- Home

- »

- Next Generation Technologies

- »

-

Industrial Vending Machine Market, Industry Report, 2030GVR Report cover

![Industrial Vending Machine Market Size, Share & Trends Report]()

Industrial Vending Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Carousel, Coil, Cabinet), By Product (MRO Tools, PPE), By End-use (Manufacturing, Oil & Gas, Construction, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-039-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Vending Machine Market Summary

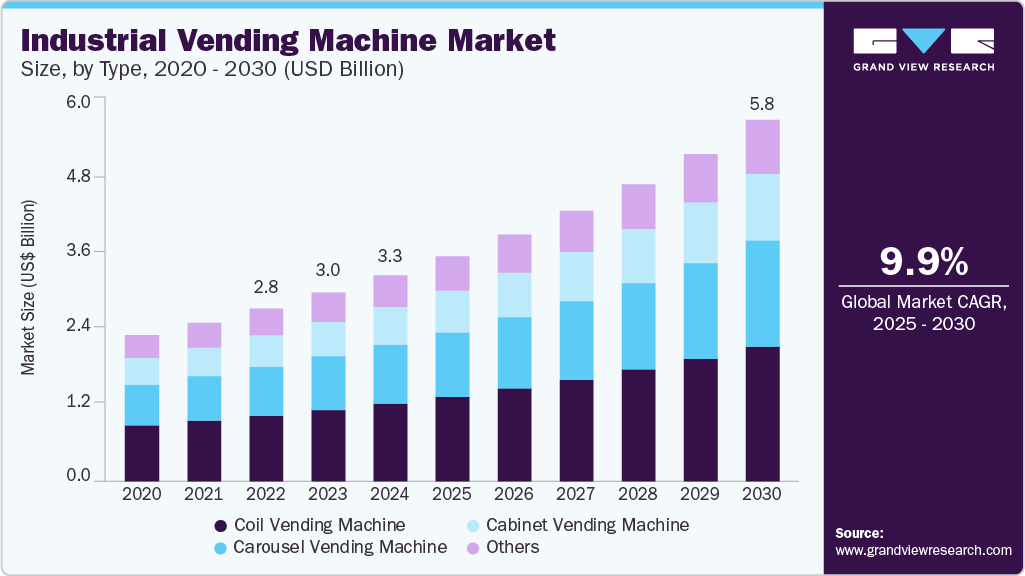

The global industrial vending machine market size was estimated at USD 3,282.4 million in 2024 and is projected to reach USD 5,767.0 million by 2030, growing at a CAGR of 9.9% from 2025 to 2030. The need for improved cost control, inventory management, and safety measures, especially in the manufacturing sector, is instrumental in driving the adoption of industrial vending machines.

Key Market Trends & Insights

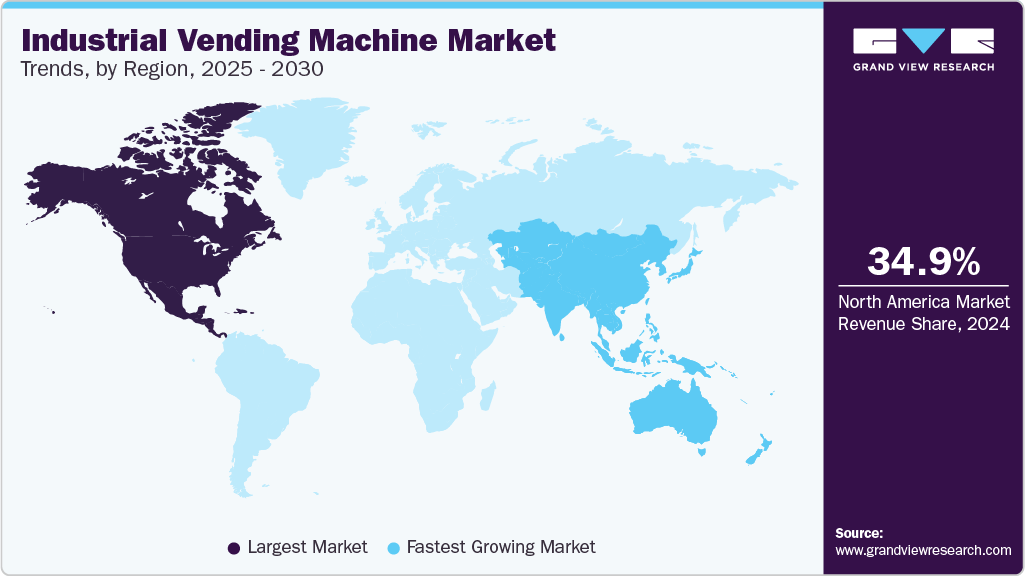

- North America held the largest revenue share of 34.9% in 2024.

- The U.S. held the largest revenue share regionally in North America in 2024.

- By type, the coil vending machine segment dominated the market and accounted for 37.7% of revenue share in 2024.

- By product, the personal protective equipment (PPE) segment dominated the market and accounted for 41.0% of revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,282.4 Million

- 2030 Projected Market Size: USD 5,767.0 Million

- CAGR (2025-2030):9.9%

- North America: Largest market in 2024

Many manufacturing facilities face challenges with inventory management, resulting in insufficient stocks and production delays. By supporting just-in-time (JIT) inventory practices, these machines help firms to maintain minimal stock levels while ensuring that critical items are always available. The industrial vending machines thus reduce storage costs and minimize the capital tied up in inventory.

Industrial vending machines prevent companies from spending on constant inventory replenishments and reduce repeated purchase expenses by lowering freight and stock outage costs. By optimizing production demands, companies can ensure the availability of tools and spare parts as required, enabling them to have better flexibility in inventory management.

Advancements in software and data analytics are also contributing to the increasing demand. Modern industrial vending machines come equipped with sophisticated software platforms that enable remote management, detailed reporting, and seamless integration with enterprise resource planning (ERP) systems. These features allow companies to centralize control over multiple vending machines across different locations, making managing inventory on a global scale easier. Generating detailed usage reports helps businesses optimize operations, reduce costs, and enhance decision-making processes.

Vending machines have undergone significant technological advancements in recent years, revolutionizing the way consumers can access products. With consumers becoming more digitally inclined, vending machines equipped with contactless payment options, such as mobile wallets, credit/debit cards, and Near Field Communication (NFC) technology, have started gaining significant traction. Using these technologies in vending machines has ensured seamless transactions, reducing the waiting time and enhancing customer experience. The technology-equipped vending machines can cater to a broad spectrum of consumer needs, including fresh food, personalized items, beauty products, electronics, and prescription medications. This versatility expands the market appeal and promotes vending machine adoption in various sectors, from offices to airports.

Lastly, the globalization of supply chains has heightened the need for efficient resource management across multiple locations. For multinational companies operating in diverse geographical regions, industrial vending machines provide a standardized solution for managing inventory across different facilities. This uniformity ensures consistency in operations, simplifies logistics, and enhances overall supply chain visibility. By enabling centralized control and monitoring of inventory levels across various sites, these machines help companies optimize their global supply chains, reduce lead times, and respond more effectively to market demands.

Type Insights

The coil vending machine segment dominated the market and accounted for 37.7% of revenue share in 2024. Coil vending machines have relatively higher storage capacity and can procure more inventory than other vending machines. Furthermore, coil vending machines consume less power and are easy to maintain, making them an economical option for companies. While they are primarily convenient for dispensing smaller items, coil vending machines offer the feature of automated reporting that can be customized to a client’s specific needs. All these benefits have ensured greater adoption of coil vending machines in all industrial setups.

The carousel vending machines are projected to experience the fastest adoption, growing at a CAGR of 10.4% over the forecast period. Carousel vending machines offer better inventory management by optimizing storage space and allowing for high-density product placement, which is crucial in industrial environments where space and efficiency are essential. Moreover, these machines enable easy access to items through their rotating shelves, reducing retrieval time and increasing operational efficiency. With industries seeking automation to streamline their operational processes, carousel vending machines are becoming increasingly attractive for managing tools, Types, and supplies in manufacturing and maintenance settings, driving their growing demand in the market.

Product Insights

The personal protective equipment (PPE) segment dominated the market and accounted for 41.0% of revenue share in 2024. Governments and regulatory authorities (like HSE in the UK or OSHA in the U.S.) have enforced stricter compliance regarding health and safety rules. PPE vending machines allow companies to provide workers easy, trackable access to the required safety gear, thereby reducing the risk of non-compliance. Furthermore, the ability of PPE vending machines to restrict & track PPE distribution per employee reduces the chances of hoarding, overuse, or theft. On the other hand, real-time tracking of PPEs prevents overstocking and enables companies to order only when needed.

The maintenance, repair, and operations (MRO) segment is estimated to register a CAGR of over 10.3% over the forecast period. During downtime, MRO supplies such as tools, spare parts, sealants, coatings, tool kits, and testing equipment are most required. Thus, MRO equipment is stocked and maintained on a large scale in industries with high downtime costs. MRO tools are one of the most essential parts of the inventory, and tracking them is important for various end use industries such as oil and gas, manufacturing, and aviation. Industrial vending machines provide an easy way to track and maintain MRO supplies, driving segment growth.

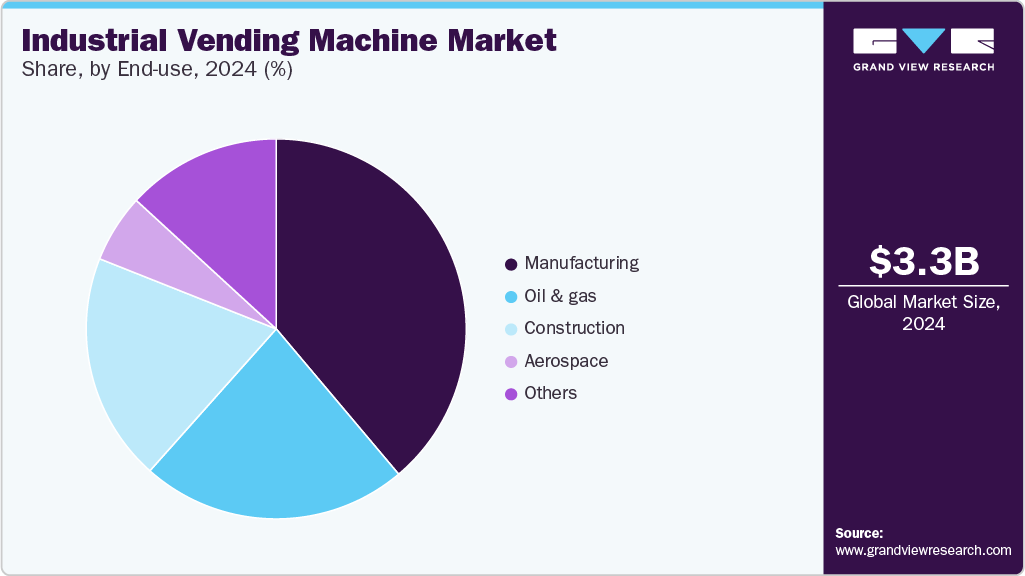

End-use Insights

The manufacturing segment accounted for approximately 38.9% of the revenue share in 2024. The uninterrupted availability of tools, Types, and personal protective equipment (PPE) to workers in a manufacturing setup is crucial to minimizing downtime. Industrial vending machines offer an automated medium to control and manage these supplies, ensuring their availability on demand and reducing wastage and inventory costs. Additionally, industrial vending machines help companies minimize stock-outs and overstocking through real-time tracking and inventory monitoring.

The aerospace segment is expected to register the highest growth, growing at a CAGR of 10.7% over the forecast period 2025-2030. The aerospace industry is subject to strict regulations and compliance requirements. Industrial vending machines can help aerospace companies to meet these requirements by providing an auditable trail of inventory usage and transactions. This helps to not only comply with the required regulations and standards but can help companies provide evidence in case of an audit or investigation. As the aerospace industry continues to grow, driven by advancements in aviation technology and increasing global travel, the need for efficient inventory solutions like industrial vending machines will likely expand in this segment.

Regional Insights

North America held the largest revenue share of 34.9% in 2024. The region's strong focus on improving operational efficiency across various industries, such as manufacturing, aerospace, and automotive, drives market growth. Companies are increasingly adopting industrial vending machines to reduce inventory management costs, minimize downtime, and ensure the availability of critical supplies such as personal protective equipment (PPE) and maintenance, repair, and operations (MRO) tools. Additionally, the rising emphasis on workplace safety and compliance with regulations has pushed organizations to invest in automated systems that provide controlled access to essential items, thereby reducing waste and unauthorized usage. The region's well-established infrastructure and technological advancements also facilitate the integration of these machines into existing systems, further fueling their adoption.

U.S. Industrial Vending Machine Market Trends

The U.S. held the largest revenue share regionally in North America in 2024. Factors such as the rising popularity of point-of-use inventory management and the push towards sustainability and waste reduction in the U.S. have encouraged industries to adopt vending machines that minimize overconsumption and ensure that materials are used efficiently, further driving their popularity. The ongoing labor shortage in the U.S. manufacturing sector is another key factor driving the country's demand for industrial vending machines. As companies continue to seek automated solutions to maintain productivity, industrial vending machines that help mitigate the impact of workforce shortages and allow workers to access necessary supplies quickly and efficiently are witnessing tremendous growth.

Asia Pacific Industrial Vending Machine Market Trends

The Asia Pacific segment is expected to register the highest growth, growing at a CAGR of 10.9% over the forecast period 2025-2030. Rapid industrialization and the expansion of manufacturing activities, particularly in countries such as China, India, Malaysia, and Vietnam, are the major growth drivers. These countries have witnessed substantial growth in their manufacturing sectors over the past few years, and the trend is expected to continue. With the growth of the manufacturing industry comes an increased demand for industrial supplies, which in turn drives the need for more efficient and cost-effective methods of managing those supplies.

Industrial vending machine market in China held a substantial market share in the Asia Pacific industrial vending machine market and will continue to dominate throughout the forecast period. China’s growth is propelled by large-scale industrialization and strong government support for industrial automation. Further, rising labor costs in the country push companies toward automation and lean manufacturing, which bodes well for the market growth.

The India industrial vending machine market is growing significantly. Industries across India are increasingly adopting vending machines to streamline inventory management, reduce wastage, and enhance operational efficiency. These machines offer convenience and accessibility, particularly in factory and industrial settings. The trend towards automation and digitization in industrial processes has accelerated the adoption of smart vending machines, which provide real-time data and analytics for better decision-making.

Europe Industrial Vending Machine Market Trends

The European market is lucrative, driven by the region's strong focus on advanced manufacturing technologies and the push towards Industry 4.0. European countries such as Germany, the UK, and France are at the forefront of industrial innovation, and companies in these nations are increasingly implementing industrial vending machines to enhance productivity and efficiency. These machines support lean manufacturing practices by ensuring that tools and supplies are readily available, reducing downtime, and improving workflow.

The growth of the industrial vending machine market in the UK is being driven by the increasing emphasis on efficient inventory management across a range of industries. Companies are striving to minimize downtime and reduce operational costs by ensuring that tools, safety equipment, and consumables are readily available at the point of use. This has led to greater adoption of vending solutions that can automate and streamline supply processes while improving accountability and usage tracking.

Key Industrial Vending Machine Company Insights

Some of the key companies in the global industrial vending machine market include Apex Industrial Technologies, LLC, AutoCrib, Inc., and MSC Industrial Direct Co., Inc.

-

Apex Industrial Technologies is a manufacturer in the industrial vending machine industry known for its innovative and technology-driven solutions. The company provides intelligent vending systems to streamline inventory management and enhance operational efficiency across various industries. Apex offers a range of products tailored to specific needs, including coil-based vending machines, locker systems, and automated storage solutions. These products cater to the efficient distribution and management of personal protective equipment (PPE), maintenance, repair, and operations (MRO) supplies, and other critical industrial tools.

-

MSC Industrial Direct Co., Inc. is a Product of Maintenance, Repair, and Operations (MRO) products and services. The company offers a variety of solutions, such as inventory management and in-plant & e-procurement solutions. MSC Industrial Direct Co., Inc. caters to verticals including industrial manufacturing, automotive, medical, government, aerospace, and education industries. The company operates via a network of 10 regional inventory centres, six customer fulfilment centres, and 38 warehouses, of which 36 are in North America

-

AutoCrib Inc. provides automated inventory management solutions tailored to various industries. The company's product offerings include a range of vending machines, such as RoboCrib, known for its versatility in dispensing a wide array of items, and the AutoLocker system, designed for secure storage and management of more extensive, high-value tools. Additionally, AutoCrib offers a cloud-based software platform that allows businesses to track inventory in real time, reducing waste and improving efficiency. The company provides its solutions to various industries, including aerospace, construction, government & military, machining, manufacturing, oil & gas, safety, transportation & automotive, and utilities.

Key Industrial Vending Machine Companies:

The following are the leading companies in the industrial vending machine market. These companies collectively hold the largest market share and dictate industry trends.

- Apex Industrial Technologies LLC

- AutoCrib, Inc.

- MSC Industrial Direct Co., Inc.

- Brammer

- IMC Group

- SecuraStock

- CribMaster

- Fastenal Company

- Airgas Inc.

- IVM, Inc.

Industrial Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,590.0 million

Revenue forecast in 2030

USD 5,767.0 million

Growth rate

CAGR of 9.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Apex Industrial Technologies, LLC; Auto Crib, Inc.;

MSC Industrial Direct Co., Inc.; Brammer; IMC Group; Secura Stock; CribMaster; Fastenal Company; Airgas Inc.; IVM Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

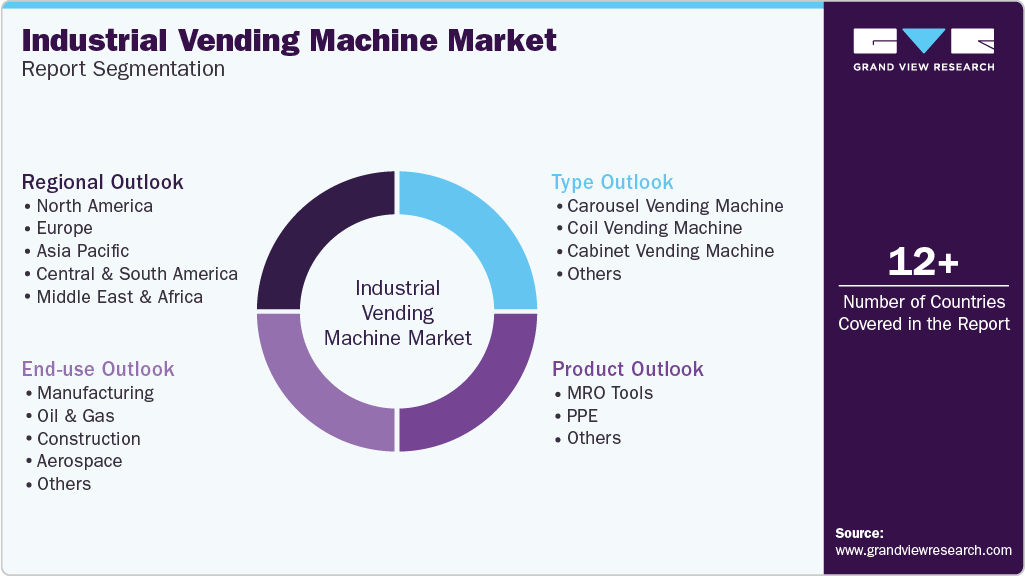

Global Industrial Vending Machine Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial vending machine market report based on type, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Carousel Vending Machine

-

Coil Vending Machine

-

Cabinet Vending Machine

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

MRO Tools

-

PPE

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Oil & Gas

-

Construction

-

Aerospace

-

Other

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial vending machine market size was estimated at USD 3.28 billion in 2024 and is expected to reach USD 3.59 billion in 2025.

b. The global industrial vending machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2030 to reach USD 5.77 billion by 2030.

b. North America dominated the industrial vending machine market with a revenue share of 34.9% in 2024. Strong presence of prominent key players in the region and widespread awareness of the worker safety and use of PPE are the factors driving the growth of the market.

b. Some of the key players operating in the industrial vending machine market include: Apex Industrial Technologies, LLC, AutoCrib, Inc., Brammer, IMC Group, SecuraStock, CribMaster, Fastenal Company, Airgas Inc., and IVM Ltd.

b. Key factors that are propelling the industrial vending machine market growth include rapid industrialization and increasing penetration of digitization in the industrial sector driving the demand for smart inventory management systems and emerging new players in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.