- Home

- »

- Renewable Chemicals

- »

-

India Palm Oil Market Size, Share & Growth Report, 2030GVR Report cover

![India Palm Oil Market Size, Share & Trends Report]()

India Palm Oil Market (2023 - 2030) Size, Share & Trends Analysis By Product (Crude Palm Oil, Palm Kernel, RBD Palm Oil, Fractionated Palm Oil), By Application (Food & Beverage, Personal Care & Cosmetics, Biofuel & Energy), And Segment Forecasts

- Report ID: GVR-1-68038-385-0

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Palm Oil Market Size & Trends

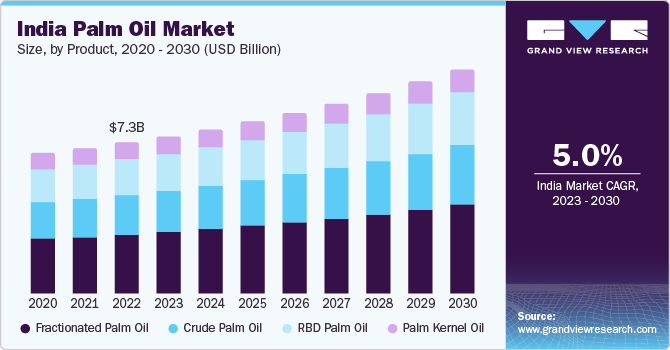

The India palm oil market size was valued at USD 7.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. Increasing demand for edible oils owing to the burgeoning population and improving economic conditions is anticipated to remain the key growth driving factor over the forecast period. The industry in India presents massive potential for growth since the government has allowed 100% FDI in plantations and has also pledged huge financial aid to farmers in the coming years. This development is likely to encourage the domestic cultivation landscape and generate greater profit margins and opportunities for companies.

The Indian industry is highly dependent on imports from Southeast Asian nations, particularly Indonesia and Malaysia, which together account for 90% of the overall imports. The government of India has reduced duties to ease supply constraints and form a stable supply through imports, thereby offsetting unmet demand.

Gradually increasing domestic production owing to investments through foreign private entities and government funding is expected to propel cultivation in upcoming years. Besides this, ease in investment policies and increasing acreage are a few other government mechanisms aimed at boosting domestic production.

Increasing demand for edible oils is expected to drive the India palm oil market. Edible oil factors in as an important component of food expenditure in India. The country is the world’s third-largest edible oil consumer and the largest importer from Indonesia and Malaysia. Population growth and improving economic conditions have led to a huge rise in processed food demand.

Traditionally edible oils were an important constituent of household foods and the unorganized processed foods industry. With the advent of food chains and the growth of packed foods, the demand for edible oils has risen tremendously in the past decade. India accounts for approximately 11% of the global edible oil consumption, 7% of oilseed production, 5% of the edible oil production, and nearly 15% of the global imports.

According to the Indian Government's Department of Food and Public Distribution, the edible oil market comprises 35% raw oil, 60% refined oil, and 5% vanaspati. Imports meet 56% of domestic edible oil demand, with palm oil/palmolein accounting for 54%. Refined palmolein consumption and blending have increased, widely used in hotels, restaurants, and food preparation.

The sustainability issue associated with cultivation is a key restraint for the palm oil market. India’s reputation along with sustainability issues needs significant improvements considering the country’s ranking on Environmental Performance Index. It is evident that sustainability efforts are largely undertaken by multinational companies with local operations. A trend prevailing in Indian companies is that short-term financial gains take precedence over long-term sustainability objectives.

From the perspective of domestic production and sustainability, it can be understood that the production of palm oil has a direct effect on the green cover of the country. Indian palm oil production follows a command area model, wherein state governments allocate land considered as wasteland to oil palm cultivators.

According to the report published by the Asia Pacific Foundation of Canada, over the past two decades, India has experienced a 23% increase in palm oil consumption, making it the largest importer globally.With 56% of India's edible oil imports being palm oil, and over 90% coming from Indonesia, Malaysia, and Thailand, the Indian government launched oilseed initiatives to reduce dependence on imports, improve food security, and address rising unemployment rates.

These lands have little value in terms of biodiversity or environmental risk. The concerned governments take due diligence before allocating the said land and cultivators are mandated to sell their entire production of FFB at a pre-determined price.

Product Insights

The fractionated palm oil segment accounted for the largest revenue share of 39.2% in 2022. This is due to the product's versatile properties, its increasing use in a variety of applications and availability at an economically viable cost. Fractionated palm oil is a type of palm oil that has been processed to remove some of the saturated fats. It is widely used in food, cosmetics and pharmaceuticals.

The Crude Palm Oil (CPO) segment is expected to grow at the fastest CAGR of 5.2% during the forecast period. The majority of CPO requirement in India is met through exports, which is further processed and finds application in the food industry and households. Steadily rising affluence levels and growing urbanization in India are the key factors driving demand in food applications.

Furthermore, refined derivatives are widely utilized in the bakery and confectionary industry in India owing to their cost competitiveness. The applications in bio-diesel have also increased significantly in recent years due to an unprecedented upsurge in petroleum prices. Furthermore, environmental concerns have also been crucial in promoting CPO applications in lubricants and biodiesel.

The 2021 National Mission on Edible Oils - Oil Palm (NMEO-OP) scheme includes aspects of previous schemes and aims to increase support and funding for 13 Indian states palm oil farmers. By 2026, the total area for palm oil cultivation is projected increase to one million hectares, and CPO production is expected to reach 1.13 million tonnes. Most of the cultivation is expected to occur in the Andaman and Nicobar Islands and seven ecologically sensitive northeastern states.

Palm kernel oil (PKO) is also expected to grow at a significant growth rate. PKO finds application in commercial cooking since it is relatively more cost-effective than other conventional counterparts and also remains stable at high cooking temperature. Increasing demand for protein-rich ingredients in the dairy and beef feed sector is the key factor contributing to growth in India.

Application Insights

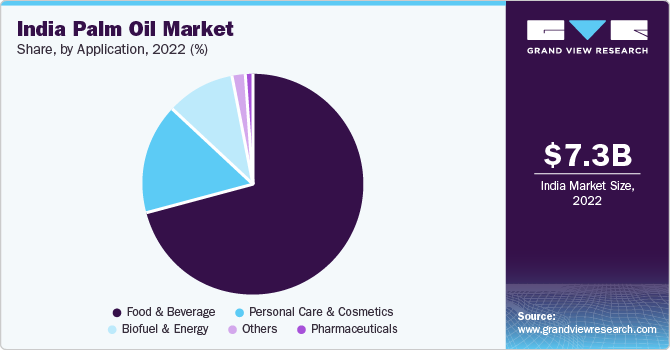

The food and beverage segment accounted for the largest revenue share of over 70.0% in 2022.Edible oil emerged as the dominant application segment in India. Palm products are widely being utilized as a cooking medium in India owing surging retail sector, limited availability of oilseeds, and it’s cheaper pricing.

The Indian edible oil industry is highly fragmented owing to the presence of a large number of organized as well as local and unorganized players. The country is also the world’s third-largest consumer and largest importer from Malaysia and Indonesia. Government’s initiatives towards the installation of advanced plant machinery and automation are expected to foster sustainable production in the near future.

The personal care and cosmetics segment accounted for a significant share in 2022. Increasing demand for a wide range of beauty products varying from an inbuilt sunscreen foundation to shampoos that not only cleanse the hair but also improve hair growth is projected to boost demand in upcoming years. Major cosmetic companies are also modifying their product portfolio with innovations as per the changing needs and preferences of consumers.

The biofuel and energy segment is expected to grow at the fastest CAGR of 5.6% during the forecast period. Increased government support, availability of raw materials, and growing demand for cleaner fuels are some factors anticipating segment growth. The Indian government has been promoting the use of biofuels as a way to reduce the country's dependence on imported oil. Crude palm oil can be refined into very high-grade biodiesel, bio-jet fuel, and other high-demand biochemical like oleic acid, which finds usage as a key raw material and active washing substance in laundry detergents and household cleaners.

Competitive Insights

Major companies are enhancing sustainable practices in sourcing, and production by utilizing less land, water, and energy resources. The industry is also witnessing several mergers and acquisitions owing to global manufacturers that are attempting to enter the fast-growing Indian market. In August 2021, Prime Minister Narendra Modi announced a national initiative called National Edible Oil Mission-Oil Palm (NMEO-OP) to increase farm incomes and self-reliance in palm oil production. The scheme involves over USD 1.0 billion in investment and aims to harness domestic edible oil prices influenced by expensive imports. The scheme is expected to incentivize palm oil production, reduce import dependence, and help farmers access the market. The plan is to increase domestic production by three times to 11 lakh MT by 2025-26, with an increase in oil palm cultivation to 10 lakh hectares by 2025-26 and 16.7 lakh hectares by 2029-30. Some of the players operating in the India palm oil market are:

-

Ruchi Soya Industries Ltd.

-

Cofco Agri Ltd.

-

Cargill India

-

Edible Group

-

3F Industries Ltd.

-

Godrej Agrovet

-

Adani Wilmar Ltd.

-

Troika India

-

Aditya Engineers

-

Sundex Process Engineers Pvt. Ltd.

-

Brissun Technology Pvt. Ltd.

-

Tinytech Udyog

-

Chempro Technovation Pvt. Ltd.

-

GlamTech Agro Process Pvt. Ltd.

Recent Developments

-

In May 2023, Godrej Agrovet's Oil Palm Business launched a finance offering for oil palm farmers in partnership with the State Bank of India (SBI). The product will enable farmers to obtain loans for micro irrigation facilities, fencing, and tube well improvements at their farms.

-

In April 2023, Baba Ramdev’s Patanjali Foods Ltd ( Ruchi Soya) pumped an investment of over USD 122 million for setting up integrated palm oil processing facilities in Telangana over the next four years.

-

In July 2022, The Malaysian Palm Oil Council and the Indian Vegetable Oil Producers' Association signed a memorandum of understanding (MoU) to promote palm oil usage. The MoU aims to increase collaboration in shared interests and advance Malaysian palm oil production and consumption, promoting the interests of producers, processors, users, and consumers.

India Palm Oil Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.87 billion

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report Updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

India

Country scope

North India; Northeast India; East India; South India; Western India

Key companies profiled

Ruchi Soya Industries Ltd.; Cofco Agri Ltd.; Cargill India Edible Group; 3F Industries Ltd.; Godrej Agrovet; Adani Wilmar Ltd.; Troika India; Aditya Engineers; Sundex Process Engineers Pvt. Ltd.; Brissun Technology Pvt. Ltd.; Tinytech Udyog; Chempro Technovation Pvt. Ltd.; GlamTech Agro Process Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Palm Oil Market Report Segmentation

This report forecasts volume & revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India palm oil market based on product, application, and region:

-

Product Outlook (Kilo Tons; Revenue, USD Million; 2018 - 2030)

-

Crude Palm Oil

-

Palm Kernel Oil

-

RBD Palm Oil

-

Fractionated Palm oil

-

-

Application Outlook (Kilo Tons; Revenue, USD Million; 2018 - 2030)

-

Food & Beverage

-

Personal care & Cosmetics

-

Biofuel & Energy

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North India

-

Northeast India

-

East India

-

South India

-

Western India

-

Frequently Asked Questions About This Report

b. The India palm oil market size was estimated at USD 7.3 billion in 2022 and is expected to reach USD 7.6 billion in 2023.

b. The global India palm oil market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 10.87 billion by 2030.

b. Fractionated palm oil dominated the India palm oil market with a share of 39.2% in 2019. This is attributable to its several therapeutic properties such as antioxidant, anti-bacterial, anti-inflammatory, stimulant, and anti-aging properties.

b. Some key players operating in the India palm oil market include Adani Wilmar Ltd., Ruchi Soya Industries Ltd., Cofco Agri Ltd., Oil Palm India Ltd., Cargill India, Godrej Agrovet, and others.

b. Key factors that are driving the market growth include the increasing demand for edible oils owing to the burgeoning population and improving economic conditions in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.