- Home

- »

- Next Generation Technologies

- »

-

IT Professional Services Market Size & Share Report, 2030GVR Report cover

![IT Professional Services Market Size, Share & Trends Report]()

IT Professional Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Project-oriented Services, ITO Services), By Deployment, By Enterprise Size, By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-762-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IT Professional Services Market Summary

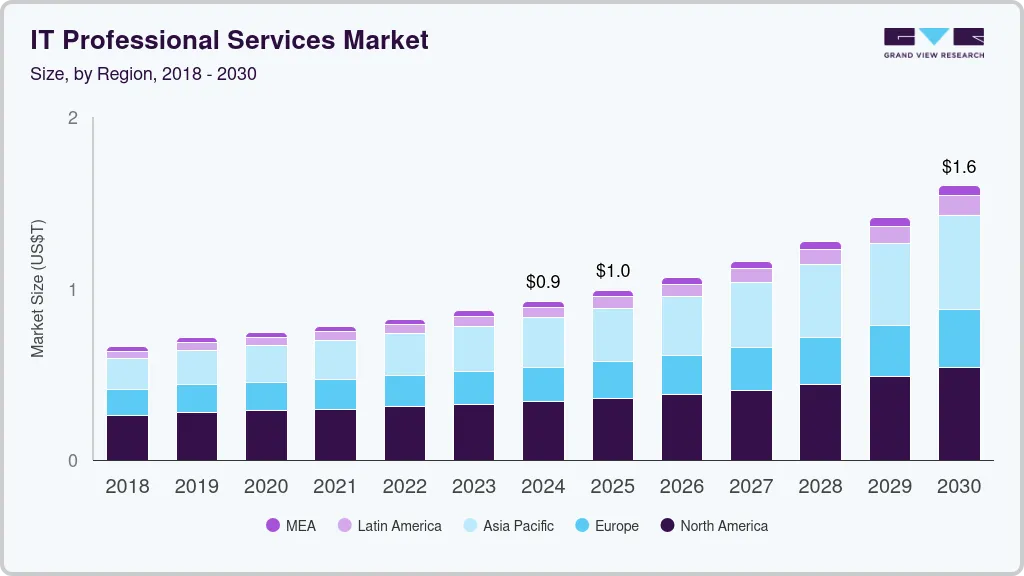

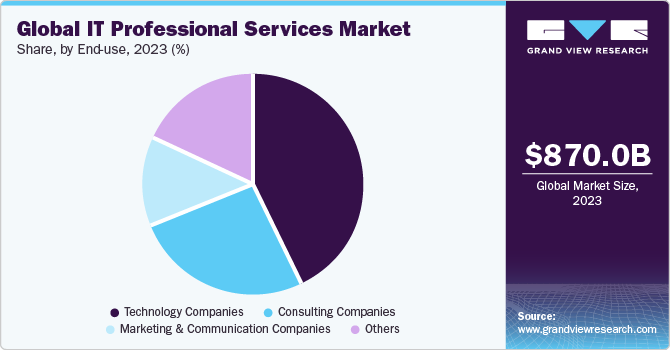

The global IT professional services market size was estimated at USD 870.05 billion in 2023 and is projected to reach USD 1,598.41 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. The rise in automation for the elimination of everyday tasks and shift in customer demand, such as customized pricing options and enhanced customer experience, are propelling enterprises to implement IT services globally and increasing the need for operational efficiency in the professional service firm.

Key Market Trends & Insights

- North America dominated the market in 2023 and accounted for a market share of 37.14%.

- The U.S. IT Professional Services Market will hold a majority market share in the North America region.

- By type, the project-oriented services segment dominated the IT professional services market in 2023 and accounted for a revenue share of 36.9%.

- By deployment, the cloud segment accounted for the largest revenue share of 69.3% in 2023.

- By enterprise size, the large enterprises segment dominated the IT professional services market in 2023 and accounted for a revenue share of 62.5%.

Market Size & Forecast

- 2023 Market Size: USD 870.05 Billion

- 2030 Projected Market Size: USD 1,598.41 Billion

- CAGR (2024-2030): 9.5%

- North America: Largest market in 2023

Furthermore, the COVID-19 pandemic tested the professional services industry by compelling them to implement remote working on a large scale and adjust their business strategies to changing market conditions. COVID-19 augmented several changes across end-use industries; firms countered the epidemic with the help of technology by focusing on talent acquisition and resource management.

Professional services software’s fundamental functions are invoice & expense management, resource allocation, project management, and automated billing. The software also plays a dynamic role in instituting robust communication between internal stakeholders of the business, automating several time-consuming tasks, profit margin expansion, and supporting IT professional services market growth.

Professional service firms can provide a variety of services, including consultation, audit and accounting, implementation support, and financial risk protection. They provide analytic capabilities as well as a foundation for managing business information. It is difficult to compete in today's market with data silos and legacy tools, so organizations rely on IT professional services to use advanced tools. These tools facilitate resource sharing, automate delivery processes, and provide accurate insights, all of which will propel the IT professional services market forward.

Most governments focus on digitalizing their economic operations, which is anticipated to create robust market opportunities for professional services automation software. Various governments, such as Canada, India, Germany, and Saudi Arabia, are supporting regional market players to accelerate economic growth. For instance, in March 2022, the Government of Canada’s has established Canada Digital Adoption Program (CDAP) with an investment of USD 4 billion to assist small and medium-sized enterprises (SMEs) in adopting digital technologies. Under this program, the SMEs will receive USD 2,400 microgrant to cover the costs related to their ecommerce business such as social media advertising, website development, and other automated web actions.

The increased competition and digitalization are pushing enterprises to engage with professional service providers. IT professional service providers provide a streamlined and standardized approach to the administrative processes of the organization, assisting in the digital transformation of the organization's operations. For instance, in February 2022, Amazon Web Services, Inc. announced infrastructure deployment global expansion and AWS local zones in 16 cities across the U.S. with around 30 new local zones. These deployments will assist AWS in expanding its computing storage, database, and other services to a large population from multiple industries. These developments would further drive the growth of the IT professional services market during the forecast period.

Market Concentration & Characteristics

The IT professional services market growth is high, and the pace is accelerating. The rise in the number of cyber breaches across enterprises can be considered as one of the major reasons helping in the IT professional services market. Similarly, the increased adoption of cloud-based services over recent years resulted in an increase in identity theft, and cyber breaches among others. Companies are adopting IT services to analyze the execution of applications and network connections.

The market can be significantly impacted by the regulations implied for ensuring data security, influencing service delivery models and shaping industry standards. Companies have to comply with General Data Protection Regulation (GDPR), NIST Cybersecurity Framework, industry specific regulations among others. Stringent compliance requirements often force companies to opt for IT professional services for regulatory adherence.

The players are actively focusing on new product development to enhance and extend their current products and services, consequently organizations have a potential chance to secure new clients and approve the new technological changes. For instance, In June 2022, HP launched innovations for the HPE GreenLake their edge cloud platform to provide data center operators with cloud services at nominal costs. With these innovations, HPE GreenLake cloud will support applications such as AI, financial services, high-performance computing (HPC) and risk & data analytics in telecom infrastructure. This will help the company attract new clients.

Type Insights

The project-oriented services segment dominated the IT professional services market in 2023 and accounted for a revenue share of 36.9%. Project-oriented services include timely maintenance, modernization, project installation, and decommissioning. These services are frequently tailored to meet the specific needs of the client, assisting them to maximize operational efficiency and deliver projects on time and within budget. Organizations can benefit from project-oriented services in a variety of ways, such as scope management, revenue management, preparing improved quotations, resource management, and effective project delivery. These are the primary factors driving segment demand.

Information Technology Outsourcing (ITO) service segment is anticipated to witness a significant CAGR of 10.3% during the forecast period owing to its ability to help organizations across various industries respond to changing business needs, allowing organizations to focus on innovation instead of IT infrastructure. Organizations utilize ITO services to gain access to deep technical expertise, deliver automation, and bring down costs by choosing an appropriate delivery model. Additionally, ITO services offer a deep pool of resources to create effective Return on Investment (ROI), and it bridges the gap between legacy IT systems and innovation. These benefits provided by ITO services are expected to boost the growth of the segment.

Deployment Insights

The cloud segment accounted for the largest revenue share of 69.3% in 2023. Cloud computing is gaining traction owing to various benefits offered such as increased accessibility, reduction in technology infrastructure costs and reduced overall implementation costs. Furthermore, the improving infrastructure for internet services is augmenting the adoption of cloud-based services. Rise in competition across various end-use industries is forcing companies to cut down on expenditure, hence creating a need for affordable services. These capabilities and features would further supplement the growth of the segment during the forecast period.

The on-premise segment is expected to witness a considerable growth of a CAGR of 8.2% over the forecast period. On-premise solutions offer increased privacy, robust data security and are less vulnerable to digital threats, driving the segment growth. Furthermore, these solutions can perform their work and provide safe access to the data even if the internet connection is interrupted due to its local data storage system.

Enterprise-size Insights

The large enterprises segment dominated the IT professional services market in 2023 and accounted for a revenue share of 62.5%. Due to improved customer experience, low operating costs, improved team collaboration, and low workforce costs, these organizations are major users of IT professional service solutions. These enterprises sign long-term agreements with IT professional services software providers in order to reduce software costs and enable their employees to become familiar with-IT professional service types quickly. For instance, in March 2022, Nividous Software Solutions announced that they had collaborated with Damco Types for streamlining non-core and core business processes across various industries using intelligent automation processes.

The Small & Medium Enterprise (SMEs) segment is expected to witness a significant growth of a CAGR of 11.6% over the forecast period. The SMEs sector is an untapped market and has become an area of focus for industry players. According to the World Bank, the SMB sector accounts for 95% of the existing business. The availability of cloud-based IT professional services tools at affordable prices is anticipated to drive their demand in the SMEs sector. On average, a small enterprise spends over 6% of its revenue on IT, whereas a mid-sized firm spends over 4% and a large enterprise spends around 3%. As the number of SMEs is increasing, competition is also increasing, which has resulted in a price drop of the solution and profit erosion.

End-Use Insights

The technology companies segment dominated the market with the largest market share of 43.8% in 2023. Technology companies rely on the intelligent use of data analytics that can be attained with the help of IT professional services. Moreover, technology continues to evolve; thus, several technology companies, particularly those focusing on the development of Technology as a Service (TaaS), opt for IT professional services as part of their efforts to support their business operations. Additionally, the COVID-19 pandemic also triggered the need for digital transformation, with many technological shifts in work culture, such as working remotely and maintaining the organization’s IT infrastructure; all of these factors are contributing to the growth of this segment.

The marketing and communication companies’ segment is anticipated to grow at a CAGR of 10.9% over the forecast period. These companies depend on extensive market research, website analysis, budget allocation, and reputation management which can be executed with the help of IT professional services. Additionally, the rise of digital media and enhanced customer experience will push the segment to grow further.

Regional Insights

North America dominated the market in 2023 and accounted for a market share of 37.14%, owing to the high adoption of cloud services and Enterprise Resource Planning (ERP) for data management. Furthermore, the integration of advanced technologies such as ITO Services (AI) & Machine Learning (ML) and new type of introduction by market players are creating positive traction for IT professional services in the region. Moreover, the majority of foreign-owned U.S. affiliate firms in the U.S. are investing heavily in IT professional services research and development, which will support the growth of IT professional services in this region during the forecast period.

U.S. IT Professional Services Market Trends

The U.S. IT Professional Services Market will hold a majority market share in the North America region. The country is one of the largest economies in the world, creating lucrative opportunities for IT services like outsourcing, data processing, etc. Similarly, the increasing adoption of cloud-based services will help in market growth.

Europe IT Professional Services Market Trends

The Europe IT professional services market will witness a high growth rate during the forecast period. The region has a strong emphasis on the implementation of data security and privacy due to the strict GDPR regulations helping drive the demand for various compliance and IT services.

The IT professional services market in the UK will experience lucrative growth opportunities during the forecast period. Companies across the UK are investing heavily in implementing digital transformation initiatives to enhance efficiency and drive innovation across various end-use sectors.

Germany IT professional services market is expected to grow at a CAGR of 8.2% during the forecast timeline. The proliferation of Industry 4.0 and the rising adoption of cloud-based services to improve overall flexibility, cost-efficiency, and scalability will help in market growth. These services provide assistance in cloud management, migration and optimization.

The IT professional services market in France will witness a high growth rate during the forecast period. The proliferation of Industry 4.0 has increased the adoption of various technologies such as AI, ML, IoT, automation for enhancing manufacturing processes. The adoption of such technologies will help in the IT professional services market growth.

Asia Pacific IT Professional Services Market Trends

The Asia Pacific IT professional services market is anticipated to witness a significant growth of a CAGR of 11.0% over the forecast period. The demand for knowledge-based services is expected to rise exponentially in the legal & advisory, and accounting service industries of this region which will boost the growth over the forecast period. Besides, growing economies such as China and India are focusing on IT development which will unfold numerous opportunities for IT professional services in the region. Additionally, the Asia Pacific region comprises numerous SMEs that largely rely on professional services for the smooth execution of daily operations.

The IT professional services market in China will grow at a CAGR of 11.6% during the forecast period. Various government initiatives such as “Made in China 2025” and “Internet Plus” to promote digital transformation and technological innovation across various end-use industries is driving the market for IT professional services.

India IT professional services market is expected to hold a market share of 13.9% in the Asia Pacific region. The increasing adoption of technologies such as big data analytics, cloud computing, artificial intelligence, and Internet of Things (IoT) is on the rise among companies in India helping the market growth.

The IT professional services market in Japan will hold a market share of 8.9% in the Asia Pacific region. The country has been an early adopter of advanced technologies across end-use industries helping provide lucrative growth opportunities in the forecast period. Furthermore, the integration of automation, cloud-based services, and AI in operations and supply chain activities will help market growth.

MEA IT Professional Services Market Trends

The Middle East & Africa (MEA) IT professional services market will grow at a CAGR of 9.5% during the forecast period. Initiatives undertaken by governments and corporations to promote advanced technologies, such as machine learning, business analytics, and Al, coupled with continuous adoption of cloud-based technologies, are anticipated to fuel the demand for IT Professional Services across business processes in Middle East countries.

The IT professional services market in Saudi Arabia will witness a high growth rate during the forecast period. Various initiatives such as the “Vision 2030” launched by the government to promote digital transformation across various sectors and reduce the dependency on oil will drive the need for IT Professional Services across various sectors in the region.

Key IT Professional Services Company Insights

The key industry participants include Accenture; Datto, Inc.; Capgemini; Microsoft Corporation, and International Business Machines Corporation.

-

Accenture plc has a diverse portfolio of IT professional services and helps their clients define their IT strategies, align technology investments with business objectives. They have expertise in IT service management, enterprise architecture helping them stand out from its competitors.

-

Microsoft Corporation has a comprehensive portfolio of products and services designed to work seamlessly, facilitating integration and interoperability across IT landscape. This integration capability simplifies deployment, maintenance and management for organizations.

Atera Networks Ltd., Datto, Inc., HELIXSTORM, Veritis Group Inc, etc. are the emerging players operating in the IT professional services market.

-

Atera Networks Ltd. Offers an all-in-one platform that combines professional services automation (PSA), remote monitoring and management (RMM) and remote access into a single solution. This integrated platform streamlines IT management processes and improves operational efficiency.

-

Datto, Inc. focuses on providing innovative and comprehensive solutions specifically designed for service providers and medium-sized businesses. It offers backup and disaster recovery solutions providing robust data protection and business continuity capabilities.

Key IT Professional Services Market Companies:

The following are the leading companies in the IT professional services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services

- Atera Networks Ltd.

- Capgemini

- Datto, Inc.

- DXC Technology Company

- FUJITSU

- HELIXSTORM

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- ScienceSoft USA Corporation

- Veritis Group Inc.

- VMware, Inc.

Recent Developments

-

In February 2024, Skyhigh Security announced the addition of managed & professional IT services to its Altitude Partner Program. With these professional services offered, companies can complete their product development and resell SkyHigh Security solutions.

-

In August 2023, Rackspace Technology announced a professional services collaboration with Google Cloud to help accelerate VM migrations. This collaboration will migrate virtual machines to Google Cloud, helping provide an efficient and innovative solutions to businesses.

-

In August 2023, HCLTech signed an agreement with TIBCO Solutions: a cloud software group. Under this agreement, HCLTech will help implement, modernize, upgrade and provide services for TIBCO products globally, helping strengthen HCL’s professional services portfolio.

IT Professional Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 924.87 billion

Revenue forecast in 2030

USD 1,598.41 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Amazon Web Services; Atera Networks Ltd.; Datto, Inc.; Capgemini; International Business Machines Corporation; DXC Technology Company; FUJITSU; HELIXSTORM; Hewlett Packard Enterprise Development LP; Microsoft; Oracle; ScienceSoft USA Corporation; Veritis Group Inc.; VMware, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Professional Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IT professional services market based on type, deployment, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Project-oriented Services

-

ITO Services

-

IT Support & Training Services

-

Enterprise Cloud Computing Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise-size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium-sized Enterprises (SMEs)

-

Large Enterprises

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Technology Companies

-

Consulting Companies

-

Marketing & Communication Companies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global IT professional services market size was estimated at USD 870.05 billion in 2023 and is expected to reach USD 924.87 billion in 2024.

b. The global IT professional services market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 1,598.41 billion by 2030.

b. Some key players operating in the IT professional services market include Accenture; Amazon Web Services; Atera Networks Ltd.; Datto, Inc.; Capgemini; International Business Machines Corporation; DXC Technology Company; FUJITSU; HELIXSTORM; Hewlett Packard Enterprise Development LP; Microsoft; Oracle; ScienceSoft USA Corporation; Veritis Group Inc.; and VMware, Inc.

b. The cloud segment accounted for the largest revenue share of 69.3% in 2023. Cloud computing is gaining traction owing to various benefits offered, such as increased accessibility, reduction in technology infrastructure costs, and reduced overall implementation costs.

b. The rise in automation for the elimination of everyday tasks and shift in customer demand, such as customized pricing options and enhanced customer experience, are propelling enterprises to implement IT services globally and increasing the need for operational efficiency in the professional service firm.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.