- Home

- »

- Electronic Devices

- »

-

Inspection Camera System Market Size & Share Report 2030GVR Report cover

![Inspection Camera System Market Size, Share & Trends Report]()

Inspection Camera System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Services), By Video Quality (SD & HD, Full HD & 4K), By Application, By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-003-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inspection Camera System Market Trends

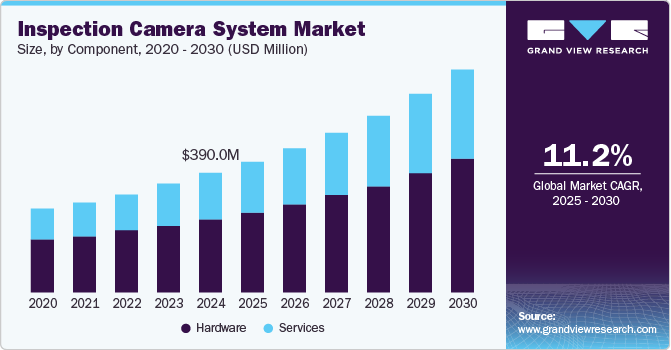

The global inspection camera system market size was valued at USD 390.0 million in 2024 and is expected to grow at a CAGR of 11.2% from 2025 to 2030. The growth of the market is primarily driven by the increasing demand for quality assurance and maintenance across various industries. As sectors such as manufacturing, construction, and healthcare prioritize safety and compliance, the need for reliable inspection technologies has surged. Inspection cameras enable detailed examinations of hard-to-reach areas, facilitating proactive maintenance and reducing the risk of equipment failure. Additionally, the push toward automation and digitalization in industrial processes has led to greater adoption of advanced inspection systems that integrate seamlessly with other technologies. This focus on operational efficiency and product integrity is propelling significant growth in the market.

Government initiatives play a crucial role in boosting the sales of inspection camera systems, particularly through regulations and funding aimed at infrastructure improvement and public safety. Many governments are implementing stricter compliance standards across sectors like construction, utilities, and environmental management, necessitating the use of advanced inspection technologies. Additionally, public sector investments in infrastructure projects often require reliable inspection solutions for quality control and monitoring. Programs aimed at upgrading municipal services, such as sewer and road inspections, further drive demand for these systems. These initiatives not only promote the adoption of inspection cameras but also encourage manufacturers to innovate and expand their offerings in response to regulatory requirements.

Manufacturers in the market are increasingly focused on introducing new products with enhanced capabilities and improvement per the changing requirement as it's usage in the desired technology. Companies' target is to provide innovative software platforms combined with cloud computing to gain an advantage with AI and machine learning technologies. Increasing approbation of 3D inspection systems offering attractive prospects in the industry, the traditional techniques offer only 2D measurement and examination.

The market presents numerous growth opportunities, particularly in emerging applications and industries. As technology evolves, new markets are developing that require sophisticated inspection solutions, such as smart cities, environmental monitoring, and renewable energy. The increasing focus on sustainability is driving demand for inspection cameras that can assess infrastructure and environmental conditions effectively. Additionally, advancements in imaging technology, such as 4K and thermal imaging, open new avenues for high-resolution inspections across various sectors. Manufacturers can capitalize on these opportunities by developing specialized products tailored to specific applications, thereby expanding their market presence and customer base.

Manufacturers are investing in research and development, enhancing product features, and expanding distribution channels. By prioritizing innovation, companies are able to introduce advanced technologies, such as wireless connectivity and AI-driven analytics, which significantly improve inspection efficiency and accuracy. Moreover, partnerships with industry stakeholders and investments in marketing initiatives are enabling manufacturers to reach a broader audience and address diverse customer needs. As competition intensifies, the emphasis on customer-centric solutions and tailored offerings will be key to capturing market share and driving growth in the inspection camera system sector.

Technological innovation is a major catalyst for the evolution of the market, leading to enhanced functionalities and new applications. Recent advancements in imaging technologies, such as high-definition and thermal cameras, have significantly improved the clarity and detail of inspections. Innovations in connectivity, such as IoT integration, enable real-time data transmission and remote monitoring, which are invaluable for industries that require immediate insights. Additionally, the incorporation of artificial intelligence and machine learning in analysis software allows for more sophisticated data interpretation and predictive maintenance. These innovations not only enhance the performance of inspection camera systems but also expand their utility across various sectors, driving growth and adoption in the market.

Component Insights

The hardware segment held a significant share of the market in 2024, driven by the essential role that cameras and related equipment play in various inspection applications. As industries increasingly adopt advanced inspection technologies, the demand for high-quality cameras, lenses, and accessories has surged. Factors such as the need for durability, precision, and reliability in inspection processes have prompted manufacturers to innovate and enhance hardware capabilities. This focus on developing robust and versatile hardware solutions has solidified the hardware segment's dominant position in the market.

The software segment market is experiencing remarkable growth, fueled by advancements in imaging technology and data analytics. Software solutions are increasingly being integrated with inspection cameras to enhance functionality, enabling real-time analysis, reporting, and data management. The growing demand for automated inspection processes, particularly in quality control and maintenance, is driving the adoption of sophisticated software tools that facilitate seamless integration with hardware. Additionally, the trend toward cloud-based solutions and AI-powered analytics is further propelling growth in this segment as users seek to leverage data for improved decision-making.

Video Quality Insights

The SD (Standard Definition) and HD (High Definition) segment held a high share of the market in 2024 due to their established presence and wide applicability in various inspection tasks. While high-resolution options are gaining popularity, SD and HD cameras remain cost-effective solutions for many organizations, providing adequate image quality for routine inspections. The balance between performance and affordability makes this segment particularly appealing to small and medium-sized enterprises, ensuring its continued prominence in the market.

The Full HD and 4K segment is experiencing rapid growth in the market, driven by the demand for superior image quality and detailed inspection capabilities. Full HD and 4K cameras offer enhanced resolution and clarity, enabling users to capture intricate details that are essential for accurate assessments. Industries such as construction, automotive, and electronics are increasingly leveraging high-resolution cameras for quality control and compliance inspections. As the cost of high-resolution imaging technology decreases, more sectors are adopting Full HD and 4K solutions, further fueling the growth of this segment.

Distribution Channel Insights

The online segment held a substantial share of the market, driven by the increasing shift toward e-commerce and digital purchasing habits. Consumers and businesses are increasingly turning to online platforms for their inspection camera needs due to the convenience, broader selection, and competitive pricing they offer. E-commerce websites provide detailed product specifications, customer reviews, and comparison tools, enabling buyers to make informed decisions. Additionally, the ability to access global suppliers and manufacturers has expanded market reach, fostering greater competition and innovation. This trend is further supported by improved logistics and shipping solutions, which enhance the overall customer experience in purchasing inspection cameras online.

The in-store segment is experiencing significant growth, driven by the tactile nature of purchasing specialized equipment and the personalized service offered by physical retail environments. Customers often prefer to see and test inspection cameras firsthand before making a purchase, allowing them to assess quality and functionality more effectively. Retailers are capitalizing on this trend by providing expert advice, demonstrations, and immediate product availability, which are appealing to both professional users and hobbyists. Additionally, the rise of hybrid retail models that combine online and in-store experiences is enhancing customer engagement, making it easier for consumers to find the right products while benefiting from the immediacy of in-store shopping. This growing preference for direct interaction with products is fostering expansion in the in-store segment of the market.

Application Insights

The pipeline segment captured a high market share in 2024. This can be attributed to the increasing demand for efficient and cost-effective solutions for monitoring and maintaining pipeline integrity. As industries prioritize safety and compliance, advanced inspection cameras equipped with cutting-edge technologies have become essential tools for detecting leaks, corrosion, and other structural issues in pipelines. This heightened focus on preventive maintenance has driven investments in these inspection systems, further solidifying their dominance in the market.

The medical segment is growing as the rising prevalence of minimally invasive procedures and advancements in medical imaging technologies have fueled demand for high-quality inspection cameras in healthcare. These cameras facilitate enhanced visualization during surgical procedures, aiding in accurate diagnoses and improving patient outcomes. Moreover, the increasing emphasis on patient safety and the adoption of telemedicine solutions have further accelerated the integration of advanced inspection camera systems in medical applications.

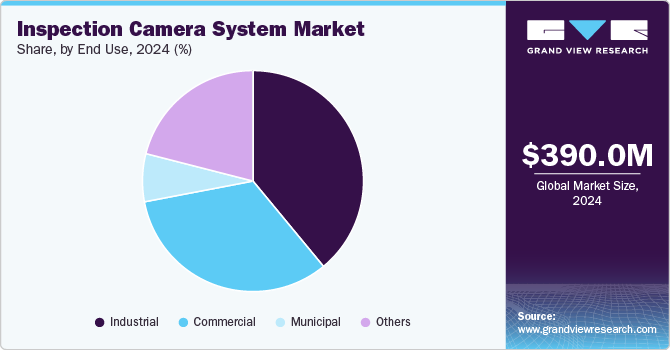

End-use Insights

The municipal segment commands a substantial share of the market, primarily due to the increasing need for infrastructure maintenance and public safety. Municipalities utilize inspection cameras for a range of applications, including sewer inspections, road and bridge assessments, and public facility monitoring. The growing focus on urban development and regulatory compliance is driving investments in advanced inspection technologies. As cities strive for better management of their assets and resources, the demand for reliable inspection camera systems in municipal applications continues to rise.

The industrial segment is witnessing significant growth in the inspection camera system market, driven by the need for quality assurance and maintenance across various manufacturing processes. Industries such as automotive, aerospace, and electronics are increasingly adopting inspection cameras to ensure product quality and compliance with safety standards. The emphasis on minimizing downtime and improving operational efficiency is prompting companies to invest in advanced inspection technologies. Furthermore, the integration of automation and smart manufacturing practices is fueling demand for sophisticated inspection camera systems in industrial settings.

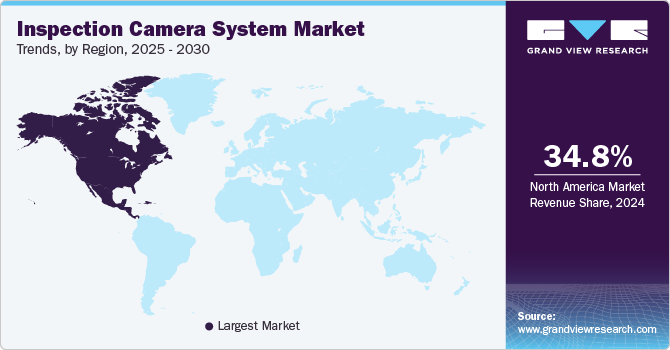

Regional Insights

North America inspection camera system market holds a high share, primarily driven by the region’s robust industrial infrastructure and stringent regulatory standards. Industries such as oil and gas, manufacturing, and construction are increasingly utilizing inspection cameras for maintenance, quality control, and compliance purposes. The presence of established players and innovative technology providers in the region fosters a competitive environment that encourages continuous advancements in inspection technologies.

U.S. Inspection Camera System Market Trends

The inspection camera system market in the U.S. is influenced by a combination of technological innovation and high consumer demand. The country’s strong focus on automation and digital transformation across various sectors, including healthcare, manufacturing, and construction, has increased the need for effective inspection solutions. Government regulations mandating regular inspections for safety and compliance further stimulate market growth.

Europe Inspection Camera System Market Trends

The inspection camera system market in Europe is on a growth trajectory, fueled by stringent regulations regarding safety and environmental compliance. Industries such as energy, construction, and transportation are increasingly adopting inspection cameras to ensure adherence to these regulations and to enhance operational efficiency. The region’s commitment to sustainability and innovation drives investments in advanced technologies, promoting the use of high-resolution and thermal imaging systems.

Asia Pacific Inspection Camera System Market Trends

The inspection camera system market in Asia Pacific is experiencing substantial growth, driven by rapid industrialization and increasing investments in infrastructure development. Countries in this region, particularly in Southeast Asia, are witnessing a surge in construction projects and manufacturing activities, leading to a heightened demand for advanced inspection technologies.

China inspection camera system market is experiencing high growth, supported by the country’s rapid economic development and significant investments in infrastructure projects. The government’s focus on modernization and the enhancement of public safety standards is driving demand for reliable inspection technologies across various sectors, including construction, utilities, and transportation.

The inspection camera system market in India is witnessing remarkable growth, driven by rapid urbanization and infrastructure development initiatives. Government projects aimed at enhancing public services and utilities create a substantial demand for effective inspection solutions in sectors such as water management, transportation, and construction.

Key Inspection Camera System Company Insights

Key players in the inspection camera system market are focusing on introducing new technology and innovative products and services, which will help them gain more customer momentum and boost their sales and revenue. Gaining the momentum of the steadily growing market, manufacturers/companies are expanding their reach by collaborating with local players to aggrandize their monopoly toward the customer.

-

Basler AG is a prominent player in the inspection camera system market. The company specializes in providing innovative products for applications in various sectors, including manufacturing, logistics, and medical technology. Basler’s extensive portfolio includes area scans, line scans, and 3D cameras, all designed to meet the demanding requirements of automated inspection processes. The company is committed to advancing technology through continuous research and development, ensuring its products offer superior image quality, speed, and reliability.

-

Eddyfi Technologies is known for its innovative non-destructive testing (NDT) technologies. The company focuses on delivering specialized inspection camera systems for various applications, including oil and gas, aerospace, and manufacturing. Eddyfi's flagship products include high-performance eddy current, ultrasonic, and visual inspection technologies that ensure the integrity and safety of critical infrastructure.

Key Inspection Camera System Companies:

The following are the leading companies in the inspection camera system market. These companies collectively hold the largest market share and dictate industry trends.

- Basler AG

- Leica Microsystems (Danaher Corporation)

- Clarcus Medical LLC

- Eddyfi Technologies

- Minicam Group (Halma plc)

- Ipek International Gmbh (IDEX Corporation)

- NDT Technologies (P) Limited

- CUES Inc.

- OMNIVISION

- I.C. LERCHER Solutions GmbH

Recent Developments

-

In April 2024, Ricoh Company, Ltd. announced its acquisition of natif.ai, a German startup specializing in artificial intelligence (AI)-driven Intelligent Capture, advanced image recognition, and optical character recognition (OCR) technologies.

-

In June 2023, Ricoh Company, Ltd. launched the RICOH SC-20, an inspection camera that works utilizing image recognition technology. The camera is designed for real-time verification of the accurate performance of manual work processes.

-

In March 2022, Omron Automation launched a series of affordable, compact board-level cameras specifically designed for embedded vision applications. The Omron B Series GigE Vision cameras are fully featured and do not require an enclosure.

Inspection Camera System Market Report Scope

Report Attribute

Details

Market size in 2025

USD 429.0 million

Revenue forecast in 2030

USD 729.0 million

Growth rate

CAGR of 11.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, video quality, application, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France China; Spain India; Japan; South Korea; Mexico; Brazil

Key companies profiled

Basler AG; Leica Microsystems; Clarus Medical LLC; Eddyfi Technologies; Minicam Group; iPEK International GmbH; NDT Technologies (P) Limited; CUES Inc.; OMNIVISION; I.C. LERCHER-Solutions GmbH

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inspection Camera System Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inspection camera system market report based on component, video quality, application, distribution channel, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Services

-

-

Video Quality Outlook (Revenue, USD Million, 2018 - 2030)

-

SD & HD

-

Full HD & 4K

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pipeline Inspection

-

Drain Inspection

-

Tank

-

Medical Inspection

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

In-Store

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Municipal

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

- Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inspection camera system market size was estimated at USD 390.0 million in 2024 and is expected to reach USD 429.0 million in 2025.

b. The global inspection camera system market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 729.0 million by 2030.

b. North America dominated the inspection camera system market with a share of more than 34% in 2024. This is attributable to the expansion of the industrial hub across the countries across the region.

b. Some key players operating in the inspection camera system market include Basler AG; Leica Microsystems; Clarus Medical LLC; Eddyfi Technologies; Minicam Group; iPEK International GmbH; NDT Technologies (P) Limited; CUES Inc.; OMNIVISION; I.C. LERCHER-Solutions GmbH

b. Key factors that are driving the inspection camera system market growth include increasing demand for inspection and obtaining a full view of the inner workings of the varied machinery at various inspection facilities across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.