- Home

- »

- Consumer F&B

- »

-

Jerky Snacks Market Size And Share, Industry Report, 2030GVR Report cover

![Jerky Snacks Market Size, Share & Trends Report]()

Jerky Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Beef, Pork, Poultry), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-426-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Jerky Snacks Market Summary

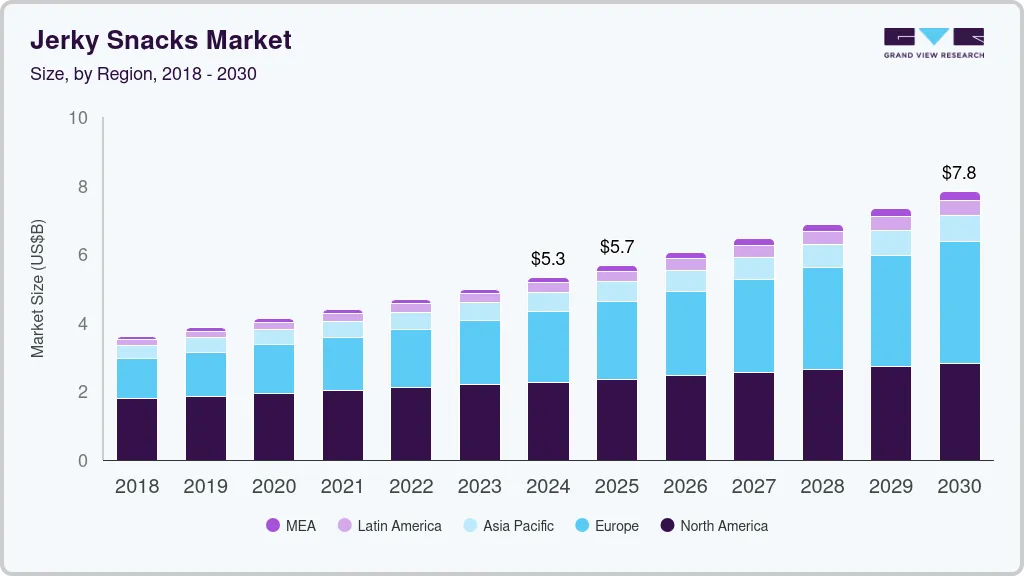

The global jerky snacks market size was estimated at USD 5,313.7 million in 2024 and is projected to reach USD 7,814.1 million by 2030, growing at a CAGR of 6.7% from 2025 to 2030. Increasing consumer demand for protein-rich and low-fat snacks is a significant driver.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, beef accounted for a revenue of USD 2,862.9 million in 2024.

- Poultry is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,313.7 million

- 2030 Projected Market Size: USD 7,814.1 Million

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

As health and fitness awareness rises, more individuals seek convenient, nutritious snack options, and jerky fits perfectly. Additionally, expanding retail channels, including supermarkets, hypermarkets, and online platforms, has made jerky snacks more accessible to a broader audience.

Jerky snacks are gaining popularity due to their high protein content. North America and Europe consumers are shifting from carbohydrate-heavy snacks to more nutritious options. There has been a notable change in consumer preferences towards healthy snacks in recent years, with a growing demand for complete ingredient transparency on packaging. Shoppers increasingly prefer products that feature clean labels, highlighting qualities such as non-GMO, gluten-free, low sodium, no artificial ingredients, minimal processing, and no antibiotics. These trends are significantly shaping the industry.

The market is also benefiting from the growing popularity of different flavors and innovative product offerings, which attract a variety of consumers. Moreover, advancements in packaging technologies that enhance the shelf life and quality of jerky snacks are contributing to the market's growth. Lastly, the rise in disposable incomes and changes in lifestyle and eating habits, particularly in developing regions, are further propelling the market expansion.

Product Insights

Beef dominated the market with the largest revenue share of 50.7% in 2024. This prominence is largely due to consumers' preference for beef as a protein source. Beef jerky is rich in protein and offers a robust flavor, making it a favorite among snack enthusiasts. The market's growth in this segment is also fueled by the availability of various flavors and product innovations, catering to diverse taste preferences. The strong consumer demand for convenient, high-protein snacks has solidified beef jerky's leading position in the market.

Poultry is expected to grow at the fastest CAGR of 7.3% over the forecast period. Poultry jerky is perceived as a healthier alternative to traditional red meat jerky, appealing to health-conscious consumers. It is often seen as a leaner protein option with lower fat content. Secondly, the growing interest in diverse and exotic flavors has led to increased experimentation with poultry jerky, attracting a broader consumer base. The demand for organic and free-range poultry products also boosts this segment's appeal. Additionally, manufacturers' innovative product offerings and marketing strategies play a significant role in driving the growth of poultry jerky in the market.

Distribution Channel Insights

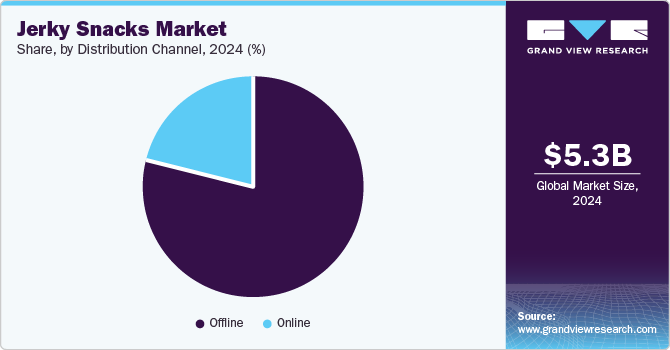

The offline channel dominated the market with the largest revenue share in 2024. This dominance is attributed to the established presence and reach of physical retail stores such as supermarkets, hypermarkets, and convenience stores. These outlets provide a tactile shopping experience, allowing consumers to see, feel, and choose their jerky snacks, which enhances purchasing confidence and satisfaction. Additionally, offline channels often offer various products and brands, catering to diverse consumer preferences. The trust and convenience associated with brick-and-mortar stores, promotional activities, and in-store marketing have significantly contributed to the robust performance of the offline channel in the jerky snacks market.

The online channel is expected to grow at the fastest CAGR over the forecast period. The increasing penetration of smartphones and internet connectivity has made online shopping more accessible and convenient for consumers. Consumers appreciate the ease of browsing and purchasing from the comfort of their homes. Furthermore, e-commerce platforms often offer a wider variety of products and brands, along with customer reviews and ratings, which help buyers make informed decisions. Additionally, online retailers' attractive discounts, promotions, and subscription services further drive consumer preference for online shopping. The growing trend of manufacturers' direct-to-consumer sales also boosts the growth of online channels.

Regional Insights

North America's jerky snacks market dominated the global market, with the largest revenue share of 42.8% in 2024. The region's strong demand for high-protein, low-fat snacks aligns perfectly with the benefits offered by jerky products. Additionally, North America has a well-established market for convenience foods, with consumers willing to pay a premium for high-quality, flavorful snacks. The presence of leading jerky manufacturers and brands in the region also significantly drives market growth. Moreover, the popularity of different flavors and innovative product offerings continues to attract a wide range of consumers.

U.S. Jerky Snacks Market Trends

The U.S. jerky snacks market is expected to grow significantly over the forecast period. A strong culture of outdoor activities and on-the-go lifestyles drives the country's growth. Americans value convenient, protein-packed snacks that cater to their busy schedules and fitness-oriented routines. The extensive availability of various jerky flavors and formats in supermarkets, convenience stores, and specialty shops further boosts market growth. Additionally, the rise of health-conscious consumers seeking low-fat, high-protein alternatives to traditional snacks has amplified the demand for jerky products. The presence of numerous local and established brands innovating in product offerings and marketing strategies also plays a critical role in driving market expansion in the U.S.

Asia Pacific Jerky Snacks Market Trends

The Asia Pacific's jerky snacks market held a considerable share in 2024. Increasing disposable incomes and urbanization are leading to shifts in dietary habits, with a growing preference for convenient and nutritious snack options. The expanding middle class in countries such as China and India drives demand for premium and imported food products, including jerky snacks. Additionally, the influence of Western eating habits and the rising trend of health and fitness are propelling the popularity of high-protein snacks like jerky. The region's diverse culinary preferences also encourage manufacturers to introduce innovative flavors tailored to local tastes, further fueling market growth.

Europe Jerky Snacks Market Trends

Europe's jerky snacks market is expected to grow at the fastest CAGR of 9.4% over the forecast period. The increasing awareness and demand for high-protein, low-fat snacks among health-conscious European consumers drive the market. Jerky snacks perfectly align with the rising trend of fitness and wellness, offering a convenient source of protein. Secondly, the expansion of retail networks and the presence of specialized health food stores have made jerky snacks more accessible to a broader audience. Additionally, introducing innovative flavors and product variations tailored to European tastes is attracting new consumers. The growing popularity of organic and clean-label jerky products also contributes to the market's robust growth.

Key Jerky Snacks Company Insights

Some key companies in the jerky snacks market include LINK SNACKS, INC., Old Trapper Smoked Products, Oberto Snacks Inc., The Hershey Company, General Mills Inc., and others.

-

Link Snacks, Inc., headquartered in Minong, Wisconsin, is a leading player in the meat snack industry. The company is renowned for its popular brands, such as Jack Link's, Peperami, and Bifi, which offer a wide range of beef jerky, pork salamis, and chorizo sticks.

-

Old Trapper Smoked Products, based in Forest Grove, Oregon, specializes in smoked meat snacks. Since its inception in 1969, Old Trapper has become a household name, known for its authentic handmade beef jerky and beef sticks.

Key Jerky Snacks Companies:

The following are the leading companies in the jerky snacks market. These companies collectively hold the largest market share and dictate industry trends.

- LINK SNACKS, INC.

- Old Trapper Smoked Products

- Oberto Snacks Inc.

- The Hershey Company

- General Mills Inc.

- Chef’s Cut Real Jerky Co

- Frito-Lay North America, Inc.

- Tillamook Country Smoker

- Conagra Brands

Recent Developments

-

In September 2024, Jack Link’s launched a limited-edition beef jerky flavor, Red Light Green Light, inspired by the Netflix series Squid Game. This unique snack combines sweet and spicy Korean Ssamjang flavors with Jack Link’s signature beef jerky, aiming to enhance the viewing experience as the series returns.

Jerky Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.67 billion

Revenue forecast in 2030

USD 7.81 billion

Growth Rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

LINK SNACKS, INC.; Old Trapper Smoked Products; Oberto Snacks Inc.; The Hershey Company; General Mills Inc.; Chef’s Cut Real Jerky Co; Frito-Lay North America, Inc.; Tillamook Country Smoker; Conagra Brands

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Jerky Snacks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global jerky snacks market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Beef

-

Pork

-

Poultry

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.