- Home

- »

- Medical Devices

- »

-

Japan Contract Development & Manufacturing Organizations Market Report, 2030GVR Report cover

![Japan Contract Development & Manufacturing Organizations Market Size, Share & Trends Report]()

Japan Contract Development & Manufacturing Organizations Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (API, Drug Product), By Workflow, By Application (Oncology, Hormonal, Glaucoma, CVD), By Service, By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-985-5

- Number of Report Pages: 127

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

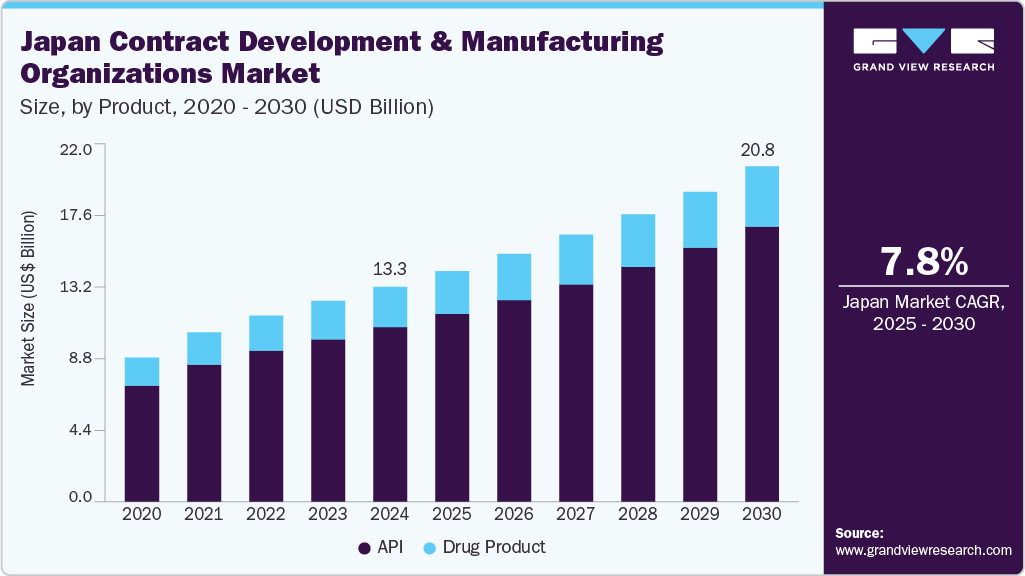

The Japan contract development and manufacturing organizations market size was estimated at USD 13.31 billion in 2024 and is projected to grow at a CAGR of 7.77% between 2025 and 2030. Key factors driving this growth include the rising demand for biopharmaceuticals, an increasing disease burden, and a growing elderly population. Moreover, increasing investments by contract development and manufacturing organizations (CDMOs) in expanding their facilities and services are expected to drive market growth further during the forecast period. The biopharmaceutical industry's margins also shrank due to rising pricing pressure, regulatory challenges, and patent expiration. Contract services were viewed as a "strategic competitive weapon" by biopharmaceutical and pharmaceutical companies because they assisted in overcoming these issues. These services save their customers money. They also helped save time, which could be efficiently utilized in operating and managing a manufacturing & research facility.

The pharmaceutical industry in Japan is highly regulated and complex. To navigate these challenges and streamline the drug development and manufacturing process, CDMOs play an essential role. For instance, according to the International Trade Administration, Japan is the third-largest pharmaceutical market in the world. This significant market size creates a strong demand for efficient and scalable drug manufacturing solutions, positioning CDMOs as critical partners in meeting domestic and international market needs. Pharmaceutical companies can navigate the regulatory complexities by utilizing the expertise and infrastructure of CDMOs, enhancing compliance with stringent standards, and accelerating the time-to-market for their products, driving the CDMOs market growth in Japan.

Cancer is one of the major causes of death in Japan. According to the data published by NCBI in September 2023, the prevalence of cancer in Japan is projected to reach 3,665,900 by 2050. The increase in cancer cases is mainly due to a significant increase in female survivors. These factors are attracting the interest of researchers in developing new cancer treatments. As of October 2024, ClinicalTrial.gov stated that over 2,294 studies were registered for cancer in Japan. The high burden of the disease is expected to boost the demand for new treatment options for cancer in the country. This is further expected to improve the demand for CDMO services in Japan.

Furthermore, according to the data published by the open-access government in December 2023, more than 30% of the total population in Japan is above 60. The same article also stated that more than one in ten people are 80 years old or older. Therefore, an increasing aging population would further lead to growing cases of several diseases such as cataract & refractive errors, hearing loss, osteoarthritis, COPD, diabetes, cardiovascular diseases, and dementia. Increasing cases of age-related disorders would further boost the demand for effective treatment options, which will further drive the growth of the Japan contract development and manufacturing organizations industry.

Opportunity Analysis

Regulatory changes have significantly improved the speed and efficiency of pharmaceutical development and market entry in Japan. The Pharmaceuticals and Medical Devices Act (PMD Act) and initiatives like the Priority Medicines (PRIME) Initiative are designed to accelerate the approval process for innovative treatments, particularly regenerative medicines, gene therapies, and biologics.

Furthermore, regulatory authorities in Japan have accelerated the approval process for regenerative medicines and gene therapies. The implementation of the Pharmaceuticals and Medical Devices Act (PMD Act), along with the 21st Century Cures Act and the PRIME (Priority Medicines) Initiative, has significantly enhanced access to regenerative medicines. These efforts by regulatory agencies are anticipated to drive the demand for the development and manufacturing of regenerative therapies in the country. Biosimilars are highly similar versions of biologics, are comparatively cheaper than biologics, and are equally effective. These features of biosimilars are expected to improve their adoption in Japan, which is further anticipated to improve the demand for CDMO services for biosimilars in the country.

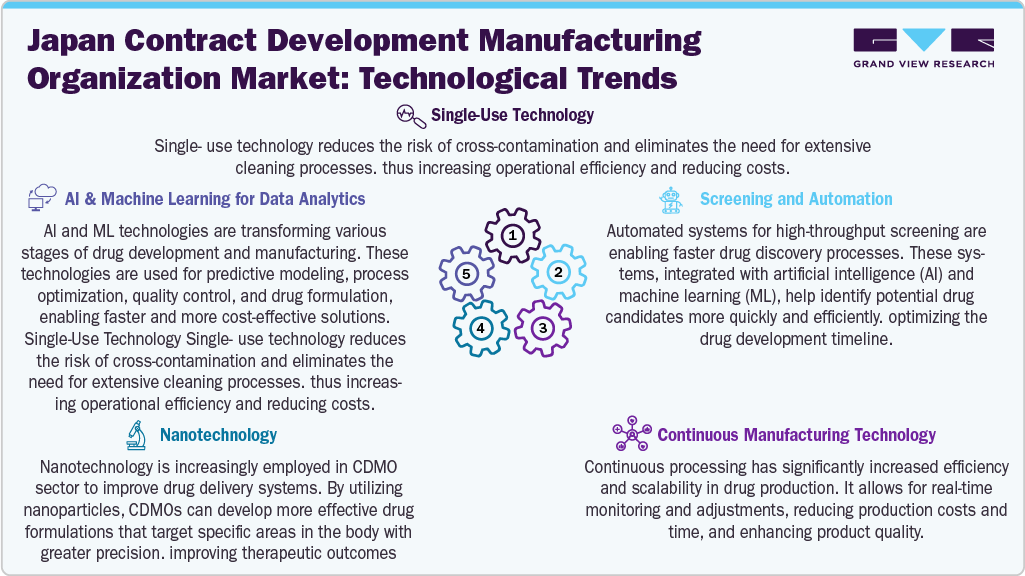

Technological Advancements

Technological advancements are reshaping the CDMO landscape in Japan by improving production efficiency, scalability, and product quality across various stages of drug development. Continuous manufacturing processes are widely adopted, allowing real-time monitoring, reduced production costs, and enhanced consistency. Moreover, single-use technologies, particularly in biologics manufacturing, are gaining traction by minimizing cross-contamination risks and reducing cleaning and validation needs, thereby accelerating operational turnaround. Integrated with AI and ML, high-throughput screening systems further support rapid identification of drug candidates, optimizing development timelines and resource allocation.

Moreover, advanced cell and gene therapy platforms enable faster and more efficient production of next-generation biologics, reinforcing Japan’s position as a leader in this space. Nanotechnology is also increasingly utilized for targeted drug delivery, enhancing therapeutic efficacy and precision. In parallel, AI and ML applications in predictive modeling, quality control, and process optimization drive cost efficiency and regulatory compliance. These digital and technological innovations collectively empower CDMOs in Japan to deliver faster, more reliable, and cost-effective solutions, positioning them as strategic partners in the global pharmaceutical supply chain.

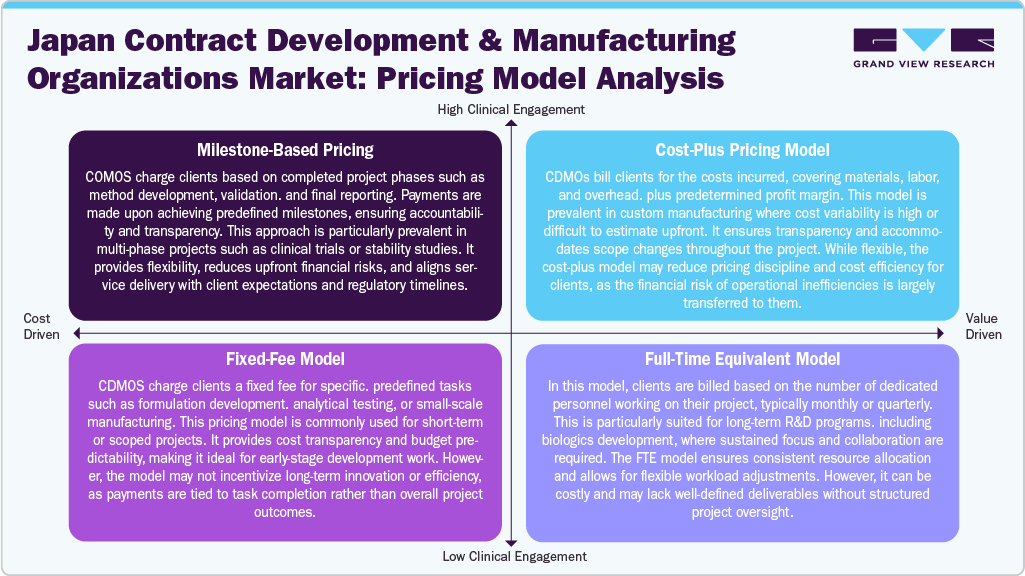

Pricing Model Analysis

The pricing model for drug development and manufacturing services in Japan's CDMO market is evolving to accommodate increasing project complexity, innovation, and global regulatory expectations. The milestone-based pricing model is widely adopted for multi-phase projects such as clinical trials, scale-up, or regulatory submissions. This model ties payments to completing specific project stages, ensuring transparency, aligning incentives, and reducing upfront financial risks. Additionally, cost-plus pricing is frequently used in custom manufacturing, where the actual cost of production is reimbursed along with a pre-agreed profit margin, offering flexibility in unpredictable or variable-cost scenarios.

Moreover, the Fixed-Fee Model remains suitable for standardized CDMO services like analytical method development or pilot batch production, but requires well-defined project scopes to mitigate financial and operational risks. The FTE-based model supports long-term, resource-intensive projects, offering dedicated staffing and deep integration, especially in biologics development. Risk-sharing and revenue-sharing models are increasingly emerging for novel therapeutics, where CDMOs receive compensation through milestone payments, royalties, or a share in future revenues. These pricing strategies reflect the growing demand for flexible, partnership-driven approaches, tailored to client goals, project timelines, and regulatory milestones in the market.

Market Concentration & Characteristics

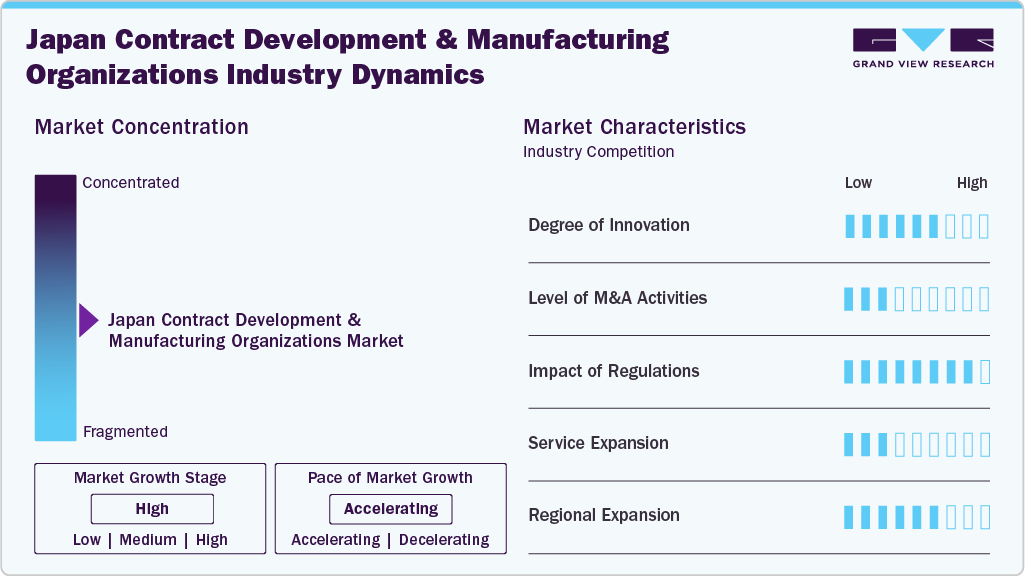

The Japan contract development and manufacturing organizations market is characterized by a moderate-to-high degree of innovation, including rapid advancements. Japan's strong focus on innovation and technology adoption allows CDMOs to leverage advanced manufacturing processes, automation, and digitalization to enhance efficiency and quality control. Furthermore, increasing demand for personalized medicine presents opportunities for CDMOs to develop tailored treatments and therapies that cater to individual patient needs, leveraging advancements in biotechnology and data analytics. For instance, in January 2024, AGC Biologics announced plans to establish a new manufacturing facility at its Yokohama Technical Center in Japan, with services extending from preclinical to commercial stages for mammalian-based protein biologics, cell therapies, and mRNA products.

The Japan contract development and manufacturing organizations industry is also characterized by the leading players with moderate levels of merger and acquisition (M&A) activity and product launches. Market players like Lonza, CMIC HOLDINGS Co., LTD., CordenPharma International, Laboratory Corporation of America, Cambrex Corporation, Bushu Pharmaceuticals, and others are involved in research expenditures, new product launches, and merger and acquisition activities. For instance, in May 2024, Japan's AGC Biologics and Netherlands-based BioConnection announced a strategic partnership to offer end-to-end biopharmaceutical development and manufacturing services. This collaboration aims to provide a comprehensive gene-to-vial solution, integrating AGC Biologics' drug substance capabilities with BioConnection's expertise in aseptic filling of vials and syringes for both clinical and commercial production.

Stringent regulatory requirements, particularly in pharmaceuticals and biotechnology, demand heightened compliance measures from CDMOs. These include adherence to Good Manufacturing Practices (GMP), stringent quality control standards, and thorough documentation practices. In addition, evolving regulatory frameworks necessitate continuous adaptation to ensure product safety, efficacy, and quality throughout the development and manufacturing processes. CDMOs must stay abreast of regulatory updates, embrace digitalization for enhanced documentation and traceability, and invest in robust quality management systems to navigate the complex regulatory landscape effectively.

The Japan contract development and manufacturing organizations industry is characterized by a moderate level of service expansion with the help of specialized expertise. CDMOs globally, including those in Japan, exhibited optimism through investments in innovative technologies and facility expansions. These investments, often in collaboration with ambitious joint ventures, were pivotal in enhancing capabilities to meet the heightened demand for CDMO services amidst the global health crisis. Such advances in the near future might keep service expansion at a moderate level.

The regional expansion factor is crucial for any service provider in the market space. CDMO outsourcing facilities are expanding to accommodate this demand, equipped with state-of-the-art technology and expertise to characterize these complex therapies accurately. For instance, in March 2025, Taiwan’s Amaran Biotech signed an MoU with Japan’s Nippon Fine Chemical and its subsidiary Zillion Fine Chemicals to expand CDMO services for nanoparticle-based drugs, including liposomes and lipid nanoparticles (LNPs). The collaboration leverages Amaran’s automated aseptic filling capabilities and Nippon’s expertise in phospholipid technology to offer end-to-end manufacturing solutions.

Product Insights

The API segment dominated the Japan CDMO market with a market share of 81.14% in 2024 and is also expected to witness the fastest growth over the forecast period. Growing burden of diseases such as cancer, diabetes, and cardiovascular disorders, initiatives by the government to improve access to generic drugs, and high demand for biopharmaceuticals in Japan are some of the primary factors contributing to the segment growth. The CDMOs in Japan are actively trying to improve the manufacturing capacity of API to fulfill future demands. For instance, in September 2024, AGC Biologics, a global biopharmaceutical CDMO, and Medinet, a Japanese cell processing company, signed a strategic partnership to enhance cell therapy CDMO services in Japan. The collaboration enhanced AGC's global manufacturing network and Medinet's extensive experience with Japanese startups and academia to gain a competitive edge in the market.

The drug product segment is expected to grow at the fastest CAGR over the forecast period, driven by the rising demand for advanced biologics, biosimilars, and cell and gene therapies. While traditional oral solid dosage forms continue to hold a significant share due to their convenience and stability, there is a shift toward more specialized formulations like injectables and personalized treatments. This shift is largely due to the increasing prevalence of chronic and complex diseases, which require more targeted and effective drug delivery systems. As these therapies often involve complex development and manufacturing processes, pharmaceutical companies increasingly rely on CDMOs for their specialized expertise, infrastructure, and regulatory compliance capabilities, further driving growth in this segment.

Workflow Insights

The commercial segment dominated the market in 2024, driven by rising demand for generic drugs and increased approvals for regenerative medicines and biopharmaceuticals. Japan’s aging population and high rates of chronic diseases like cancer, cardiovascular conditions, and Alzheimer’s contribute to a growing need for effective treatments. The country’s leadership in regenerative medicine, supported by a progressive regulatory framework, accelerates the approval of innovative therapies. Japanese pharmaceutical companies are also partnering with AI startups to improve drug development, reduce costs, and enhance manufacturing efficiency. These factors highlight the critical role of CDMOs in supporting the commercial drug manufacturing sector and addressing its healthcare needs.

The clinical segment is projected to grow at the fastest CAGR over the analysis timeframe. The high segmental growth is owing to the introduction of the Clinical Trial Act in 2018, which aimed to improve the quality and integrity of clinical research. According to the WHO, this act and Japan's commitment to enhancing its regulatory framework have led to a significant increase in clinical trials, with approximately 65,000 conducted in 2024. This growth directly benefits CDMOs, as they provide crucial services such as drug formulation, manufacturing of clinical trial materials, and regulatory compliance. As clinical trials expand, CDMOs play a key role in supporting pharmaceutical companies, ensuring high-quality, compliant trial processes, and reinforcing Japan's global pharmaceutical research and development position.

Application Insights

The oncology segment dominated the Japan CDMO industry in 2024. The oncology market is likely to expand with increasing cancer cases in Japan. The segment's market is likely to expand with increasing cancer cases globally. For instance, the Cancer Atlas mentioned that the number of cancer cases is expected to reach 29 million globally by 2040. Furthermore, the WHO mentioned that in 2020, cancer was the leading cause of death globally, affecting approximately 10 million fatalities. Furthermore, recent trends have shown a vast migration in pharmaceutical products with significant advancements in cancer treatment. In addition, the growing demand for oncology drugs & therapies, fueled by innovative targeted treatments, immunotherapies, and personalized medicine approaches, contributes to the market. Increasing patent expirations, rising pharmaceutical research & development investments, and growing requirements for oncology drugs & biologic innovations are the factors driving the oncology pharmaceutical CDMO market’s growth.

The cardiovascular diseases segment is estimated to witness the second fastest CAGR over the forecast period. The high burden of the geriatric population is increasing the number of cardiovascular diseases in the country. Furthermore, there are a significant number of people in Japan with sedentary lifestyles, which include eating fast food, a lack of exercise, smoking, and alcohol consumption. Moreover, the increasing prevalence of hypertension complicates the management of cardiovascular conditions. To address these challenges, there is a growing emphasis on collaboration among pharmaceutical companies and CDMOs to develop innovative therapies and improve patient care. In addition, initiatives focused on preventive healthcare and public awareness campaigns are essential in promoting heart health and reducing the burden of cardiovascular diseases globally and in Japan.

Service Insights

The contract manufacturing segment dominated the market in 2024. The success of the contract manufacturing market is driven by increasing overall investment, growing quick entry of products into the markets, and the range of services offering are some advantages offered by contract manufacturing organizations, which has led companies to outsource their pharmaceutical/biotechnology manufacturing. Furthermore, the growing entry of new market players and the rising research & development (R&D) budget are expected to fuel the segment growth over the forecast period. Furthermore, in Japan, growing investment among companies in CDMOs is expected to drive the segment. For instance, in January 2024, Adragos Pharma, a CDMO based in Germany, mentioned that it would invest significantly in the Japanese pharmaceutical contract manufacturing industry. Further, the company mentioned that by 2028, it will invest 2.5 billion JPY in Saitama (Kawagoe plant), Japan, to produce around 3 billion tablets annually.

On the other hand, the contract development segment is projected to grow at the fastest CAGR over the analysis timeframe. The high segmental growth is driven by increased competitive drug development and growing demand for pharmaceutical & biotechnology products, including innovative medications & generic medications. In addition, advancements in API manufacturing and increasing focus on drug development, manufacturing, and regulatory compliance requirements are key factors propelling segment growth. Moreover, the services offer various advantages for pharmaceutical/biotechnology companies, such as low-cost product development, reducing a product's overall manufacturing cost, increased production capacity, and the ability to focus on core development activities such as drug discovery and drug innovations, which are anticipated to boost the market over the forecast period.

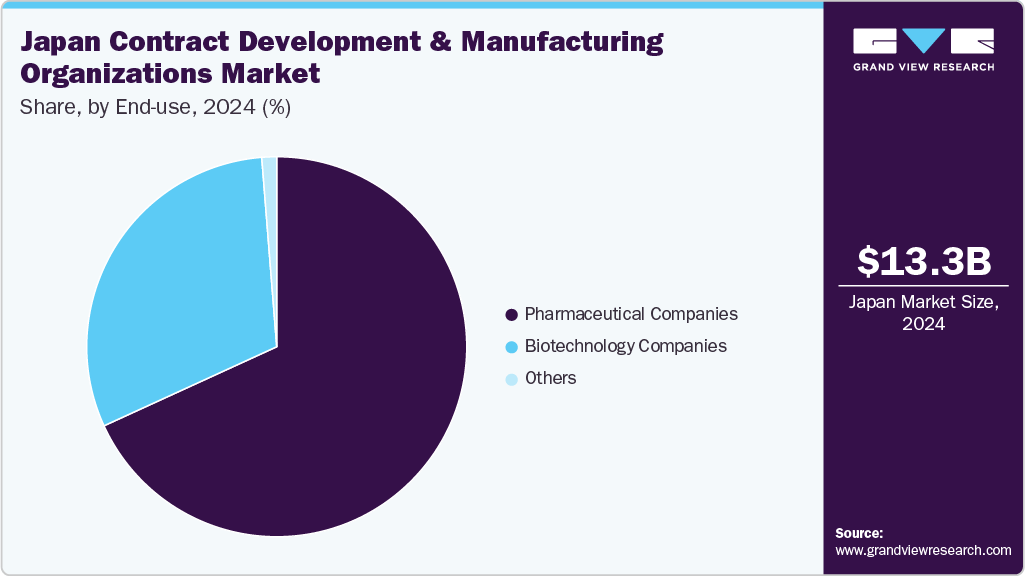

End Use Insights

Based on end use, the pharmaceutical companies segment held the largest share in the market in 2024. The segment growth is owing to the growing trend of outsourcing end-to-end services, especially among small and midsized pharmaceutical companies lacking therapeutic development expertise. Besides, an increase in R&D spending by pharmaceutical companies for developing potential novel products and a rise in investments by CDMOs to develop core capabilities are expected to boost the market in the coming decade. Furthermore, pharmaceutical companies are expanding their global footprint along with CDMO to cater to increased client needs & access new market needs. This includes establishing facilities in emerging Asia Pacific markets to capitalize on the growing demand, further lowering the operating costs. Such factors are anticipated to drive the market growth.

On the other hand, the biopharmaceutical companies segment is anticipated to witness the fastest CAGR over the estimated timeline. The segment growth is due to the increasing trend of outsourcing services among biotechnology companies. Besides, continuous efforts to enhance productivity and efficiency drive biotech companies to focus on core competencies and outsource their functions to CDMOs. In addition, the presence of stringent regulatory requirements in developed countries and the lack of capacity & capability to perform functions are expected to propel segment growth over the forecast period. In addition, lowering profit margins, coupled with rising competition in the market, are contributing to market growth. In addition, easy access to industry experts is another factor accelerating the demand for outsourcing services. For instance, in May 2024, Enzene Biosciences launched a new drug discovery division. The new division will expand the company's CDMO services to the biotech industry & complement its EnzeneXTM-equipped biologics manufacturing site, which will open in the U.S. Such factors are anticipated to drive the segment.

Key Japan CDMO Company Insights

Some of the key players operating in the market include CordenPharma; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Lonza; Laboratory Corporation of America Holdings; Catalent, Inc.; Thermo Fisher Scientific, Inc. (Pantheon); Samsung Biologics; and FUJIFILM Corporation. The major players operating across the Japan CDMO market are focused on the adoption of inorganic strategic initiatives such as mergers, partnerships, and acquisitions.

Key Japan CDMO Companies:

- LabCorp

- Wuxi AppTec, Inc.

- Lonza

- Recipharm AB

- Samsung Biologics

- Catalent, Inc.

- CordenPharma International

- Cambrex Corporation

- Thermo Fisher Scientific, Inc.

- FUJIFILM Diosynth Biotechnologies

- Sumitomo Chemical Company, Limited

- CMIC HOLDINGS Co., LTD.

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

Recent Developments

-

In March 2025, Blackstone announced the acquisition of a 60% majority stake in CMIC Co., Ltd., while CMIC HOLDINGS retained the remaining 40%. The partnership aimed to enhance CMIC’s capabilities and expand its global reach in the evolving pharmaceutical landscape. In December 2024, Cambrex entered into a strategic agreement with Eli Lilly and Company to enhance clinical development capabilities for Lilly's biotech collaborators. Cambrex collaborates with Lilly's Catalyze360-ExploR&D, an early external innovation and collaboration arm, to provide comprehensive services, including drug substance and product manufacturing, analytical services, and R&D expertise.

-

In December 2024, Sumitomo Chemical and Sumitomo Pharma announced the establishment of a joint venture, RACTHERA Co., Ltd. This strategic move aimed to accelerate the development of regenerative medicine and cell therapy by leveraging the combined expertise of both companies. Sumitomo Pharma brings advanced knowledge in iPS cell-derived therapies, including treatments for Parkinson's disease and retinal disorders, while Sumitomo Chemical contributes its strengths in industrial engineering and quality management.

Japan Contract Development & Manufacturing Organizations Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.28 billion

Revenue Forecast in 2030

USD 20.76 billion

Growth rate

CAGR of 7.77% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product type, workflow, application, service, end use

Key companies profiled

CordenPharma; WuXi AppTec; Cambrex Corporation; Recipharm AB.; Lonza; Novo Holdings A/S (Catalent, Inc.); Labcorp.; Thermo Fisher Scientific, Inc.; Samsung Biologics; FUJIFILM Corporation (FUJIFILM Diosynth Biotechnologies); Sumitomo Chemical Co. Ltd.; CMIC HOLDINGS Co., LTD.; Bushu Pharmaceuticals Ltd; Nipro Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Contract Development & Manufacturing Organizations Market Report Segmentation

This report forecasts revenue growth at segment levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan CDMO market report based on product, workflow, application, service, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

API

-

Synthesis

-

Synthetic

-

Solid

-

Liquid

-

-

Biotech

-

-

Type

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Antibody Drug Conjugate (ADC)

-

Others

-

-

Drug

-

Innovative

-

Generic

-

-

Manufacturing

-

Continuous manufacturing

-

Batch manufacturing

-

-

-

Drug Product

-

By Drug Type

-

Oral solid dose

-

Semi-Solid Dose

-

Liquid Dose

-

Others

-

-

By Type

-

Innovative

-

Generic

-

-

By Molecule

-

Small Molecule

-

Large Molecule

-

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Commercial

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Hormonal

-

Glaucoma

-

Cardiovascular Diseases

-

Diabetes

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Development

-

Contract Manufacturing

-

Packaging

-

Quality Control and Assurance

-

Visual Inspection

-

Others

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Others

-

Frequently Asked Questions About This Report

b. The Japan contract development and manufacturing organization market size was estimated at USD 13.31 billion in 2024 and is expected to reach USD 14.28 billion in 2024.

b. The Japan contract development and manufacturing organization market is expected to grow at a compound annual growth rate of 7.77% from 2025 to 2030 to reach USD 20.76 billion by 2030.

b. Based on product, the API segment dominated the market and accounted for the largest revenue share of 81.14% in 2024. Growing demand for new drugs in Japan and high disease are expected to support segment growth.

b. Some of the key market players operating in the Japan CDMO market are, CordenPharma; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Lonza; Laboratory Corporation of America Holdings; Catalent, Inc.; Thermo Fisher Scientific, Inc. (Pantheon); Samsung Biologic; FUJIFILM Corporation; NIPRO; Sumitomo Chemical Co., Ltd.; CMIC Holdings Co., Ltd.; and Bushu Pharmaceuticals Ltd.

b. Key factors that are driving the Japan CDMO market growth include growing demand for biopharmaceuticals, high burden of diseases and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.