- Home

- »

- Next Generation Technologies

- »

-

IT Services Outsourcing Market Size & Share Report, 2030GVR Report cover

![IT Services Outsourcing Market Size, Share & Trends Report]()

IT Services Outsourcing Market Size, Share & Trends Analysis Report By Service (Application Services, Emerging Technology Services, Others), By Location (On-shore, Off-shore), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-519-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

IT Services Outsourcing Market Trends

The global IT services outsourcing market size was valued at USD 639.59 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. The industry is anticipated to witness substantial demand for IT operations to allow companies to focus on their core tasks and reduce operational costs. The growing vigilance regarding data security and customer-centricity in projects, especially in the aerospace & defense and BFSI sectors, are fueling the demand for information technology services outsourcing. The market is also progressing owing to the ever-increasing demand for consultancy-related projects. The growing need for proficiency in formulating and streamlining IT strategy, enterprise architecture advisory, portfolio consulting, and ensuring effective and smooth digital transformation further boosts industry growth.

Rapid innovations, offering various benefits to different industries globally, will also support market growth. Delegation of time-consuming and tedious tasks to service providers empowers businesses to concentrate on their central functionalities and reduces the load on their internal resources. It also offers optimization of capacity, resources, flexibility to meet the demands of the changing commercial environment and better access to innovation and intellectual property.

Service providers are coming up with different operational and pricing models to gain a competitive edge over others. The advent of cloud computing has fueled market growth as it enables firms to automate and ease their business applications and processes. Hence, enterprises, especially Small & Medium Businesses (SMBs), are largely deploying the Software as a Service (SaaS) model and the Infrastructure as a Service (IaaS) model, which has compelled the service providers to capitalize on the cloud-based offerings.

Companies are even seen engaging in multi-sourcing which involves the division of a project into different components, which are handled by several independent vendors. This allows the companies to reduce their operational risk and dependency owing to the project’s split amongst different vendors. In 2017, A German electric utility firm, E.ON SE outsourced its network system to T-systems International GmbH and its data center and desktop operations to Hewlett Packard Enterprise Development LP. Various key companies in the industry, such as NTT Data and Capgemini, have implemented the multi-sourcing models. However, these models can be challenging to implement as the company has to coordinate between the suppliers continually.

The growth of IT operations outsourcing is further anticipated to be driven by the commencement of digitization trends prompting SMBs as well as large businesses to opt for advanced IT infrastructure. Development of the Industrial Internet of Things (IIoT) across the Industry 4.0 platform is expected to fuel the demand for IT operations within the hybrid information technology-managed environment. Companies are subcontracting these IT operations to keep pace with the market dynamics and reduce their overhead costs and lead time. However, the global market is witnessing a shrink in its growth rate due to the increasing number of Global In-house Centers (GICs) of companies. According to Nasscom, in Q4 2022, 11 new Global Capability Centers (GCCs) were set up in India, all in tier 1 cities.

End-use Insights

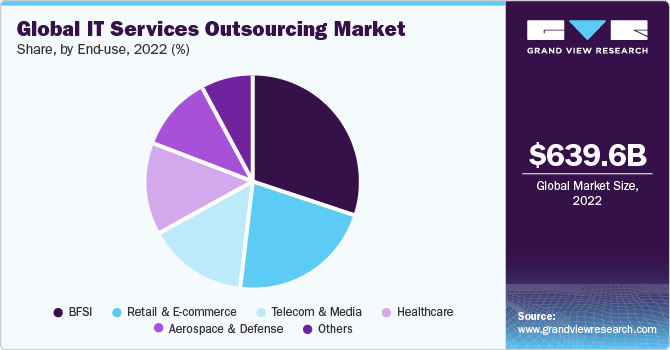

Based on end-use, the market has been categorized into aerospace & defense, BFSI, healthcare, retail & e-commerce, telecom & media, and others. The other end-use segment includes automobile, energy, public service, and utility sectors. The BFSI segment accounted for the largest revenue share of 29.8% in 2022 owing to its significant investment in automation, AI-based conversational systems, and cybersecurity.

The retail and e-commerce segment is expected to grow at the fastest CAGR of 9.7% during the forecast period. This growth can be attributed to the numerous start-ups deploying an online shopping platform for customers. Moreover, technological advancements have enabled customized shopping experiences for consumers using AI, Virtual Reality (VR), and deep learning techniques. Increasing deployment of these technologies in the sector is anticipated to drive market growth.

The aerospace & defense segment is projected to have substantial growth owing to the increasing adoption of autonomous systems, AI, sensors, and additive manufacturing in the sector. Implementation of IoT in this sector, which is mostly not an automotive company’s expertise and is an outsourced service, offers better operation & control, traffic planning, material management, staff & passenger information management, energy management, and data analytics. Moreover, the deployment of IoT delivers unscheduled aircraft maintenance, sensory inputs, tail allocation, reliable & secure communications, and cloud application development services. These technological deployments need a skilled and experienced workforce, thus fueling the market growth.

The healthcare sector is driving the growth of IT services subcontracting due to a surge in the development of tailored software platforms as per the requirements of healthcare providers and increasing usage of big data in the medical sector. Health information management across computerized systems is of vital importance to the healthcare sector. Hence, organizations outsource their information technology solutions to ensure a secure exchange of information between providers, consumers, and quality monitors.

The usage of information technology in healthcare allows medical organizations to minimize human errors and reduce costs in maintaining patient records for their safety & reliability. Furthermore, telecom operators are under relentless pressure to manage their principal disbursements in network deployment to cut their operating costs. Hence, the industry has observed several telecom operators subcontracting their value-added services comprising next-generation communication, content, and commerce services to IT service providers.

Location Insights

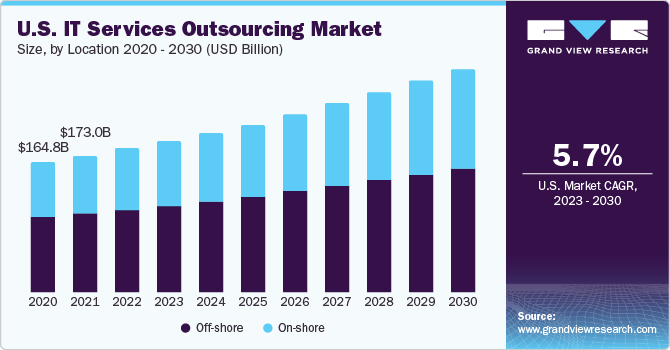

Based on location, the market has been classified into on-shore and off-shore locations. The off-shore segment accounted for the largest revenue share of 50.1% in 2022. Offshoring information technology operations to developing nations to avail cost benefits, mitigation of currency risks, and fulfillment of offset obligations have been driving the off-shore business over decades. Companies have preferred the Asia Pacific countries as their offshoring destination mainly because of the ample availability of skilled talent and low-cost labor. The market is likely to witness a shift in this trend and prefers onshoring over the forecast period.

The on-shore segment is expected to grow at the fastest CAGR of 8.5% during the forecast period. Onshoring of IT operations mitigates the hurdles of off-shore outsourcing. The indirect costs of quality lapse, communication gap, and security & intellectual property risks are lesser in onshoring. Therefore, the industry is observing a shift towards onshoring information technology operations. Moreover, on-shore activities enable businesses to partner with the vendors in their time zone and work inside the same legal authority. This allows an easily streamlined and improved communication between the two firms, which in turn surges the effectiveness of services outsourced.

Regional Insights

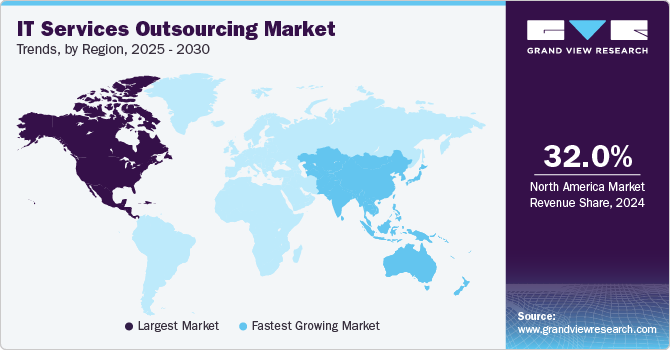

North America dominated the IT services outsourcing market and accounted for the largest revenue share of 33.6% in 2022. The majority of technology-driven companies are based in North America, and the region has been observing higher revenue share due to the early adoption of new technologies. U.S. accounted for the highest revenue share owing to the tenacious countrywide expansion in the IT sector and the growing deployment of information technology operations, enterprise software, data center systems, and communication systems.

Asia Pacific is expected to grow at the fastest CAGR of 10.3% during the forecast period owing to the increasing number of partnerships between businesses and IT service providers. Software development is one of the prime IT tasks, which is outsourced to the countries in this region due to cost-effectiveness, enhanced quality, time management, and availability of skilled developers.

Service Insights

The application services segment accounted for the largest revenue share of 20.0% in 2022. The eight primary services evaluated in this market report comprise application services, emerging technology, data center operations, helpdesk offerings, infrastructure capacity, managed security operations, network operations, and other services. The other IT outsourcing segment includes quality engineering & assurance and consultancy operations. The infrastructure capacity business forms a vital fragment of the global market, thereby providing infrastructure design & implementation, cloud computing, and remote infrastructure management services to businesses. The network operations analyzed in the study are on an upsurge for several functionalities, the most important ones being network optimization, wireless infrastructure, contact center transformation, and Unified Communications and Collaboration (UCC).

The emerging technology services segment is expected to grow at the fastest CAGR of 10.3% during the forecast period. Emerging technologies, such as artificial intelligence (AI), cloud computing, and the Internet of Things (IoT), offer a wide range of opportunities for businesses. However, these technologies can be complex and expensive to implement in-house. Outsourcing to a third-party provider can give businesses access to the latest technologies without the need to invest in their infrastructure. Another contributing factor to the expansion of the emerging technology services segment is the widening skills gap. There is a need for more skilled IT professionals in many parts of the world. Outsourcing to a third-party provider can give businesses access to a pool of skilled IT professionals who are already familiar with emerging technologies.

Various industries are observing a shift in their processes as automation takes over traditional methods. Companies, as well as their vendors, strive to implement state-of-the-art technologies in their business processes. Hence, the emerging technology services segment is anticipated to witness the fastest CAGR during the forecast period. Managed security operations segment is expected to observe a considerable growth rate from 2023 to 2030. The upsurge in the growth of this segment is attributed to the growing demand and vigilance of data security, governance and compliance, risk management, and threat & vulnerability management.

The rapid expansion of the e-commerce sector, usage of smartphones and social media, various governments’ emphasis on the digital economy, and rise in technology-driven start-ups have led to the speedy growth of the market. In addition, the rise in the number of cloud service providers is adding to the data space requirement, thereby supporting market development. Demand for outsourcing helpdesk services is also on the surge as it allows companies to save on internal resources, costs, and time to focus on core business processes.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations, to augment their market share. For instance, in June 2023, Accenture acquired Flutura, an Indian industrial AI company, to bolster its industrial AI services for clients in the energy, chemicals, metals, mining, and pharmaceutical industries. The acquisition of Flutura is a strategic move by Accenture to expand its reach in the industrial AI market.

Key IT Services Outsourcing Companies:

- Accenture

- IBM

- Fujitsu

- Hewlett Packard Enterprise Development LP

- SAP SE

- Capgemini

- Cognizant

- Infosys Limited

- NTT Data Corporation

- Oracle

Recent Developments

-

In June 2023, Accenture, a consulting firm, plans to make significant investments in its Data & AI practice over the next three years. The investment is expected to aid the company's clients across all industries in their rapid and sustainable transformation, as well as to apply artificial intelligence to achieve higher growth, efficiency, and resilience. Accenture's Data & AI practice expands to provide more industry solutions and pre-built models to clients in a number of industries.

-

In June 2023, Hewlett Packard Enterprise (HPE) expanded its partnership with Amazon Web Services (AWS) to simplify hybrid cloud transformation for enterprises. The expanded partnership provides customers with a more seamless way to manage and move workloads between HPE's on-premises infrastructure and AWS.

-

In June 2023, IBM and Adobe announced the expansion of their partnership to help brands accelerate content supply chains using artificial intelligence (AI). The companies leverage Adobe's AI-powered services, such as Adobe Sensei GenAI and Adobe Firefly, to help brands create, manage, and deliver content more efficiently and effectively.

-

In June 2023, Sonata Software, a global modernization and software development firm partnered with SAP Commerce to help companies accelerate the process of digital transformation. SAP Commerce, an enterprise e-commerce platform to be paired with Sonata Software's digital commerce experience to give end-to-end e-commerce solutions to customers. This includes storefront design, implementation, and maintenance in order to provide customers with consistent and personalized experiences across several touchpoints and channels.

-

In April 2023, Fujitsu, a Japanese information technology (IT) company, announced the expansion of its digital transformation (DX) consulting capabilities throughout Europe. In Spain and Estonia, the business opened two new Near Response Centers (NRCs). The NRCs provide consumers with quick access to highly experienced experts who can assist them with their digital transformation concerns.

-

In March 2023, Cohesity and IBM announced a partnership to address the essential demand for resiliency in hybrid cloud settings and data security. The two companies' data protection, cyber resilience, and data management technologies are to be combined to form IBM Storage Defender, a new service that integrates Cohesity's data protection. IBM Storage Defender is intended to assist enterprises in protecting their data from a wide range of threats such as malware, ransomware, and data exfiltration. The technology aims to give users a consolidated view of data security across cloud, on-premises, and hybrid settings.

-

In March 2023, Rimini Street introducedRimini ONE, a new outsourcing service program from Rimini Street, provides a comprehensive set of unified, integrated services for running, managing, supporting, customizing, configuring, connecting, protecting, monitoring, and optimizing enterprise applications, databases, and technology software. Rimini ONE is intended to assist businesses of all sizes in lowering costs, increasing productivity, and achieving peace of mind through the outsourcing of enterprise software management and maintenance.

-

In February 2023, Oracle launched a new suite of cloud-native banking services called Oracle Banking Cloud Services. The services are designed to help banks accelerate their move to the cloud and meet the challenges of today's digital banking environment. Oracle Banking Cloud Services is a componentized and composable suite of services. It means that banks can choose the services that they need and build them into a solution that meets their specific requirements.

IT Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 686.92 billion

Revenue forecast in 2030

USD 1,180.42 billion

Growth Rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, location, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Accenture; IBM; Fujitsu; Hewlett Packard Enterprise Development LP; SAP SE; Capgemini; Cognizant; Infosys Limited; NTT Data Corporation; Oracle

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Services Outsourcing Market Report Segmentation

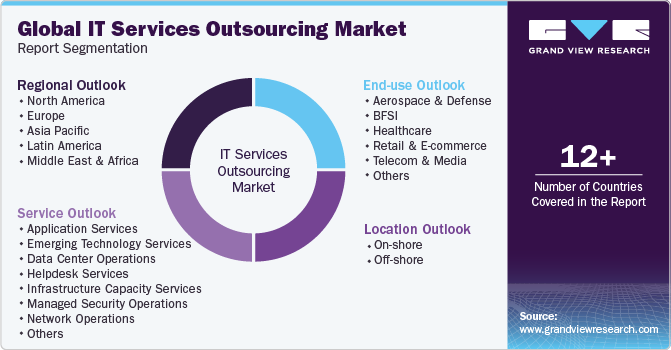

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global IT services outsourcing market report based on service, location, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Application Services

-

Emerging Technology Services

-

Data Center Operations

-

Helpdesk Services

-

Infrastructure Capacity Services

-

Managed Security Operations

-

Network Operations

-

Others

-

-

Location Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-shore

-

Off-shore

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Aerospace & Defense

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

Telecom & Media

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IT services outsourcing market size was valued at USD 639.59 billion in 2022 and is expected to reach USD 686.92 billion in 2023.

b. The global IT services outsourcing market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 1,180.42 billion by 2030.

b. BFSI segment registered the largest revenue share of around 30.32% in 2022 owing to its significant investment in automation, artificial intelligence-based conversational systems, and cybersecurity.

b. Some key players operating in the IT services outsourcing market include Accenture, IBM, Fujitsu, Hewlett Packard Enterprise Development LP, and SAP SE.

b. The growing vigilance regarding data security and customer-centricity in projects, especially in the aerospace & defense and BFSI sectors, are projected to propel the demand for information technology services outsourcing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."