- Home

- »

- Communication Services

- »

-

Internet Protocol Television Market Size & Share Report, 2030GVR Report cover

![Internet Protocol Television Market Size, Share & Trends Report]()

Internet Protocol Television Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Subscription (Subscription Based IPTV, Subscription Free IPTV), By Component, By Device, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-342-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Internet Protocol Television Market Summary

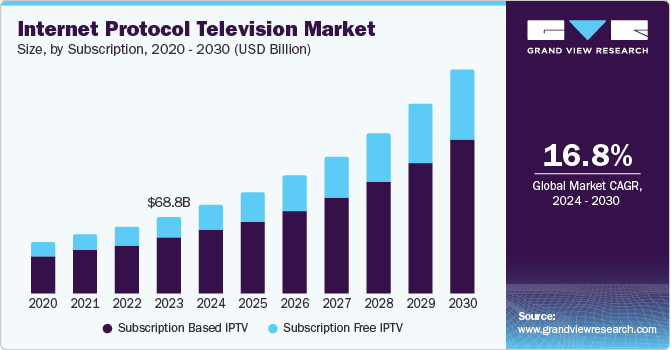

The global internet protocol television (IPTV) market size was estimated at USD 68.84 billion in 2023 and is projected to reach USD 200.22 billion by 2030, growing at a CAGR of 16.8% from 2024 to 2030. The shift in consumer behavior toward on-demand and personalized content drives market growth.

Key Market Trends & Insights

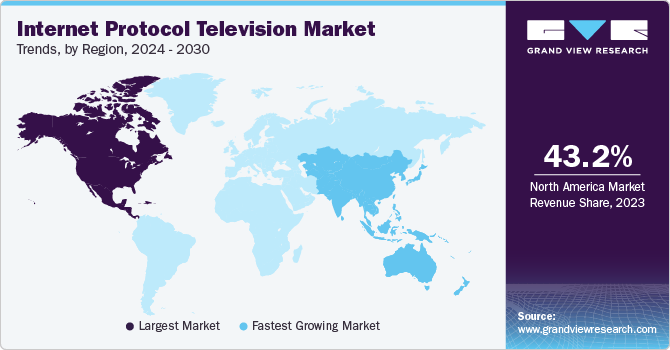

- North America dominated the global internet protocol television (IPTV) market with the largest revenue share of 43.2% in 2023.

- By subscription, the subscription-based IPTV segment led the market with the largest revenue share of 72.7% in 2023.

- By component, the software segment accounted for the largest market revenue share in 2023.

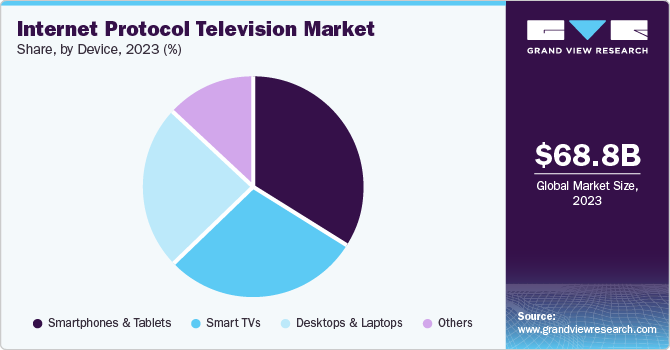

- By device, the smartphones & tablets segment accounted for the largest market revenue share in 2023.

- By end use, the gaming segment is expected to grow at the fastest CAGR during the forecat period.

Market Size & Forecast

- 2023 Market Size: USD 68.84 Billion

- 2030 Projected Market Size: USD 200.22 Billion

- CAGR (2024-2030): 16.8%

- Largest Market: North America

Traditional broadcasting models, which rely on fixed schedules and limited programming options, are becoming less engaging to viewers who prefer the flexibility of choosing what to watch and when. Internet protocol television (IPTV) offers a solution to this demand by delivering television content over the internet, allowing users to access a wide range of programming on multiple devices, including smartphones, tablets, and smart TVs.

Another significant factor contributing to the rise of IPTV is the expansion of high-speed internet infrastructure. As broadband internet becomes more accessible and affordable in many parts of the world, IPTV services can reach a larger audience. Modern internet connections' improved bandwidth and reliability enable the seamless streaming of high-quality video content, including HD and 4K, essential for drawing and retaining subscribers. This technological advancement has made IPTV a viable alternative to traditional cable and satellite TV services, particularly in regions where these services may be limited or expensive.

Furthermore, the increasing demand for IPTV is also fueled by the growing popularity of over-the-top (OTT) platforms and the integration of IPTV with other digital services. Many IPTV providers offer bundled services, including video streaming, voice-over-internet-protocol (VoIP) calls, and internet services, creating a comprehensive entertainment and communication package for consumers. This bundling not only enhances the value proposition for users but also fosters customer loyalty and increases the overall adoption of IPTV services.

In addition to these factors, the rise of smart home technology and the proliferation of connected devices further accelerate the demand for IPTV. As more households adopt smart TVs, gaming consoles, and other internet-enabled devices, the convenience of accessing IPTV through these platforms becomes increasingly appealing. Moreover, IPTV's ability to offer interactive features, such as video-on-demand, live TV recording, and multi-screen viewing, provides users with a more engaging and customizable television experience.

Subscription Insights

The subscription-based IPTV segment held the largest market revenue share of 72.7% in 2023. Consumers seek more flexible and affordable alternatives to traditional cable TV, and subscription-based IPTV offers a wide range of channels and content at lower costs. The rise of high-speed internet connectivity has also facilitated smoother streaming experiences, making IPTV services more reliable and appealing. Additionally, the ability to access content on multiple devices, such as smartphones, tablets, and smart TVs, enhances the convenience and accessibility of IPTV. This segment is further driven by the growing demand for on-demand content and personalized viewing experiences, which subscription-based IPTV services are well-positioned to deliver.

The subscription-free IPTV segment is expected to grow at the fastest CAGR of 19.1% over the forecast period. The growing consumer preference for cost-effective entertainment solutions and flexibility in content consumption drives the segment growth. As more users seek to avoid the recurring costs associated with traditional subscription-based services, they are turning to free IPTV options that provide access to a wide variety of content without long-term commitments. Additionally, the rise of smart TVs and streaming devices has made it easier for consumers to access free IPTV services, further driving demand. The increasing availability of high-speed internet and the growing penetration of digital devices have also contributed to the popularity of subscription-free IPTV, as users can stream content seamlessly without the need for traditional cable or satellite services.

Component Insights

The software segment held the largest market revenue share in 2023. The increasing demand is attributed to the need for advanced content delivery, user interface enhancements, and seamless integration with various devices. Software solutions enable IPTV service providers to offer personalized content, interactive features, and a more user-friendly experience. Additionally, the software facilitates better content management, security, and analytics, allowing providers to optimize their offerings and improve customer satisfaction. The growing adoption of cloud-based services and the rise of OTT (over-the-top) platforms further drive the demand for software that supports scalability and flexibility in IPTV services.

The hardware segment is expected to grow at the fastest CAGR over the forecast period. The growing need for advanced set-top boxes, routers, and other networking equipment that support high-quality video streaming and interactive services drives the segment's growth. As IPTV providers expand their offerings to include features such as 4K resolution, virtual reality, and cloud-based services, the demand for more sophisticated and powerful hardware infrastructure becomes essential. Additionally, the rising adoption of IPTV in emerging markets, where there is a need for robust and scalable hardware solutions to meet increasing user demand, further drives this growth.

Device Insights

The smartphones & tablets segment held the largest market revenue share in 2023. The widespread adoption of mobile devices has made them a primary medium for content consumption, particularly among younger demographics. With advancements in mobile technology, smartphones and tablets offer high-definition displays and powerful processors, making them suitable for streaming IPTV content. Additionally, the convenience and portability of these devices allow users to access IPTV services on the go, leading to higher engagement and viewership. Moreover, the rise of 5G technology enhances the streaming experience on mobile devices, reducing buffering and improving video quality. As consumers increasingly prefer flexible and mobile viewing options, the demand for IPTV on smartphones and tablets continues to grow.

The smart TVs segment is expected to grow significantly over the forecast period. Smart TVs offer seamless integration of IPTV services, eliminating the need for external devices such as set-top boxes, which enhances user convenience and reduces hardware clutter. Additionally, smart TVs are equipped with advanced features such as high-definition streaming, voice control, and personalized content recommendations, which align with the growing consumer preference for interactive and customized viewing experiences. In addition, key market players are continuously investing in research and development to introduce innovative TVs. For instance, in June 2024, SAMSUNG announced the launch of its QLED 4K television with built-in multi-voice assistant features. The increasing penetration of high-speed internet and the shift towards on-demand content further fuel this demand, making smart TVs suitable for IPTV users seeking a comprehensive, user-friendly entertainment solution.

End-use Insights

The media and entertainment segment held the largest market revenue share in 2023. The growing consumer preference for personalized and on-demand content drives the segment growth. As viewers seek more control over their viewing experiences, IPTV offers a flexible and convenient platform to access various media content on multiple devices, including live TV, movies, and series. Additionally, the rise of high-quality streaming services, combined with the global expansion of high-speed internet and the proliferation of smart devices, has fueled the adoption of IPTV. This trend is further supported by the increasing availability of exclusive content and partnerships between IPTV providers and media companies, catering to diverse audience preferences and contributing to the overall growth in demand within the media and entertainment sector.

The gaming segment is expected to grow at the fastest CAGR over the forecast period. The growing adoption of interactive and immersive gaming experiences that can be integrated with IPTV platforms drives the segment growth. With high-speed internet and streaming technology advancements, IPTV provides a seamless platform for delivering high-quality, real-time gaming content. Additionally, the rise of cloud gaming and e-sports, which rely on robust streaming infrastructure, further boosts the demand for gaming within IPTV. As more consumers seek multi-functional entertainment options, IPTV's ability to support traditional media and gaming content makes it engaging, driving growth in this segment.

Regional Insights

North America internet protocol television market held the largest market revenue share of 43.2% in 2023. Consumers increasingly opt for IPTV services as they offer greater flexibility, access to a wide range of channels, and the ability to watch content on multiple devices, including smartphones and tablets. Additionally, the rise of high-speed internet across the region has enhanced the quality and reliability of IPTV services. Streaming services such as Netflix, Hulu, and others have popularized the concept of streaming content, which has further driven the adoption of IPTV. Furthermore, the trend toward cord-cutting, driven by the desire for cost-effective and customizable viewing options, has significantly contributed to the growing demand for IPTV in North America.

U.S. Internet Protocol Television Market Insights

The U.S. internet protocol television market regionally held the largest market revenue share in 2023. The U.S. has a highly competitive broadband market, which has improved internet speeds and accessibility, making IPTV more viable for a larger population. The rise of popular streaming services, such as Hulu Live, YouTube TV, and Sling TV, which operate on IPTV technology, has also contributed to its growth. Furthermore, the preference for personalized, on-demand content among U.S. viewers has made IPTV a suitable option.

Europe Internet Protocol Television Market Insights

Europe internet protocol television market is expected to grow prominently in the forecast period. IPTV services in Europe often provide various content options, such as local, regional, and international channels and on-demand content. The availability of content in multiple languages and across different platforms engages the varied population in Europe. Additionally, the region's strong emphasis on digitalization, with the European Union's Digital Agenda pushing for widespread high-speed broadband access, further drives the market growth.

The UK internet protocol television market is expected to grow significantly in the forecast period. Increasing demand for on-demand content is a key factor driving growth in the UK IPTV market. IPTV providers in the UK offer diverse content, including live TV, sports, and exclusive shows, which benefit a broad audience. The shift away from traditional cable TV, driven by the demand for customizable and cost-effective entertainment options, has also contributed to the growing popularity of IPTV in the region.

Asia Pacific Internet Protocol Television Market Insights

Asia Pacific market is expected to grow at the fastest CAGR over the forecast period. The region's rapid technological advancements and widespread internet penetration, especially in countries such as China, India, and South Korea, have facilitated the adoption of IPTV services. Additionally, these countries' rising middle-class population has increased disposable income, enabling more consumers to access premium digital entertainment services. Furthermore, local content production, including regional language programming, has also fueled IPTV's favor by catering to diverse cultural preferences.

India internet protocol television market is projected to grow rapidly in the coming years. Government efforts in India to transform digitally, including digitizing cable TV and Direct-to-Home (DTH) services, are also supporting the growth of IPTV in the nation. The emergence of network service providers has transformed the IPTV landscape in India, offering complimentary live subscriptions to their customers. In addition, the rising smartphone penetration in the country allows users to stream OTT content from their comfort places, which is also driving the market growth.

Key Internet Protocol Television Company Insights

Some key companies in the internet protocol television market include Akamai Technologies; Hibox Systems; MatrixStream Technologies, Inc.; Muvi; MwareTV; and others.

-

Hibox Systems provides IPTV solutions that are created to distribute content and interactive services to different devices such as televisions, computers, and mobile devices. They provide Hibox Aura for creating Pay TV services, Hibox Enterprise for communication with employees and customers through video, and Smartroom Hospitality for hotel TV systems.

-

MwareTV offers a wide range of IPTV solutions designed to meet a variety of client requirements. Their services consist of the Mware Solutions Suite, which addresses all areas of the IPTV ecosystem such as content management, delivery, user interfaces, and analytics. They provide Mware CloudTV for cloud-centric TV offerings, Mware Streaming for top-notch streaming options, and Mware Middleware, a strong tool for managing IPTV services.

Key Internet Protocol Television Companies:

The following are the leading companies in the internet protocol television market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Hibox Systems

- MatrixStream Technologies, Inc.

- Muvi

- MwareTV

- Setplex LLC

- TeleData GmbH

- Deutsche Telekom AG

- TelergyHD

- Triple Play Interactive Network Pvt. Ltd.

Recent Developments

-

In April 2023, Akamai Technologies announced the launch of its new cloud computing capabilities aimed at enhancing streaming video quality and personalization for over-the-top (OTT) services. These capabilities help operators reduce costs and improve content monetization. Akamai also announced improvements in Common Media Client Data (CMCD) support, which enhances video performance by reducing buffering and start-up times.

Internet Protocol Television Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 79.05 billion

Revenue forecast in 2030

USD 200.22 billion

Growth Rate

CAGR of 16.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Subscription, component, device, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Africa, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Akamai Technologies; Hibox Systems; MatrixStream Technologies, Inc.; Muvi; MwareTV; Setplex LLC; TeleData GmbH; Deutsche Telekom AG; TelergyHD; Triple Play Interactive Network Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internet Protocol Television Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the internet protocol television market report based on subscription, component, device, end-use, and region.

-

Internet Protocol Television Market Subscription Outlook (Revenue, USD Billion, 2018 - 2030)

-

Subscription Based IPTV

-

Subscription Free IPTV

-

-

Internet Protocol Television Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

Internet Protocol Television Market Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartphones & Tablets

-

Smart TVs

-

Desktops and Laptops

-

Others

-

-

Internet Protocol Television Market End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advertising and marketing

-

Media and entertainment

-

Gaming

-

Online stores

-

Telecom and IT

-

Healthcare and medical

-

Other

-

-

Internet Protocol Television Market Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.