- Home

- »

- Pharmaceuticals

- »

-

Inhalable Biologics Market Size, Share, Industry Report, 2030GVR Report cover

![Inhalable Biologics Market Size, Share & Trends Report]()

Inhalable Biologics Market (2025 - 2030) Size, Share & Trends Analysis Report By Biologics (Peptides & Proteins, Monoclonal Antibodies, RNAi-based Therapeutics), By Application (Diabetes, Cancer), By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-530-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Inhalable Biologics Market Summary

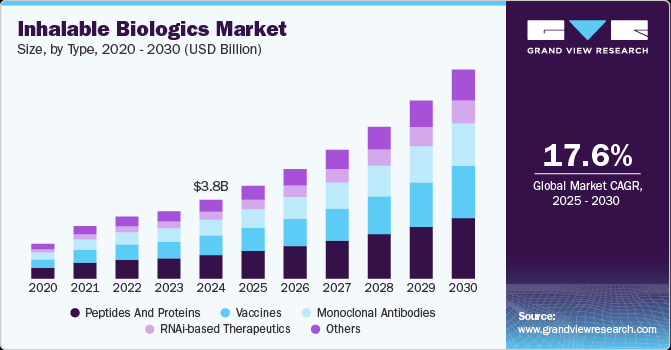

The global inhalable biologics market size was estimated at USD 3,794.6 million in 2024 and is projected to reach USD 10,061.5 million by 2030, growing at a CAGR of 17.6% from 2025 to 2030. The market is driven by the growing prevalence of respiratory diseases, increasing demand for non-invasive drug delivery, and advancements in formulation technologies enhancing biologic stability for inhalation.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, peptides and proteins accounted for a revenue of USD 1,327.5 million in 2024.

- RNAi-based therapeutics are the most lucrative grade segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,794.6 million

- 2030 Projected Market Size: USD 10,061.5 million

- CAGR (2025-2030): 17.6%

- North America: Largest market in 2024

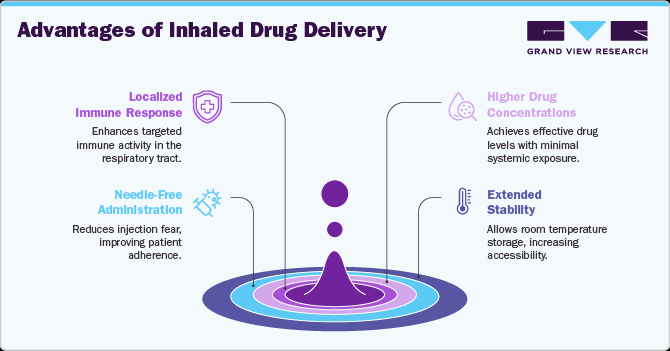

Rising patient preference for self-administration, faster drug onset through pulmonary delivery, and expanding research on inhalable monoclonal antibodies, peptides, and RNAi-based therapeutics further fuel market growth. A strong pipeline of inhalable biologics, including novel formulations and drug-device combinations, is expected to accelerate market expansion. Regulatory support and technological innovations also contribute to market expansion.

The market is experiencing significant growth driven by several key factors. The rising prevalence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and cystic fibrosis is a major contributor, as these conditions require effective and patient-friendly therapeutic options. According to CDC, ACAAI, in June 2023 Asthma, a chronic lung airway inflammation, affects 7.7% of Americans (24.9 million), with higher prevalence in adults (8%) and females (9.7%). It leads to 94,000 hospital stays and over 900,000 emergency visits annually, costing $50 billion. Triggers include allergens, irritants, weather, exercise, or illness. Inhaled corticosteroids and immunotherapy are effective treatments. Around 60% of adults and 44% of children have uncontrolled asthma. Allergists, specialists in asthma care, help identify triggers and manage symptoms. Inhalable biologics offer rapid onset of action, improved drug absorption, and targeted delivery to the lungs, enhancing treatment efficacy while minimizing systemic side effects.

Market players like Ocugen, Moderna, Pfizer-BioNTech, and AstraZeneca are driving growth through innovations in vaccine delivery methods, including mucosal and inhaled vaccines. Their investments in advanced technologies, rapid development capabilities, and strategic collaborations contribute to enhanced product offerings, improved patient accessibility, and expanded market reach, fueling overall market expansion. For instance, in January 2025, Ocugen, Inc. announced FDA clearance of its IND application to initiate a Phase 1 trial for OCU500, an inhaled and intranasal COVID-19 vaccine. Sponsored by NIAID under Project NextGen, the trial will assess safety, tolerability, and immunogenicity in 80 adults. OCU500, based on ChAd36 vector technology, aims to provide durable immunity using a low dose. Ocugen plans to expand the mucosal platform to other respiratory diseases, including influenza and RSV.

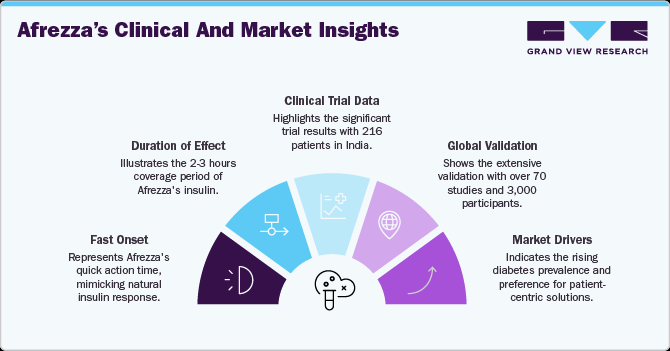

Moreover, biologics such as Afrezza, MannKind Corporation's inhaled insulin, drives market growth through its rapid-acting delivery system, enhancing patient compliance and convenience. Its innovative technology paves the way for inhaled therapeutics, supporting broader adoption of pulmonary drug delivery platforms in diabetes and respiratory treatment markets. In addition, the regulatory approval granted for the distribution and marketing of Afrezza (insulin human) Inhalation Powder represents a significant driver for the inhaled biologics market. Developed by MannKind Corporation and approved in the U.S. since 2014, Afrezza is a rapid-acting insulin administered via inhalation, targeting adult patients with type 1 and type 2 diabetes mellitus. This non-injectable solution addresses patient discomfort associated with traditional insulin injections, enhancing convenience and adherence, especially for those with needle aversion.

Afrezza offers a fast onset of action within 12 minutes and mimics the body's natural insulin response post-meal, with effects lasting 2-3 hours. The Indian approval follows a phase 3 clinical trial involving 216 patients, which demonstrated significant HbA1c reductions when used alongside oral antidiabetic medications. Globally, over 70 clinical studies with more than 3,000 participants have validated Afrezza’s efficacy and safety, solidifying its market potential. The increasing diabetes prevalence and the growing preference for patient-centric solutions further reinforce this development as a key driver in the market.

Pipeline Analysis

The development of inhalable biologics is rapidly expanding, with biologics now accounting for 30% of therapies in the respiratory drug pipeline. Previously, respiratory treatments were dominated by small molecules, but the shift toward protein-based therapies highlights the industry's move toward more effective, patient-friendly alternatives to injections. The adoption of solid protein formulations for pulmonary delivery is gaining traction due to its ability to reduce dosage requirements, minimize off-target effects, and improve patient adherence. Additionally, the rise of shelf-stable dry powder inhalers eliminates reliance on cold chain logistics, enhancing global accessibility. Companies like Lonza are investing in spray-drying protein formulations for pulmonary delivery, strengthening clinical and commercial manufacturing capabilities. With ongoing advancements in formulation technologies and respiratory drug delivery platforms, the inhalable biologics pipeline is set for significant growth in the coming years.

A notable development includes the creation of inhalable mRNA medicines using lipid nanoparticles (LNPs) functionalized with zwitterionic polymers, as published in the Journal of the American Chemical Society in November 2024. The study demonstrated stable nebulization, effective mRNA delivery to mice lungs, and consistent protein expression without lung inflammation, including in cystic fibrosis models. This innovation, supported by funding from NIH, Sanofi, and other institutions, highlights advancements in inhalable biologic delivery, broadening therapeutic applications, enhancing patient compliance, and contributing to overall market expansion.

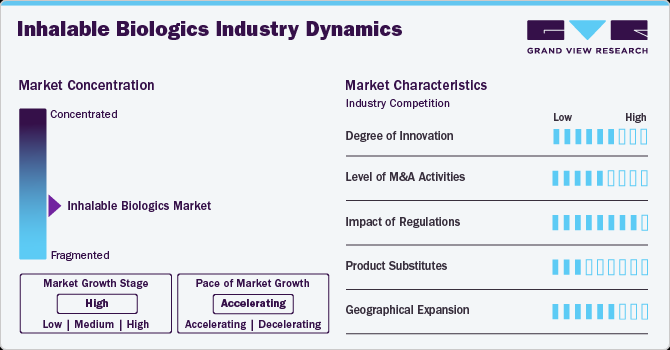

Market Concentration & Characteristics

The peptide therapeutics field is advancing with innovations in drug formulations, targeted delivery systems, and combination therapies. These developments focus on improving efficacy, reducing side effects, and creating next-generation treatments with extended half-life and improved bioavailability. Emerging therapies address conditions like metabolic disorders, cancer, neurological diseases, gastrointestinal disorders, and cardiovascular conditions.

Mergers and acquisitions play a pivotal role in the inhalable biologics industry, with leading pharmaceutical companies acquiring biotech firms to strengthen their respiratory and biologics portfolios. Strategic collaborations focus on enhancing manufacturing capabilities, accessing advanced inhalation technologies, and expanding product pipelines. The growing demand for targeted pulmonary treatments and the need for innovative delivery platforms are driving industry consolidation.

Regulatory agencies such as the FDA and EMA impose strict guidelines to ensure the safety, efficacy, and quality of inhalable biologics. The approval process involves extensive preclinical and clinical evaluations, which can extend timelines and increase development costs. Market adoption is influenced by reimbursement frameworks, as the high production and formulation costs of inhaled biologics require adequate insurance coverage. Regulatory harmonization across regions is crucial to facilitate global market entry and ensure patient access.

Inhalable biologics compete with various alternative treatments, including small-molecule inhalers, systemic biologic therapies, oral medications, and non-pharmacological interventions like lifestyle changes and surgical options. Despite these alternatives, inhalable biologics are gaining traction due to their targeted delivery, rapid onset of action, and potential to reduce systemic side effects. Their expanding application in managing chronic respiratory conditions, infectious diseases, and emerging indications reinforces their market position.

Companies are actively expanding into high-growth markets such as Asia-Pacific, Latin America, and the Middle East, driven by increasing disease prevalence and improving healthcare infrastructure. Growing awareness of inhaled therapies, supportive government policies, and broader insurance coverage are enhancing market penetration. However, regional growth is influenced by challenges related to pricing, supply chain management, and adherence to local regulatory standards.

Type Insights

Based on type, the peptides and proteins segment led the market with the largest revenue share of 29.85% in 2024, due to their broad therapeutic applications, stability improvements, and efficient pulmonary absorption. They are widely used in treating respiratory diseases like asthma and COPD, offering rapid onset and targeted lung delivery with reduced systemic side effects. Technological advancements, such as dry powder and soft mist inhalers, enhance their stability and bioavailability. In addition, innovations in formulation, including nanoparticle carriers, prevent degradation during aerosolization. High patient demand for non-invasive treatments and pharmaceutical investments in expanding peptide and protein applications further drive their market leadership.

The RNAi-based therapeutics segment is anticipated to grow at the fastest CAGR during the forecast period. The growth is driven by advancements in gene silencing technologies, increasing approvals for RNAi-based drugs, and expanding research targeting various diseases, including genetic disorders and cancers. The segment benefits from favorable regulatory environments and growing investments from pharmaceutical companies. The inhalable delivery of RNAi therapeutics offers advantages such as targeted lung delivery for respiratory diseases, enhancing efficacy and reducing systemic side effects, further propelling the market growth.

Application Insights

Based on application, the respiratory diseases segment led the market with the largest revenue share of 66.93% in 2024, due to the high prevalence of chronic conditions such as Chronic Obstructive Pulmonary Disease (COPD), asthma, cystic fibrosis, and post-COVID-19 complications. The demand for rapid drug delivery and ease of use through inhalable biologics supports disease management and improves patient adherence. The segment benefits from approved COVID-19 vaccines, ongoing clinical trials, and a strong pipeline of products targeting asthma and other respiratory conditions, driving continuous market expansion.

The diabetes segment held a significant share in the market, driven by the increasing adoption of inhaled insulin therapies like Afrezza. Inhalable biologics offer non-invasive alternatives to injectable insulin, enhancing patient comfort and compliance. Technological advancements in inhalation devices and growing awareness of diabetes management contribute to this segment's rapid expansion. Retail pharmacies play a key role in the distribution, making therapies more accessible to patients seeking convenient, needle-free treatment options.

Dosage Form Insights

Based on dosage form, the dry powder inhalers (DPI) segment led the market with the largest revenue share of 38.45% in 2024, due to their ease of use, portability, and absence of propellants. DPIs enable quick drug delivery, supporting the management of chronic respiratory diseases like asthma and COPD. Afrezza, an FDA-approved DPI insulin, highlights the growing use of DPIs beyond respiratory treatments, offering rapid-acting insulin delivery for diabetes management. The segment benefits from patient preference, improved adherence, and pharmaceutical advancements, reinforcing its strong market presence across distribution channels.

The nebulizers segment is anticipated to grow at the fastest CAGR during the forecast period, driven by rising prevalence of severe respiratory diseases and demand for home-based care. These devices provide easy administration, especially for patients with limited coordination or severe conditions. Innovations like portable and quieter nebulizers enhance patient convenience and market appeal. Hospitals and homecare settings increasingly adopt nebulizers for chronic disease management, while pharmaceutical companies develop biologic formulations compatible with nebulizers, improving patient accessibility and treatment adherence.

Distribution Channel Insights

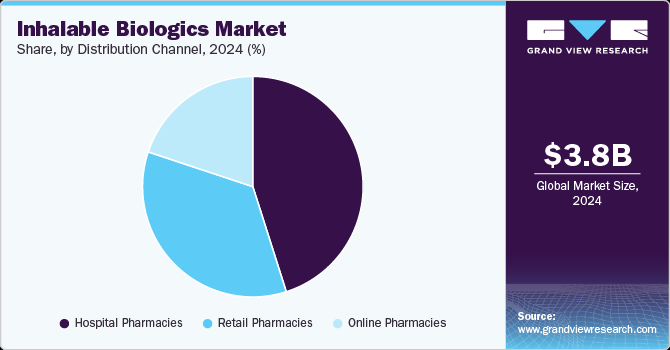

Based on distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 45.10% in 2024, due to their ability to manage complex therapies requiring medical supervision. These settings ensure proper administration, patient monitoring, and adherence to treatment protocols. Inhalable biologics for conditions like respiratory diseases and severe infections often necessitate specialized care available in hospitals. In addition, hospitals maintain robust supply chains and have direct access to patient populations, enabling timely delivery of biologics. Their role in managing acute and chronic conditions further strengthens their market leadership.

The retail pharmacies segment is projected to grow at the fastest CAGR of 17.7% over the forecast period, driven by increasing patient preference for convenient and accessible treatment options. Expanding healthcare infrastructure and wider availability of biologics in retail settings enable patients to obtain prescriptions without hospital visits. Advancements in inhalable drug formulations, which are easier to self-administer, further support this trend. Retail pharmacies also benefit from growing awareness, improved insurance coverage, and patient education initiatives. Their ability to offer quick access to medications contributes to their rapid market growth.

Regional Insights

North America dominated the inhalable biologics market with the largest revenue share of 38.69% in 2024, driven by the high prevalence of respiratory diseases such as COPD, asthma, and cystic fibrosis. Increased adoption of monoclonal antibodies and RNAi-based therapeutics via inhalation routes is enhancing treatment outcomes. Advancements in inhaler technologies, including Dry Powder Inhalers, Metered Dose Inhalers, and novel inhalation systems, are improving patient compliance. Hospital pharmacies dominate distribution, while retail and online pharmacies are witnessing growing demand for chronic disease inhalable biologics.

U.S. Inhalable Biologics Market Trends

The inhalable biologics market in the U.S. accounted for the largest market revenue share in North America in 2024, propelled by substantial biopharma investments, high R&D expenditure, and early regulatory approvals. The rising usage of inhalable biologics for oncology, diabetes, and respiratory diseases is accelerating market growth. Innovations in peptide and protein-based inhalable, coupled with increasing utilization of nebulizers and soft mist inhalers, are improving drug delivery efficiency. Hospital pharmacies remain the primary distribution channel, with retail pharmacies expanding their presence.

Europe Inhalable Biologics Market Trends

The inhalable biologics market in Europe is experiencing steady growth, led by Germany, France, and the UK. The region benefits from strong clinical research infrastructure, government support for biotech innovation, and increased adoption of inhalable monoclonal antibodies and RNAi-based therapeutics. The market sees growing applications in respiratory diseases, diabetes, and cancer. Dry Powder Inhalers and Metered Dose Inhalers are the predominant dosage forms, with hospital pharmacies holding the largest share.

The UK inhalable biologics market is driven by increased funding for biopharmaceutical R&D and a focus on personalized medicine. Demand for inhalable biologics targeting asthma and COPD is rising, with expanding clinical trials and partnerships between academia and industry. Retail pharmacies are gaining traction in chronic disease management, complementing hospital pharmacy distribution channels.

The inhalable biologics market in Germany is a key player in the Europe market, supported by advanced manufacturing capabilities and robust biotech investments. Growing demand for inhalable therapies targeting metabolic disorders, infectious diseases, and cancer is observed. Hospital pharmacies hold a significant share of the distribution segment in the country, with increasing online pharmacy penetration enhancing patient access.

The France inhalable biologics market growth is driven by the increasing adoption of inhalable biologics for autoimmune and inflammatory diseases. Regulatory advancements and public healthcare initiatives are supporting market expansion. Dry Powder Inhalers and Nebulizers are commonly used, with hospital pharmacies leading distribution.

Asia-Pacific Inhalable Biologics Market Trends

The inhalable biologics market in Asia-Pacific is experiencing rapid growth, driven by the rising prevalence of chronic respiratory diseases and expanding access to healthcare. Countries such as China, India, and Japan are leading the market, supported by growing local manufacturing, clinical trials, and regulatory approvals. Innovations in soft mist inhalers and novel inhalation systems are improving market penetration.

The Japan inhalable biologics market is expanding due to government funding for peptide and protein-based biologics research and increasing focus on aging-related respiratory conditions. Hospital pharmacies remain the dominant distribution channel, with retail pharmacies enhancing access to chronic disease treatments.

The inhalable biologics market in China is growing rapidly, supported by robust biopharma manufacturing, significant R&D investments, and government initiatives to improve healthcare accessibility. The demand for inhalable therapies for respiratory diseases, diabetes, and cancer is rising, with expanding online pharmacy platforms facilitating patient access.

Latin America Inhalable Biologics Market Trends

The inhalable biologics market in Latin America is witnessing growth in the inhaled biologics market, led by increasing healthcare expenditures and a rising awareness of advanced treatment options. Brazil stands out as a key market, driven by government health initiatives and investments in biopharmaceutical manufacturing. The demand for effective therapies for respiratory diseases is fostering the adoption of inhaled biologics in the region.

The Brazil inhalable biologics market growth is fueled by a high prevalence of respiratory conditions and a proactive approach by the government to improve healthcare outcomes. Investments in local production of biopharmaceuticals and the expansion of healthcare infrastructure are enhancing the accessibility of inhaled biologic therapies. Collaborations with international companies are also contributing to the availability of innovative treatments.

Middle East & Africa Inhalable Biologics Market Trends

The inhalable biologics market in the Middle East and Africa is expanding its inhaled biologics market due to improving healthcare infrastructure and a growing burden of respiratory diseases. Countries like Saudi Arabia are experiencing increased demand for advanced therapies, supported by government initiatives aimed at healthcare modernization. Efforts to enhance healthcare accessibility and investments in biopharmaceutical research are key drivers in this region.

The Saudi Arabia inhaled biologics market is growing rapidly, underpinned by government-driven healthcare reforms and increased investment in biotechnology research and development. The rising incidence of respiratory conditions necessitates effective treatment solutions, leading to greater adoption of inhaled biological therapies. The country's focus on integrating advanced healthcare technologies aligns with the expansion of this market segment.

Key Inhalable Biologics Company Insights

Leading players in the inhalable biologics industry include Kamada Pharmaceuticals, MannKind Corporation, Ab Initio Pharma, Ocugen, Inc., CanSino Biologics, and AstraZeneca.

Key Inhalable Biologics Companies:

The following are the leading companies in the inhalable biologics market. These companies collectively hold the largest market share and dictate industry trends.

- Kamada Pharmaceuticals

- MannKind Corporation

- Ab Initio Pharma

- Ocugen, Inc.

- CanSino Biologics

- AstraZeneca

Recent Developments

-

In December 2024, MannKind Corporation and Cipla Ltd. announced CDSCO approval of Afrezza (insulin human) Inhalation Powder for adults in India, following approvals in the U.S. and Brazil. MannKind will supply the product, with Cipla handling marketing. Shipments are expected by late 2025. Afrezza, a rapid-acting inhaled insulin, offers a non-injectable option for diabetes management in India, where over 74 million adults have diabetes. Safety precautions include risks of bronchospasm in chronic lung disease patients.

-

In December 2024, Ab Initio Pharma will participate as a Silver Sponsor at the 35th Drug Delivery to the Lungs (DDL) Conference, held December 11-13, 2024, in Edinburgh. Showcasing its CDMO services at Booth #210, the company focuses on drug delivery solutions for small molecules, peptides, oligonucleotides, and RNA-based therapies. Highlights include a presentation on intranasal mRNA delivery by CSO Dr. Hui Xin Ong and a poster on inhaled oligonucleotides.

-

In December 2024, Cipla received CDSCO approval on December 11, 2024, to exclusively distribute and market Afrezza (inhaled insulin) in India, developed by MannKind Corporation. Afrezza is a rapid-acting insulin for type 1 and type 2 diabetes, offering a non-injectable alternative with quick absorption and a 2-3 hour effect. Cipla aims to enhance diabetes management accessibility, leveraging its distribution network to improve patient outcomes across India.

Inhalable Biologics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.47 billion

Revenue forecast in 2030

USD 10.06 billion

Growth rate

CAGR of 17.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Kamada Pharmaceuticals; MannKind Corporation; Ab Initio Pharma; Ocugen, Inc.; CanSino Biologics; AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inhalable Biologics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inhalable biologics market report based on type, application, dosage form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Peptides and Proteins

-

Vaccines

-

Monoclonal Antibodies

-

RNAi-based Therapeutics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory diseases

-

COPD

-

Asthma

-

Cystic Fibrosis

-

COVID-19

-

Others

-

-

Diabetes

-

Cancer

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Powder Inhalers

-

Metered Dose Inhalers

-

Nebulizers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global inhalable biologics market size was estimated at USD 3.79 billion in 2024 and is expected to reach USD 4.47 billion in 2025

b. The global Inhalable Biologics market is expected to grow at a compound annual growth rate of 17.63% from 2025 to 2030 to reach USD 10.06 billion by 2030

b. Based on drug class, the peptides and proteins segment accounted for the largest revenue share of 29.85% in 2024, due to their broad therapeutic applications, stability improvements, and efficient pulmonary absorption.

b. Key players operating in the market are F. Hoffmann-La Roche Ltd., Novartis AG, AbbVie Inc., Johnson & Johnson Services, Inc., Merck & Co., Inc., and Pfizer Inc.

b. The inhalable biologics market is driven by the growing prevalence of respiratory diseases, increasing demand for non-invasive drug delivery, and advancements in formulation technologies enhancing biologic stability for inhalation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.