- Home

- »

- Next Generation Technologies

- »

-

Intelligent Building Automation Technologies Market Report, 2030GVR Report cover

![Intelligent Building Automation Technologies Market Size, Share & Trends Report]()

Intelligent Building Automation Technologies Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Product, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-218-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global intelligent building automation technologies market size was valued at USD 102.74 billion in 2022 and is expected to grow at a CAGR of 8.8% from 2023 to 2030. The market has witnessed considerable growth due to growing concerns over global warming, rising energy prices, and increasing awareness regarding energy conservation. Rising use of renewable energy sources and increasing consumer awareness about environmental protection will further drive the intelligent building automation technologies (IBAT) market. Building automation systems (BAS) integrate lighting, energy, safety, and security into one intuitive system, balancing optimum efficiency with productivity and occupant comfort. Growing awareness of life safety and security among the population is expected to favor market growth. People are becoming aware of financial losses incurred due to natural or man-made calamities such as floods, earthquakes, terrorist attacks, or construction fires. For instance, according to the U.S. Fire Administration, in 2018 alone, there were 5,610,000 fire incidents, with losses totaling USD 23 billion.

Organizations are widely adopting intelligent building automation technologies, which offer various applications such as lighting management, managing air conditioning, heat ventilation, and analyzing building data. Organizations are largely focusing on measures to curb energy consumption by activating/deactivating lights, HVAC systems, and other applications. According to research by elektormagazine.com, implementing IBAT in 10,000 square meters can save as much as 1,000,000 euros a year. Such factors are expected to fuel market growth.

Increasing the need for enhanced security and safety in intelligent buildings is also expected to contribute considerably to the intelligent building automation technologies industry growth. Adoption of various building automation protocols, open-ended architecture development, easy access to technological developments, and implementation of intelligent BAS in residences are expected to support industry growth on a large scale. Intelligent building automation technologies analyze and monitor the performance of buildings in terms of sustainability, comfort, and productivity. Also, these technologies are used in residences for microgrid management.

However, a lack of awareness among end-users and high initial investments may challenge growth over the forecast period. Also, technical difficulties related to intelligent building automation technologies operation may hinder market growth. Nevertheless, commoditization of the systems and developing a comprehensive valuation model may be an opportunity for key players. IP-based communication and convergence of the Internet of Things and automation technologies are opening new avenues for developing BAS across commercial, residential, and industrial segments.

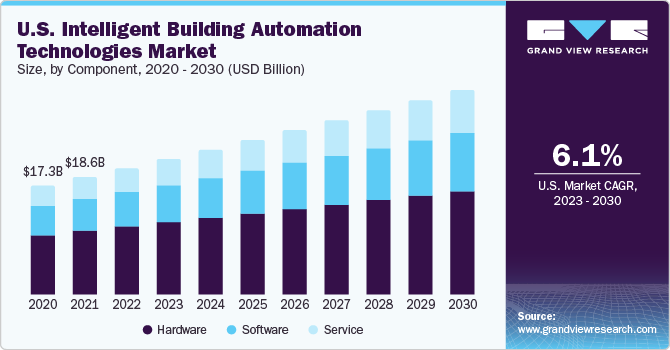

Component Insights

The component segment is segmented into hardware, software, and service. The hardware segment held the largest market share of 53.8% in 2022. Intelligent building automation technologies are an interconnected software and hardware network that controls and monitors the building facility environment. Various hardware equipment used include actuators, controllers, and sensors. These devices collectively ensure that HVAC systems are properly managed through automated control and that the building climate remains within an acceptable range.

The service segment mainly comprises multiple gas extractors and is estimated to exhibit the fastest CAGR of 10.0% over the forecast period. Intelligent building automation technology services comprise engineering services. These engineering services help achieve energy-efficient, safe, and economical operation of building control systems. Implementing smart building services reduces operational expenses, reduces energy usage, and improves performance. It, in turn, is expected to propel the services segment's growth over the forecast period.

Product Insights

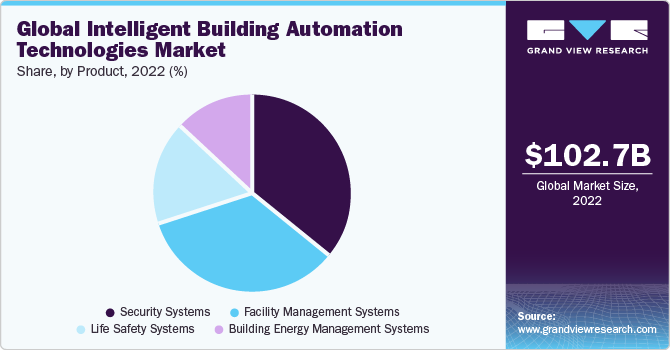

The product segment is segmented into security systems, life safety systems, facility management systems, and building energy management systems (BEMS). Security systems dominated the market, with the highest revenue share of 35.8% in 2022. Security systems include building access control, CCTV, and elevator access control, which help reduce risks and prevent property loss and damage. Facilities management systems are the largest contributor to this market, whereas demand for BEMS is expected to grow significantly.

Growing concerns about losses in emergencies, the need for logging methods for energy consumed by residential and industrial equipment, and the rising popularity of security through video surveillance are expected to spur the demand for intelligent building automation technology. Building energy management systems mainly focus on controlling, monitoring, measuring, and optimizing building technical services. These systems offer various benefits, such as reduced energy consumption, easy detection of power issues, and reduced carbon emissions. They monitor energy consumed by mechanical and electrical equipment, such as air conditioners, ventilators, and heaters, to reduce costs and increase efficiency.

On the other hand, the life safety systems segment is expected to grow at a significant CAGR of 10.1% over the forecast period. Life safety systems, such as fire detection, emergency evacuation, and security systems, are essential components of any building to ensure the safety and security of occupants. Integrating intelligent technologies makes these systems more efficient and effective in detecting, responding to, and managing emergencies, enhancing overall safety.

Application Insights

The application segment is segmented into residential, commercial, and industrial. The commercial segment dominated the market with the highest revenue share of 40.9% in 2022. In large commercial sites, such as industrial zones, office parks, shopping malls, airports, and seaports, intelligent building automation technology helps reduce the cost of energy, spatial management, and maintenance by a large percentage. This application segment is expected to continue its dominance over the forecast period owing to the increasing need to improve commercial building efficiency and stringent regulations regarding energy consumption.

The residential segment is expected to witness the fastest growth of CAGR of 10.4% over the forecast period. Growing concerns for security among homeowners due to rising burglaries and thefts globally are anticipated to drive the residential segment. The need to save energy and curb costs is also a crucial factor boosting the adoption of intelligent building automation technologies. Property owners can use data collected by motion and occupancy sensors at a building level to regulate air-conditioning and lighting in real-time, thereby reducing energy costs and optimizing the internal environment for its intended purpose.

Regional Insights

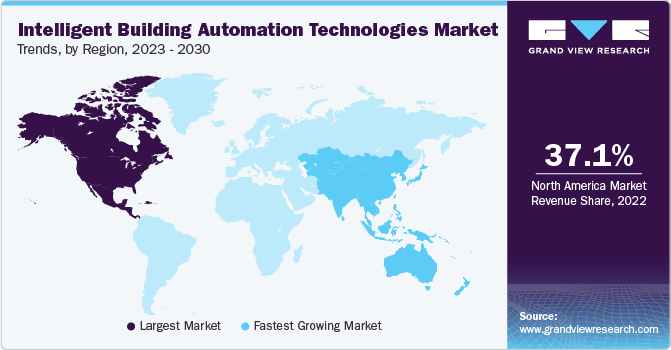

North America dominated the market with the largest revenue share of 37.1% in 2022. North America has been at the forefront of technological innovation and research. The region is home to numerous tech companies, research institutions, and startups driving advancements in intelligent building automation technologies. This technological leadership fosters the development and adoption of cutting-edge solutions.

The European market is expected to grow significantly during the forecast period. Market growth can be attributed to EU directives such as the Energy Performance of Buildings Directive, aimed at improving the energy performance of a building. Moreover, homeowners' rising implementation of security systems is expected to keep growth prospects upbeat. Increasing demand for energy-efficient products and smart grid services in countries such as France and Germany is expected to propel regional growth over the forecast period.

The Asia Pacific is expected to grow at the fastest CAGR of 12.0% during the forecast period due to the adoption of intelligent building automation technology in emerging economies such as China and India. Moreover, governments in countries such as India, South Korea, and China are investing in developing smart cities. Besides, enhancing network infrastructure in the region is expected to provide lucrative opportunities for market players in the coming years. The Middle East and Africa are expected to witness significant growth over the forecast period due to huge public infrastructure development investments. Moreover, the growing number of international tourists bodes well for implementing security systems, further fueling the intelligent building automation technologies market.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in February 2021, Honeywell International Inc. and IDEMIA, a global leader in Augmented Identity, announced a strategic partnership to establish an intelligent building ecosystem. This collaboration seeks to enhance the experience for both building operators and occupants by seamlessly integrating Honeywell's building management and security systems with IDEMIA's biometric-based access control solutions.

Key Intelligent Building Automation Technologies Companies:

- ABB

- General Electric

- Honeywell International Inc.

- Eaton

- Hubbell

- Azbil Corporation

- Ingersoll Rand

- Johnson Controls

- Rockwell Automation Inc.

- Seimens

- Schneider Electric

- United Technologies

Recent Developments

-

In July 2023, RENEW Energy Partners, LLC and Buildings IOT collaborated to accelerate decarbonizing buildings and advancing the implementation of property technology, analytics, and controls within the constructed landscape. Leveraging Buildings IOT's sophisticated, intelligent building management platform, onPoint will amplify and hasten RENEW's objective of reducing carbon emissions from the built environment. This partnership will see onPoint provided as a service to property owners and all clientele of RENEW.

-

In May 2023, Cohesive Technologies, communication solutions, unveiled its engagement in the prestigious Smart Home Expo 2023, the nation's foremost technology event. In partnership with Snom, a key player in SIP unified communication solutions, the company will present its newest offerings and solutions during the event.

-

In June 2022, in a joint effort, IoT building automation frontrunner 75F and open smart building platform provider J2 Innovations (J2) unveiled a partnership focused on enhancing the energy efficiency of medium-sized commercial properties. J2 and 75F combine their strengths to accelerate the adoption of plug-and-play, IoT-driven building automation solutions.

Intelligent Building Automation Technologies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 113.06 billion

Revenue forecast 2030

USD 204.53 billion

Growth Rate

CAGR of 8.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ABB; General Electric; Honeywell International Inc.; Eaton; Hubbell; Azbil Corporation; Ingersoll Rand; Johnson Controls; Rockwell Automation Inc; Seimens; Schneider Electric; United Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

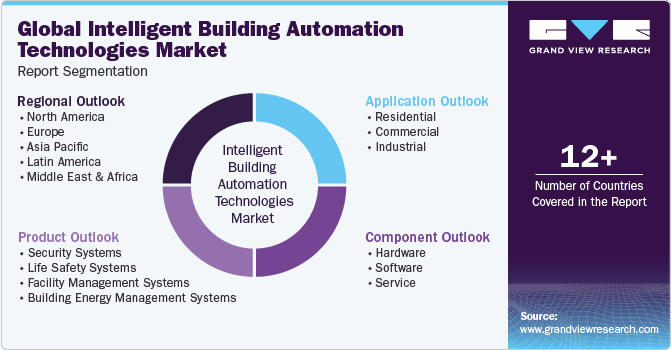

Global Intelligent Building Automation Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global intelligent building automation technologies market based on component, product, application, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Security Systems

-

Life Safety Systems

-

Facility Management Systems

-

Building Energy Management Systems

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global intelligent building automation technologies market size was estimated at USD 102.74 billion in 2022 and is expected to reach USD 113.06 billion in 2023.

b. The global intelligent building automation technologies market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 204.53 billion by 2030.

b. Hardware dominated the intelligent building automation technologies market with a share of around 54.0% in 2022. This is attributed to need of hardware devices to ensure HVAC systems are properly managed through automated control and that the building climate remains within an acceptable range.

b. Some key players operating in the intelligent building automation technologies market include ABB; Azbil Corporation; Eaton; General Electric; Ingersoll Rand plc.; Siemens Building Technologies Inc.; Schneider Electric; Honeywell International Inc.; Hubbell Inc.; Johnson Control; and Rockwell Automation Inc.

b. Key factors that are driving the market growth include a high level of awareness for energy efficiency, growing demand for enhanced safety and security, and supportive government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.