- Home

- »

- Plastics, Polymers & Resins

- »

-

Industrial Bulk Packaging Market Size, Industry Report, 2030GVR Report cover

![Industrial Bulk Packaging Market Size, Share & Trends Report]()

Industrial Bulk Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Metal, Paper & Paperboard), By Product (Drums, Pails, Pails, Totes/ Cracks), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-466-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Bulk Packaging Market Trends

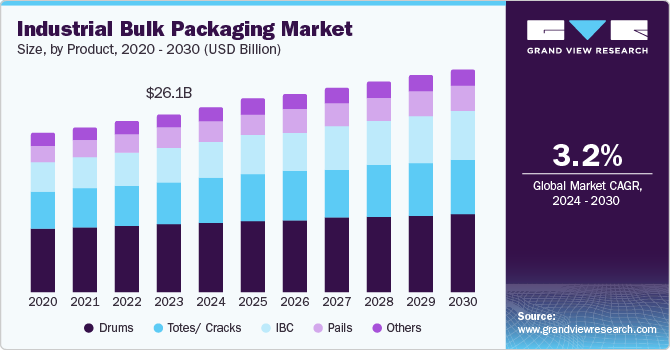

The global industrial bulk packaging market size was valued at USD 26.14 billion in 2023 and is expected to expand at a CAGR of 3.2% from 2024 to 2030. The increasing industrial activity, particularly in developing regions, boosts the demand for efficient and reliable packaging solutions. Furthermore, the rise in global trade and long-distance commerce necessitates robust packaging to ensure the safe transport of goods. The growing emphasis on sustainability and adopting eco-friendly packaging materials are significant drivers as industries seek to reduce their environmental footprint.

The expanding food and beverage and pharmaceutical and chemical industries contribute to the heightened demand for bulk packaging solutions. Lastly, advancements in packaging technology, such as the development of intermediate bulk containers (IBCs) and other innovative solutions, are enhancing the efficiency and versatility of industrial bulk packaging.

The emergence of sustainable and recyclable packaging materials is a significant driver as industries increasingly adopt eco-friendly solutions to meet regulatory requirements and consumer preferences. The steady growth in construction activities worldwide also boosts the demand for bulk packaging, particularly for transporting construction materials.

Material Insights

Plastic dominated the market with the largest revenue share of 39.4% in 2023. Plastic packaging offers exceptional versatility and durability, making it an ideal choice for various industrial applications. Its lightweight nature reduces transportation costs and enhances handling efficiency, which is crucial for bulk packaging. Additionally, plastic’s ability to be molded into various shapes and sizes allows customized packaging solutions tailored to specific industry needs. The segment’s growth is further fueled by advancements in plastic manufacturing technologies, improving the material’s strength and sustainability. Despite growing environmental concerns, the plastic segment thrives due to ongoing innovations in recyclable and biodegradable plastic materials, addressing performance and ecological considerations.

Paper & paperboard is expected to grow at the fastest CAGR of 3.5% over the forecast period. This rapid expansion is attributed to the increasing demand for sustainable, eco-friendly packaging solutions. As industries and consumers become more environmentally conscious, the preference for biodegradable and recyclable materials is driving the adoption of paper and paperboard in bulk packaging. Additionally, advancements in paper manufacturing technologies have enhanced the strength and durability of paper-based packaging, making it a viable alternative to traditional materials like plastic. The versatility of paper and paperboard, which can be easily customized and printed on, further adds to its appeal across various industries, including food and beverage, pharmaceuticals, and consumer goods. This segment’s growth is also supported by stringent regulations and policies promoting sustainable packaging materials, reinforcing its position as a key player in the industrial bulk packaging market.

Product Insights

Drums dominated the market with the largest revenue share in 2023. This dominance is primarily due to the drums’ robust and durable nature, making them ideal for transporting and storing a wide range of industrial goods, including chemicals, oils, and food products. Drums offer excellent protection against contamination and damage, ensuring the safe handling of hazardous and non-hazardous materials. Their versatility in accommodating various capacities and their compatibility with different materials, such as steel, plastic, and fiber, further enhance their appeal across multiple industries. Additionally, the ease of handling and stacking drums and their reusability and recyclability contribute to their widespread adoption.

The IBC segment is expected to grow at the fastest CAGR over the forecast period. IBCs are highly versatile and efficient, providing a cost-effective solution for transporting and storing a wide range of liquids, semi-solids, and granulated substances. Their design allows for easy handling and stacking, optimizing space utilization in storage and transportation. Additionally, IBCs are known for their durability and reusability, which align with the growing emphasis on sustainability and reducing environmental impact. The segment’s growth is further driven by advancements in IBC design and materials, enhancing their strength, safety, and compatibility with various industrial applications.

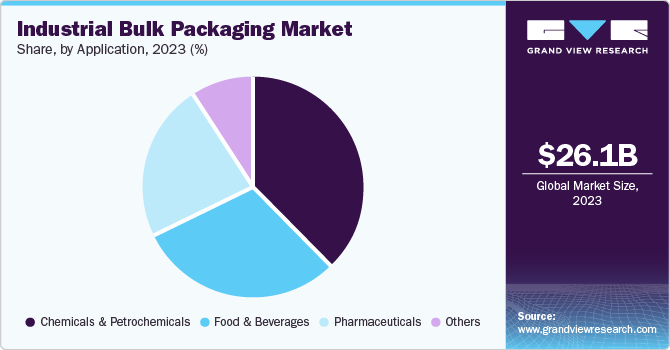

Application Insights

Chemicals & petrochemicals dominated the market with the largest revenue share in 2023. These materials often require specialized packaging to ensure safety, prevent contamination, and comply with stringent regulatory standards. Drums, Intermediate Bulk Containers (IBCs), and other bulk packaging solutions are particularly well suited for handling hazardous and non-hazardous chemicals, offering robust protection and ease of handling. The growth of this segment is further supported by the expanding chemical and petrochemical industries, which are integral to numerous sectors, including manufacturing, pharmaceuticals, and agriculture. As these industries continue to grow, the demand for reliable and efficient bulk packaging solutions is expected to remain strong, reinforcing the leading position of the chemicals and petrochemicals segment in the market.

The pharmaceutical segment is expected to grow at the fastest CAGR over the forecast period. This rapid growth is driven by the increasing demand for safe and secure packaging solutions to transport and store pharmaceutical products. The stringent regulatory requirements for pharmaceutical packaging to ensure product integrity and patient safety are a significant factor propelling this segment’s expansion.

Regional Insights

Asia Pacific industrial bulk packaging dominated the global market with the largest revenue share in 2023. Rapid industrialization and urbanization in countries such as China, India, and Japan have significantly increased the demand for bulk packaging solutions across various industries, including chemicals, pharmaceuticals, and food & beverages. The pharmaceutical sector is expanding rapidly due to rising healthcare needs and substantial investments in healthcare infrastructure, necessitating reliable bulk packaging for safe transport and storage.

China Industrial Bulk Packaging Market Trends

China’s industrial bulk packaging dominated the Asia Pacific market, with the largest revenue share of 51.8 % in 2023. This dominance is attributed to the rapid industrial expansion across the chemical, pharmaceuticals, and agriculture sectors. Furthermore, favorable policies and incentives for manufacturing and industrial growth combined with stringent regulations for the safe transport of hazardous materials are expected to drive market growth in this region.

Europe Industrial Bulk Packaging Market Trends

The European industrial bulk packaging market was identified as a lucrative region in 2023. The region's strong focus on sustainability and circular economy principles is expected to drive market growth. Furthermore, European governments and industries are increasingly adopting eco-friendly packaging materials and reusable packaging solutions to reduce waste, which is anticipated to drive the region's growth.

The UK industrial bulk packaging market is expected to grow significantly over the forecast period. The region's growth is attributed to the rising demand from industries such as chemicals, pharmaceuticals, food and beverages, and agriculture.

North America Industrial Bulk Packaging Market Trends

North America industrial bulk packaging market is expected to grow significantly over the forecast period owing to robust industrial activities across sectors such as chemicals, food & beverages, and agriculture.

The U.S. industrial bulk packaging market is anticipated to grow over the forecast period. Rapid technological advancements in the packaging sector and growing industrial output position the region for continuous growth.

Key Industrial Bulk Packaging Company Insights

Some key companies in the industrial bulk packaging market include Greif, Inc., My Flexitank Industries Sdn Bhd, Shandong Anthente New Materials Technology Co. Ltd, and others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Grief Inc. is a leading global provider in the industrial bulk packaging market, known for its diverse portfolio that caters to industries such as chemicals, food & beverages, agriculture, and pharmaceuticals.

Key Industrial Bulk Packaging Companies:

The following are the leading companies in the industrial bulk packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Shandong Anthente New Materials Technology Co. Ltd

- My Flexitank Industries Sdn Bhd

- Greif, Inc.

- International Paper Company

- Büscherhoff Spezialverpackung GmbH & Co. KG

- Bulk Lift International, Inc.

- Bemis Company, Inc.

- Environmental Packaging Technologies, Inc.

- Hoover Ferguson Group

- Schuetz GmbH & Co. KGaA

Recent Developments

-

In March 2024, Greif, Inc., a leading industrial packaging product and service provider, successfully concluded the acquisition of Ipackchem Group SAS. This acquisition would help Greif unlock new market opportunities and grow as a prominent player in high-performance jerrycans and small plastic containers.

Industrial Bulk Packaging Market Report Scope

Report Attribute

Details

Market size in 2024

USD 27.21 billion

Revenue forecast in 2030

USD 32.80 billion

Growth Rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, Product, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

My Flexitank Industries Sdn Bhd; Greif, Inc.; Shandong Anthente New Materials Technology Co. Ltd; International Paper Company; Büscherhoff Spezialverpackung GmbH & Co. KG; Bulk Lift International, Inc.; Bemis Company, Inc.; Environmental Packaging Technologies, Inc.; Hoover Ferguson Group; Schuetz GmbH & Co. KGaA

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Bulk Packaging Market Report Segmentation

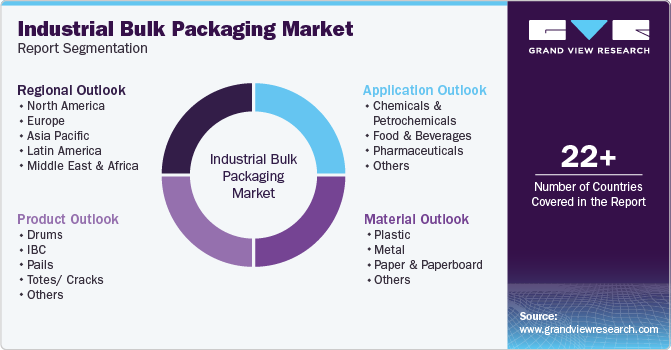

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial bulk packaging market report based on material, product, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Paper & Paperboard

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Drums

-

IBC

-

Pails

-

Totes/ Cracks

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemicals & Petrochemicals

-

Food & Beverages

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.