- Home

- »

- Advanced Interior Materials

- »

-

Investment Casting Market Size, Share, Industry Report 2033GVR Report cover

![Investment Casting Market Size, Share & Trends Report]()

Investment Casting Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Application (Aerospace & Defense, Automotive, Oil & Gas, Medical, Mechanical Engineering, Automation, Energy Technology, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-896-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Investment Casting Market Summary

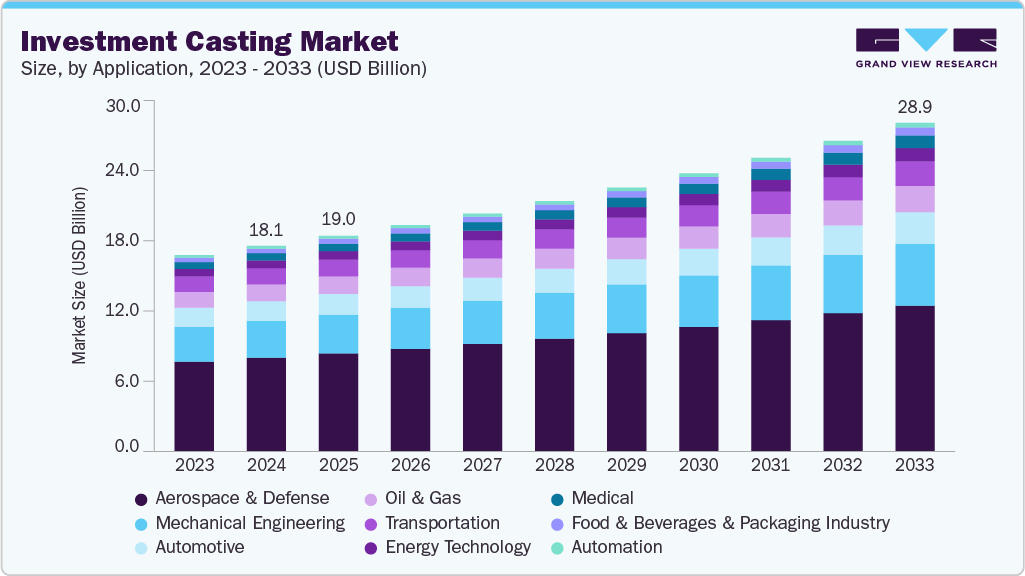

The global investment casting market size was valued at USD 18.13 billion in 2024 and is projected to reach USD 28.96 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The industry is growing steadily due to rising aerospace, automotive, and industrial demand.

Key Market Trends & Insights

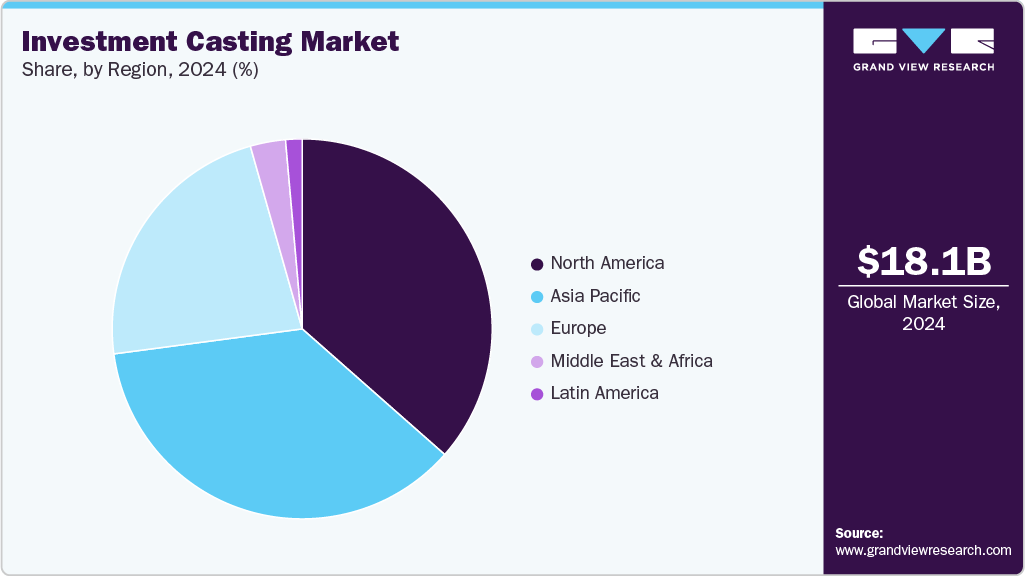

- North America dominated the investment casting market with the largest market revenue share of 36.5%.

- Investment casting market in the U.S. is expected to grow at a substantial CAGR of 5.1% from 2025 to 2033.

- By application, aerospace & defense accounted for the largest market revenue share of over 45.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.13 Billion

- 2033 Projected Market Size: USD 28.96 Billion

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

In 2024, global aircraft deliveries increased, with Boeing alone delivering 285 units in the year's first half. At the same time, electric vehicle production reached around 17 million units worldwide, driven by rising EV adoption in China, the U.S., and Europe. These trends are boosting the need for lightweight, high-precision components that investment casting enables. Advancements in 3D printing and digital simulation are also making the process faster and more efficient, encouraging wider use across industries.Technological advancements are making the investment casting process faster, more precise, and cost-effective. Additive manufacturing is increasingly being used to create wax patterns or ceramic molds, shortening development timelines and reducing tooling costs. Computer-aided design (CAD), simulation tools, and automation enhance dimensional accuracy and consistency in complex parts. These developments are especially beneficial in industries with low tolerance for error, such as aerospace, medical devices, and defense.

The medical device industry is another growing end-use segment for investment casting. With aging populations and rising healthcare access, demand for surgical instruments, dental fixtures, and orthopedic implants is increasing. Investment casting supports manufacturing bio-compatible, corrosion-resistant parts in stainless steel, titanium, and cobalt-chrome alloys. The technique offers design flexibility and a smooth surface finish, essential for medical applications requiring precision, cleanliness, and patient safety.

Lastly, the energy and industrial sectors further boost demand for investment cast parts. Applications in gas turbines, valves, impellers, and pump housings rely on the mechanical strength and thermal resistance that investment casting provides. As global infrastructure projects expand and renewable energy installations grow, especially in wind and thermal power, the need for robust and durable components is rising. Countries investing heavily in energy infrastructure, such as China, the U.S., and India, are expected to sustain long-term demand for investment cast components.

Drivers, Opportunities & Restraints

The industry is primarily driven by the growing demand for precision-engineered components in the aerospace, automotive, and medical sectors. As industries strive for lightweight yet high-performance parts, investment casting offers superior dimensional accuracy and intricate designs using a wide range of alloys. The surge in commercial aircraft production and the rising trend of electric vehicles have also accelerated the adoption of this casting process, especially for turbine blades, orthopedic implants, and engine components.

Several emerging opportunities are shaping the future of the investment casting industry. Integrating 3D printing for pattern making significantly reduces lead times and enhances customization capabilities. Demand is also rising in renewable energy applications, such as wind turbines and fuel cell components. Additionally, expanding defense spending in various regions creates long-term prospects for castings used in weapon systems and naval ships. Emerging economies are investing in industrial infrastructure, further contributing to market growth.

Despite its advantages, the investment casting market faces some restraints. High initial setup costs and longer production cycles than alternative methods can discourage small-scale manufacturers. Volatility in raw material prices, especially for specialty alloys, impacts cost predictability.

Application Insights

Aerospace held the largest revenue share of 45.6% in 2024. The aerospace segment, a cornerstone of the investment casting market, benefits significantly from the scale and precision demanded by modern aviation. In 2024, the global commercial aircraft fleet was estimated at around 28,400 active airliners, marking the industry's return to pre‑pandemic levels. With forecasts projecting that number to grow by roughly 28 percent over the following decade, reaching about 36,400 by 2034, manufacturers are under pressure to supply high‑performance, lightweight parts such as turbine blades, structural fittings, and fuel system components made via investment casting. The reliance on heat‑resistant superalloys and titanium, combined with stringent aerospace quality standards, makes the aerospace sector a major adopter of investment casting technologies.

The medical segment in the investment casting market plays a crucial role in producing high-precision components used in surgical instruments, orthopedic implants, and dental devices. The process offers exceptional accuracy, complex geometries, and smooth surface finishes required for critical medical applications where biocompatibility and reliability are paramount. Materials such as stainless steel, titanium, and cobalt-chrome alloys are commonly used due to their strength and corrosion resistance. The growing demand for minimally invasive surgeries and advanced diagnostic equipment further contributes to the adoption of investment casting in the healthcare sector.

Regional Insights

North America accounted for the largest revenue share of 36.5% in 2024. North America investment casting market is experiencing steady growth due to the region's strong aerospace and defense sector. Aircraft manufacturers increasingly use investment casting techniques to produce high-precision, complex metal components that meet strict performance and safety standards. The demand for lightweight yet durable parts in jet engines, turbines, and structural assemblies has encouraged manufacturers to adopt investment casting for its ability to deliver intricate geometries with minimal material waste. Additionally, defense fleets' modernization programs support sustained procurement of high-performance cast components, strengthening market growth.

U.S. Investment Casting Market Trends

The investment casting market in the U.S. is driven by the country’s robust aerospace manufacturing base, which places a premium on lightweight, high-strength components with complex geometries. Major aircraft and defense contractors rely on investment casting to meet the precise specifications required for turbine blades, fuel system parts, and airframe structures. The growth of commercial aviation and continued defense spending contribute to steady order volumes for cast parts. Technological advancements in ceramic molds and metal alloys are also enhancing the performance and efficiency of cast components, reinforcing their use across aerospace platforms.

Asia Pacific Investment Casting Market Trends

The investment casting market in Asia Pacific is witnessing strong growth due to rising demand from automotive, aerospace, and industrial machinery sectors across countries like China, India, Japan, and South Korea. The growing focus on lightweight, fuel-efficient vehicles and the increasing production of complex engine and structural components are pushing manufacturers to adopt investment casting. The medical sector is also expanding, with greater demand for precision instruments and implants, while energy and infrastructure projects continue to require durable, high-performance metal components.

Europe Investment Casting Market Trends

The investment casting market in Europe is fueled by the defense and medical industries. Defense contractors require durable, high-performance components for military aircraft, naval systems, and armored vehicles. Investment casting enables the production of intricate parts with tight tolerances that meet strict reliability and strength standards. At the same time, the expanding medical sector across Western and Northern Europe is increasing the demand for precision surgical tools, dental devices, and orthopedic implants. These applications require smooth finishes and biocompatible materials, making investment casting an ideal manufacturing method.

Latin America Investment Casting Market Trends

The investment casting market in Latin America is experiencing gradual growth driven by expanding industrial activity and transportation manufacturing, especially in countries like Brazil and Mexico. Automotive production is rising as global automakers increase investments in regional manufacturing hubs, leading to greater demand for precision-cast components such as engine parts, brake systems, and suspension assemblies. Mechanical engineering applications dominate the current market share, with components used in pumps, valves, and heavy machinery seeing consistent demand across agriculture, construction, and manufacturing sectors.

Middle East & Africa Investment Casting Market Trends

The investment casting market in the Middle East & Africa is growing due to steady demand from the oil and gas sector, which forms the industrial backbone of countries like Saudi Arabia, the UAE, and Qatar. These industries require precision-cast components such as valves, turbine blades, and pump housings that can withstand harsh operating conditions. Investment casting offers the accuracy and material strength needed for such critical applications. As oilfield services and energy infrastructure continue to expand, the need for durable and complex metal parts supports ongoing growth in the market.

Key Investment Casting Companies Insights

Key players operating in the investment casting market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Investment Casting Companies:

The following are the leading companies in the investment casting market. These companies collectively hold the largest market share and dictate industry trends.

- Alcoa Corporation

- CIREX bv (Signicast Corporation)

- Dongfeng Metal Products Co. Ltd.

- Dongying Giayoung Precision Metal Co. Ltd.

- Impro

- MetalTek

- Milwaukee Precision Casting

- Ningbo Jiwei Melt Mould Castings Co. Ltd.

- Ningbo Wanguan

- Precision Castparts Corporation

- RLM Industries

- Taizhou Xinyu Precision Casting Co. Ltd.

- Zollern

Recent Development

- In September 2024, 3D Systems introduced QuickCast Air, a new advanced software tool in its investment casting portfolio, specifically designed to optimize material removal from the interior of casting patterns. This innovation significantly reduces material consumption, lowers pattern production costs, speeds up build times, and improves the burnout process and draining efficiency. The technology allows foundries and manufacturers, particularly in sectors like aerospace, defense, and energy, to produce large, high-precision investment casting patterns much faster and at a fraction of the cost associated with traditional tooling, all without constraints on geometric complexity.

Investment Casting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.02 billion

Revenue forecast in 2033

USD 28.96 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; UK; Singapore; Australia; China; India; Japan; South Korea; Brazil; Argentina South Africa; UAE

Key companies profiled

Alcoa Corporation; CIREX bv (Signicast Corporation); Dongfeng Metal Products Co. Ltd.; Dongying Giayoung Precision Metal Co. Ltd.; Impro; MetalTek; Milwaukee Precision Casting; Ningbo Jiwei Melt Mould Castings Co. Ltd.; Ningbo Wanguan; Precision Castparts Corporation; RLM Industries; Taizhou Xinyu Precision Casting Co. Ltd.; Zollern

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Investment Casting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global investment casting market report on the basis of application and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Oil & Gas

-

Medical

-

Mechanical Engineering

-

Automation

-

Food & Beverages and Packaging Industry

-

Energy Technology

-

Transportation

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.