- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Inorganic Color Pigments Market Size Report, 2020-2027GVR Report cover

![Inorganic Color Pigments Market Size, Share & Trends Report]()

Inorganic Color Pigments Market Size, Share & Trends Analysis Report By Product (Iron Oxide, Carbon & Vegetable Black, Ultramarine Blue, Chrome Green), By Application, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-221-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The global inorganic color pigments market size was valued at USD 3.10 billion in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 3.0%, in terms of revenue, from 2020 to 2027. The market is expected to be driven by the growing application of inorganic color pigments in plastics, paints and coatings, and printing inks. Inorganic color pigments are used to provide color to the substrate by blending them or by applying as a coating on the surface. These pigments are produced by mixing metal oxides with the help of simple chemical reactions such as oxidation and high-temperature calcination procedure. Because of their composition, inorganic color pigments offer high tinting strength, excellent light and weather fastness, excellent resistance towards solvent and oxidizing agent, heat stability, and consistency.

The growing demand for surface treatment activity along with a rising preference for better aesthetics across numerous industries including construction, automotive, medical, and cosmetics, is expected to drive the market growth over the forecast period. Surface treatments play a significant role in improving the functional and aesthetic appeal of the materials by altering the chemical and physical properties of pigments. Properties such as reduced absorption of dispersant and low oil absorption are further making inorganic color pigments suitable for application in plastics, paints, and coatings for various surface treatment activities in several end-use industries.

Growing construction activities and significant development in automotive industries in various developing and developed countries such as the U.S., India, China, Germany, the U.K., and other European countries has resulted in increased demand for plastics and paints and coatings in recent years. Emerging regions such as Asia Pacific and the Middle East and Africa have witnessed strong growth in non-residential sectors, including FMCG, IT, telecom, and retail which is further fuelling the demand for plastics and paints and coatings products. Thus, the positive aspect of the paint and coating market coupled with the rising application of plastics to reduce the overall weight, better design, and aesthetics in the automotive industry is anticipated to boost the market demand in the coming years.

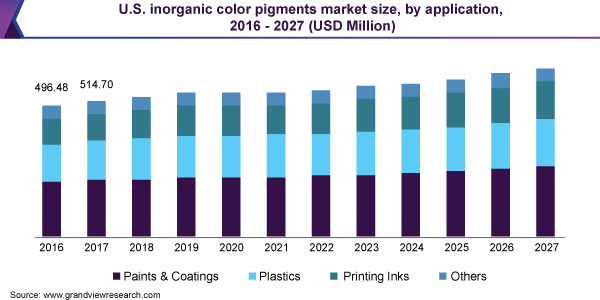

Application Insights

The paints and coatings segment led the market and accounted for more than a 38% share of the global revenue in 2019. The significant market share is attributed to the increasing demand for paints and coatings in construction, automotive, and general industry applications. Paints and coatings are the major application segment of inorganic color pigments, particularly for exterior and industrial coatings where durability, stability, and anti-corrosive properties are crucial. Rising demand for coatings from various industries, such as building and construction and oil and gas, is expected to have a positive impact on the demand for inorganic color pigments over the forecast period.

Rapidly growing urbanization, rising population, and industrial growth have resulted in the increasing need for construction and infrastructure development across the globe. Various governments are taking numerous initiatives, such as India’s Housing for All and Smart City project to provide housing to its population, and China’s investment of USD 142.0 billion on 26 infrastructure projects in 2019, which is expected to accelerate the growth of the construction industry. These factors are likely to significantly boost the demand for paints and coatings, which, in turn, fuel the growth of the inorganic color pigments market over the forecast period.

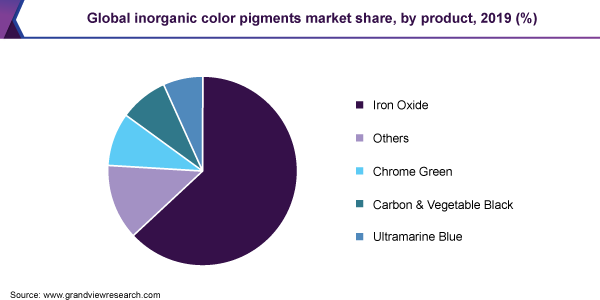

Product Insights

The iron oxide segment led the market and accounted for more than 60% share of the global revenue in 2019. The increasing demand from the paints and coating industry is expected to drive the segment over the forecast period. Iron oxide is widely preferred over natural pigments, owing to their excellent quality and purity. Moreover, they offer excellent weather resistance, heat resistance, and fire resistance which make them suitable applications in various paints and coatings used in industrial, automotive, and architectural applications.

Iron oxide pigments in the construction industry are used for producing pavement blocks, bricks, roofing tiles, stamped concrete, designer tiles, and decorative or colored concrete products among others. They impart color and offer resistance against UV rays and all kinds of atmospheric conditions owing to which they are also used in various applications such as coatings, plastics, paper, and printing inks.

Regional Insights

Asia Pacific dominated the market and accounted for over 38% of the revenue share in 2019. The positive outlook of the plastics and paints and coatings market in China, India, Japan, and South Korea is expected to promote the usage of inorganic color pigments over the forecast period. The easy availability of raw materials, coupled with less stringent laws regarding VOC emissions as compared to North America and Europe, has provided a huge opportunity for the use of plastics and paints and coating products in various end-use sectors such as construction, automotive, marine, and manufacturing in the region.

Low labor cost in countries such as China and India has attracted many foreign investors to set up their manufacturing facilities in the region, resulting in higher construction activities, which, in turn, is anticipated to propel the demand for paints and coatings and thus inorganic color pigments in the region over the forecast period.

However, the sharp decline in the consumption of plastics and paints and coatings in end-use industries, such as automotive and construction, owing to several movement and operational restrictions imposed by the governments is anticipated to hamper the regional demand for inorganic color pigments in the last two quarters of 2020.

Key Companies & Market Share Insights

Companies in the market are continuously engaged in new product development to cater to the broad range of end-use markets. For instance, in February 2018, Venator Materials PLC announced the launch of its new GRANUFIN pigments. The new pigments comprise a hybrid pigment, black, and bluish-black carbon grade that combines elements of carbon black pigment and iron oxide. These new pigments can be utilized in the construction industry to create colored concrete.

Mergers and acquisitions, and capacity expansions, are also some of the popular strategies adopted by a majority of the players operating in the global inorganic color pigments market. For instance, in December 2019, Applied Minerals, Inc. announced that it has agreed with one of the prominent cement manufacturers in the United States to supply nearly 30,000 tons per annum of unmilled, crushed iron oxide for two years. The prominent players operating in the inorganic color pigments market include:

-

Huntsman International LLC

-

BASF SE

-

Lanxess

-

Venator Materials PLC

-

Applied Minerals, Inc.

-

Cathay Industries

-

Hunan Sanhuan Pigment Co., Ltd.

-

KRONOS Worldwide, Inc.

Inorganic Color Pigments Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.20 billion

Revenue forecast in 2027

USD 3.93 billion

Growth Rate

CAGR of 3.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Kilotons and Revenue in USD Million & CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

Huntsman International LLC.; Venator Materials PLC; Applied Minerals, Inc.; Lanxess; Cathay Industries; Hunan Sanhuan Pigment Co., Ltd.; KRONOS Worldwide, Inc.; BASF SE.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the global inorganic color pigments market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Iron Oxide

-

Carbon and Vegetable Black

-

Ultramarine Blue

-

Chrome Green

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Plastics

-

Paints & Coatings

-

Printing Inks

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inorganic color pigments market size was estimated at USD 3.1 billion in 2019 and is expected to reach USD 3.2 billion in 2020.

b. The inorganic color pigments market is expected to grow at a compound annual growth rate of 3.0% from 2020 to 2027 to reach USD 3.9 billion by 2027.

b. Asia Pacific dominated the inorganic color pigments market with a share of 38.2% in 2019. This is attributable to the positive outlook of paints and coatings consumption in countries such as China, India, and Japan.

b. Some of the key players operating in the global inorganic color pigments market include Huntsman International LLC, Venator Materials plc, Applied Minerals, Inc., Lanxess AG, Cathay Industries among others.

b. Key factors driving the inorganic color pigments market growth include growing demand for surface treatment activity along with a rising preference for better aesthetics across the numerous industries including construction, automotive, medical, and cosmetic industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."