- Home

- »

- Advanced Interior Materials

- »

-

Industrial Air Compressor Market Size & Share Report, 2030GVR Report cover

![Industrial Air Compressor Market Size, Share & Trends Report]()

Industrial Air Compressor Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reciprocating, Centrifugal), By Lubrication, By Operation, By Capacity, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-246-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Air Compressor Market Summary

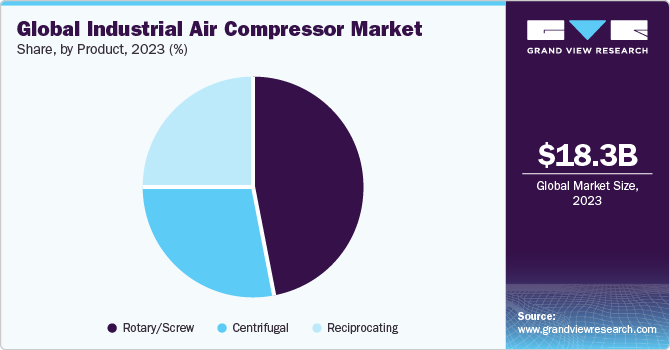

The global industrial air compressor market size was estimated at USD 18.32 billion in 2023 and is projected to reach USD 25.18 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. This growth is driven by rapid industrialization in emerging economies. The increased industrial activity requires efficient compressed air systems to operate machinery in the manufacturing sector.

Key Market Trends & Insights

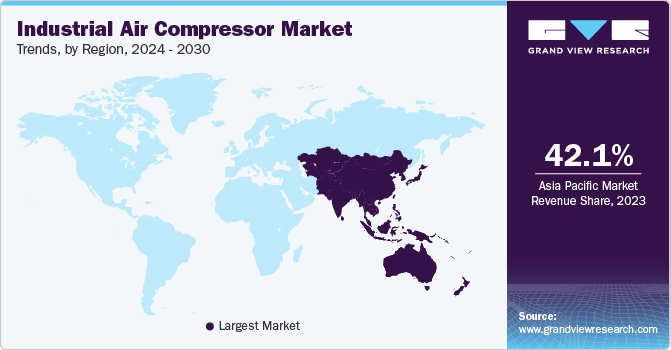

- Asia Pacific led the market and accounted for 42.1% of the global revenue share in 2023.

- The industrial air compressor market in China held over 50% revenue share of the Asia Pacific market.

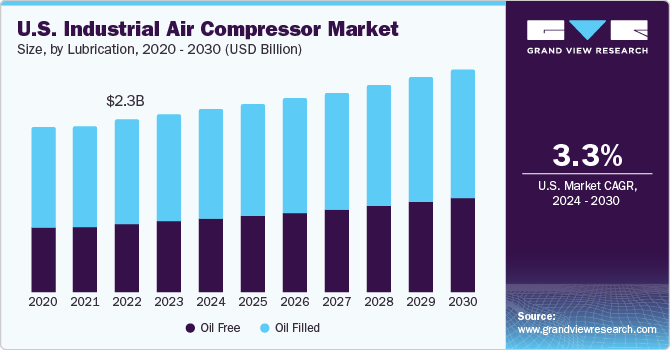

- By lubrication, the oil-free air compressor segment is anticipated to witness a high CAGR from 2024 to 2030.

- By end use, the manufacturing segment led the market in 2023 and is anticipated to witness a high CAGR from 2024 to 2030.

- By product, the centrifugal segment is anticipated to witness high growth over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 18.32 Billion

- 2030 Projected Market Size: USD 25.18 Billion

- CAGR (2024-2030): 4.1%

- Asia Pacific: Largest market in 2023

As emerging economies are experiencing significant expansion in the manufacturing, oil & gas, and food & beverage industries, the demand for industrial air compressors is rising. Businesses in various industries are automating their production process. Thus, there is a growing demand for efficient and reliable compressed air systems. Hence, the shift toward automation.is not only driving the demand for industrial air compressors but also catalyzing innovation in the sector.

In the U.S., an important factor for the industrial air compressor is the growth of key industries such as manufacturing, oil & gas, and food processing. Air compressors are important to power various tools used in the manufacturing processes, such as paint shops and assembly lines. In the oil & gas industry, the air compressor is used as a power source for a wide range of pneumatic tools. As the manufacturing and oil & gas sectors have been witnessing significant growth, the requirement for efficient and reliable compressed air systems is increasing. Hence, the upsurge in industrial activity serves as an important growth driver for the industrial air compressor market.

The ongoing technological innovations are expected to contribute to the market expansion. Innovations such as variable speed drives and smart controls enhance the reliability and performance of industrial air compressors. Manufacturers in the U.S. are continuously undertaking research and development (R&D) activities to introduce cutting-edge compressor solutions that align with the evolving industry standards. Hence, technological advancements play an important role in driving the market growth. For instance, Jenny, a stationary electric compressor manufacturer, provides horizontal- and vertical-tank electric stationary compressors in singles-stage or two-stage. Additionally, the subsequent launch of non-oil and gas-based projects and continuous investments in the industry are driving the global demand for air compressors.

At the global level, the rising importance of energy efficiency and sustainability is driving the adoption of eco-friendly and energy-efficient air compressor solutions. Industries worldwide are prioritizing efforts to reduce energy consumption, meet environmental regulations, and reduce their carbon emissions, leading to the rising demand for eco-friendly compressor solutions. Further, the increasing use of automation technologies and adherence to Industry 4.0 standards in manufacturing operations are propelling the market growth.

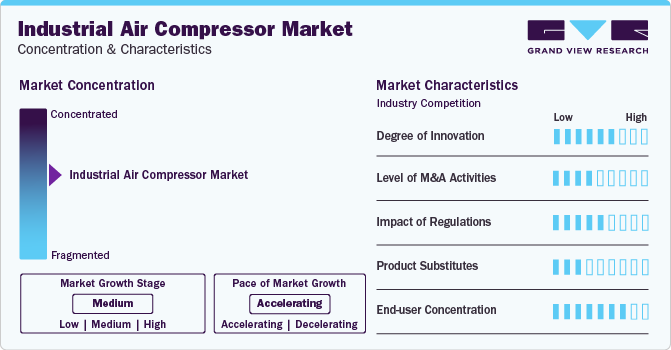

Market Concentration & Characteristics

The market growth stage is medium and the pace of the growth is accelerating. The industrial air compressor market is characterized by a high degree of competition owing to the various cost-efficient technologies adopted by the industry players for manufacturing air compressors. Emerging economies witnessed rapid growth in the manufacturing sector, leading to increased competition among the players.

The market is also characterized by a high degree of product innovation, which results in the development of high-quality industrial air compressors. For example, In June 2022, Ingersoll Rand announced the launch of its MSG Turbo Air NX 1500 compressor, designed for the food and beverages industry. The MSG Turbo-Air NX 1500 compressor is designed to provide customers seeking a 100% oil-free, long-lasting, low maintenance, and low-maintenance alternative with a low total cost of ownership. The new product launch can lead to increased market penetration by entering into new segments and expanding its customer base.

The demand for sustainable and environment-friendly industrial air compressors is increasing, and this trend is likely to increase R&D spending by various market players. The market is also significantly influenced by the growing regulatory compliance framework across the globe.

The industrial air compressor industry is moderately consolidated, with a few major players dominating and a large number of smaller companies competing. Acquisitions and regional expansion are the most significant strategies adopted by the key players. For instance, in April 2023, Atlas Copco completed the acquisition of Shandong Bozhong Vacuum Technology Co., Ltd., an innovator and manufacturer of vacuum systems and pumps. The acquired company became a division of the industrial vacuum division in the vacuum technique business segment of Atlas Copco. Such acquisitions are likely to help the companies to improve their market presence.

Lubrication Insights

The oil-filled air compressor segment dominated the market in 2023, due to lower maintenance requirements. They utilize lubricating oil to reduce the friction between moving components, preventing damage and ensuring smoother operation. The oil aids in dissipating the heat produced during the functioning of the air compressor, effectively cooling the compressor parts and enhancing overall efficiency.

The oil-free air compressor segment is anticipated to witness a high CAGR from 2024 to 2030, owing to its ability to supply compressed air without the presence of oil residues. Oil-free air compressors play a vital role in ensuring product quality, process integrity, and environmental compliance in many critical applications such as food & beverage and oil & gas. The product demand is predicted to rise in the coming years as the prominence of energy recovery & energy efficiency increases and CO2 emissions are reduced. For instance, according to the International Energy Agency (IEA), to reduce energy waste and lower CO2 emissions, the Inflation Reduction Act of 2022 makes significant investments in energy efficiency. These aforementioned factors are anticipated to propel the demand for oil-free air compressors in the coming years.

Operation Insights

The electric segment dominated the market in 2023, as electric compressors offer cost-effective operation compared to gasoline or diesel-powered air compressors due to the stability, availability, and affordability of electricity prices. In addition, they operate quietly, which makes them ideal for indoor environments or noise-sensitive areas where noise reduction is important. Electric air compressors can be used in a wide range of applications and offer more energy-efficient solutions than gasoline-powered air compressors.

The internal combustion engine (ICE) segment is anticipated to witness a high growth over the forecast period. These air compressors are portable and can be used in remote locations where electricity is not available. As the air compressors are powered by ICE, they typically provide higher output compared to the electric motor of the same size. These air compressors can be used in different applications.

Capacity Insights

The 501 and above kW capacity air compressor segment led the market in 2023, due to their ability to handle the higher volumetric flow of air. In the manufacturing sector, heavy-duty equipment often relies on high-pressure compressed air for effective operation. These high-capacity air compressors can supply compressed air to power such equipment. In many manufacturing processes, it is important to maintain precise control over air pressure and flow rate. This is essential for preserving product quality.

The 101-200 kW segment is anticipated to witness high growth over the forecast period. The small-capacity air compressors are compact, lightweight, and offer high portability for easy transportation within industrial facilities. Hence, they provide flexibility and convenience. Further, these small-capacity air compressors generate less noise, which makes them suitable for indoor environments or noise-sensitive settings.

End-use Insights

The manufacturing segment led the market in 2023 and is anticipated to witness a high CAGR from 2024 to 2030, owing to the extensive reliance of the manufacturing sector on compressed air for powering a wide range of pneumatic tools and equipment. In manufacturing operations, compressed air finds application in areas such as material handling, drilling using pneumatic motors, and painting. Industrial compressed air is often used to drive the pneumatic actuators, facilitating precise movement of machinery.

According to the U.S. Department of Agriculture, food, agriculture, and related industries contributed approximately USD 1.264 trillion in 2021, accounting for 5.4% of the total U.S. GDP. The growth of the food & beverage industry has indeed contributed to the expansion of the industrial air compressors market. As the food & beverage industry grows, there's a higher demand for the production capacity of industrial air compressors. The food & beverage industry is highly regulated, where maintaining quality and hygiene standards is crucial. Air compressors are used for cleaning, drying, and sterilization to ensure that food and beverage products meet rigorous safety and quality requirements.

Product Insights

The rotary/screw segment dominated the market by holding a 47.1% revenue share in 2023, owing to the ability of this product to supply a continuous flow of fluid at high pressure. They are known for their compact design, ability to operate over a longer period, high reliability, and effectiveness. For instance, in June 2023, Power Equipment Direct collaborated with ABAC Air Compressors to launch its unique rotary screw machines in the U.S. The AS Series of rotary screw air compressors is built with ground-breaking integrated block technology that reduces downtime, maximizes efficiency, and simplifies maintenance, making it an ideal choice for automotive, industrial, and other applications that require a reliable source of air.

The growth in the oil & gas industry is a key factor contributing to the rise in demand for rotary pumps. Rotary pumps are significantly used in the oil & gas industry to transport fluid from one point to another during the refining process. The growth in the oil & gas sector in the U.S. is driving the rotary pump market growth.

The centrifugal segment is anticipated to witness high growth over the forecast period, owing to the product’s ability to transfer large volumes of compressed air at high flow rates. They operate at high capacities, which makes them a suitable option for large volumetric air demand requirements. The centrifugal air compressors have fewer moving parts compared to rotary or screw air compressors. Due to this, they require less maintenance.

Regional Insights

The North America industrial air compressor market is characterized by a highly developed industrial base and advanced engineering capabilities. In addition to that, the region’s growing manufacturing sector in the automotive, electronics, and aerospace industries propels the demand for air compressors. Furthermore, the market also witnessed the demand for mobile and portable compressors due to the need for flexibility.

U.S. Industrial Air Compressor Market Trends

The U.S. industrial air compressor market accounted for more than 60.0% of the regional revenue share in 2023. This can be attributed to the advanced manufacturing capabilities, technological expertise, and commitment to quality and innovation across various industrial sectors.

Europe Industrial Air Compressor Market Trends

The industrial air compressor market in Europe is characterized by a highly developed industrial base, advanced engineering capabilities, and a strong focus on sustainability and efficiency. Countries like Germany and France are at the forefront of manufacturing activities, driving the demand for compressed air systems. The established market players in Europe are adopting the merger and acquisition strategy to strengthen their market presence.

The German industrial air compressor market accounts for more than 30% of the regional revenue. The demand for air compressors in Germany can be attributed to factors such as industrial automation and technology innovation. The automotive sector’s growth is primarily driving the demand for compressed air systems due to the requirement for precision manufacturing processes and a high level of quality control.

The industrial air compressor market in the UK is expected to grow significantly over the forecast period, due to growing compressed air demand in the UK’s endues industries such as food processing and automotive.

Asia Pacific Industrial Air Compressor Market Trends

Asia Pacific led the market and accounted for 42.1% of the global revenue share in 2023. In Asia Pacific, rapid industrialization, expanding manufacturing sectors, and increasing investments in infrastructure and technology drive the demand for industrial air compressors. Countries like China, Japan, and India are leading contributors to the growth of the regional manufacturing sector, with a strong presence in automotive manufacturing, electronics, and heavy machinery industries.

The industrial air compressor market in China held over 50% revenue share of the Asia Pacific market, driven by the increasing manufacturing activities across electronics, pharmaceutical, and automotive manufacturing. China’s focus on automation and technological advancement is driving the demand for the air compressors in the country.

The industrial air compressor market in India is anticipated to grow at a CAGR of 6.0% over the forecast period, attributed to the increasing demand for compressed air in various industries such as pharmaceutical, textile, automotive, and manufacturing.

Central & South America Industrial Air Compressor Market Trends

The industrial air compressor market in Central & South America is expected to witness significant growth from 2024 to 2030, owing to the increasing industrial investments in the automotive, aerospace & defense, medical, and oil & gas sectors. The oil and gas industry represents a significant segment, leveraging the demand for air compressors and supporting the region's prominent position in the global energy market.

The industrial air compressor market in Brazil is projected to grow at a CAGR of 59.1% over the forecast period. The growing manufacturing in the automotive sector and rising construction activity are expected to boost the demand for industrial air compressors.

Middle East & Africa Industrial Air Compressor Market Trends

The Middle East and Africa industrial air compressor market’s growth is driven by investments in oil and gas infrastructure, power generation, and industrial diversification initiatives. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced technologies to enhance the efficiency and reliability of their industrial components, creating opportunities for industrial air compressors to provide solutions for component protection and maintenance.

The industrial air compressor market in Saudi Arabia is projected to grow at a CAGR of 4.9% over the forecast period. The growth of this market is driven by the expansion of the oil & gas industry in Saudi Arabia.

Key Industrial Air Compressor Company Insights

The industrial air compressor market mainly consists of global players, of which a few operate regionally. New product launches, mergers and acquisitions, partnerships, and collaborations are vital strategies that companies adopt for sustained growth. Key raw material suppliers and equipment manufacturers have integrated their operations to provide raw materials and manufacture the final product to cut down on raw materials procurement and operation costs. Major market players frequently undertake geographical expansion strategies to enter established and newer markets. New product developments and approvals are also a part of the key initiatives key companies undertake to gain more substantial market penetration.

Some of the market players adopted the expansion strategy to increase the product reach and availability in diverse geographical areas. For instance, In March 2023, FS Elliot Co., LLC, an oil-free air compressor manufacturer, announced an investment of USD 2.0 million to expand its warehouse and manufacturing space in the U.S. It also announced the addition of two Mazak Integrex machines. The recent addition of the two new robotic arms helps automate the machining process, making it even more efficient. Moreover, the market players have undertaken marketing strategies to improve their brand recall in the market.

Key Industrial Air Compressor Companies:

The following are the leading companies in the industrial air compressor market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Copco

- Ingersoll Rand Plc

- Doosan Infracore

- Hitachi

- Kobe Steel

- Mitsubishi Heavy Industries

- Volkswagen (Man Energy Solutions)

- Kirloskar Pneumatics

- Elgi Equipments

- Siemens Energy

- Sulzer

- Baker Hughes

- Danfoss

- Boge Kompressoren

- Nardi Compressori Srl

Recent Developments

-

Atlas Copco introduced their next-generation mid-class smart industrial air compressors in February 2023. Both compressors include a smart temperature control system. They have an innovative hybrid bearing that extends the lifetime of the drive train by 33%. This product launch is likely to help the company strengthen its position as an innovative solution provider in the industrial air compressor market.

-

In February 2024, Doosan Infracore launched a new PA12.7v portable air compressor. The newly launched compressor utilizes a system called FlexAir technology that allows the compressor in a range of 12.1 bar to 5.5 bar and offers free air deliveries from 5.2 to 7-meter cube per minute.

Industrial Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.11 billion

Revenue forecast in 2030

USD 25.18 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, lubrication, operation, capacity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Atlas Copco; Ingersoll Rand Plc; Doosan Infracore; Hitachi; Kobe Steel; Mitsubishi Heavy Industries; Volkswagen (Man Energy Solutions); Kirloskar Pneumatics; Elgi Equipments; Siemens Energy; Sulzer; Baker Hughes; Danfoss; Boge Kompressoren; Nardi Compressori Srl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Air Compressor Market Report Scope

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial air compressor market report based on product, lubrication, operation, capacity, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-free

-

Oil Filled

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 100 kW

-

101-200 kW

-

201-300 kW

-

301-500 kW

-

501 & Above

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Manufacturing

-

Healthcare/Pharmaceutical

-

Food & Beverage

-

Energy & Utility

-

Automotive

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial air compressor market size was estimated at USD 18.32 billion in 2023 and is expected to be USD 19.11 billion in 2024.

b. The global industrial air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 25.18 billion by 2030.

b. The Asia Pacific region dominated the market and accounted for 42.1% share in 2023, due to the growing manufacturing sector, favorable government policies, surge in industrial activities, and investment in infrastructure.

b. Some of the key players operating in the industrial air compressor market include, Atlas Copco, Ingersoll Rand Plc, Doosan Infracore, Hitachi, Kobe Steel, Mitsubishi Heavy Industries, Volkswagon (Man Energy Solutions), Kirloskar Pneumatics, Elgi Equipments, Siemens Energy, Sulzer, Baker Hughes, Danfoss, Boge Kompressoren, Nardi Compressori Srl.

b. The key factors that are driving the industrial air compressor market include the expansion of automotive, manufacturing, and oil & gas industries. Technological advancement and increasing emphasis on energy efficiency and sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.