- Home

- »

- Network Security

- »

-

IT And Telecom Cyber Security Market Size Report, 2030GVR Report cover

![IT And Telecom Cyber Security Market Size, Share & Trends Report]()

IT And Telecom Cyber Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment (On-premise, Cloud), By Enterprise Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-975-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IT And Telecom Cyber Security Market Summary

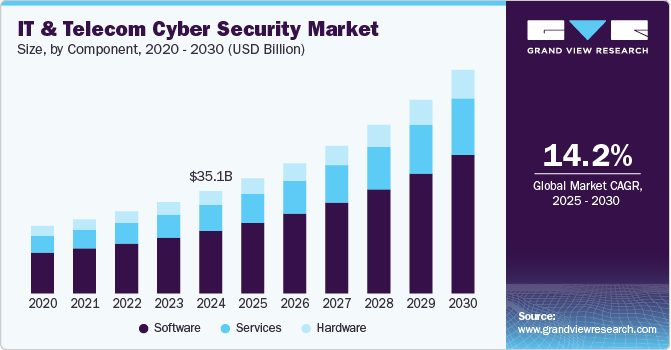

The global IT & telecom cyber security market size was estimated at USD 35.11 billion in 2024 and is projected to reach USD 76.73 billion by 2030, growing at a CAGR of 14.2% from 2025 to 2030. The IT and tele communications sectors are increasingly vulnerable to cyber-attacks due to the vast amounts of sensitive data and the interconnectedness of systems.

Key Market Trends & Insights

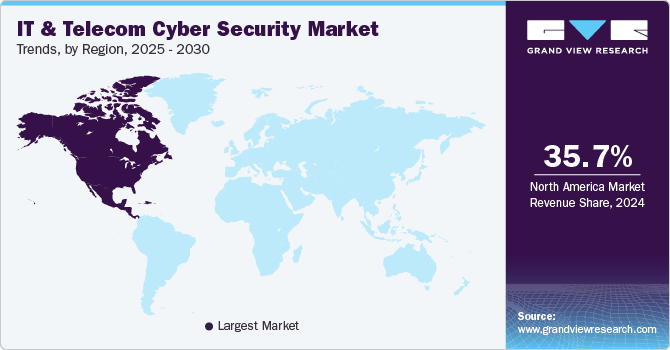

- North America dominated the IT & telecom cyber security market with the largest revenue share of 35.73% in 2024.

- The U.S. is expected to grow at a significant CAGR of 11.2% from 2025 to 2030.

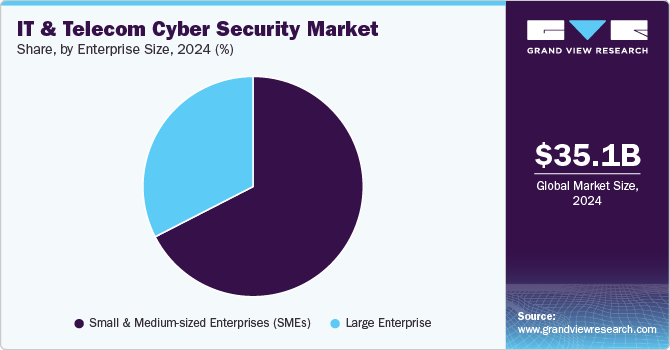

- Based on enterprise size, the SMEs segment led the market with the largest revenue share of 67.46% in 2024.

- Based on component, the software segment led the market with the largest revenue share of 61.11% in 2024.

- Based on deployment, the on-premise segment led the market with the largest revenue share of 57.15% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.11 Billion

- 2030 Projected Market Size: USD 76.73 Billion

- CAGR (2025-2030): 14.2%

- North America: Largest market in 2024

With the surge in ransomware, DDoS attacks, phishing, and insider threats, businesses are prioritizing robust cybersecurity solutions to safeguard their operations and customer data. This rising threat landscape fuels demand for cybersecurity technologies and services. The rapid shift to cloud-based services within IT and telecom industries has created new security challenges. As organizations migrate their data, applications, and infrastructure to the cloud, they expose themselves to potential breaches and unauthorized access. This has led to the increased adoption of cloud-specific security tools, such as cloud access security brokers (CASBs), encryption technologies, and identity and access management (IAM) systems, to ensure that cloud environments remain secure.

Hybrid and multi-cloud deployments have become more popular, requiring tailored security solutions that can protect data across multiple platforms. As more companies embrace cloud technologies to scale their operations and reduce costs, the demand for robust cloud security will continue to rise. This trend is further fueled by the need for organizations to comply with industry regulations regarding data protection and security in the cloud, which accelerates the market growth for cybersecurity solutions in the cloud domain.

The global deployment of 5G networks represents a major milestone for the telecommunications industry but also introduces new cybersecurity risks. 5G technology promises faster connectivity and lower latency, but its decentralized architecture and increased number of connected devices make it more susceptible to attacks. This has heightened the need for security solutions that can manage and mitigate these vulnerabilities, such as secure network slicing, advanced threat detection, and zero-trust architecture for 5G networks. As reported by 5G Americas, a trade association of wireless cellular network operators, global 5G connections reached nearly 2 billion in the first quarter of 2024, with 185 billion new connections added. It is expected to rise to 7.7 billion by 2028. In North America, 5G adoption accounts for 32% of all wireless cellular connections, double the global average. The region saw an 11% growth, adding 22 billion new 5G connections during this period.

Component Insights

Based on component, the software segment led the market with the largest revenue share of 61.11% in 2024. The integration of AI and machine learning (ML) into cybersecurity software is transforming how threats are detected and mitigated. AI-powered cybersecurity software can analyze vast amounts of data in real time, identifying patterns and anomalies that might signal potential attacks. This predictive capability enables companies to detect threats earlier and respond more effectively, minimizing damage. The adoption of AI-based security solutions is growing rapidly, as IT and telecom companies look to enhance their security posture in the face of increasingly complex threats

The services segment is expected to grow at the fastest CAGR of 14.2% over the forecast period. The increasing regulatory pressures faced by IT and telecom companies. Compliance with data protection regulations such as GDPR, CCPA, and sector-specific standards such as PCI-DSS (for telecoms handling payment data) requires continuous monitoring, auditing, and reporting. Cybersecurity service providers offer compliance management and auditing services to help companies meet these legal requirements and avoid fines. As governments and industry bodies tighten regulations around data privacy and security, the demand for cybersecurity services that ensure compliance is expected to grow significantly.

Deployment Insights

Based on deployment, the on-premise segment led the market with the largest revenue share of 57.15% in 2024, driven by the requirements of the integration with legacy systems. Many IT and telecom companies rely on legacy infrastructure that may not be easily compatible with cloud-based security solutions. On-premise deployment allows for better compatibility with existing systems, providing a smoother transition when upgrading security infrastructure. This is especially important for large telecom companies with vast, complex networks that require highly customized security solutions tailored to their specific needs. On-premise deployment ensures that companies can implement these custom solutions more effectively, without the need to completely overhaul their systems, making it an appealing choice for organizations seeking to balance innovation with stability.

The cloud segment is expected to grow at a significant CAGR over the forecast period, owing to the increased demand for hybrid and multi-cloud environments. As more IT and telecom companies adopt multi-cloud strategies to diversify their operations and avoid vendor lock-in, the complexity of securing data across multiple cloud platforms grows. This complexity has driven the demand for advanced security solutions that can offer seamless protection and management across various cloud providers. Tools that ensure unified security management, threat visibility, and compliance across hybrid and multi-cloud environments are becoming crucial for enterprises, further contributing to market expansion.

Enterprise Size Insights

Based on enterprise size, the SMEs segment led the market with the largest revenue share of 67.46% in 2024. The digital transformation journey of SMEs has accelerated significantly in recent years, driving the need for enhanced cybersecurity measures. As these businesses adopt cloud computing, e-commerce platforms, and digital communication tools, they become more vulnerable to cyber threats. This transformation has led SMEs to recognize the importance of investing in cybersecurity to protect their digital assets and customer data.

The large enterprise segment is expected to grow at a significant CAGR over the forecast period. The adoption of advanced technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain, is reshaping the IT and telecom landscape for large enterprises. While these technologies offer significant benefits, they also introduce new vulnerabilities that necessitate enhanced security measures. Large organizations are increasingly seeking cybersecurity solutions that can integrate with these emerging technologies, enabling them to secure their evolving digital environments effectively.

Regional Insights

North America dominated the IT & telecom cyber security market with the largest revenue share of 35.73% in 2024. North American enterprises are significantly ramping up their investments in cybersecurity solutions in response to the escalating frequency and sophistication of cyber threats. With high-profile breaches making headlines, organizations recognize the urgent need to bolster their security postures. As a result, companies are allocating larger portions of their IT budgets to cybersecurity technologies, including advanced threat detection, incident response, and endpoint security solutions. This trend is expected to continue as organizations prioritize cybersecurity as a critical component of their overall risk management strategies.

U.S. IT And Telecom Cyber Security Market Trends

The IT & telecom cyber security market in the U.S. is expected to grow at a significant CAGR of 11.2% from 2025 to 2030. Regulatory compliance is a significant trend impacting the U.S. IT and telecom cybersecurity landscape. With the introduction of stringent data protection regulations, such as the California Consumer Privacy Act (CCPA) and various sector-specific guidelines, organizations must ensure compliance to avoid penalties and reputational harm. This regulatory pressure is driving investment in cybersecurity solutions that facilitate compliance, including data encryption, identity management, and comprehensive auditing capabilities.

Europe IT And Telecom Cyber Security Market Trends

The IT & telecom cyber security market in Europe is anticipated to grow at a significant CAGR from 2025 to 2030, owing to the growing adoption of advanced cybersecurity technologies, including artificial intelligence (AI), machine learning, and automation. European companies are increasingly leveraging these technologies to enhance threat detection, response capabilities, and overall security posture.

The UK IT & telecom cyber security market is expected to grow at a rapid CAGR during the forecast period, due to growing cyber incidents highlighting vulnerabilities within supply chains, prompting organizations to focus more on securing their supply chain networks. As businesses increasingly rely on third-party vendors and partners, the risk of cyber threats infiltrating through these connections has become a significant concern. Organizations are adopting strategies to assess the cybersecurity posture of their suppliers, implement stringent security requirements, and conduct regular audits to mitigate risks.

The IT & telecom cyber security market in Germany held a substantial market share in Europe in 2024. The increasing awareness of the cyber skills gap is driving initiatives aimed at developing a skilled cybersecurity workforce in Germany. The country is investing in education and training programs to address the shortage of qualified professionals in the cybersecurity field. Organizations are collaborating with academic institutions and industry partners to create training initiatives, internships, and certification programs that foster the development of new cybersecurity talent.

Asia Pacific IT And Telecom Cyber Security Market Trends

The IT & telecom cyber security market in Asia Pacific is anticipated to grow at a significant CAGR of 16.3% from 2025 to 2030, driven by the growing adoption of cloud services. As businesses migrate their operations to the cloud, they face new challenges in securing their data and applications. Consequently, there is a surge in demand for cloud security solutions that offer features such as encryption, identity and access management, and threat detection. Organizations are increasingly seeking to implement shared responsibility models to ensure that both cloud providers and users are accountable for security.

The Japan IT & telecom cyber security market is expected to grow at a rapid CAGR during the forecast period. The Japanese government has implemented various initiatives to enhance national cybersecurity, particularly in response to the increasing frequency of cyber-attacks. The establishment of the Cybersecurity Strategy Council and the National Center of Incident Readiness and Strategy for Cybersecurity (NISC) signifies a concerted effort to boost defenses. These initiatives include setting stricter regulations for data protection and cybersecurity, particularly for critical infrastructure sectors such as finance, healthcare, and telecommunications.

The IT & telecom cyber security market in China held a substantial market share in Asia Pacific in 2024, owing to the growing adoption of advanced technologies such as artificial intelligence (AI) and big data analytics in cybersecurity practices. Chinese companies are leveraging these technologies to enhance their threat detection and response capabilities. AI-driven security solutions can analyze vast amounts of data in real-time, identify anomalies, and predict potential threats, allowing organizations to proactively mitigate risks.

Key IT And Telecom Cyber Security Company Insights

Key players operating in the global market includePalo Alto Networks, Inc.,Cisco Systems, Inc.,Broadcom, CrowdStrike, and IBM Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key IT And Telecom Cyber Security Companies:

The following are the leading companies in the IT and telecom cyber security market. These companies collectively hold the largest market share and dictate industry trends.

- AO Kaspersky Lab

- Broadcom

- Check Point Software Technology Ltd.

- Cisco Systems, Inc.

- CrowdStrike

- IBM Corporation

- McAfee, Inc.

- Microsoft

- Palo Alto Networks, Inc.

- Sophos

Recent Developments

-

In September 2024, Broadcom, Comcast, and Charter Communications announced a collaborative effort to develop Unified DOCSIS chipsets for smart amplifiers, network nodes, and cable modems, facilitating both FDX and ESD versions of the DOCSIS 4.0. The partnership aims to significantly enhance DOCSIS networks by integrating advanced Artificial Intelligence and Machine Learning, leveraging Broadcom’s embedded Neural Processing Unit (NPU) in network nodes, smart amplifiers, and modems. These advancements aim to enable operators to boost operational efficiency and enhance network security and reliability with features like advanced cybersecurity, intrusion detection, and phishing protection to combat AI-driven threats.

-

In March 2024, Cisco completed the acquisition of Splunk, an American software company paving the way for enhanced visibility and insights across an organization’s digital landscape. This move allows Cisco to offer distinctive solutions tailored for networking, security, and operations leaders. Coupled with its investments in channels and AI, this acquisition enables customers to unlock business value than before.

IT And Telecom Cyber Security Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.47 billion

Revenue forecast in 2030

USD 76.73 billion

Growth rate

CAGR of 14.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report component

Revenue forecast, company share, competitive landscape, growth factors, and trends

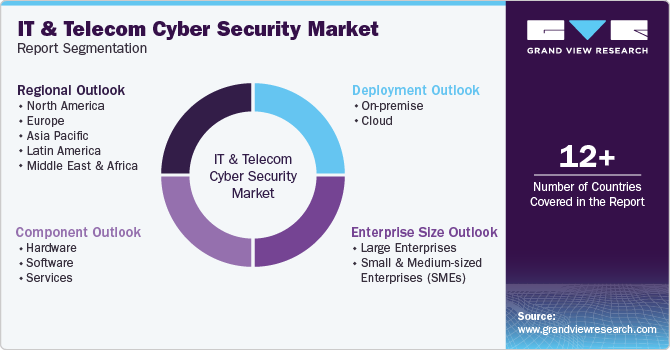

Segments covered

Component, deployment, enterprise size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea, Brazil, UAE, Kingdom of Saudi Arabia, and South Africa

Key companies profiled

AO Kaspersky Lab; Broadcom; Check Point Software Technology Ltd.; Cisco Systems, Inc.; CrowdStrike; IBM Corporation; McAfee, Inc.; Microsoft; Palo Alto Networks, Inc.; Sophos

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT And Telecom Cyber Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IT & telecom cyber security market report based on component, deployment, deployment, enterprise size, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.