- Home

- »

- Next Generation Technologies

- »

-

Industry 5.0 Market Size & Share, Industry Report, 2030GVR Report cover

![Industry 5.0 Market Size, Share & Trends Report]()

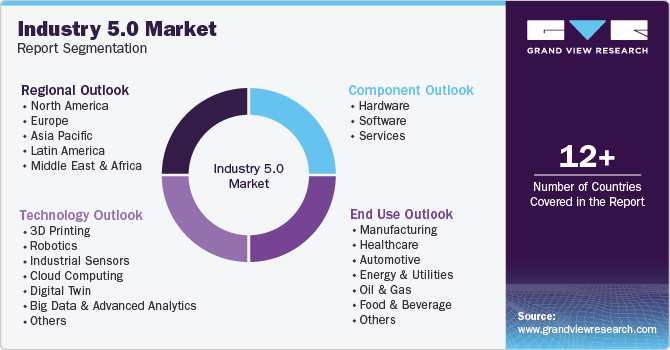

Industry 5.0 Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (3D Printing, Robotics, Industrial Sensors, Cloud Computing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-514-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industry 5.0 Market Summary

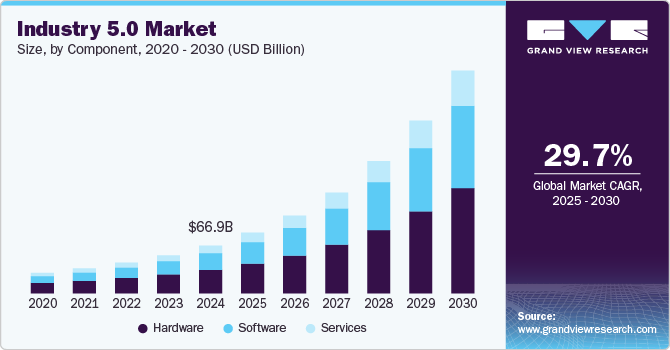

The global industry 5.0 market size was estimated at USD 66,908.4 million in 2024 and is projected to reach USD 312,239.7 million by 2030, growing at a CAGR of 29.7% from 2025 to 2030. In Industry 5.0, the concept of human-robot collaboration, or "cobots," takes center stage.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, South Korea is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, hardware accounted for a revenue of USD 41,634.7 million in 2024.

- Software is the most lucrative component segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 66,908.4 Million

- 2030 Projected Market Size: USD 312,239.7 Million

- CAGR (2025-2030): 29.7%

- Asia Pacific: Largest market in 2024

Unlike the automation of previous industrial revolutions, Industry 5.0 emphasizes the synergy between humans and machines, where robots assist with repetitive tasks while humans focus on complex decisions. Cobots are designed to work side by side with human workers, boosting productivity and ensuring a safer work environment. This collaboration creates a more efficient and fulfilling workplace, aligning with the human-centric goals of Industry 5.0. As a result, businesses in Industry 5.0 can achieve higher production rates without losing the touch of human creativity and decision-making.

In Industry 5.0, AI is not just used to automate tasks but also to assist human decision-making. AI-powered tools provide insights and predictions, helping workers in Industry 5.0 make faster, data-driven decisions. This AI integration boosts the human role by empowering them with real-time information to solve complex problems. Instead of replacing human intelligence, Industry 5.0 harnesses the power of AI to enhance it, making collaboration between machines and humans more seamless. This trend also extends to predictive maintenance, which is crucial in Industry 5.0 for ensuring optimal system performance and reducing unplanned downtime.

Industry 5.0 emphasizes the trend of mass personalization, where manufacturers create products tailored to the unique preferences of individual customers. With flexible production systems and the advent of 3D printing, Industry 5.0 makes it possible to offer personalized products on a scale, something that was previously reserved for high-cost luxury goods. This shift allows businesses to meet the rising consumer demand for personalized experiences, while also maintaining operational efficiency. The use of AI and advanced manufacturing techniques will empower businesses in Industry 5.0 to offer customization without compromising on speed or cost. The ability to mass-produce individualized products will become a hallmark of Industry 5.0, allowing brands to offer truly unique solutions.

Sustainability is a major driver in Industry 5.0, with companies focusing on reducing environmental impacts through green technologies and eco-friendly practices. A shift toward a circular economy, central to Industry 5.0, involves reusing materials, recycling, and creating products designed for long-term durability and reuse. Manufacturers in Industry 5.0 are increasingly adopting energy-efficient processes and reducing waste, aligning with consumer expectations and regulatory pressures. Industry 5.0 also encourages innovation in the use of renewable energy sources and sustainable materials to reduce the carbon footprint of production. By prioritizing sustainability, Industry 5.0 fosters responsible growth and aligns industrial advancements with global environmental goals.

Edge computing is critical in Industry 5.0, as it enables real-time data processing closer to the source, allowing for faster and more efficient decision-making. In Industry 5.0, IoT devices generate enormous amounts of data, and edge computing ensures that critical insights can be acted upon immediately, without delay. This capability enhances operational efficiency and ensures the production line is constantly optimized for peak performance. By reducing the reliance on centralized servers, Industry 5.0 also lowers latency and improves the security of sensitive data. The widespread adoption of edge computing will be a key enabler of Industry 5.0 as it powers smarter, more responsive manufacturing systems.

Industry 5.0 is transforming traditional manufacturing through decentralized production systems powered by technologies such as 3D printing. This shift enables localized production, significantly reducing supply chain complexity and costs, while also allowing for faster responses to changing market demands. Manufacturers in Industry 5.0 will leverage Artificial Intelligence (AI) & Machine Learning (ML) to produce goods on demand, minimizing excess inventory and waste. The ability to print products directly from digital models will enable mass customization, a hallmark of Industry 5.0, offering consumers more personalized choices. This decentralization, powered by digital tools, makes Industry 5.0 more agile, reducing reliance on centralized factories and streamlining production processes.

Component Insights

The hardware segment captured a significant market share of around 49% in 2024. The collaborative robot (cobots) market is one of the fastest-growing segments in Industry 5.0. Cobots are designed to work alongside humans, enhancing productivity while performing tasks such as repetitive assembly, packaging, and testing. Unlike traditional industrial robots, cobots are equipped with advanced sensors and AI algorithms, allowing them to interact with human workers safely and efficiently. The growing demand for automation in manufacturing coupled with the human-centric focus of Industry 5.0 is driving rapid adoption of these robots. As industries strive for more personalized products, cobots in Industry 5.0 enable seamless integration into flexible production lines that require both human creativity and robotic precision.

The software segment is expected to witness the highest CAGR of around 30.8% from 2025 to 2030. Digital twin technology is playing an increasingly vital role in Industry 5.0, enabling companies to create virtual replicas of physical assets, production lines, or entire factories. These virtual models help simulate and predict the behavior of physical systems, providing insights that allow businesses to optimize performance and troubleshoot potential issues before they occur. Software for digital twins integrates AI, machine learning, and IoT data to monitor, analyze, and improve real-time processes. In Industry 5.0, this trend will enhance human-machine collaboration by giving operators and engineers a dynamic, data-driven platform to make informed decisions. As digital twin software evolves, it will enable businesses to rapidly adapt to changing demands while ensuring the efficiency and sustainability of their operations.

Technology Insights

The robotics segment captured the highest market share in 2024. Modern robots in Industry 5.0 leverage advanced sensors for precision, safety, and adaptability in industrial environments. LiDAR, 3D visions, and haptic sensors allow robots to navigate complex environments with minimal human intervention. These technologies enhance object recognition, avoidance, and real-time decision-making, making robotics more dependable. Smart sensors integrated with IoT systems enable remote monitoring and autonomous adjustments in real time. As industries prioritize precision and worker safety, sensor-driven robotics is expected to see rapid adoption.

The Artificial Intelligence (AI) & Machine Learning (ML) segment is expected to witness the highest CAGR from 2025 to 2030. Industry 5.0 focuses on mass customization powered by AI and ML. Manufacturers are using AI-driven analytics and machine learning algorithms to create highly personalized products in real-time. AI-powered production lines can adapt to customer preferences and modify product designs dynamically. The use of digital twins and generative AI helps manufacturers optimize customized production while maintaining efficiency. AI-driven customization is enhancing customer satisfaction and creating new business models.

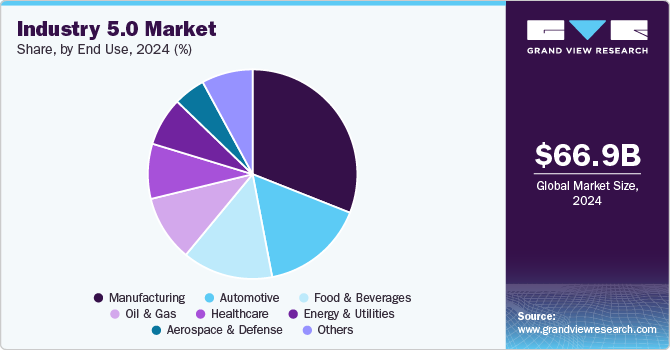

End Use Insights

The manufacturing segment captured the highest market share in 2024. Manufacturers are moving towards hyper-personalized production, where AI-driven analytics help create customized products on a scale. Smart factories equipped with AI and digital twins analyze customer preferences and adapt production in real time. Additive manufacturing (3D printing) plays a crucial role by enabling rapid prototyping and on-demand production. AI-powered supply chains ensure just-in-time delivery of raw materials, reducing waste and inventory costs. This shift towards customization is enhancing customer satisfaction and opening new revenue opportunities.

Automotive segment is expected to witness CAGR of around 21.0% through 2030. The automotive industry is one of the sectors experiencing significant growth in the Industry 5.0 market. This growth is driven by various technological advancements that enable businesses to operate more efficiently, reduce costs, and improve customer experience. The key technology driving the growth in the automotive industry is IoT. IoT-enabled sensors monitor equipment performance and identify potential issues before they become serious problems.

Regional Insights

The Industry 5.0 market in North America generated the highest revenue share, accounting for approximately 30.0% in 2024. The region is a global leader in Industry 5.0 adoption, driven by innovative advancements in artificial intelligence (AI), robotics, and digital twin technologies. Rapid automation across key sectors, particularly manufacturing and logistics, is enhancing operational efficiency, productivity, and sustainability. Supportive government policies and increased investments in smart factories are further accelerating the shift toward human-centric automation and innovation.

U.S. Industry 5.0 Market Trends

The U.S. Industry 5.0 market held a dominant position in 2024, fueled by substantial investments in AI-powered robotics, edge computing, and smart manufacturing technologies. U.S. companies are increasingly adopting digital twins and augmented reality (AR) to optimize production processes, improve predictive maintenance, and reduce downtime. The resurgence of reshoring initiatives, coupled with government incentives for smart factory development, is driving significant growth in industrial automation and technological innovation.

Europe Industry 5.0 Market Trends

The Europe Industry 5.0 market was identified as a lucrative region in 2024, characterized by a strong emphasis on sustainability, workforce collaboration, and smart manufacturing. The European Union’s strategic policies are promoting AI-driven automation, circular economy practices, and digital transformation across industries such as automotive and aerospace. Significant investments in industrial IoT (IIoT) and cyber-physical systems are further propelling market growth, positioning Europe as a key player in the global Industry 5.0 landscape.

The UK the integration of AI and robotics into the manufacturing sector is gaining momentum, aimed at boosting efficiency and reducing reliance on offshore production. The country’s Industry 5.0 strategy prioritizes human-robot collaboration, advanced analytics, and sustainable industrial practices. Government-backed digitalization programs and investments in 5G-enabled smart factories are driving productivity and fostering innovation across the industrial sector.

Germany, a prominent leader in industrial automation, is advancing its Industry 5.0 initiatives with a focus on AI-driven smart manufacturing and digital twin technologies. Building on its strong Industry 4.0 foundation, Germany is leveraging its engineering expertise to pioneer intelligent automation solutions. Increased research and development in cyber-physical systems and IIoT are driving the next phase of manufacturing evolution, solidifying Germany’s position as a key innovator in the Industry 5.0 market.

Asia Pacific Industry 5.0 Market Trends

The Industry 5.0 market in the Asia Pacific region is expected to grow at the highest CAGR of over 31% from 2025 to 2030. Asia Pacific is witnessing significant growth in Industry 5.0 adoption, led by technological advancements in robotics, AI, and cloud computing. The region’s manufacturing powerhouses are investing heavily in smart factories, autonomous systems, and real-time data analytics. Rising demand for industrial automation in automotive, electronics, and healthcare sectors is propelling market expansion.

China is at the forefront of Industry 5.0 adoption, with aggressive investments in robotics, AI, and smart manufacturing technologies. The government’s “Made in China 2025” initiative is accelerating large-scale automation, reducing dependency on manual labor, and enhancing supply chain efficiency. The integration of AI-powered predictive maintenance and digital twin solutions is further optimizing industrial productivity and positioning China as a global leader in advanced manufacturing.

Japan continues to lead in robotics and AI-driven automation, with Industry 5.0 initiatives centered on human-machine collaboration. The country’s advanced robotics ecosystem and expertise in cyber-physical systems are shaping the future of smart manufacturing. Investments in 6G, edge computing, and IoT-based industrial solutions are enhancing operational efficiency and scalability across diverse industries, reinforcing Japan’s role as a key innovator in the Industry 5.0 market.

Key Industry 5.0 Company Insights

Some of the key players operating in the market include ABB and Siemens

-

Siemens is a global leader in industrial automation, digitalization, and smart manufacturing solutions, offering technologies such as digital twins, IoT platforms, and AI-driven analytics. Their solutions enable manufacturers to create highly efficient, sustainable, and human-centric production systems. Siemens is at the forefront of integrating AI and machine learning into industrial processes, enhancing predictive maintenance and operational efficiency. As a key player in Industry 5.0, Siemens is driving the convergence of physical and digital systems to foster collaboration between humans and machines.

-

ABB is a powerhouse in robotics, automation, and electrification, providing advanced solutions for industrial applications. Their collaborative robots and energy-efficient systems are transforming manufacturing by enabling flexible and sustainable production. ABB is investing heavily in AI-powered automation and digital twins to optimize industrial processes and improve productivity. In the context of Industry 5.0, ABB is focused on creating adaptive, human-centric ecosystems that prioritize safety, efficiency, and innovation.

Universal Robots A/S, and Nexus Integra are some of the emerging participants in the Industry 5.0 market.

-

Universal Robots is a pioneer in collaborative robots (cobots), designed to work safely alongside humans in industrial environments. Their cobots are known for their flexibility, ease of use, and ability to adapt to various tasks, making them ideal for small and medium-sized enterprises (SMEs). The company is driving the adoption of human-robot collaboration, enabling more personalized and efficient manufacturing processes. With the integration of AI and machine learning, Universal Robots is expanding its applications into healthcare, logistics, and other non-traditional sectors.

-

Nexus Integra provides an open IoT platform that integrates data from multiple sources to enable real-time decision-making and predictive maintenance in industrial settings. Their platform supports smart factory solutions, helping manufacturers achieve greater efficiency and sustainability. By focusing on interoperability and data-driven insights, Nexus Integra is playing a key role in the transition to Industry 5.0. Their solutions empower businesses to create adaptive, human-centric production systems that prioritize collaboration and innovation.

Key Industry 5.0 Companies:

The following are the leading companies in the industry 5.0 market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Honeywell International Inc.

- 3D Systems

- Rockwell Automation

- Siemens

- Emerson Electric Co

- Piher Sensing Systems

- Stratasys

- Schneider Electric

- Cisco Systems, Inc.

- FANUC CORPORATION

- Yaskawa Electric Corp

- Kuka AG

- Universal Robots A/S

Recent Developments

-

In January 2024, Siemens introduced groundbreaking innovations at CES 2024, the world’s premier technology event, aimed at bridging the physical and digital worlds to redefine industrial reality. The company unveiled advancements in AI and immersive engineering designed to accelerate the adoption of the industrial metaverse. Siemens also showed how these technologies are empowering global innovators through its open digital business platform, Siemens Xcelerator, enabling greater efficiency and transformation across industries.

-

In April 2023, Stratasys launched GrabCAD Print Pro software, featuring integrated quality assurance capabilities from Riven. This advanced solution optimizes print preparation for Stratasys 3D printers, catering to manufacturers aiming for efficient large-scale production of end-use parts. The software enhances print accuracy, minimizes material waste, and accelerates time-to-market, driving greater efficiency in additive manufacturing.

Industry 5.0 Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84,960.3 million

Revenue forecast in 2030

USD 312,239.7 million

Growth rate

CAGR of 29.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; UAE; Saudi Arabia

Key companies profiled

ABB; Honeywell International Inc.; 3D Systems; Rockwell Automation; Siemens; Emerson Electric Co.; Piher Sensing Systems; Stratasys; Schneider Electric; Cisco Systems, Inc.; FANUC CORPORATION; Yaskawa Electric Corp; Kuka AG

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industry 5.0 Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Industry 5.0 market report based on component, technology, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

3D Printing

-

Robotics

-

Industrial Sensors

-

Cloud Computing

-

Artificial Intelligence (AI) & Machine Learning (ML)

-

Augmented Reality (AR) & Virtual Reality (VR)

-

Digital Twin

-

Big Data & Advanced Analytics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Healthcare

-

Automotive

-

Energy & Utilities

-

Oil and Gas

-

Food & Beverage

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Industry 5.0 market size was estimated at USD 66,908.4 million in 2024 and is expected to reach USD 84,960.3 million in 2025.

b. The global Industry 5.0 market is expected to grow at a compound annual growth rate of 29.7% from 2025 to 2030 to reach USD 3312,239.7 million by 2030.

b. North America dominated the Industry 5.0 market with a share of 30.0% in 2024, driven by innovative advancements in artificial intelligence (AI), robotics, and digital twin technologies. Rapid automation across key sectors, particularly manufacturing and logistics, is enhancing operational efficiency, productivity, and sustainability.

b. Some key players operating in the Industry 5.0 market include ABB, Honeywell International Inc., 3D Systems, Rockwell Automation, Siemens, Emerson Electric Co., Piher Sensing Systems, Stratasys, Schneider Electric, Cisco Systems, Inc., FANUC CORPORATION, Yaskawa Electric Corp, and Kuka AG

b. Key factors that are driving the market growth include the integration of artificial intelligence for automation, the rise of advanced robotics for enhanced productivity, and the growing demand for personalized, human-centric solutions in manufacturing processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.