- Home

- »

- Next Generation Technologies

- »

-

Integrated Bridge Systems Market Size, Industry Report, 2030GVR Report cover

![Integrated Bridge Systems Market Size, Share & Trends Report]()

Integrated Bridge Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Subsystem (Navigation Systems, Communication Systems), By Platform (Commercial Vessels), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-626-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Integrated Bridge Systems Market Summary

The global integrated bridge systems market size was estimated at USD 8.27 billion in 2024 and is projected to reach USD 10.07 billion by 2030, growing at a CAGR of 3.5% from 2025 to 2030. The Integrated Bridge Systems (IBS) market is strongly driven by stringent international regulatory frameworks mandating safety, interoperability, and operational reliability.

Key Market Trends & Insights

- Asia Pacific integrated bridge systems market held the largest share of 38.9% of the global market in 2024.

- The China integrated bridge systems market is growing significantly due to China’s dominance in global shipbuilding.

- Based on the component, the hardware segment accounted for the largest share, 68.5%, in 2024.

- By subsystem, the navigation systems segment held the largest market share in 2024.

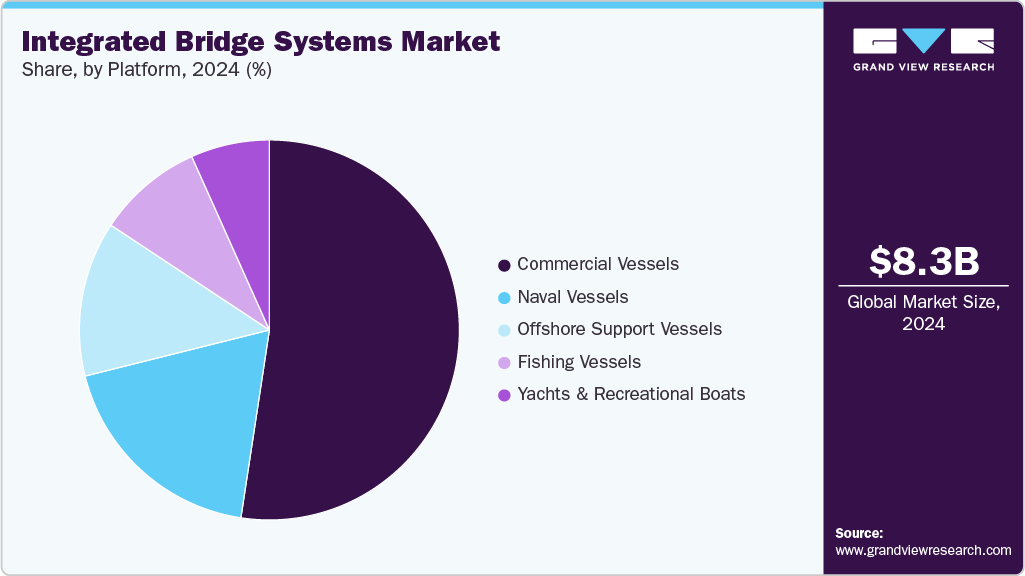

- By platform, the commercial vessels segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.27 Billion

- 2030 Projected Market Size: USD 10.07 Billion

- CAGR (2025-2030): 3.5%

- Asia Pacific: Largest market in 2024

The International Maritime Organization’s (IMO) MSC.64(67) resolution, adopted in 1996, set foundational performance standards for integrated bridge systems, requiring modular, interoperable designs with centralized control and fail-safe operational protocols.

Additionally, SOLAS Chapter V, Regulation 19, enforces redundancy requirements to ensure that any subsystem failure triggers immediate alarms without compromising other critical functions. These regulations compel maritime operators to adopt integrated bridge systems architectures that meet evolving global safety benchmarks. For instance, the U.S. Coast Guard’s Keeper-class vessels, including the USCGC Ida Lewis, integrate bridge systems solutions validated against IMO and American Bureau of Shipping standards, ensuring rigorous compliance across navigational and machinery control subsystems. This regulatory landscape standardizes integrated bridge systems configurations and fosters innovation in modular system design, accommodating continuous advancements in maritime safety norms.

Modern IBS platforms increasingly leverage advanced navigation technologies to enhance situational awareness and operational precision. The U.S. Coast Guard incorporates Differential Global Positioning System (DGPS) and Electronic Chart Display and Information System (ECDIS) within its IBS frameworks, achieving real-time positioning accuracy within 10 meters even under adverse weather conditions. These systems synthesize radar, sonar, and Automated Identification System (AIS) data into unified displays, reducing navigator workload and improving decision-making. The USCGC Ida Lewis exemplifies this integration by utilizing Dynamic Positioning Systems (DPS) that autonomously maintain vessel position during buoy-tending operations, processing inputs from ECDIS and environmental sensors. Such technological synergies minimize human error and optimize route execution, particularly in congested or hazardous maritime environments.

Automation is critical in modern integrated bridge systems, significantly reducing manual intervention and reliance on large crews. The U.S. Coast Guard’s Keeper-class cutters employ integrated bridge systems with automated machinery control and monitoring systems, centralizing engine diagnostics, alarm management, and log-keeping. This automation enables a single operator to manage propulsion, navigation, and safety systems concurrently, which previously required multiple personnel. Deploying fiber-optic networks and centralized workstations further streamlines data flow across subsystems, enhancing real-time decision-making during critical operations such as search-and-rescue or oil spill response missions.

Robust redundancy and fail-safe protocols are vital to integrated bridge systems design, ensuring continuous operation despite subsystem failures. SOLAS Chapter V mandates isolation of faults to prevent cascading failures, coupled with audible and visual alarms to alert officers promptly. The USCGC Ida Lewis illustrates these principles through redundant workstations and independent power supplies for key subsystems like radar and ECDIS. Its integrated bridge systems also incorporate a “fail-to-safe” mode that defaults to manual override if automation is compromised, maintaining navigational integrity during emergencies. These protocols are crucial in high-stakes maritime environments where system downtime can result in catastrophic consequences.

Dynamic Positioning Systems (DPS) have become integral components of integrated bridge systems, which has propelled the market growth, especially for vessels requiring precise maneuvering in open waters. The U.S. Coast Guard employs DPS to maintain station-keeping within a 10-meter radius, even amid challenging conditions such as 30-knot winds and 8-foot waves. By integrating inputs from DGPS, gyrocompasses, and wind sensors, DPS autonomously adjusts thrusters and propulsion to counteract environmental forces. This capability is essential for offshore operations like buoy maintenance, where manual positioning is impractical or dangerous. Integrating DPS into IBS elevates operational safety and expands the range of maritime activities achievable in adverse conditions.

Component Insights

The Hardware segment accounted for the largest share, 68.5%, in 2024, underpinned by the ongoing modernization of maritime fleets and stricter compliance with IMO e-navigation mandates. The rise of autonomous and semi-autonomous vessels is catalyzing demand for advanced radar systems, multifunction displays, and solid-state sensors, with manufacturers increasingly focusing on modular, upgradable systems to reduce lifecycle costs. Additionally, military retrofits and commercial vessel refits prioritize high-spec hardware integration to meet evolving navigational and cybersecurity standards.

The Software segment is projected to grow at the fastest CAGR over the forecast period, driven by the maritime industry's transition towards digital twins, predictive analytics, and real-time route optimization. Cloud-based bridge systems and integrated platform management software are gaining traction, especially among commercial fleet operators seeking operational visibility across vessels. Enhanced UI/UX design, AI-based situational awareness, and remote diagnostics are reshaping how bridge operators interact with critical navigation data, with maritime SaaS solutions expected to accelerate adoption through 2030.

Subsystem Insights

The Navigation Systems segment held the largest market share in 2024. Navigation systems remain the backbone of integrated bridge systems adoption, particularly as shipping lanes grow increasingly congested and Arctic route usage rises. The need for precision routing, collision avoidance, and fuel-efficient navigation is driving demand. Integrated ECDIS, radar, GPS, and sonar systems are seeing a wave of upgrades, while IMO and SOLAS regulations continue to push shipowners towards fully digitized navigation bridges. Moreover, integration with autonomous decision support tools elevates navigation subsystems' strategic role in voyage planning.

The Automatic Identification System (AIS) segment is projected to grow at the fastest CAGR over the forecast period, due to tightening global vessel tracking mandates, especially across Asia-Pacific and Europe. The emphasis on maritime domain awareness and port security has encouraged nations to adopt advanced Class A/B AIS solutions. Furthermore, the convergence of AIS data with real-time analytics and fleet management dashboards fosters a smarter, interconnected maritime ecosystem. The increasing role of AIS in piracy prevention and fishing vessel monitoring is opening new avenues in defense and commercial sectors.

Platform Insights

The commercial vessels segment dominated the market in 2024, fueled by expanding global seaborne trade, green shipping initiatives, and vessel automation trends. Bulk carriers, container ships, and tankers increasingly adopt integrated bridge systems to comply with the IMO’s GHG reduction strategies through route optimization and fuel monitoring. Additionally, the retrofit demand across aging fleets is notable in regions like Southeast Asia and the Middle East, where economic recovery is prompting investments in digital navigation and safety systems.

The yachts & recreational boats segment is projected to grow at the fastest CAGR over the forecast period. The yachts and recreational boats segment, while niche, is showing notable growth in high-income regions such as North America and Europe. Rising demand for luxury marine experiences and personal maritime autonomy is driving the installation of compact, user-friendly integrated bridge systems units. Features such as touchscreen-based controls, integrated autopilot systems, and real-time weather overlays are becoming standard in high-end yachts. The segment also benefits from new entrants offering modular bridge solutions tailored for small- to mid-sized recreational craft.

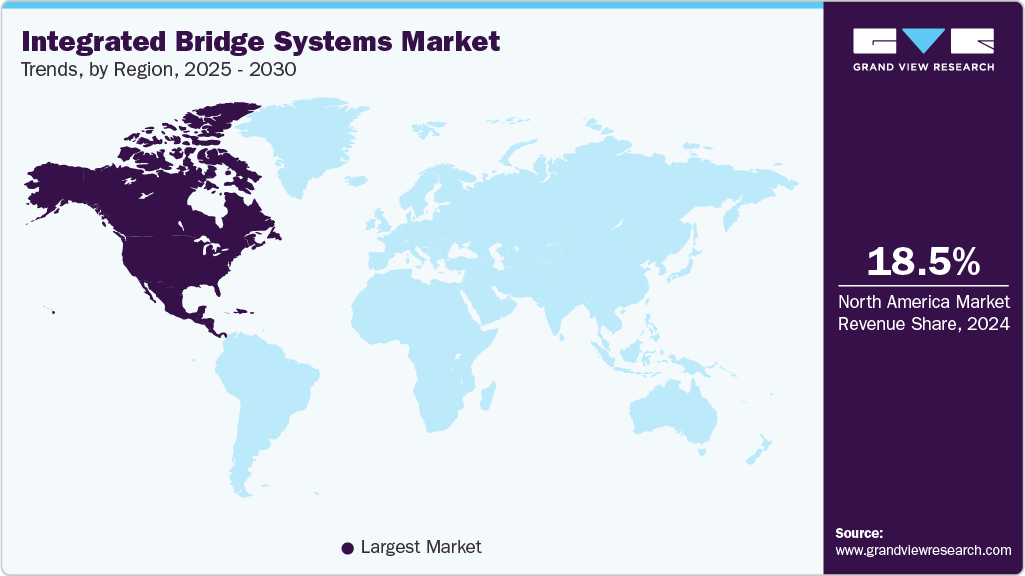

Regional Insights

The North America Integrated Bridge Systems market accounted for 18.5% of the overall market in 2024. The region’s growth is driven largely by increased defense spending, particularly in the U.S. the Navy’s modernization programs rely heavily on advanced integrated bridge systems technologies for surface ships. The presence of major integrated bridge systems developers such as Northrop Grumman and Raytheon also fuels the market’s expansion. Meanwhile, in Canada, economic growth and increasing export activities boost demand for integrated bridge systems, alongside the government’s naval modernization efforts, which support deploying advanced integrated bridge systems in defense vessels.

U.S. Integrated Bridge Systems Industry Trends

The U.S. Integrated Bridge Systems industry held a dominant position in 2024. The U.S. market for Integrated Bridge Systems benefits from substantial defense budgets and strategic modernization programs. The U.S. Navy’s focus on combat system upgrades has elevated the demand for sophisticated bridge integration technologies. Additionally, innovation projects like the Mayflower Autonomous Ship showcase the country’s drive toward autonomous navigation systems that are heavily dependent on integrated bridge systems. Leading defense contractors contribute significantly to the availability and advancement of these technologies, positioning the U.S. as a key integrated bridge systems market globally.

Europe Integrated Bridge Systems Industry Trends

The Europe Integrated Bridge Systems industry was identified as a lucrative region in 2024. With Germany and the UK at the forefront, Europe is advancing its maritime sector through increased digitization and smart technology adoption, including integrated bridge systems. Germany’s National Master Plan for Maritime Technologies promotes innovations in autonomous ship navigation and digital bridge systems. German shipbuilders like Meyer Werft integrate modern integrated bridge systems solutions in their vessels to comply with EU safety mandates. The UK’s Maritime 2050 strategy also prioritizes digital and smart bridge integration for commercial and military fleets. The Royal Navy’s new Type 31 frigates exemplify this trend by incorporating fully digital bridge systems into their modernization program.

The Germany integrated bridge systems market is driven by the actively advancing maritime technology through government-backed initiatives to digitalize navigation and bridge systems. The National Master Plan for Maritime Technologies supports development in autonomous ship systems and bridge integration. German shipbuilders have invested in modern integrated bridge systems for large vessels such as cruise ships, ensuring compliance with rigorous European maritime safety standards and enhancing operational efficiency.

The UK integrated bridge systems market is growing significantly. UK’s maritime sector is transforming under the Maritime 2050 strategy, which focuses on integrating cutting-edge digital technologies such as integrated bridge systems in both commercial and naval fleets. This transformation is evident in the Royal Navy’s Type 31 frigates, which fully integrate digital bridge systems to improve command, control, and navigation capabilities. Such investments underscore the country’s commitment to maintaining a technologically advanced maritime fleet.

Asia Pacific Integrated Bridge Systems Industry Trends

The APAC region is witnessing rapid growth in the adoption of integrated bridge systems by major shipbuilding nations like China, Japan, and India. China leads the global shipbuilding industry by volume, accounting for nearly 40% of global tonnage, and continues to innovate with intelligent bridge-building machines utilizing BeiDou satellite navigation technology for enhanced precision and safety. Japan’s maritime industry is growing steadily, with companies like Furuno Electric reporting significant revenue increases due to demand for advanced maritime technologies, including integrated bridge systems. India is focused on strengthening its bridge infrastructure through projects such as Setu Bharatam, Bharatmala Pariyojna, and the Indian Bridge Management System (IBMS), which emphasize construction, modernization, and management of bridges and highways, indirectly supporting the growing market for integrated bridge systems in commercial and defense vessels.

The China integrated bridge systems market is growing significantlydue to China’s dominance in global shipbuilding. China produces 40% of the world's ship tonnage and aggressively invests in technology upgrades. The deployment of intelligent, integrated bridge-building machines based on BeiDou satellite navigation exemplifies the country’s technological leadership, enhancing construction safety and efficiency. These advancements support China’s growing integrated bridge systems market, as commercial and defense maritime sectors increasingly adopt integrated navigation and control solutions.

The India integrated bridge systems market is driven by infrastructure modernization programs that strongly focus on bridges and highways, indirectly supporting integrated bridge systems growth. The Setu Bharatam project aims to eliminate railway crossings on national highways by constructing over 200 new Railway Over Bridges (ROBs) and upgrading thousands of existing bridges. The Bharatmala Pariyojna initiative seeks to interconnect district headquarters with high-quality highways, including numerous tunnels, bridges, and elevated corridors. Additionally, the Indian Bridge Management System (IBMS) employs mobile inspection units to survey and maintain the country’s bridge infrastructure. These efforts reflect India’s commitment to safer, more efficient transportation infrastructure, stimulating the demand for integrated bridge navigation and control systems in commercial and defense maritime platforms.

Key Integrated Bridge Systems Company Insights

Some of the major players in the Integrated Bridge Systems market include Anschütz GmbH, Northrop Grumman, Kongsberg Maritime, and Wärtsilä. These companies have consistently invested in research and development to enhance system integration, automation, and situational awareness aboard commercial and naval vessels. Their products often comply with stringent international maritime safety regulations and are widely adopted across diverse vessel categories due to proven reliability, scalability, and performance in complex operational environments. Additionally, their global distribution networks, strategic partnerships with shipbuilders, and participation in government defense programs have solidified their competitive positions in the market.

-

Anschütz GmbH, based in Germany, is a prominent player in navigation and bridge systems with a strong legacy in maritime technology. The company is known for its expertise in gyro compass technology and has evolved into a comprehensive supplier of integrated bridge systems for both commercial and naval vessels. Anschütz’s solutions are valued for their precision, safety, and seamless navigation, control, and monitoring components integration. Global fleets widely adopt their systems and comply with international maritime regulations, making them a trusted partner for shipowners and shipbuilders. The company also strongly focuses on R&D, continuously advancing automation and digital navigation capabilities.

-

Wärtsilä, headquartered in Finland, is a global leader in smart marine and energy solutions, including integrated bridge systems that enhance vessel efficiency and safety. The company offers highly customizable IBS platforms integrating navigation, communication, engine monitoring, and automation controls into a unified system. Wärtsilä's strength lies in its holistic approach-delivering both bridge systems and propulsion, power systems, and lifecycle support. Their IBS solutions are widely used in new builds and retrofits across commercial and naval fleets, supporting the maritime industry's digital transformation. With a focus on sustainability, Wärtsilä emphasizes energy-efficient and environmentally compliant technologies within its bridge system offerings.

Key Integrated Bridge Systems Companies:

The following are the leading companies in the integrated bridge systems market. These companies collectively hold the largest market share and dictate industry trends.

- Anschütz GmbH

- Northrop Grumman

- Kongsberg Maritime

- Wärtsilä

- Hensoldt AG

- Noris Group GmbH

- L3Harris Technologies, Inc.

- RPF Meridian JSC

- Japan Radio Co.

- FURUNO ELECTRIC CO.,LTD.

Recent Developments

-

In October 2023, Anschütz GmbH delivered advanced integrated bridge systems for three LNG-powered multi-purpose vessels built by Abeking & Rasmussen for the German Waterways and Shipping Administration. The systems feature six Synapsis NX workstations, integrating radar, ECDIS, and autopilot to enhance navigation safety and efficiency in challenging maritime operations.

-

In November 2021, Wärtsilä Corporation delivered an advanced integrated bridge solution for the National Geographic Resolution, a polar expedition cruise vessel, integrating navigation and communication systems to ensure safety in extreme polar environments.

Integrated Bridge Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.49 billion

Revenue forecast in 2030

USD 10.07 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, subsystem, platform, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Anschütz GmbH; Northrop Grumman; Kongsberg Maritime; Wärtsilä; Hensoldt AG; Noris Group GmbH; L3Harris Technologies, Inc.; RPF Meridian JSC; Japan Radio Co.; FURUNO ELECTRIC CO.,LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

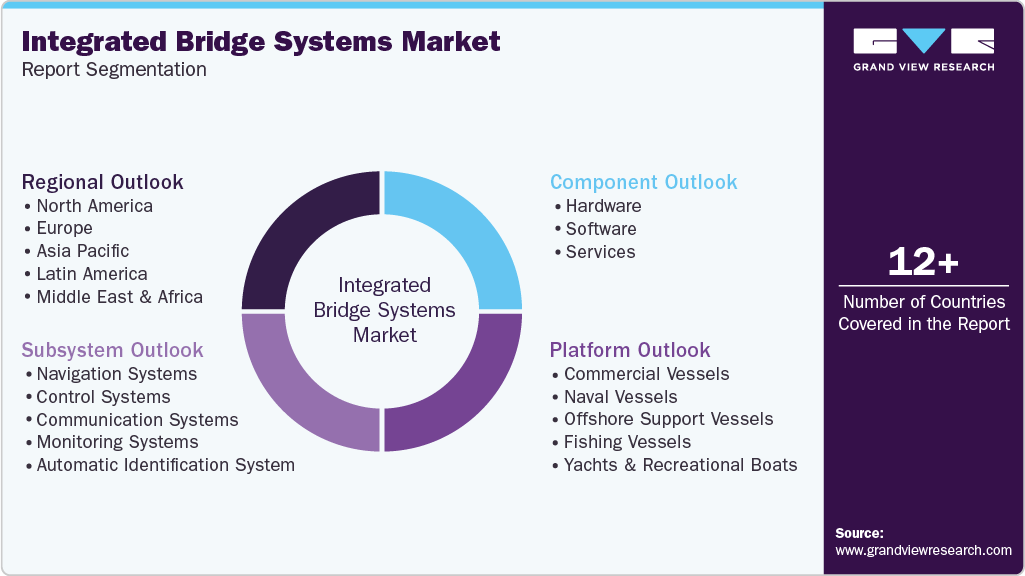

Global Integrated Bridge Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global integrated bridge systems market report based on component, subsystem, platform, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Subsystem Outlook (Revenue, USD Billion, 2018 - 2030)

-

Navigation Systems

-

Control Systems

-

Communication Systems

-

Monitoring Systems

-

Automatic Identification System

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Vessels

-

Naval Vessels

-

Offshore Support Vessels

-

Fishing Vessels

-

Yachts & Recreational Boats

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global integrated bridge systems market size was estimated at USD 8.27 billion in 2024 and is expected to reach USD 8.49 billion in 2025.

b. The global integrated bridge systems market size is expected to grow at a significant CAGR of 3.5% to reach USD 10.07 billion in 2030.

b. Asia Pacific held the largest market share of 38.9% in 2024. This growth is fueled by major shipbuilding nations like China, Japan, and India. China leads the global shipbuilding industry by volume, accounting for nearly 40% of global tonnage, and continues to innovate with intelligent bridge-building machines utilizing BeiDou satellite navigation technology for enhanced precision and safety.

b. Some of the players in the integrated bridge systems market are Anschütz GmbH, Northrop Grumman, Kongsberg Maritime, Wärtsilä, Hensoldt AG, Noris Group GmbH, L3Harris Technologies, Inc., RPF Meridian JSC, Japan Radio Co., and FURUNO ELECTRIC CO., LTD.

b. The key driving trend in the integrated bridge systems (IBS) market is the growing demand for automation and digitalization in maritime navigation. As ships become more technologically advanced, there is increasing emphasis on integrated systems that enhance operational efficiency, situational awareness, and safety. This trend is further fueled by regulatory mandates for safer navigation and the rise in smart shipping initiatives, which require advanced bridge solutions with real-time data integration, remote monitoring, and seamless communication capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.