- Home

- »

- Next Generation Technologies

- »

-

Iris Recognition Market Size & Share, Industry Report, 2030GVR Report cover

![Iris Recognition Market Size, Share & Trends Report]()

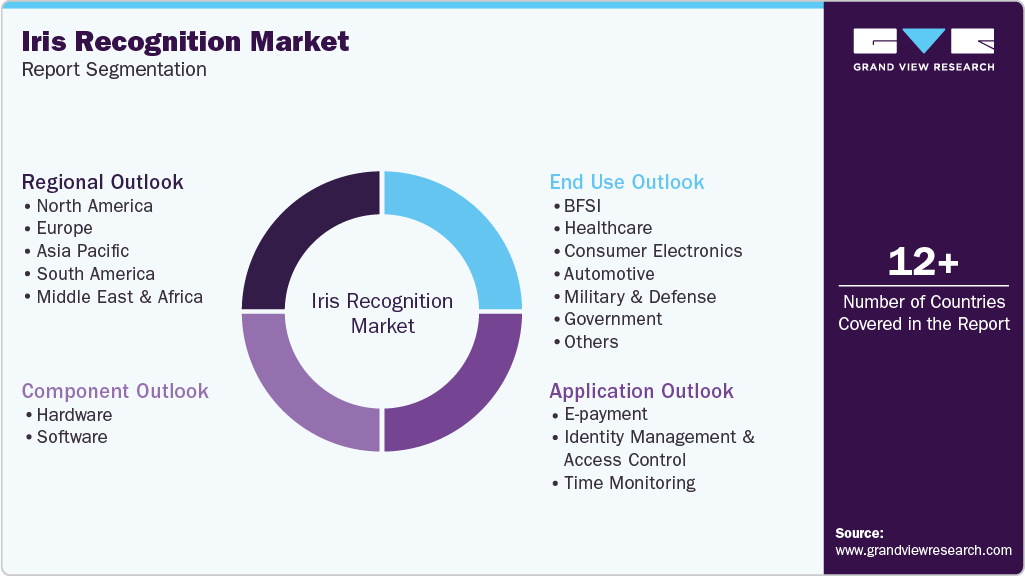

Iris Recognition Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (E-payment, Identity management & access control, Time monitoring), By End Use (BFSI, Healthcare, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-135-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Iris Recognition Market Summary

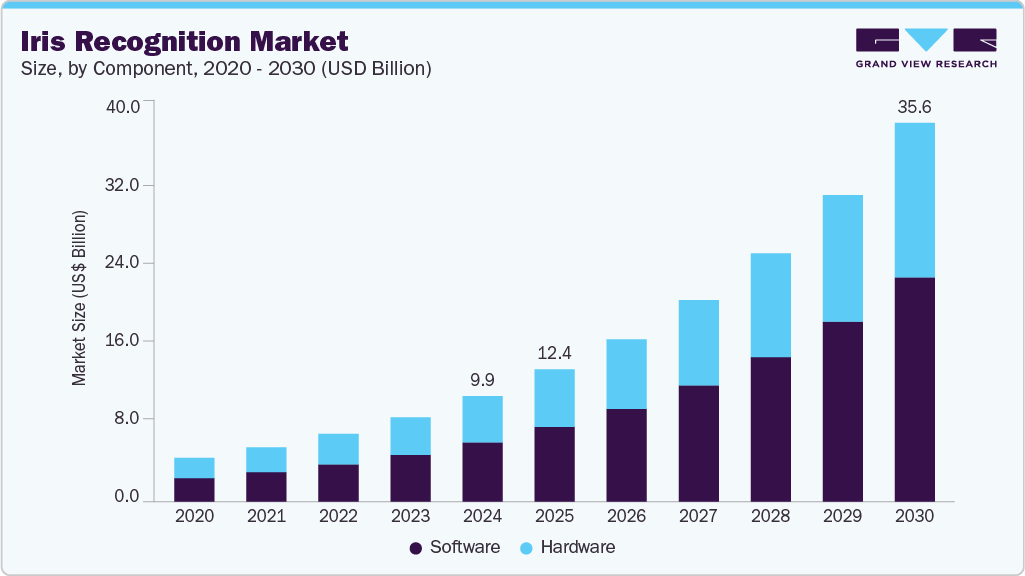

The global iris recognition market size was estimated at USD 9.91 billion in 2024, and projected to reach USD 35.57 billion by 2030, it is growing at a CAGR of 23.4% from 2025 to 2030. This growth is primarily driven by rising demand for advanced security solutions across sectors such as banking, healthcare, government, and consumer electronics.

Market Size & Trends:

- North America iris recognition industry held the leading market share of 29% in 2024.

- The U.S. iris recognition market is expected to grow significantly over the forecast period.

- By component, the hardware segment held a significant share of over 43.9% of the global revenue in 2024.

- By application, the identity management & access control segment led the market in 2024.

- Based on end use, the consumer electronic segment held a significant revenue share in 2024.

Key Market Statistics:

- 2024 Market Size: $9.91 Billion

- 2030 Estimated Market Size: $35.57 Billion

- CAGR: 23.4% (2025 - 2030)

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The increasing adoption of biometric authentication in smartphones, ATMs, and border control systems is also contributing significantly to market expansion. Technological advancements in AI and machine learning are enhancing the accuracy and speed of iris recognition systems, further fueling adoption.High scalability, non-invasiveness, and stability offered by iris recognition are expected to propel market growth. The major advantage of this technology is that the patterns of the iris remain stable throughout life, and the technology's accuracy is extremely high, making it a highly reliable authentication system. Iris recognition is the most accurate biometric technology that can be accessed from a distance. Compared to other biometric systems, iris recognition has a very low false acceptance and rejection rate. Moreover, iris recognition is used in high-security applications such as border control, military, and law enforcement.

Global airport security systems have undergone significant adjustments due to growing security concerns. Modern biometric and Radio Frequency Identification Technology (RFID) have become increasingly popular. Iris recognition technology has been used at major Canadian airports to speed up the customs process for travelers. This facility uses iris scanning equipment to record data, verified against data from the enrollment database. Similarly, in Europe, the Netherlands implemented an Iris recognition technology that enables users to bypass lines at immigration by using a fast-track system. The government set up iris scanners at several viewpoints so tourists could compare live iris data with the information on the e-Visa.

The market is expanding due to the provision of better security to avoid fraud, shorter transaction times, and increasing iris recognition technology use by government banks. However, the market's expansion is anticipated to be constrained by customers' need to understand iris recognition-based ATMs. On the other hand, increased iris recognition-based ATM penetration in developing nations like China, Brazil, and others can be viewed as a commercial opportunity.

In healthcare, technologies like iris recognition in patient identification are gaining traction not only for their accuracy in identifying a patient upon entry into a facility but also for their usefulness in quick and accurate determination of the patient's current location within the hospital, among the various departments, such as home health, the ER, and other mobile environments, or in any other location before providing long-term care.

The automated teller machine (ATM), which has undergone substantial development, continues to play a crucial role in offering cardholders worldwide quick and safe banking services. As ATM channels increase, the likelihood of ATM fraud in banking operations has increased. Iris technology is increasingly being developed and being included in ATMs, especially in Asia and America. Through biometric authentication, the solution increases security on a new level and improves consumer satisfaction. Jing King Tech Group's ATMs have been combined with IriTech's Gemini-Core, a next-generation iris camera with excellent recognition capabilities. Jing King is a Singapore-based organization specializing in providing financial automation solutions. At Fintech Singapore, the company showcased its Gemini-built-in ATM and garnered enthusiastic interest. The terminal can authenticate users using iris & face recognition biometrics, which helps considerably in cutting down on time, improving security, and usability.

Component Insights

The hardware segment held a significant share of over 43.9% of the global revenue in 2024. Hardware improvements are crucial for enhancing iris recognition systems' accuracy, speed, and overall performance. High-resolution cameras are essential for capturing detailed images of the iris. Advances in camera technology have led to the development of smaller, more efficient, and higher-resolution sensors that can capture iris images with greater clarity and precision. Significant initiatives by major companies are also fueling market growth. For instance, in March 2025, Azimuth, part of Rostec State Corporation, launched Vzor, the first fully Russian iris recognition hardware and software system. Vzor enables fast, contactless, and highly accurate identification, comparable to DNA testing, and is unaffected by glasses or contact lenses. Designed for high-security and high-traffic areas, it can recognize 40-90 people per minute at up to 1.5 meters. The solution is entirely developed in Russia, reinforcing Azimuth’s leadership in security and monitoring systems.

The software segment is predicted to register the fastest CAGR over the forecast years. Iris recognition software has seen significant growth and development over the years, as software has improved in accuracy over time due to developments in hardware and image processing techniques. Due to its increased accuracy, it is now a favored option for applications needing a high level of security, like border control and access control systems. In addition, as software technology develops and spreads, the cost of installing iris recognition systems has gradually decreased, making it more affordable for a wider range of businesses. For instance, in May 2025, Mantra Softech Pvt. Ltd. extended its license for Fingerprint Cards’ iris biometrics software to expand its presence in India and emerging markets. The extension allows Mantra to integrate FPC’s iris recognition into more authentication and enrollment devices. Target applications include India’s PDS and NREGA schemes, banking and KYC processes, SIM distribution, national ID programs, healthcare, access control, and border processing.

Application Insights

The identity management & access control segment led the market in 2024. Solutions for Iris recognition are utilized in various industries for applications, including access control and identity management. For instance, iris recognition technologies are utilized by customers to access their bank accounts and staff to log in to their workstations in the banking and finance vertical. Moreover, iris recognition software is used in various industries for access control and identity management. For instance, in May 2025, Bitwarden, Inc. partnered with Guidepoint Global, LLC to enhance the reach of its password manager, a centralized security solution for managing and sharing passwords, automating user account provisioning, and monitoring security metrics. Built on open-source architecture with zero-knowledge encryption, the platform ensures only users can access their encrypted data. It supports both cloud and on-premises deployment and aims to strengthen identity and access management amid rising cyber threats targeting credentials.

The time monitoring segment is expected to grow at the fastest CAGR over the forecast period. Employees do not need to memorize passwords thanks to biometric iris technology. Employees do not need to fill out timecards physically, and employers do not have to worry about misplaced or lost key cards, which are frequently utilized with attendance tracking. Businesses may track employee time worked automatically and in real-time with iris recognition time tracking alternatives that interface with payroll, helping to guarantee that data is consistent across all platforms. Eliminating the need to enter changes into various work systems several times also lessens the stress on HR employees. Similarly, iris recognition technology is used in travel and immigration to stop illegal immigrants from entering the nation using fake travel documents. These technologies are used in many airport terminals to improve the ease, promptness, and effectiveness of border-crossing formalities for authorized travelers. Government agencies widely use iris recognition technology for identification and authentication purposes.

End Use Insights

Based on end use, the consumer electronic segment held a significant revenue share in 2024. Iris recognition is a precise and efficient method for safeguarding individuals, sensitive data, and other items. Iris recognition is becoming popular as more consumer electronics, such as PCs and laptops, use it. The simplicity and trustworthiness of iris recognition technology have become more well-known due to its laptop application. In addition, the market is being driven by factors including the incorporation of iris scanners in smartphones, growing use in government projects, increased fraud and security concerns, and higher demand from the consumer electronics sector.

The BFSI segment is expected to grow at the fastest CAGR over the forecast period. In the BFSI industry, iris recognition is used for biometric verification, adding an extra layer of security to transactions and access to private financial data. Iris scans can be used by customers to securely enter their accounts and authorize financial activities. Moreover, for access control at branches and vaults, banks and other financial organizations use iris recognition technology. This increases physical security by ensuring that only authorized workers can enter restricted locations.

Regional Insights

North America iris recognition industry held the leading market share of 29% in 2024. Prominent initiatives by governments and authorities are propelling market growth over the forecast period. As part of its biometric entry-exit program, U.S. Customs and Border Protection (CBP) was looking at the use of iris recognition. To authenticate travelers' identities, improve border security, and speed up the immigration procedure, Iris scans are being tried at airports and border crossings. Moreover, Governmental organizations in North America are funding iris identification technology research and development. This includes initiatives to improve law enforcement, public safety, and national security.

U.S. Iris Recognition Industry Trends

The U.S. iris recognition market is expected to grow significantly over the forecast period, driven by increasing demand for advanced biometric security solutions across government, healthcare, and financial sectors. Rising concerns over identity theft and data breaches are pushing organizations to adopt more secure and contactless authentication methods. The integration of iris recognition technology in airports, border control, and law enforcement is also gaining momentum, enhancing national security initiatives. Furthermore, federal initiatives promoting biometric verification and investments in homeland security are further supporting market expansion.

Europe Iris Recognition Industry Trends

The iris recognition market in Europe is expected to grow significantly over the forecast period, driven by increasing demand for secure and contactless biometric authentication across various sectors. Governments across the region are investing in advanced security infrastructure, including biometric identification for border control, national ID programs, and law enforcement applications. In addition, growing awareness about data privacy and stringent regulatory requirements, such as GDPR, are encouraging organizations to adopt more secure biometric solutions.

Asia Pacific Iris Recognition Industry Trends

The Asia Pacific iris recognition market is anticipated to register the fastest CAGR over the forecast period. Significant developments in different countries in the region are propelling market growth. For instance, the Iris biometrics database containing the information of 20 million people was already created by China in July 2020, which is included in a system developed by the Beijing Municipal Public Security Bureau and IrisKing. Similarly, in India, the banks are allowed to validate single transactions that go over a certain annual limit with an Iris scan or facial recognition in some cases to lower tax evasion and fraud.

Key Iris Recognition Company Insights

Some key companies in the iris recognition industry are Thales Group, IDEMIA, and NEC Corporation.

-

Thales Group is a global leader in advanced technologies for defense, aerospace, transportation, and digital identity and security. Within its digital identity and security division, Thales Group offers cutting-edge biometric solutions, including iris recognition systems. The company leverages its expertise in AI and cybersecurity to deliver highly accurate and secure iris recognition technologies used in border control, law enforcement, and identity verification applications. Thales’ iris recognition solutions are designed to be fast, contactless, and scalable, ensuring seamless integration into large-scale national ID programs and critical infrastructure security systems. Its technology is also used in secure access control and authentication processes across both public and private sectors.

-

IDEMIA is a global leader in identity technologies, specializing in biometric solutions such as iris recognition. The company's iris recognition technology is renowned for its high accuracy and security, making it suitable for applications in border control, law enforcement, and national identity programs. IDEMIA's OneLook Gen2 device exemplifies this, offering rapid, contactless iris and facial recognition, even for individuals in motion, enhancing efficiency in high-throughput environments like airports. The company's algorithms have consistently ranked at the top in independent evaluations, including the NIST Iris Exchange (IREX) benchmark, emphasizing their reliability and performance. IDEMIA's iris recognition solutions are deployed globally, including in India's Aadhaar program, which has enrolled over a billion individuals, and in border control systems in countries such as Singapore and the UAE.

Key Iris Recognition Companies:

The following are the leading companies in the iris recognition market. These companies collectively hold the largest market share and dictate industry trends.

- Thales Group

- IDEMIA

- Iris ID, Inc.

- Iritech, Inc.

- Princeton Identity

- NEC Corporation

- SAP SE

- HID Global Corporation

- EyeLock LLC

- Hangzhou Hikvision Digital Technology Co., Ltd.

Recent Developments

-

In March 2025, Iris ID introduced the IrisAccess iA1000, a next-generation multimodal biometric access control device that combines iris and facial recognition. Designed to meet diverse security needs and budgets, the iA1000 comes in two configurations and is positioned as a future-ready solution for secure access management. It features a touchscreen LCD, Wi-Fi, and Power over Ethernet (PoE) and supports both OSDP and Wiegand communication protocols. Additionally, the device includes a versatile card reader compatible with multiple card formats and mobile credentials, offering advanced functionality and seamless integration for modern access control systems.

-

In February 2025, Iris ID, Inc. expanded its partnership with the Texas Department of Public Safety by adding over 200 Icam TD100A iris recognition units to their Livescan systems. This move emphasizes the growing use of iris recognition in law enforcement, enhancing the DPS’s ability to protect Texas’s 30 million residents and critical infrastructure. The technology supports efficient, around-the-clock access to key systems such as the Next Generation Identification Iris Service (NGI), aiding law enforcement amid increasing security demands and limited resources.

-

In November 2024, NEC Corporation developed a compact multimodal biometric authentication technology that combines face and iris recognition using a single camera image. Designed for both indoor and outdoor use, the system offers fast and accurate authentication of millions of users by simply connecting a camera module to a PC or tablet. The compact module can be integrated into POS systems, ATMs, and portable devices. NEC plans to roll out the technology by the end of 2026 for applications in payments and access control across industries such as finance, retail, and entertainment.

Iris Recognition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.41 billion

Revenue forecast in 2030

USD 35.57 billion

Growth rate

CAGR of 23.4% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, application, end use, and region

Region scope

North America; Europe; Asia Pacific; Latin America;Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Thales Group; IDEMIA; Iris ID, Inc.; Iritech, Inc.; NEC Corporation; SAP SE; HID Global Corporation; EyeLock LLC; Hangzhou Hikvision Digital Technology Co., Ltd.; Princeton Identity

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Iris Recognition Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global iris recognition market report based on component, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

E-payment

-

Identity management & access control

-

Time monitoring

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

Consumer Electronics

-

Automotive

-

Military & Defense

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global iris recognition market size was estimated at USD 9.91 billion in 2024 and is expected to reach USD 12.41 billion in 2025.

b. The global iris recognition market is expected to grow at a compound annual growth rate of 23.4% from 2025 to 2030 to reach USD 35.57 billion by 2030.

b. The hardware segment holds a significant share of over 43.9% of global revenue in 2024. Hardware improvements are crucial for enhancing Iris recognition systems' accuracy, speed, and overall performance.

b. Some key players operating in the iris recognition market include Thales Group, IDEMIA, Iris ID, Inc., Iritech, Inc., NEC Corporation, SAP SE, HID Global Corporation, EyeLock LLC, Hangzhou Hikvision Digital Technology Co., Ltd.

b. Key factors that are driving the iris recognition market growth include high scalability, non-invasiveness, and stability offered by iris recognition.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.