- Home

- »

- Network Security

- »

-

Intrusion Detection And Prevention Systems Market Size Report, 2030GVR Report cover

![Intrusion Detection And Prevention Systems Market Size, Share & Trends Report]()

Intrusion Detection And Prevention Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Type, By Technology, By Deployment, By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-575-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intrusion Detection And Prevention Systems Market Summary

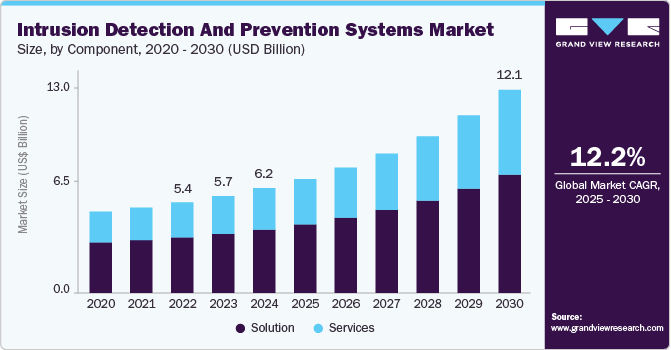

The global intrusion detection and prevention systems market size was estimated at USD 6.25 billion in 2024 and is projected to reach USD 12.14 billion by 2030, growing at a CAGR of 12.2% from 2025 to 2030. The growth is driven by the increasing integration of AI and machine learning for real-time threat detection and response, enabling more proactive security measures.

Key Market Trends & Insights

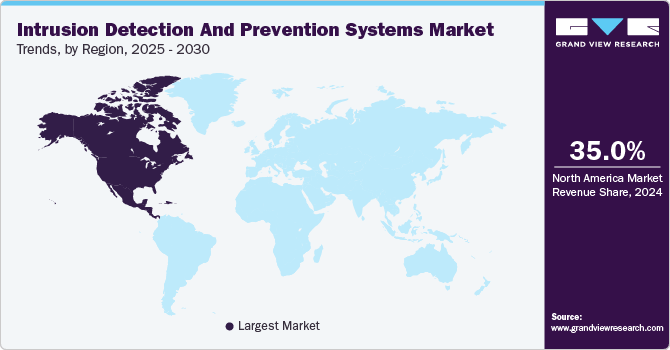

- North America intrusion detection and prevention systems industry held a significant share of over 35% in 2024.

- The intrusion detection and prevention systems industry in the U.S. is expected to grow significantly from 2025 to 2030.

- By component, the solution segment dominated the industry and accounted for a revenue share of over 60% in 2024.

- By technology, the hybrid IDS segment is expected to grow at a significant rate during the forecast period.

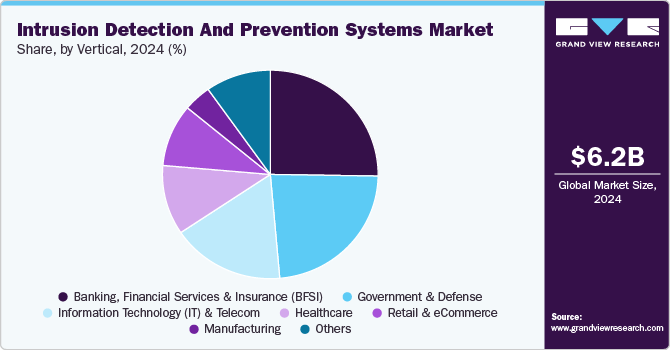

- By vertical, the BFSI segment accounted for the largest market share of over 25% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.25 Billion

- 2030 Projected Market Size: USD 12.14 Billion

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

One of the primary factors propelling the market growth is the increasing prevalence of cyberattacks, such as data breaches, ransomware, and Distributed Denial of Service (DDoS) attacks. As organizations continue to adopt digital transformation strategies, they face the challenge of safeguarding their networks, endpoints, and data from these increasingly sophisticated threats. Furthermore, regulatory frameworks such as GDPR, HIPAA, and PCI-DSS are imposing stricter security controls, further driving the adoption of IDPS solutions. The need to comply with these regulations is a significant driver for organizations to invest in real-time monitoring and prevention system.Cloud adoption is a key trend influencing the IDPS market, as businesses move their workloads and applications to cloud environments. This shift introduces new security risks, prompting the evolution of traditional IDPS solutions to better protect cloud-based infrastructures. Solutions that can be scaled with hybrid and multi-cloud environments are in high demand. Additionally, the proliferation of Internet of Things (IoT) devices introduces further complexity, as the growing number of connected devices increases the attack surface and makes network security even more critical.

Another key growth catalyst for the industry is the rising adoption of managed security services. These services enable organizations, especially small and medium-sized enterprises (SMEs), to access robust IDP solutions on a subscription basis without the need for heavy upfront investment in infrastructure or personnel. This model offers scalability, 24/7 monitoring, and expert incident response, making enterprise-grade security more accessible. In parallel, technological advancements like artificial intelligence (AI) and machine learning (ML) are significantly boosting the performance of IDP systems by enabling them to detect emerging threats in real-time, reduce false positives, and adapt continuously to evolving attack patterns. Furthermore, the shift toward Zero Trust Architecture is reinforcing the importance of IDP as a critical layer for continuous verification and access control. In Zero Trust models, IDP solutions act as enforcement points, monitoring and validating traffic and behavior across users, devices, and workloads at all times.

Initial deployment often requires substantial investment in infrastructure, skilled personnel, and integration with existing security ecosystems, which can be prohibitive for resource-constrained organizations. Additionally, managing IDP systems can be complex, especially in large or highly distributed environments. These systems can generate a high volume of alerts, many of which may be false positives, leading to alert fatigue and operational inefficiencies. This creates a dependency on skilled cybersecurity analysts, a resource that is in short supply globally, further exacerbating the issue.

Component Insights

The solution segment dominated the industry and accounted for a revenue share of over 60% in 2024. The adoption of AI-powered intrusion detection and prevention solutions is increasing due to their ability to analyze network behavior in real time. These solutions leverage machine learning algorithms to identify sophisticated cyber threats that evade traditional security measures. With the rise of ransomware and APTs (Advanced Persistent Threats), enterprises are prioritizing solutions that offer automated response mechanisms. Cloud-based intrusion detection solutions are gaining traction as they provide scalability and seamless integration with hybrid IT environments. Regulatory compliance requirements, such as GDPR and CCPA, are further driving the demand for advanced security solutions.

The services segment is anticipated to grow at a significant CAGR during the forecast period. Managed Security Service Providers (MSSPs) are witnessing increased demand as businesses seek cost-effective IDS/IPS services. Organizations are outsourcing intrusion detection and prevention services to ensure round-the-clock monitoring and incident response. With the complexity of cyber threats evolving, companies are prioritizing threat-hunting services to identify hidden vulnerabilities. Incident response and forensics services are growing in importance, helping businesses quickly mitigate and recover from security breaches. Compliance-driven industries such as BFSI and healthcare are opting for specialized intrusion prevention services to meet regulatory mandates.

Type Insights

The network-based segment accounted for the largest revenue share in 2024. The expansion of hybrid and multi-cloud environments is driving the demand for network-based IDS/IPS solutions that can monitor complex infrastructures. With remote work becoming the norm, businesses are securing VPN and SD-WAN connections with network-based intrusion prevention mechanisms. Security teams are leveraging behavior-based threat detection to counter zero-day vulnerabilities and unknown malware. AI-powered analytics are enhancing network anomaly detection, enabling proactive threat hunting. Governments and enterprises are collaborating to develop threat intelligence-sharing frameworks for improved network security.

The network behavior analysis segment is expected to grow at a significant rate during the forecast period. Enterprises are increasingly leveraging network behavior analysis (NBA) solutions to detect insider threats and advanced cyberattacks. These solutions use AI-powered analytics to establish baseline network activity and identify deviations indicative of threats. The rise of ransomware-as-a-service (RaaS) has heightened the need for real-time anomaly detection capabilities. Organizations are adopting behavior-based security approaches to counteract polymorphic malware and zero-day exploits. Regulatory compliance frameworks are encouraging businesses to integrate NBA with existing security infrastructure for better threat visibility.

Technology Insights

The network intrusion detection system (NIDS) segment accounted for the largest market share in 2024. The integration of AI and machine learning in NIDS is enhancing threat detection accuracy and reducing false positives. Enterprises are deploying NIDS solutions to monitor east-west traffic within their networks, preventing lateral movement of threats. The rise of encrypted traffic has led to advancements in deep packet inspection (DPI) capabilities within NIDS. Organizations are increasingly using NIDS alongside security orchestration, automation, and response (SOAR) solutions for proactive incident response. The growing adoption of zero-trust architectures is reinforcing the role of NIDS in securing enterprise networks.

The hybrid IDS segment is expected to grow at a significant rate during the forecast period. The adoption of hybrid IDS is increasing due to the need for flexible security solutions in hybrid cloud environments. Companies are leveraging hybrid IDS for real-time behavioral analytics to detect anomalies across multiple attack vectors. Cloud service providers are offering hybrid IDS as part of their security offerings to enhance cloud-native security. Enterprises are prioritizing hybrid IDS that can scale dynamically based on network traffic fluctuations. The integration of hybrid IDS with SOAR platforms is streamlining security automation and remediation processes.

Deployment Insights

The on-premises segment accounted for the largest market share in 2024. Despite the shift to cloud, many enterprises continue to invest in on-premises IDS/IPS for greater control and security. Organizations handling sensitive data, such as financial institutions and government agencies, prefer on-premises solutions to ensure data sovereignty. The integration of AI-driven threat detection in on-premises IDS/IPS is enhancing real-time response capabilities. Businesses with high-performance network requirements are deploying on-premises IDS/IPS to minimize latency and maintain security resilience. On-premises solutions are being upgraded with machine learning algorithms to improve anomaly detection and reduce false positives.

The cloud segment is expected to grow at a significant CAGR during the forecast period. The rapid adoption of cloud-based intrusion detection and prevention solutions is driven by the shift toward hybrid and multi-cloud environments. Enterprises are leveraging AI-powered cloud security solutions to detect and prevent advanced cyber threats in real time. The demand for cloud-based IDS/IPS is increasing due to its scalability, cost-effectiveness, and ease of deployment. Cloud service providers are integrating IDS/IPS with security information and event management (SIEM) for enhanced threat visibility. Regulatory requirements, such as GDPR and CCPA, are pushing businesses to adopt cloud-native security solutions for compliance.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2024. Large enterprises are increasingly adopting AI-driven IDS/IPS solutions to counter sophisticated cyber threats. The integration of IDS/IPS with extended detection and response (XDR) platforms is improving enterprise-wide threat visibility. Companies are prioritizing network behavior analysis to detect advanced persistent threats (APTs) in real time. Large enterprises are leveraging IDS/IPS solutions for compliance with global cybersecurity regulations, such as ISO 27001 and NIST. The growing adoption of hybrid cloud environments is driving demand for scalable, enterprise-grade IDS/IPS solutions.

The small and medium-sized enterprises (SMEs) segment is expected to grow at a significant CAGR during the forecast period. SMEs are adopting cloud-based IDS/IPS solutions due to their affordability and ease of deployment. The rise in ransomware attacks targeting SMEs has increased the demand for real-time intrusion detection system. AI-driven IDS/IPS solutions are helping small businesses improve their security posture without requiring large security teams. Managed IDS/IPS services are gaining popularity among SMEs to address cybersecurity threats without extensive in-house expertise. The need for compliance with industry regulations, such as PCI DSS for payment security, is driving IDS/IPS adoption among SMEs.

Vertical Insights

The banking, financial services, and Insurance (BFSI) segment accounted for the largest market share of over 25% in 2024. Financial institutions are investing in AI-powered IDS/IPS solutions to combat rising cyber fraud and phishing attacks. The adoption of network behavior analysis is helping BFSI organizations detect fraudulent transactions and insider threats. Regulatory frameworks such as PCI DSS and GDPR are driving BFSI companies to enhance their intrusion detection capabilities. Financial firms are integrating IDS/IPS with a fraud detection system to prevent unauthorized access to customer data. The rise of digital banking is increasing the need for cloud-based IDS/IPS to secure online transactions.

The government & defense segment is expected to grow at a significant CAGR during the forecast period. Governments are deploying advanced IDS/IPS solutions to counter nation-state cyber threats and cyber espionage. An AI-powered intrusion prevention system is helping defense agencies detect and neutralize advanced cyber threats. The rise of cloud adoption in government IT infrastructures is driving demand for cloud-based IDS/IPS solutions. Zero-trust frameworks are being implemented to secure sensitive government data from insider and external threats. The integration of IDS/IPS with cyber threat intelligence feeds is improving national security defenses.

Regional Insights

North America intrusion detection and prevention systems industry held a significant share of over 35% in 2024. North America has seen a sharp rise in ransomware and Advanced Persistent Threat (APT) attacks, targeting critical infrastructure, financial institutions, and healthcare sectors. The double extortion tactic, where attackers both encrypt and steal data, is pushing companies toward automated intrusion prevention. The U.S. government’s Cybersecurity & Infrastructure Security Agency (CISA) is enhancing national defenses with real-time threat intelligence sharing. Businesses are shifting from signature-based detection to behavioral analytics-driven IDP, reducing false positives and improving response times.

U.S. Intrusion Detection And Prevention Systems Industry Trends

The intrusion detection and prevention systems industry in the U.S. is expected to grow significantly from 2025 to 2030. With increasing ransomware attacks on financial institutions, U.S. banks and fintech firms are prioritizing real-time IDP adoption. The rise of digital payments and online banking fraud has led to a surge in cloud-based IDP investments. The Federal Reserve and SEC are enforcing cyber risk management frameworks that require financial firms to integrate advanced intrusion detection solutions.

Europe Intrusion Detection And Prevention Systems Industry Trends

The intrusion detection and prevention systems market in Europe is expected to grow at a CAGR of 12.0% from 2025 to 2030. The GDPR and NIS2 Directive have made intrusion detection and prevention systems mandatory for businesses handling sensitive data. The European Union is enforcing strict cybersecurity certification standards, requiring real-time threat monitoring and automated incident response. Businesses are adopting AI-powered IDP solutions to ensure compliance while reducing manual intervention.

The UK intrusion detection and prevention systems industry is expected to grow rapidly in the coming years. The UK has strict GDPR compliance regulations, requiring enterprises to deploy intrusion detection and prevention solutions for data privacy and security. The National Cyber Security Centre (NCSC) mandates businesses to integrate AI-driven IDP frameworks to mitigate ransomware and phishing threats. Cloud security is a key focus area, with businesses deploying SaaS-based IDP for hybrid work environments.

The intrusion detection and prevention systems market in Germany held a substantial share in 2024. Germany’s Industry 4.0 transformation has led to a surge in IDP deployment in industrial and manufacturing sectors. Smart factories and IoT networks require real-time threat detection solutions to mitigate cyber-physical security risks. Companies like Siemens and Bosch are integrating AI-driven IDP to protect automated production lines from cyberattacks.

Asia Pacific Intrusion Detection And Prevention Systems Industry Trends

The intrusion detection and prevention systems market in the Asia Pacific is growing significantly at a CAGR of 13.8% from 2025 to 2030. The increasing adoption of cloud computing, 5G, and IoT across China, India, Japan, and Australia is accelerating IDP market growth. China’s Cybersecurity Law is pushing companies to integrate AI-based IDP solutions for real-time threat detection. Japan and South Korea’s financial institutions are enhancing network security by adopting behavior analytics-driven IDP. India’s data localization policies are fueling demand for on-premises and hybrid IDP architectures. The region’s e-commerce and telecom sectors are also investing in cloud native IDP solutions to prevent DDoS and phishing attacks.

China intrusion detection and prevention systems industry held a substantial share in 2024. China’s rapid adoption of 5G, IoT, and AI-powered smart cities has increased the need for real-time IDP solutions. With smart grids, digital banking, and cloud networks expanding, DDoS and ransomware attacks are on the rise. The government is investing in edge security solutions that integrate IDP to detect and neutralize network intrusions before they escalate. Telecom providers like Huawei and ZTE are embedding AI-driven IDP capabilities within their 5G network security frameworks. The rise in cyber warfare threats is pushing China to develop sovereign cybersecurity defense mechanisms.

The intrusion detection and prevention systems industry in Japan held a substantial share in 2024. Japan has seen a surge in financial fraud and ransomware attacks targeting the banking, insurance, and healthcare industries. Leading financial institutions are investing in behavior-based IDP solutions to detect and prevent real-time cyber threats.

India intrusion detection and prevention systems industry is growing due to rapid cloud adoption and hybrid work culture, driving demand for scalable, cloud-based IDP solutions. Government-backed initiatives such as Digital India and Aadhaar-linked financial systems require highly secure IDP architectures. Banks and fintech firms are integrating AI-powered IDPs to mitigate fraud, phishing, and malware attacks. Indian IT giants like TCS, Infosys, and Wipro are developing cloud-native IDP solutions to cater to SMEs and enterprises. With the 5G rollout accelerating, telecom firms are also embedding IDP into network security infrastructures.

Key Intrusion Detection And Prevention System Companies Insights

Key players operating in the intrusion detection and prevention systems market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Intrusion Detection And Prevention Systems Companies:

The following are the leading companies in the intrusion detection and prevention systems market. These companies collectively hold the largest market share and dictate industry trends.

- Allegion plc

- ASSA ABLOY

- BAE System

- Cisco System, Inc.

- Fortinet, Inc

- IBM Corporation

- Palo Alto Networks

- Robert Bosch GmbH

- Secureworks, Inc.

- Sophos Ltd

Recent Developments

-

In January 2025, Palo Alto Networks partnered with SITA to deliver comprehensive cybersecurity protection for mission-critical airport applications. This collaboration integrates Palo Alto Networks' AI-powered cybersecurity platforms into SITA's CyberSecurity portfolio, enhancing the security of remote access points, mobile workforces, and airport assets such as check-in workstations and baggage scanners. Managed by SITA's CyberSOC, the solution aims to ensure smooth passenger flows, minimize downtimes, and reduce turnaround times by implementing advanced cybersecurity measures.

-

In January 2025, Cisco completed its acquisition of SnapAttack, a privately held company based in Arlington, Virginia, known for its threat detection and engineering platform. This strategic move aims to bolster Cisco's Splunk capabilities by integrating SnapAttack's technology and expertise, thereby accelerating the development of advanced threat detection content and engineering solutions. SnapAttack's platform offers a comprehensive threat detection and engineering management lifecycle solution, enabling security analysts to continuously assess, organize, and optimize their security content. This integration is expected to enhance Cisco's ability to provide robust, proactive cybersecurity measures for its clients.

-

In October 2024, IBM and Securitas introduced a groundbreaking approach to security contracts by integrating advanced technology and data-driven insights into traditional security services. This innovative model merges IBM's AI and analytics capabilities with Securitas' expertise in physical security, enabling more proactive, predictive, and tailored security solutions for clients. The collaboration marks a major shift in the security industry, highlighting the growing importance of technology-driven services in enhancing risk management and operational efficiency.

Intrusion Detection And Prevention Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.81 billion

Revenue forecast in 2030

USD 12.14 billion

Growth rate

CAGR of 12.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, technology, deployment, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Fortinet, Inc; IBM Corporation; Cisco System, Inc.; Palo Alto Networks; Robert Bosch GmbH; Allegion plc; ASSA ABLOY; Secureworks, Inc.; BAE System; Sophos Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intrusion Detection And Prevention Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intrusion detection and prevention systems market report based on component, type, technology, deployment, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Network-based

-

Network Behavior Analysis

-

Wireless-based

-

Host-based

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Network Intrusion Detection System (NIDS)

-

Host Intrusion Detection System (HIDS)

-

Network Intrusion Prevention System (NIPS)

-

Hybrid IDS

-

Host Intrusion Prevention System (HIPS)

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Manufacturing

-

IT & Telecom

-

Healthcare

-

Retail & E-commerce

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global intrusion detection and prevention market size was valued at USD 6.25 billion in 2024 and is expected to reach USD 6.81 billion in 2025.

b. The global intrusion detection and prevention market, in terms of revenue, is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 12.14 billion in 2025.

b. The solution segment dominated the industry and accounted for a revenue share of over 60% in 2024. The adoption of AI-powered intrusion detection and prevention solutions is increasing due to their ability to analyze network behavior in real time. These solutions leverage machine learning algorithms to identify sophisticated cyber threats that evade traditional security measures. With the rise of ransomware and APTs (Advanced Persistent Threats), enterprises are prioritizing solutions that offer automated response mechanisms.

b. Some key players operating in the IDPS market include Allegion plc, ASSA ABLOY, BAE System, Cisco System, Inc., Fortinet, Inc, IBM Corporation, Palo Alto Networks, Robert Bosch GmbH, Secureworks, Inc., Sophos Ltd among others.

b. The growth is driven by the increasing integration of AI and machine learning for real-time threat detection and response, enabling more proactive security measures. One of the primary factors propelling the market growth is the increasing prevalence of cyberattacks, such as data breaches, ransomware, and Distributed Denial of Service (DDoS) attacks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.