dominated the India virtual production market with a share of 29% in 2022. This is attributable to India's thriving film industry, a natural epicenter for integrating virtual production techniques into cinematic storytelling, capitalizing on the country's rich cinematic traditions.

b. Some key players operating in the India virtual production market include Adobe; Annapurna Studios; Cineom; Green Rain Studios LLP; Intellistudios (DB Productions); Liminal – VR/AR Agency; Media.Monks (S4 Capital); Qube Cinema; TILTLA; Toonz Media Group

b. Key factors that are driving the market growth include Growing digitization in the media and entertainment industry, Cost effectiveness enabled by virtual production and Technological innovations and advancements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.