- Home

- »

- Next Generation Technologies

- »

-

Intelligent Document Processing Market Size Report, 2030GVR Report cover

![Intelligent Document Processing Market Size, Share & Trends Report]()

Intelligent Document Processing Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Technology (ML, NLP), By Deployment, By Organization Size, By End-use (Manufacturing, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-023-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intelligent Document Processing Market Summary

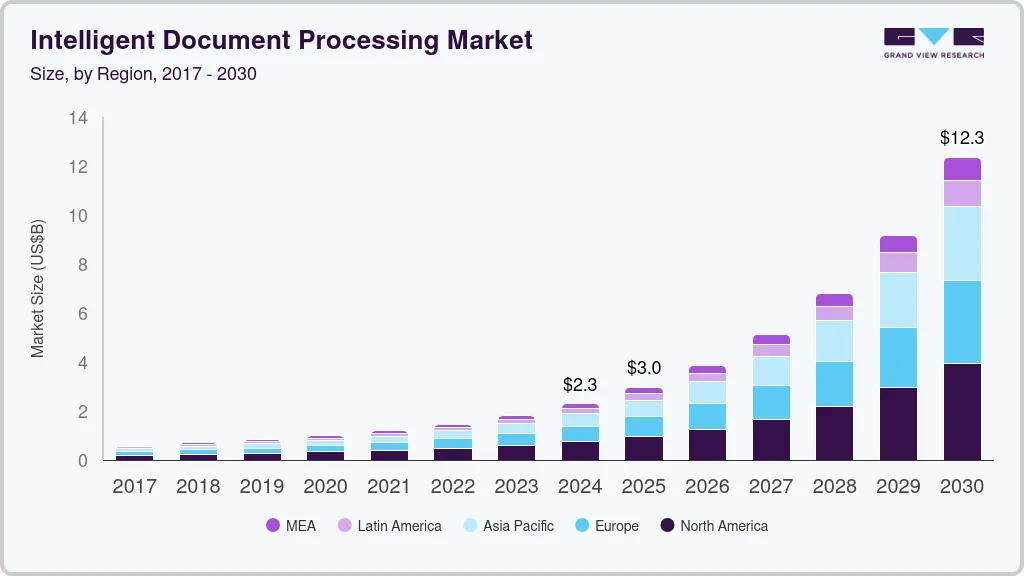

The global intelligent document processing market size was estimated at USD 2.30 billion in 2024 and is projected to reach USD 12.35 billion by 2030, growing at a CAGR of 33.1% from 2025 to 2030. Factors driving the market growth include the increasing digital transformation investments and the need for cost-effective and efficient document processing solutions.

Key Market Trends & Insights

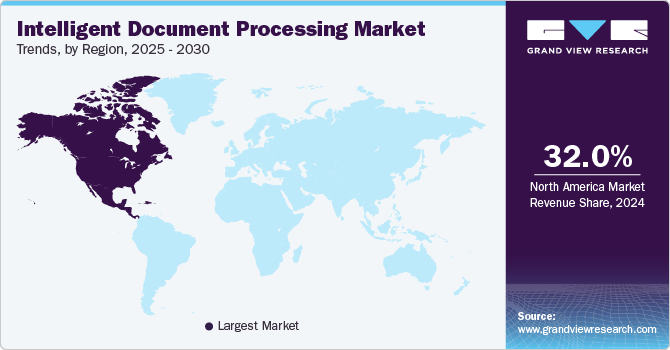

- North America intelligent document processing market held the largest revenue share of over 32.0% in 2024.

- Asia Pacific intelligent document processing market is anticipated to register the highest CAGR over the forecast period.

- Based on component, the solution segment led the market in 2024, accounting for over 63.0% share of the global revenue.

- Based on technology, the Machine Learning (ML) segment accounted for the largest market revenue share in 2024.

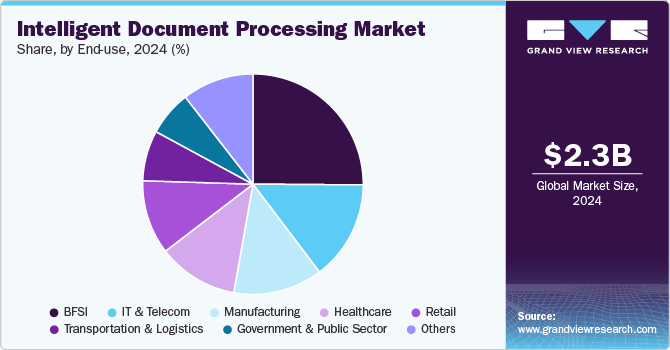

- Based on end-use, the BFSI segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.30 Billion

- 2030 Projected Market Size: USD 12.35 Billion

- CAGR (2025-2030): 33.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, increasing digitalization in developing nations offers significant growth opportunities for the market. IDP solutions use technologies such as machine learning (ML), natural language processing (NLP), optical character recognition (OCR), and computer vision to capture data from documents, classify, and then extract relevant data for further integration and processing.

The advantages of intelligent document processing solutions include reductions in operational costs & errors and improved data quality & usability for analysis. Some of the use cases of the solution include invoice processing, fraud detection, and customer onboarding. IDP technology is used to improve the efficiency and effectiveness of operations.

Automated document processing and data extraction through Intelligent Document Processing (IDP) enhance workflow efficiency, minimize errors, and bolster compliance. For instance, the United States Department of Defense utilizes IDP to streamline the handling of military contracts, resulting in substantial savings and a decreased likelihood of fraud. Moreover, the UK’s National Health Service employs IDP to automate patient record processing, leading to improved accuracy in records and a reduction in medical errors.

The increasing adoption of technology and digitalization in developing countries such as, India, South Africa, and Indonesia is expected to create substantial growth opportunities for the market. However, data privacy issues pose a challenge, as documents often contain sensitive personal information, and any potential data breaches could hinder market expansion. As technology advances, IDP is becoming more cost-effective and accessible, allowing businesses of all sizes to implement it more easily.

There are various factors driving the growth of IDP market such as regulatory compliance, enhanced customer service, and improved business decision-making. In consequence, the adoption of IDP is anticipated to rise as businesses increase their awareness of its benefits, which include increased efficiency, cost reductions, compliance, customer support, and data-driven strategies. As technology continues to evolve and become more accessible, IDP is likely to become a fundamental component of document processing in various industries.

Component Insights

The solution segment led the market in 2024, accounting for over 63.0% share of the global revenue. Enterprises are handling large volumes of unstructured data, such as emails, forms, and scanned documents, requiring advanced tools to process, classify, and extract information effectively. IDP solutions leverage AI and machine learning to manage these data complexities. Moreover, businesses aim to automate routine document processing tasks to reduce manual intervention, errors, and processing times. IDP solutions streamline these workflows, improving operational efficiency, accuracy, and cost savings.

The services segment is predicted to foresee significant growth in the forecast years. IDP services help businesses comply with industry regulations by enabling secure document processing and data management, increasing demand for regulatory and compliance consulting services. Moreover, to ensure optimal utilization of IDP tools, companies invest in training, technical support, and maintenance, driving growth in the managed services and support segment. Furthermore, companies require support for integrating IDP solutions with existing systems such as, CRM, ERP, and data management platforms. This integration need fuels growth in deployment and maintenance services.

Technology Insights

The Machine Learning (ML) segment accounted for the largest market revenue share in 2024. This is attributed to the significant use of ML techniques to automate the extraction and processing of information from various documents, such as invoices, purchase orders, contracts, and forms, augmenting market growth. Machine learning is a crucial component that leverages the growth of Intelligent Document Processing (IDP). Machine learning algorithms are trained on large volumes of labeled data to extract information from documents accurately. These models learn from patterns, context, and structures within the documents, improving accuracy in data extraction, reducing errors, and increasing reliability. For instance, ML models learn to distinguish between invoices, receipts, and contracts, allowing the IDP system to handle each document type appropriately.

The Natural Language Processing segment is expected to showcase significant growth over the forecast period. NLP-powered IDP solutions can automate text understanding and interpretation, reducing manual effort. Organizations aiming for cost-efficient and scalable document processing workflows are investing in NLP-based IDP tools. NLP enables IDP systems to work across languages, which is crucial for global businesses managing multilingual documents. The need for localization and accurate processing of international documents boosts NLP demand.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024 due to its scalability, accessibility, and cost-efficiency. By adopting cloud deployment, organizations can avoid the expense and upkeep of dedicated infrastructure, instead utilizing a pay-as-you-go model offered by cloud providers. This approach minimizes initial costs, removes the need for hardware and software maintenance, and enables flexible scaling of IDP systems to fit organizational budgets and requirements.

The on-premises segment will witness significant growth in the coming years. This growth is driven by the enhanced security provided by on-premises deployment, particularly in industries such as healthcare and banking, financial services, and insurance (BFSI), which often face stricter compliance requirements. Key advantages of on-premises deployment, such as faster processing times and lower latency than cloud-based solutions, are also fueling market growth. Organizations with high document volumes require a real-time processing, therefore, use of on-premises deployment offers quicker document access and faster processing speeds.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. This growth is driven by the enhanced security provided by on-premises deployment, particularly in industries such as, healthcare and banking, financial services, and insurance (BFSI), which often face stricter compliance requirements. Key advantages of on-premises deployment, such as faster processing times and lower latency than cloud-based solutions, are also fueling market growth. Organizations with high document volumes or a need for real-time processing benefit from on-premises deployment, as it enables quicker document access and faster processing speeds.

The SMEs segment is expected to grow at the highest CAGR in the coming years. IDP solutions help SMEs ensure compliance by automating the processing and storage of sensitive documents, such as financial records and contracts, in line with regulatory standards. Moreover, SMEs are increasingly investing in digital transformation, and IDP technology supports this shift by digitizing paper-based processes, improving data accuracy, and reducing manual effort.

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2024. The growth is due to the high volume of documents processed within the BFSI sector to deliver products and services. The BFSI industry leverages intelligent document processing (IDP) technology to boost operational efficiency, elevate customer experiences, and maintain compliance standards. IDP extracts essential information from documents such as bank statements, pay stubs, and tax returns to evaluate creditworthiness and eligibility. These advantages drive the adoption of IDP technology within the BFSI sector.

The government & public sector segment is projected to experience significant growth in the coming years. Government agencies handle vast amounts of paperwork, such as applications, licenses, and permits. IDP automates these processes, significantly reducing manual effort, expediting workflows, and minimizing errors. By implementing IDP, government bodies can respond more quickly to public inquiries and provide faster, more accurate services, leading to better citizen engagement and satisfaction. Furthermore,IDP solutions offer high levels of data security and help agencies comply with regulatory standards related to data protection and privacy, essential for managing sensitive public data.

Regional Insights

North America intelligent document processing market held the largest revenue share of over 32.0% in 2024. Organizations across sectors in North America are prioritizing digital transformation, and IDP solutions play a crucial role in digitizing and automating document-intensive processes. Moreover, Industries such as, BFSI, healthcare, and government rely on IDP to manage large volumes of documents securely and efficiently, which is fueling market growth.

U.S. Intelligent Document Processing Market Trends

The U.S. intelligent document processing market is expected to grow in 2024. U.S. technology sector is at the forefront of AI and machine learning innovation, which is enhancing IDP solutions by improving document classification, data extraction, and accuracy in information processing. Moreover, organizations are leveraging IDP to streamline customer-facing processes such as onboarding, loan applications, and claims processing, enhancing customer satisfaction and driving IDP adoption.

Europe Intelligent Document Processing Market Trends

The intelligent document processing market in the Europe region is expected to witness significant growth over the forecast period. Europe’s strong data protection regulations, including General Data Protection Regulation (GDPR), are prompting businesses to adopt secure and compliant IDP solutions to manage and process sensitive data effectively.The BFSI sector in Europe is one of the largest users of IDP solutions to automate document processing, enhance customer service, and ensure compliance with regulatory standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Asia Pacific Intelligent Document Processing Market Trends

The intelligent document processing market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The shift toward cloud computing is allowing organizations in the Asia Pacific to leverage scalable IDP solutions without the need for substantial infrastructure investments, making it more accessible for various business sizes. Companies are identifying that improving customer interactions is crucial for success. IDP enables faster document processing, leading to quicker response times and better overall customer service.

Key Intelligent Document Processing Company Insights

Some key players in the intelligent document processing market are ABBYY, UiPath, and IBM Corporation. These companies are leveraging advanced technologies, providing comprehensive solutions, focusing on specific industry needs, and emphasizing user experience and innovation.

-

ABBYY utilizes advanced optical character recognition (OCR) and machine learning algorithms, enabling it to accurately extract data from a wide range of document types, formats, and layouts. The company's focus on accuracy and efficiency in data processing helps organizations reduce manual effort, minimize errors, and improve overall productivity.

-

UiPath combines IDP capabilities with various robotic process automation (RPA) technology companies, allowing organizations to automate document processing workflows seamlessly alongside other business processes. Moreover, UiPath has built a strong ecosystem of partnerships with other technology providers, enhancing its offerings with complementary tools and services that improve document processing and automation capabilities.

Key Intelligent Document Processing Companies:

The following are the leading companies in the intelligent document processing market. These companies collectively hold the largest market share and dictate industry trends.

- ABBYY

- AntWorks

- Appian

- Automation Anywhere, Inc.

- Datamatics Global Services Limited

- Hyperscience

- IBM Corporation

- Open Text Corporation

- SHI International Corp

- UiPath

Recent Developments

-

In June 2024, Reveille, Enterprise Content Management solutions provider, collaborated with ABBYY, the intelligent automation company, to integrate ABBYY’s FlexiCapture to improve the document automation monitoring processes. ABBYY FlexiCapture utilizes natural language processing, machine learning, and AI to deliver enterprise-level data capture and extraction. Reveille for ABBYY FlexiCapture provides the security, performance, and reliability of IDP operations.

-

In June 2024, Automation Anywhere, Inc., AI-based automation company, collaborated with Microsoft, technology company, to incorporate the Microsoft Azure OpenAI Service into Automation Anywhere Inc.’s AI + Automation Enterprise System, enabling enterprises to automate intricate end-to-end processes across various applications with the assistance of AI Agents.

-

In May 2024, Mphasis, customized technology solutions provider, launched DeepInsights Doc AI, an intelligent document processing solution using generative AI technology. This platform enables Mphasis to assist enterprise clients in extracting context-specific information from documents of any format or layout and integrating it with downstream IT systems to produce actionable insights. DeepInsights Doc AI provides a customized large language model (LLM) solution tailored to the specific needs of enterprises in document processing, encompassing information discovery, information extraction, insight generation, and context-aware search with recommendations. The solution can be self-hosted within the enterprise cloud, offering enhanced flexibility.

Intelligent Document Processing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.96 billion

Revenue forecast in 2030

USD 12.35 billion

Growth rate

CAGR of 33.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Netherlands; China; India; Japan; Australia; South Korea; Chile; Argentina; Brazil; UAE; South Africa; KSA

Key companies profiled

ABBYY; AntWorks; Appian; Automation Anywhere, Inc.; Datamatics Global Services Limited; Hyperscience; IBM Corporation; Open Text Corporation; SHI International Corp; UiPath

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intelligent Document Processing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global intelligent document processing market report based on component, technology, deployment, organization size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Computer Vision

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Sized Enterprises (SMEs)

-

Large Size Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

Retail

-

Government & Public Sector

-

Transportation & Logistics

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global intelligent document processing market size was estimated at USD 2.30 billion in 2024 and is expected to reach USD 2.96 billion in 2025.

b. The global intelligent document processing market is expected to grow at a compound annual growth rate of 33.1% from 2025 to 2030 to reach USD 12.35 billion by 2030.

b. North America dominated the intelligent document processing market with a share of 32.8% in 2024. Organizations across sectors in North America are prioritizing digital transformation, and IDP solutions play a crucial role in digitizing and automating document-intensive processes. Moreover, Industries such as BFSI, healthcare, and government rely on IDP to manage large volumes of documents securely and efficiently, which is fueling market growth.

b. Some key players operating in the intelligent document processing market include ABBYY; AntWorks; Appian; Automation Anywhere, Inc.; Datamatics Global Services Limited; Hyperscience; IBM Corporation; Open Text Corporation; SHI International Corp; and UiPath.

b. Factors driving the market growth include the increasing digital transformation investments and the need for cost-effective and efficient document processing solutions. Moreover, increasing digitalization in developing nations offers significant growth opportunities for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.