Industry Insights

The global industrial adhesives market size was valued at USD 47.60 billion in 2018 and is expected to grow at a CAGR of 5.9% from 2019 to 2025. The rising demand from the packaging industry and growing automobile sector especially in developing economies are expected to drive the market growth over the coming years.

Various properties of the product such as flexibility, solvent-free, lower costs, less vibration, high fatigue & thermal shock tolerance along with reduced waste and high productivity have increased its application in the automotive industry. The product is increasingly replacing conventional materials such as fasteners used indoors, hoods, deck lid flanges, roof panels, and dashboards along with other automobile components.

Adhesive bonding technologies have reduced the time and costs required to bond automotive components, while ultimately reducing overall weight & fuel consumption and improving efficiency. Increasing federal & governmental regulations regarding carbon emissions are expected to further complement product applications in the automotive industry.

Increasing packaging demand from various end-use industries such as pharmaceuticals, food & beverages, and cosmetics is expected to drive market growth over the coming years. Growth of e-commerce commodities demand, in which packaging is a necessary factor, is anticipated to drive the product demand over the coming years.

The industrial adhesives market is likely to face a challenge due to volatile crude oil prices. Crude oil derivatives such as vinyl acetate monomer, polyols, toluene diisocyanate (TDI), and methylene diphenyl diisocyanate (MDI) are used in the manufacture of raw materials for industrial adhesives. The fluctuation in the price of crude oil negatively impacts the raw material costs, thus leading to the high pricing of the product. This is likely to hinder the market growth over the coming years.

Product Insights

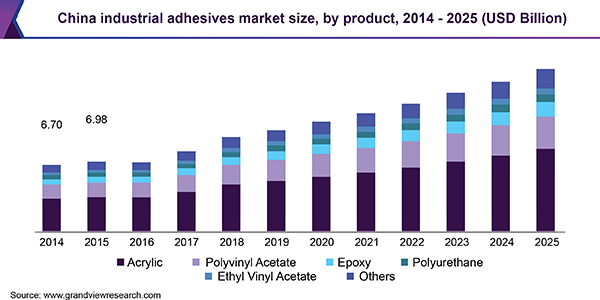

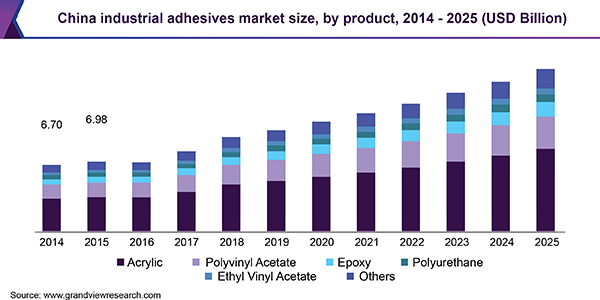

Acrylics were the leading product segment accounted for a volume share of 43.5% in 2018. They are used to enhance the aesthetic appeal and improve the bonding strength of metals. Characteristics such as fast curing, acid & solvent resistant make them suitable in various end-use industries such as furniture, medical devices, and packaging.

Polyvinyl acetate is expected to register an average growth owing to its properties such as high boiling & temperature resistance. Its superior bond strength along with the improved creep resistance makes it suitable for use in the packaging industry and furniture manufacturing.

Epoxy adhesives are largely used in the automotive industry. Properties of epoxy adhesives such as durability, oil absorption capacity, good wash-out resistance, and high strength across a wide temperature range make them suitable for the automotive industry. They are majorly used in the car body owing to their high mechanical strength and adhesion to metals and heat & corrosion resistance. The aforementioned advantages of epoxy adhesives are likely to propel the product demand over the coming years.

Polyurethanes are projected to register a CAGR of 4.5%, in terms of revenue, from 2019 to 2025. They are used to bind different materials such as wood, rubber, cardboard, or glass. Increasing demand from the wood industry is anticipated to drive the market growth over the next seven years. Besides, rising construction activities globally is likely to increase its application in kitchen flooring, cupboards, and work surfaces owing to its high-fracture resistance.

Application Insights

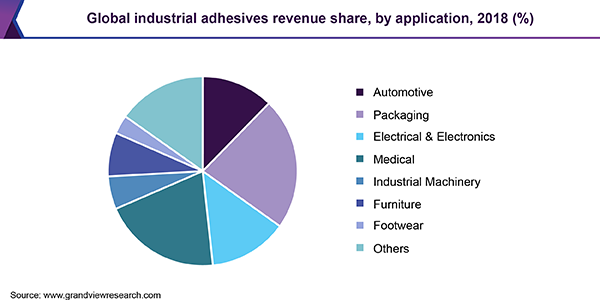

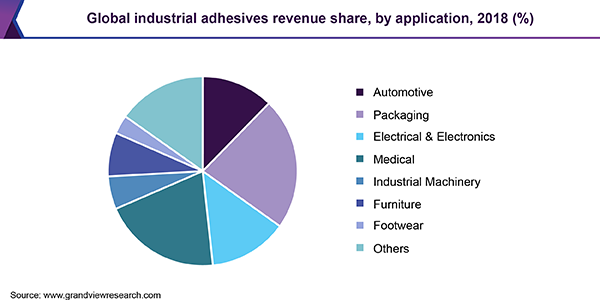

In the packaging segment, increasing the application of industrial adhesives for labeling, carton sealing, and corrugated box manufacturing has resulted in high market penetration. Moreover, rising demand for frozen goods, expanding the food & beverage industry, and flexible packaging applications are expected to provide growth opportunities. Properties such as high handling strength, superior performance under stressful conditions, and curing ability have made adhesives a popular replacement for mechanical fasteners in packaging applications.

The automotive segment is projected to grow at a CAGR of 4.7%, in terms of volume, over the forecast period. Shifting trend towards lightweight cars with streamlined modern designs to facilitate lesser wind resistance and enable high speeds is promoting adhesive applications in automobiles. Average car bodies have steel sheets with 0.6 to 0.8 mm thickness which require high strength bonding to promote maximum safety in case of accidents or mishaps. The growth is majorly driven by rising demand from the automotive industry to assemble various materials such as glass, rubber, and plastic.

In the medical segment, rising prevalence of diseases and increasing geriatric population is expected to contribute to the market growth. Industrial adhesives are increasingly being used to manufacture, assemble, pack, and label medical devices and equipment. Disposable devices and reusable products such as surgical masks, gloves, catheters, syringes, and others are generally bonded using high grade, sterilized adhesives.

The footwear segment is projected to register a CAGR of 6.4%, in terms of revenue, over the forecast period. This growth is attributed to the increasing use of polyurethane adhesives owing to high adhesion and cohesion strength. Solvent-based polyurethanes along with various other adhesives such as PCP are used in the manufacture of footwear. Changing lifestyle along with rising health concerns is likely to propel the demand for designer and sports shoes, which in turn is anticipated to augment the market growth over the coming years.

Regional Insights

The Asia Pacific was the leading region and accounted for 44.9% of the overall volume in 2018. Major automotive companies have shifted their production facilities to countries such as China, India, Thailand, and Vietnam owing to cheap labor and favorable government regulations. Increasing per capita income among the middle class in countries such as China and India is anticipated to fuel automotive sales over the next seven years. These factors are expected to drive product consumption over the coming years.

The furniture market in the region is projected to grow at a rapid pace over the coming years due to rising real income of the consumer, population growth, and urbanization. The global organized furniture is anticipated to grow by 20% annually, as per the World Bank. The growth is attributed to the rapidly growing consumer markets of Asia Pacific especially in India. This is likely to propel the product demand over the coming years.

In North America, increasing demand from the packaging industry is expected to remain a key driving factor for market growth over the forecast period. Change in consumer preferences towards convenience, extended shelf life, quick-serve, and portability of products is attributable to the growth of the packaging sector, which consumes a large number of industrial adhesives. This is likely to propel the market growth over the coming years.

Europe is anticipated to register a CAGR of 4.7%, in terms of revenue, over the forecast period. The market is driven by the growing automotive industry. The automotive industry accounts for 4% of the region’s GDP. Production of motor vehicles in the region increased by 4.4% from 2014 to 2018. The rising automotive production in turn is anticipated to propel the utilization of industrial adhesives in the coming years.

Industrial Adhesives Market Share Insights

Global industrial adhesives market is widely spread with the presence of various international and local players including Henkel AG & Co., Cytec Industries Inc., Hitachi Chemical Company Ltd, Mitsubishi Chemicals Corporation, Dow Chemical Co, Bayer Product Science (Covestro), DuPont de Nemours, Inc., Adhesive Films Inc., Toyo Polymer Co. Ltd.

The market players are adopting strategies such as mergers & acquisitions, capacity expansion, and long term contracts with the end-users to increase the competitive rivalry. For instance, in January 2017, H.B. Fuller Company acquired the assets of H.E. Wisdom & Sons, Inc. and its affiliate Wisdom Adhesives Southeast, LLC, which strengthened the company’s presence in North America.

Report Scopes

|

Attribute

|

Details

|

|

The base year for estimation

|

2018

|

|

Actual estimates/Historical data

|

2014 - 2017

|

|

Forecast period

|

2019 - 2025

|

|

Market representation

|

Volume in Kilotons, Revenue in USD Million, and CAGR from 2019 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, and Brazil

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global industrial adhesives market based on product, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Acrylic

-

Polyvinyl acetate

-

Epoxy

-

Polyurethane

-

Ethyl vinyl acetate

-

Others

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Automotive

-

Packaging

-

Electrical & electronics

-

Medical

-

Industrial machinery

-

Furniture

-

Footwear

-

Others

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)