- Home

- »

- Next Generation Technologies

- »

-

Internet Of Things Fleet Management Market Report, 2030GVR Report cover

![Internet Of Things Fleet Management Market Size, Share & Trends Report]()

Internet Of Things Fleet Management Market Size, Share & Trends Analysis Report By Solution, By Enterprise Size, By Platform, By Deployment (Private, Public, Hybrid), By Service, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-329-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

IoT Fleet Management Market Size & Trends

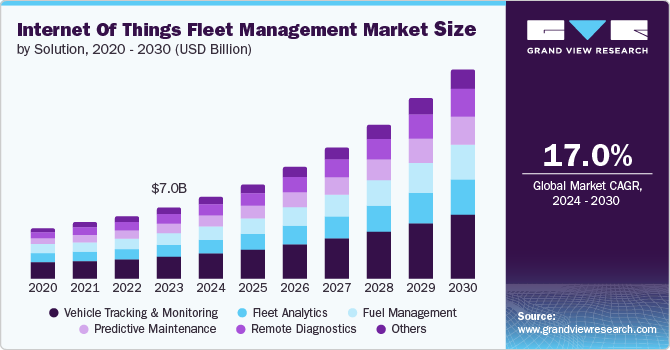

The global internet of things fleet management market size was valued at USD 7.03 billion in 2023 and is projected to grow at a CAGR of 17.0% from 2024 to 2030. The growth of internet of things (IoT) fleet management market is attributed to aspects such as the growing inclusion of connected vehicle technology and the rising demand for operational efficiency to meet the changing needs of a competitive industry worldwide. The emergence of e-commerce platforms, an increase in global trade, and a rise in sustainability consciousness are expected to generate greater demand for this market during the forecast period.

The increasing adoption of telematics devices and embedded sensors in vehicles is developing the widespread adoption of IoT fleet management solutions. Growing availability of technologies such as 5G networks have empowered the seamless integration of IoT technologies with fleet management systems.

An IoT fleet management system connects everything from the field to the back office, offering various advantages to companies. This ensures achievement of operational efficiencies such as enhancing safety, providing real-time data that can be acted upon, and improving customer experiences. IoT integrated with smart devices are capable of collecting and communicating large amount of data that assists businesses in multiple ways. In addition, advancements in cloud computing, artificial intelligence (AI) and big data technologies are fueling the growth of enhanced IoT fleet management solutions by offering deeper insights and improved functionalities.

IoT fleet management systems have enabled businesses in the industry to have full control over numerous business dynamics through use of technology. This includes tracking, communicating, monitoring, fuel management, remote diagnostic, generating and storing data, and providing most efficient solutions for identified problems within time constraint.

Solution Insights

The vehicle tracking & monitoring segment dominated the IoT fleet management market and accounted for a revenue share of 32.6% in 2023. This includes using global positioning system (GPS) technology, portable connected devices, and sensors. The growth for this segment is mainly driven by the growing adoption of vehicle tracking & monitoring by businesses to minimize the impact of commute risks, to provide real-time assistance in case of emergencies or spillage, and to develop and maintain an integrated network of vehicles.

The predictive maintenance segment is anticipated to experience the fastest CAGR of 20.4% during the forecast period. IoT sensors assist the management teams in identifying the critical issues related to vehicle maintenance while predicting the potential problems that might pose higher risks in approaching time or during the commute. This eliminates operational anomalies and ensures timely repairs. The growing number of fleet solution providers, increasing fleet transactions related to longer distances, and growing need for effective maintenance of advanced vehicles are expected to increase demand for this segment in approaching years.

Enterprise Type Insights

The large enterprise segment dominated the global industry in 2023. The growth of this segment is attributed to the availability of substantial financial resources, extensive fleet operations, and the inevitable requirement for sophisticated and advanced fleet management solutions. Enormous growth in global trade, growing response to e-commerce websites, and unceasing import & export of several products, including food, consumer goods, equipment, materials, automotive parts, electronics, and more, are expected to develop an upsurge in demand for IoT fleet management solutions in large enterprises.

The small and medium enterprise segment is anticipated to experience the fastest CAGR during the forecast period. This segment is primarily driven by the increasing number of small and medium-scale businesses offering solutions and products to an extensive customer base worldwide. According to the U.S. Small Business Administration, Office of Advocacy, in 2023, nearly 33,185,550 were present in the U.S. that employed approximately 61.7 million Americans. By leveraging the real-time data, IoT fleet management solutions allow small enterprises to make informed decisions to improve their operations and gain a competitive edge.

Platform Insights

The device management segment dominated the global market in 2023. A few other platforms associated with IoT fleet management include application enablement and network management. One of the primary factors responsible for the dominance of device management is its ability to provide centralized oversight and control over a diverse array of IoT devices. For instance, vehicle sensors can provide real-time data on fuel consumption, engine health, and route optimization in a logistics fleet. Device management platforms collect and store this data, allowing fleet managers to make informed decisions quickly, such as rerouting vehicles to avoid traffic or scheduling maintenance to prevent breakdowns.

Application enablement segment is anticipated to experience the fastest CAGR during the forecast period. The growth of this segment is mainly driven by the rising adoption of the IoT application enablement platform (AEP) and its scalability. AEP IoT has ability to scale up to thousands of connected devices at an efficient cost. Moreover, application enablement platforms enable seamless integration with fleet management systems and third-party applications. As IoT technologies continue to evolve and bring innovation in fleet management operations, the importance of robust and effective device management solutions is expected to propel segment growth further.

Deployment Insights

The private deployment segment held the largest revenue share of the global industry in 2023. Private cloud environments provide greater flexibility and customization options than public cloud solutions. Fleet management operations often require tailored applications with existing IT infrastructure, such as ERP systems, software, and databases. Private clouds allow organizations to customize their IoT deployments, integrate with their systems, and maintain complete control over fleet management without relying on external providers. Moreover, private cloud environments enable organizations to scale resources according to fluctuating demand and business growth.

The hybrid deployment is anticipated to experience the fastest CAGR during the forecast period, driven by its scalability, flexibility, and enhanced performance in managing fleet operations. A hybrid cloud allows companies to keep some data and applications in their private cloud while using the public cloud, such as AWS and Intel cloud service for other tasks. In addition, advancements in networking technologies are making it easier to adopt hybrid Furthermore, IoT hybrid clouds enable businesses to utilize their IoT solutions effectively while meeting the demands, enabling real-time insights, and reducing bandwidth costs.

Service Insights

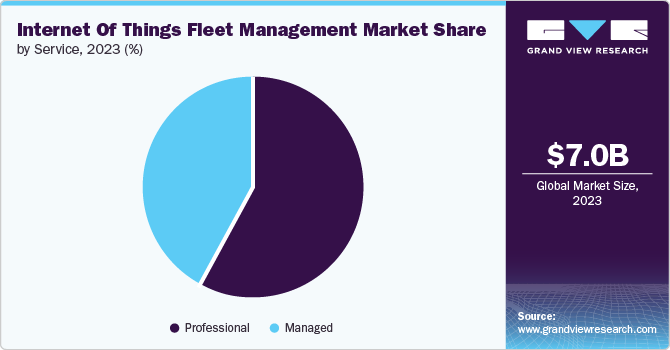

The professional services segment dominated the global market in 2023. Rising innovation in IoT technology, operational efficiency, and robust security are key growth drivers for this segment. Rapid introductions of enhanced IoT-enabled products and networks, such as 5G and 6G, are developing significant opportunities for this segment. The increasing popularity of end-to-end IoT fleet solutions provided by professional service providers to the logistics industry is another factor fueling the market growth. These services entail specialized expertise and tailored consulting services essential for implementing and optimizing IoT fleet management solutions and assisting businesses in enhancing organizational goals and operational workflows. Furthermore, the professional segment excels in offering ongoing support and maintenance services that ensure the continuous operation and optimization of IoT fleet management solutions.

Managed services segment is projected to grow at the fastest CAGR from 2024 to 2030. This is attributed to increasing demand for cloud-based services and growing infrastructure complexities. Capabilities such as flexibility and efficient management of various tasks have made managed services very popular in the IoT fleet management market. Moreover, a growing focus on handling multiple fleet management operations through a single network, alongside a significant need for cost reduction, is expected to boost the managed IoT fleet management service segment.

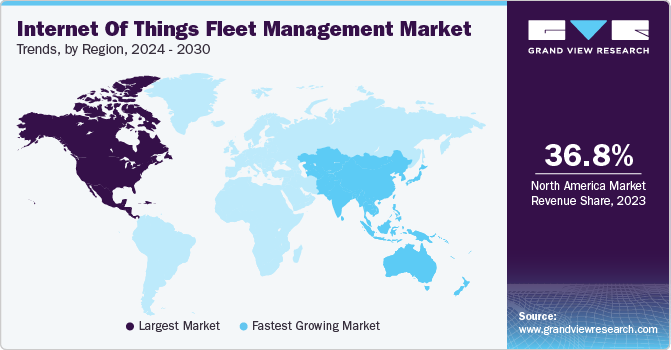

Regional Insights

North America internet of things fleet management market dominated the global industry and accounted for revenue share of 36.8% in 2023. The growth of this segment is attributed to a robust technology ecosystem and increasing fleet vehicle size in the region. Early adoption trends in the region, especially in technology applications, are expected to develop significant demand for the IoT fleet management market. Furthermore, the rising number of autonomous vehicles and the growing importance of the safety and security of these vehicles are anticipated to fuel growth in the regional industry.

U.S. Internet Of Things Fleet Management Market Trends

The U.S. IoT fleet management market dominated the regional industry in 2023. This market is primarily driven by the hub for technological advancements and the country's strong presence of fleet management solutions providers. The presence of large enterprises and multiple companies operating in industries such as automotive, food, technology, electronics, and consumer goods is developing an upsurge in demand for this market. According to The Observatory of Economic Complexity (OEC), in April 2024, cars exported from the U.S. accounted for a value of USD 5.27 billion. In addition, according to the Economic Research Service U.S. Department of Agriculture, the total agriculture export was valued at USD 178.70 billion in 2023. These aspects are expected to generate greater demand for the IoT fleet management industry in the country.

Europe Internet Of Things Fleet ManagementMarket Trends

The Europe IoT fleet management market grew significantly in 2023. The growth is driven by small enterprises' increasing adoption of cloud-based services and the high number of tech companies. Like North America's regional industry, Europe also boasts robust technology innovation and large companies developing and investing in cloud computing technologies. According to Eurostat, the U.S. was prime destination for EU exports of various goods in 2023, while China was the origin for largest share of EU imports. The growing global trade in the region is expected to drive growth for this market approaching years.

Germany IoT fleet management market accounted for significant revenue share of the regional industry in 2023. This market is primarily driven by the presence of robust tech sector and large automotive industry manufacturers. Germany plays key role in European logistics market with trade of presence of large ports, airports, and road & rail networks. The growing internal trade between European countries, increasing demand for operational efficiency and rising need about vehicle tracking and monitoring is expected to develop higher rate of growth for this market.

Asia Pacific Internet Of Things Fleet Management Market Trends

Asia Pacific IoT fleet management market is anticipated to witness the fastest CAGR of 21.0 % in 2023. This industry is mainly driven by increasing export and import through multiple countries in the region, such as China, India, and Japan, growing global demand for various products exclusively found or made in the region, presence of multiple industries that engage in frequent global trades, and rising need for effective fleet management solutions. The entry of numerous global companies in the region, vendor services provided by several companies in the region to multinational manufacturing organizations operating worldwide, and the rising support of governments to adopt digital technology solutions in the industry are expected to drive growth in this market.

China Iot fleet management market held the significant share of regional industry in 2023. Owing to rapid digital transformations, increasing technology adoptions and robust trade, the IoT fleet management market in China has experience rising demand in recent years. Moreover, the government’s Belt and Road Initiative to integrate trade routes connecting China with the rest of the world is another significant growth driver for the IoT fleet management market in the region.

Key Internet Of Things Fleet Management Company Insights

Some of the key companies in the Internet of Things fleet management market include, Intel Corporation, Amazon Web Services, Inc., Cisco Systems, Inc., Telephonica S.A. and others. To develop competitive edge over other market participants, key companies in the industry are adopting multiple strategies such as innovation, enhanced research & development, data analytics, collaborations and mergers & acquisitions.

-

TomTom International BV, one of the prominent companies in location technologies and consumer technology devices, offers multiple products such as maps, location intelligence, automotive software, navigation apps, traffic data and analytics tools, accessories, and sat navs. Services offered by the company include fleet management and logistics, mobility on demand, road traffic management, location analytics, electrification, digital cockpit, automated driving, navigation for automotive, and intelligence speed assistant.

-

Telefónica S.A., a telecommunication company based in Spain, provides multiple enterprise services such as enterprise networking, cloud solutions, voice services, satellite solutions, security solutions, and IoT services. Some of its IoT services include managed IoT connectivity, fleet management, cargo locate, blockchain, and private LTE/5G networks services. Company’s worldwide connectivity backed by its network footprint and multiple partnerships for roaming enhanced the quality of fleet management services.

Key Internet Of Things Fleet Management Companies:

The following are the leading companies in the internet of things fleet management market. These companies collectively hold the largest market share and dictate industry trends.

- Intel Corporation

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Telefonica S.A.

- Semtech Corporation

- Oracle

- TomTom International BV

- AT&T

- Telenor Connexion (Telenor Group)

- KORE Wireless

- Geotab Inc.

- Samsara Inc.

Recent Developments

-

In July 2024, Soracom, a significant player in smart IoT connectivity services market, introduced two novel services, Soracom Flux and Soracom Query Intelligence. Flux is designed to enable non-tech users to develop IoT applications integrated with AI. Query Intelligence is developed to deliver simpler solution to manage large scale IoT deployments.

-

In March 2024, Targa technologies, global IoT-based technology company, expanded its portfolio by introducing ViaSat Fleet Start and Advanced, new fleet management solutions. These solutions are designed to convert the real time data gathered from passenger and light commercial vehicles into actionable acumens.

-

In August 2023, Telefonica, one of the prominent telecommunication industry participants and a Canada-based technology and telematics devices company, Geotab, announced a strategic partnership with Vecttor, specialist urban passenger transportation brands. The partnership was aimed at increasing the efficiency and safety of their vehicles through advanced IoT fleet management solutions. The collaboration underscores the growing importance of IoT technologies in transforming fleet management.

Internet Of Things Fleet Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.06 billion

Revenue forecast in 2030

USD 20.61 billion

Growth rate

CAGR of 17.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, enterprise size, platform, deployment, service, region

Regional scope

North America, Europe, APAC, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Intel Corporation; Amazon Web Services, Inc.; Cisco Systems, Inc.; Telefonica S.A.; Semtech Corporation; Oracle; TomTom International BV; AT&T; Telenor Connexion (Telenor Group); KORE Wireless; Geotab Inc.; Samsara Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internet Of Things Fleet Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global internet of things fleet management market report based on solution, enterprise size, platform, deployment, service, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vehicle tracking & monitoring

-

Fleet Analytics

-

Fuel Management

-

Predictive Maintenance

-

Remote Diagnostics

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Device Management

-

Application Enablement

-

Network Management

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private

-

Public

-

Hybrid

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional

-

Managed

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."