- Home

- »

- Advanced Interior Materials

- »

-

Industrial Lightweight Construction Fasteners Market Report, 2033GVR Report cover

![Industrial Lightweight Construction Fasteners Market Size, Share & Trends Report]()

Industrial Lightweight Construction Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Self-drilling Screws, Self-tapping Screws), By Roofing System, By Wall System, By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-645-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Lightweight Construction Fasteners Market Summary

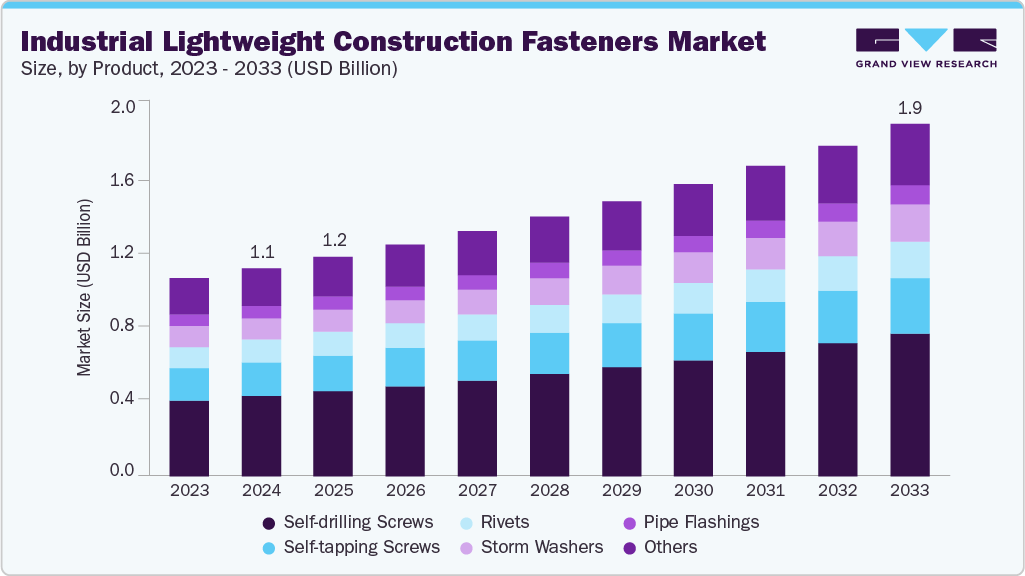

The global industrial lightweight construction fasteners market size was estimated at USD 1.16 billion in 2024, and is projected to reach USD 1.96 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The demand for ILC (Industrial Lightweight Construction) fasteners is increasing due to the growing adoption of lightweight materials across key industries such as automotive, aerospace, electronics, and industrial machinery.

Key Market Trends & Insights

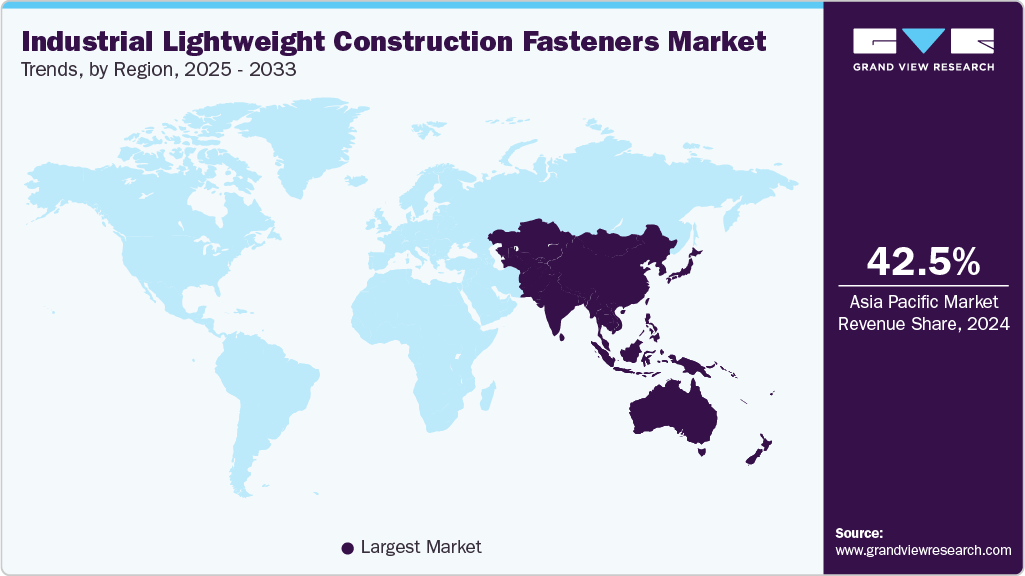

- Asia Pacific dominated the industrial lightweight construction fasteners market with the largest revenue share of 42.5% in 2024.

- By product, the self-drilling screws segment is expected to grow at fastest CAGR of 6.7% over the forecast period.

- By roofing system, the sandwich panel roof segment is expected to grow at the fastest CAGR of 6.7% over the forecast period.

- By wall system, the wall with sandwich panels segment is expected to grow at the fastest CAGR of 6.7% over the forecast period.

- By end use, the energy & utilities (solar and green roofs) segment is expected to grow at the fastest CAGR of 6.7% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.16 Billion

- 2033 Projected Market Size: USD 1.96 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

With rising global pressure to reduce carbon emissions and improve energy efficiency, manufacturers are shifting from traditional heavy metals to composites, aluminum, and high-strength plastics. This transition necessitates the use of specialized fasteners that can effectively secure lightweight components without compromising structural integrity, thereby fueling the need for advanced fastening solutions.Several key drivers are propelling the growth of the ILC (Industrial Lightweight Construction) fasteners industry. The rapid expansion of electric vehicles (EVs), where every gram of weight affects battery performance and range, is creating significant demand for lightweight, durable fasteners. Similarly, the aerospace industry’s continuous efforts to enhance fuel efficiency and reduce material weight are pushing the development of high-performance fastening systems. Additionally, government regulations around vehicle emissions, energy use in construction, and green manufacturing practices are encouraging the use of lightweight construction techniques, further supporting market expansion.

Prominent players in the ILC (Industrial Lightweight Construction) fasteners market are increasingly focusing on direct-to-customer models through online platforms to streamline distribution and enhance profitability. By bypassing traditional intermediaries, manufacturers can better control pricing, reduce lead times, and improve customer engagement. These online channels also enable real-time tracking of customer preferences and market trends, allowing companies to adapt their product offerings accordingly. This strategic shift not only boosts profit margins but also strengthens manufacturers’ responsiveness to evolving industry demands and end user requirements.

Market Concentration & Characteristics

The ILC fasteners market is moderately concentrated, with a mix of global players and specialized regional manufacturers. Leading companies such as Hilti, Bulten AB, Arconic, Stanley Black & Decker, and Nifco dominate the landscape with strong brand recognition, diversified product portfolios, and global distribution networks. These key players invest heavily in R&D to innovate fastening technologies compatible with lightweight materials like composites, aluminum, and carbon fiber. However, regional players also hold notable market share by catering to specific industrial needs and offering cost-effective solutions. Strategic mergers, acquisitions, and partnerships are common as companies aim to expand capabilities and market presence.

In the ILC fasteners industry, potential substitutes include adhesive bonding, welding, clinching, and riveting technologies. These alternatives are increasingly used in applications where seamless joints, reduced part counts, or enhanced aerodynamics are preferred. For instance, in automotive and aerospace sectors, structural adhesives and laser welding are gaining traction due to their ability to reduce weight and enhance strength. However, mechanical fasteners continue to dominate because of their reliability, ease of inspection, and ability to disassemble components for maintenance or recycling. The choice between fasteners and substitutes often depends on performance requirements, cost, material compatibility, and ease of assembly.

Product Insights

The self-drilling screws segment held highest revenue share of 38.6% in 2024, owing to its widespread application in industrial, automotive, and construction settings. These screws offer the dual advantage of drilling and fastening in a single operation, significantly reducing installation time and labor costs. Their compatibility with lightweight materials like aluminum and composites makes them ideal for modern manufacturing environments that prioritize speed, efficiency, and structural integrity. Additionally, their high holding power and adaptability to various substrates have made them a preferred choice among builders and contractors working with pre-engineered and modular components.

The storm washers segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. These washers enhance sealing performance and provide extra protection against water, wind, and environmental stress, making them essential in roofing and exterior panel applications. As lightweight construction becomes more prevalent in both commercial and residential buildings, demand for reliable, weather-resistant fastening accessories like storm washers is rising. Their ability to ensure long-term structural durability and prevent fastener failure under harsh conditions is driving their increased adoption across construction and infrastructure projects.

Roofing System Insights

The sandwich panel roof segment held the highest revenue share of 45.5% in 2024, driven by its widespread use in industrial buildings, warehouses, and cold storage facilities. These panels offer excellent thermal insulation, structural strength, and quick installation-all of which align with the goals of lightweight construction. The increasing demand for energy-efficient buildings and sustainable materials has further fueled the adoption of sandwich panel roofing systems. As a result, there has been a corresponding surge in demand for specialized fasteners that can securely anchor these multi-layered panels without compromising insulation or structural integrity.

The double-sheet roof with seam or clamping profile segment is expected to grow at the fastest CAGR of 6.4% over the forecast period, particularly in commercial and architectural applications. These systems provide a sleek, weather-tight, and highly durable roofing solution that supports both aesthetic and functional requirements. As architects and builders seek advanced roofing solutions for modern infrastructure, the need for precision-engineered fasteners compatible with seam or clamping profiles is rising. The segment’s growth is further supported by innovations in fastening technologies that ensure secure attachment while allowing for thermal expansion and contraction, making them ideal for large-span, high-performance roofs.

Wall System Insights

The wall with sandwich panels segment held the highest revenue share of 41.6% in 2024, owing to its widespread use in industrial buildings, warehouses, and commercial complexes. These panels offer excellent thermal insulation, soundproofing, and fire resistance while ensuring faster installation and reduced structural load. As lightweight construction methods continue to gain traction, the demand for compatible fastening solutions that can securely fix sandwich panels without compromising their performance is increasing. This has led to a surge in the use of high-performance fasteners specifically designed for multi-layered wall systems.

The profiled wall with cassette structure segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. Cassette systems offer superior design flexibility, clean aesthetics, and enhanced durability, making them increasingly popular in modern façade construction. These structures require precision fastening solutions that ensure long-term stability, weather resistance, and ease of assembly. The growing emphasis on modular construction, energy efficiency, and architectural customization is fueling the adoption of cassette wall systems, driving strong demand for innovative and specialized ILC fasteners tailored for these applications.

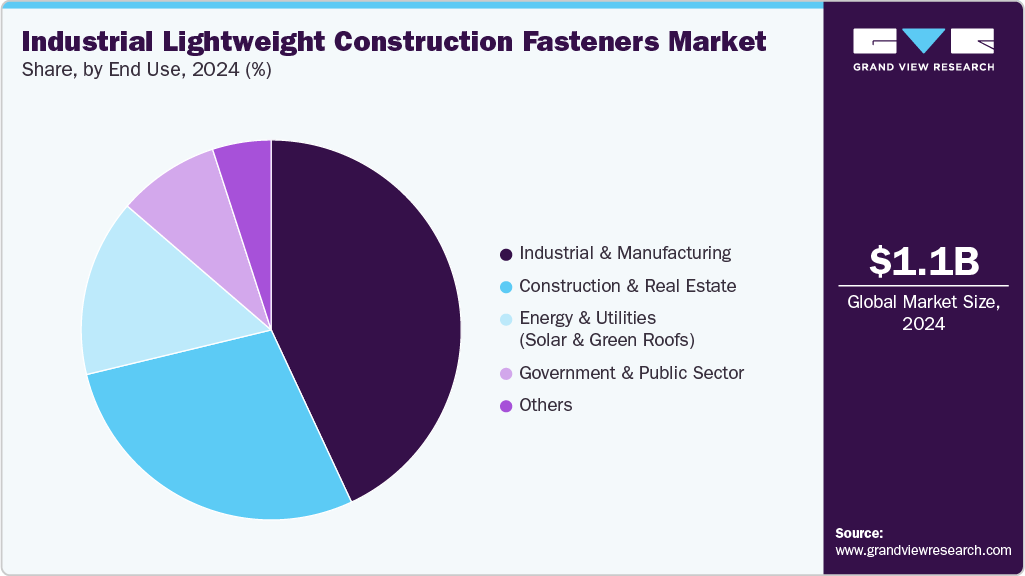

End Use Insights

The industrial & manufacturing segment held the highest revenue share of 43.1% in 2024, driven by the widespread adoption of lightweight construction practices in factories, warehouses, and production facilities. These sectors demand fast, cost-effective, and structurally sound building solutions, making lightweight materials paired with advanced fastening systems highly attractive. The need for durable, corrosion-resistant, and high-load-bearing fasteners is especially critical in heavy-duty operations, where structural integrity and safety are paramount. Additionally, rising investments in industrial infrastructure and modernization efforts are further fueling the demand for reliable fastening technologies.

The energy & utilities (solar and green roofs) segment is expected to grow at a CAGR of 6.7% over the forecast period. As the global shift toward renewable energy and sustainable construction accelerates, there is a rising need for lightweight, easy-to-install fasteners that can securely support solar panels and vegetation-based roofing systems. These applications often require specialized fasteners capable of withstanding dynamic loads, temperature variations, and outdoor exposure. Government incentives, net-zero energy targets, and growing awareness around green building certifications are further propelling the growth of this segment, making it a key focus area for fastener manufacturers.

Distribution Channel Insights

The direct distribution channel segment held the highest revenue share of 61.4% in 2024, driven by manufacturers’ growing emphasis on selling directly to contractors, builders, and end users. This strategy allows companies to simplify their supply chain, minimize reliance on third-party intermediaries, and boost profitability. Direct distribution also offers better control over pricing strategies, improves customer service, and enables faster adaptation to shifting market demands. Consequently, numerous leading manufacturers have developed in-house sales teams and dedicated online platforms to enhance their direct-to-customer relationships and strengthen market positioning.

The indirect distribution channel segment is projected to expand at a CAGR of 5.9% during the forecast period, especially in developing regions where extensive networks of local dealers and distributors remain essential. These intermediaries provide deep market knowledge, logistical capabilities, and established trust with small to mid-sized contractors who often prefer traditional purchasing methods. As construction activity grows in underserved and remote locations, manufacturers are increasingly collaborating with indirect channel partners to broaden their customer base, extend geographic coverage, and maintain consistent product availability.

Regional Insights

Asia Pacific dominated the ILC (Industrial Lightweight Construction) fasteners market and accounted for the largest revenue share of about 42.5% in 2024, owing to rapid industrialization, robust growth in automotive and aerospace sectors, and the rising adoption of lightweight construction materials. China, India, Japan, and South Korea are investing heavily in advanced manufacturing and infrastructure, driving demand for high-performance fasteners. Government initiatives supporting smart manufacturing and electric vehicles are further accelerating the need for durable and lightweight fastening solutions in the region.

China Industrial Lightweight Construction Fasteners Market Trends

The China Industrial Lightweight Construction Fasteners market is expected to grow during the forecast period. China remains the single-largest contributor in Asia Pacific due to its massive automotive production capacity, booming EV sector, and expansion of high-speed rail and aerospace manufacturing. The country’s focus on weight reduction to enhance fuel efficiency and performance across sectors has driven the adoption of composite structures and matching fastener systems. Local fastener manufacturers are increasingly collaborating with global players to enhance product standards and exports.

North America Industrial Lightweight Construction Fasteners Market Trends

North America is witnessing steady growth in the ILC (Industrial Lightweight Construction) fasteners industry, propelled by a mature aerospace and defense sector, along with increasing electric vehicle production. Manufacturers in the U.S. and Canada are focusing on integrating advanced materials like carbon fiber and aluminum in industrial design, creating demand for compatible lightweight fasteners. Sustainability goals and regulatory pressure on emissions are pushing industries toward lightweight, high-strength alternatives.

The U.S. plays a pivotal role in North America’s ILC fasteners market, thanks to its technological innovation in automotive, aerospace, and industrial machinery. The country’s strong focus on lightweighting in both military and commercial aircraft, along with high R&D investments in material science, is contributing to market expansion. Leading U.S. companies are also reshoring production, boosting domestic demand for advanced fastener systems.

Europe Industrial Lightweight Construction Fasteners Market Trends

Europe is a key player, driven by stringent environmental regulations and its leadership in automotive engineering and aerospace. Countries like Germany, France, and the UK are promoting lightweight construction to meet emission reduction targets. The shift toward electric vehicles and increased adoption of composite materials in industrial manufacturing are boosting demand for high-strength, corrosion-resistant, lightweight fasteners across the continent.

The Germany ILC (Industrial Lightweight Construction) fasteners market holds a dominant position in Europe, due to its strong automotive and mechanical engineering sectors. German manufacturers are at the forefront of integrating lightweight construction in premium vehicles and industrial equipment. High levels of automation and precision engineering demand fasteners with tight tolerances and advanced material compatibility, driving innovation and exports from the region.

Latin America Industrial Lightweight Construction Fasteners Market Trends

Latin America is an emerging market for ILC fasteners, supported by the gradual modernization of industrial infrastructure and the expansion of automotive manufacturing, particularly in Brazil and Mexico. While adoption is slower compared to developed markets, increasing foreign investments and trade agreements are enhancing the region’s exposure to lightweight construction trends and driving demand for specialized fasteners.

Middle East & Africa Industrial Lightweight Construction Fasteners Market Trends

The Middle East & Africa ILC (Industrial Lightweight Construction) fasteners industry is witnessing gradual growth, with demand mainly driven by industrial expansion in the Gulf Cooperation Council (GCC) nations and infrastructure development in parts of Africa. Lightweight construction is gaining attention in energy, transportation, and construction sectors, where reducing load and improving efficiency are becoming priorities. Investment in aerospace hubs like the UAE is also expected to contribute to future growth in fastener demand.

Key Industrial Lightweight Construction Fasteners Company Insights

The ILC (Industrial Lightweight Construction) fasteners market comprises prominent players such as Hilti Group, Stanley Black & Decker, Arconic Corporation, Bulten AB, Nifco Inc., Illinois Tool Works (ITW), LISI Group, TR Fastenings, Bossard Group, and PennEngineering. These companies are actively adopting strategies such as continuous product innovation, regional expansion, and strategic collaborations to solidify their competitive edge. Additionally, there's a growing emphasis on designing application-specific, corrosion-resistant, and high-strength fasteners that are compatible with advanced lightweight materials used across automotive, aerospace, and industrial sectors.

Furthermore, top players are engaging in targeted mergers and acquisitions to diversify their technological capabilities and enhance their global reach. For example, in March 2024, PennEngineering acquired a German-based specialty fastener manufacturer focused on lightweight composite fastening systems, enabling the company to expand its presence in the European automotive market. This acquisition supports PennEngineering’s commitment to providing next-generation fastening technologies optimized for hybrid and electric vehicle platforms, where weight reduction and assembly efficiency are critical.

Key Industrial Lightweight Construction Fasteners Companies:

The following are the leading companies in the industrial lightweight construction fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- Hilti Group

- Stanley Black & Decker

- Arconic Corporation

- Bulten AB

- Nifco Inc.

- Illinois Tool Works (ITW)

- LISI Group

- TR Fastenings

- Bossard Group

- PennEngineering

Industrial Lightweight Construction Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2033

USD 1.96 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, roofing systems, wall system, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; South Korea; Brazil; UAE

Key companies profiled

Hilti Group; Stanley Black & Decker; Arconic Corporation; Bulten AB; Nifco Inc.; Illinois Tool Works (ITW); LISI Group; TR Fastenings; Bossard Group; PennEngineering

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Lightweight Construction Fasteners Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial lightweight construction fasteners market report based on product, roofing system, wall system, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-drilling Screws

-

Self-tapping Screws

-

Rivets

-

Storm Washers

-

Pipe Flashings

-

-

Roofing System Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-sheet Profiled Roof

-

Sandwich Panel Roof

-

Double-sheet Profile Roof

-

Double-sheet Roof with Seam or Clamping Profile

-

Tin Tile Roof

-

Others

-

-

Wall System Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-sheet Profiled Wall

-

Wall with Sandwich Panels

-

Profiled Wall with Cassette Structure

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar and Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial lightweight construction fasteners market size was estimated at USD 1.16 billion in 2024 and is expected to reach USD 1.22 billion in 2025.

b. The global industrial lightweight construction fasteners market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 1.96 billion by 2033.

b. The self-drilling screws segment held highest revenue market share of 38.6% in 2024, owing to its widespread application in industrial, automotive, and construction settings.

b. Some of the key players operating in the ILC (industrial lightweight construction) fasteners market include Hilti Group, Stanley Black & Decker, Arconic Corporation, Bulten AB, Nifco Inc., Illinois Tool Works (ITW), LISI Group, TR Fastenings, Bossard Group, PennEngineering.

b. The key factors driving the industrial lightweight construction fasteners market include increasing demand for lightweight materials, strict regulatory standards, technological innovation, supply chain efficiency, and the growth of end-use industries like automotive and aerospace.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.