- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Kapok Fiber Market Size & Share, Industry Report, 2033GVR Report cover

![Kapok Fiber Market Size, Share & Trends Report]()

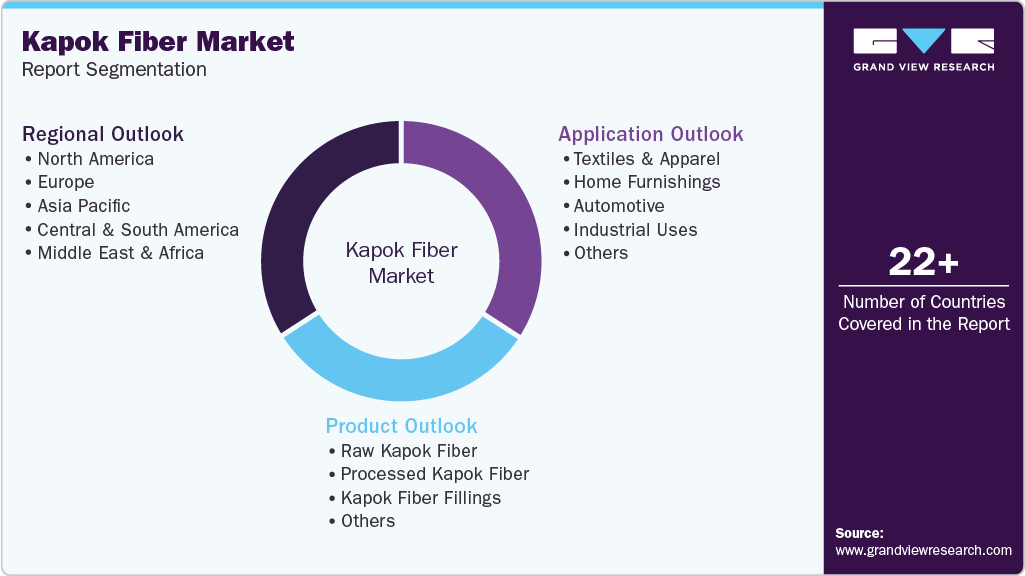

Kapok Fiber Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Textiles & Apparel, Home Furnishings, Automotive), By Product (Raw Kapok Fiber, Processed Kapok Fiber, Kapok Fiber Fillings), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-767-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kapok Fiber Market Summary

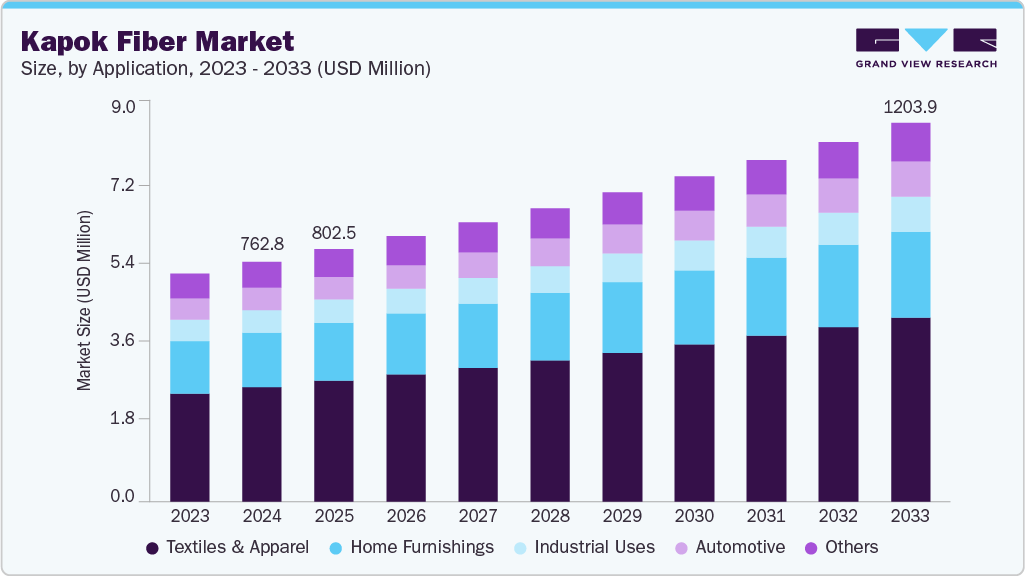

The global kapok fiber market size was estimated at USD 762.8 million in 2024 and is projected to reach USD 1203.9 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033, driven by the increasing consumer preference for sustainable and eco-friendly materials across various industries. As environmental concerns intensify, kapok fiber's natural biodegradability and lightweight properties position it as a favored alternative to synthetic fibers.

Key Market Trends & Insights

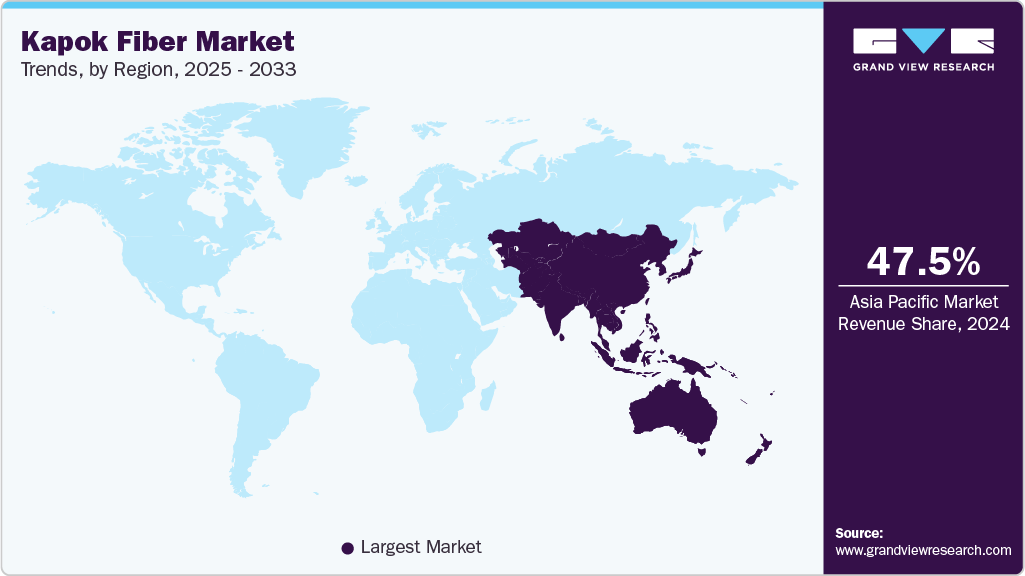

- Asia Pacific dominated the global kapok fiber industry with the largest revenue share of 47.5% in 2024.

- By product, the kapok fiber fillings segment is expected to grow at the fastest CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By application, the automotive segment is expected to grow at the fastest CAGR of 5.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 762.8 Million

- 2033 Projected Market Size: USD 1,203.9 Million

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

This trend is reflected in growing demand for kapok fiber in textile, bedding, and upholstery applications, where consumers seek natural, organic, and hypoallergenic products. The rising adoption of environmentally conscious lifestyles fuels this market growth by encouraging manufacturers to integrate kapok fiber into their offerings.Technological advancements in the processing of kapok fiber also contribute significantly to market expansion. Traditional challenges such as its hollow structure and difficulty in spinning have been mitigated through innovative processing techniques that enhance fiber durability and versatility. These improvements have widened the fiber’s applicability into new areas, including insulation materials and automotive components. Enhanced production efficiencies and product quality further attract industrial applications, allowing kapok fiber to increasingly substitute for synthetic fibers in various sectors. These advancements enable the market to capture a broader customer base.

Government regulations and growing corporate sustainability initiatives act as important catalysts for the market. Environmental policies worldwide increasingly favor the use of renewable, biodegradable raw materials, thereby encouraging the adoption of kapok fiber. Automotive, furniture, and construction industries are among those benefiting from such regulations as they seek compliant, eco-friendly materials for upholstery, insulation, and fillings. Furthermore, rising awareness and enforcement regarding indoor air quality and sustainable building practices amplify demand for natural fibers like kapok in both residential and commercial settings, promoting market growth.

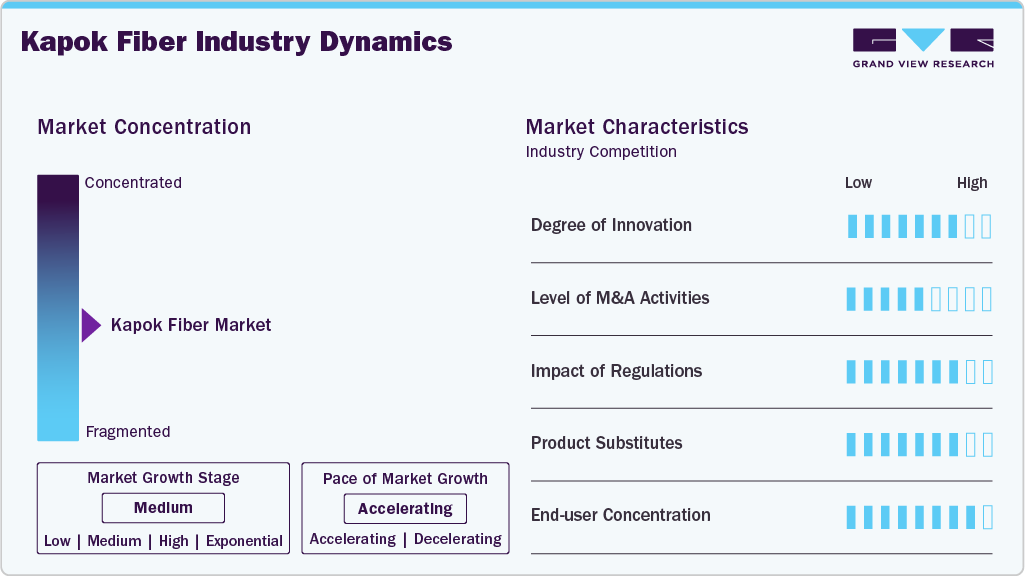

Market Concentration & Characteristics

The global market for kapok fiber exhibits a moderately concentrated structure with several established players and a growing number of new entrants focusing on sustainable natural fibers. The degree of innovation is increasingly pronounced, with advances in processing technologies addressing the inherent challenges of kapok’s hollow fiber structure, thereby improving its durability and applicability across diverse industries. Market consolidation through mergers and partnerships remains limited, but strategic collaborations aimed at expanding product portfolios and geographical reach are on the rise. Regulatory frameworks promoting sustainable and biodegradable materials bolster the market by favoring kapok fiber over synthetic substitutes. Substitution threats exist mainly from other natural fibers and synthetic materials, but kapok’s unique properties, such as biodegradability, hypoallergenic nature, and buoyancy, enhance its competitive positioning. End-user markets are moderately fragmented, spanning textiles, upholstery, automotive, and insulation sectors, with no single buyer dominating the demand landscape.

Innovation within the kapok fiber industry is driven primarily by the need to improve fiber processing methods to expand end-use applications, particularly in high-value segments such as medical textiles and eco-friendly home furnishings. While mergers and acquisitions are not yet widespread, collaborations and joint ventures reflect a strategic focus on sustainable product development and enhancing supply chain efficiencies. Regulatory impact is significant as global environmental standards increasingly emphasize the use of renewable, non-toxic, and biodegradable materials, which align well with kapok fiber’s natural origin. Service substitutes like synthetic fibers and alternative natural fibers continue to challenge the market but increasing consumer awareness about environmental and health benefits supports kapok’s growth. The end-user concentration is diversified, with the textile industry representing a key consumer base, alongside emerging demand from automotive and construction sectors, emphasizing sustainability in material sourcing.

Application Insights

Based on application, the textiles & apparel segment dominated the market, accounting for a revenue share of 47.7% in 2024, driven by the increasing demand for sustainable and eco-friendly materials in the fashion industry. Consumers are becoming more conscious of the environmental impact of synthetic fibers, leading to greater adoption of biodegradable and natural fibers like kapok. Its lightweight, moisture-resistant, and hypoallergenic properties make it a preferred choice for clothing, home textiles, and accessories. Investments in sustainable fashion and rising awareness of cruelty-free products further amplify market growth in this segment.

The automotive segment is expected to grow significantly at a CAGR of 5.7% over the forecast period, driven by its outstanding insulation, sound absorption, and lightweight qualities, which contribute to fuel efficiency and noise reduction in vehicles. As automotive manufacturers increasingly seek eco-friendly and renewable materials to reduce carbon footprints, kapok fiber offers an attractive alternative for upholstery, seat padding, and interior components. The trend towards greener vehicles, combined with regulatory emphasis on sustainability in automotive production, propels demand. Advancements in fiber treatment enhance durability and integration into composite materials, expanding its usage across vehicle models.

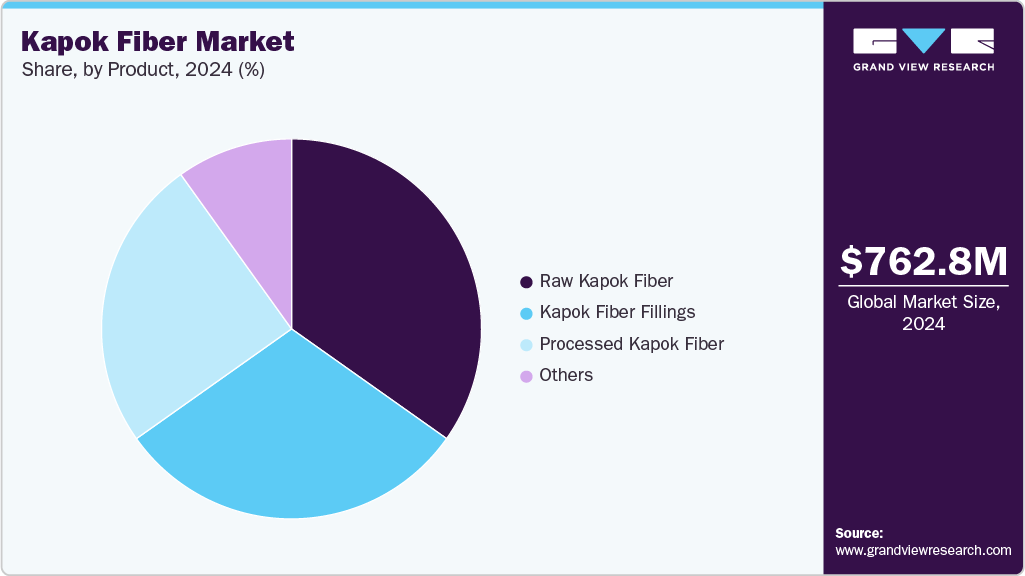

Product Insights

The raw kapok fiber segment dominated the market, accounting for a revenue share of 34.8% in 2024, driven by efforts to scale cultivation through agricultural research and improved harvesting techniques. The raw fiber’s natural buoyancy, water resistance, and thermal insulation properties support diverse industrial applications, from textile filling to insulation materials. Supportive government policies aiming to promote sustainable agriculture and diversified crop production further strengthen supply.

The kapok fiber fillings segment is anticipated to grow at the fastest CAGR of 5.6% during the forecast period, driven by demand for eco-friendly and hypoallergenic stuffing materials in bedding, upholstery, cushions, and consumer goods. Kapok fiber’s inherent softness, natural resilience, and resistance to dust mites and mold make it preferable over synthetic fillings, especially for health-conscious consumers. The growing trend toward organic home furnishing and sustainable product lines drives adoption.

Regional Insights

Asia Pacific kapok fiber industry held the largest share of 47.5% in the global market in 2024, primarily due to abundant raw material availability and established production infrastructure in countries such as China, Indonesia, and India. The textile and furniture sectors in this region experience rapid expansion, fueled by rising consumer preference for natural and sustainable products. Increasing export opportunities for kapok fiber products and government incentives promoting sustainable agriculture bolster the market. The growing middle-class population with higher disposable income and awareness of eco-friendly alternatives further accelerates regional demand. Innovations in kapok fiber processing and diversified applications reinforce market growth in the Asia Pacific.

China Kapok Fiber Market Trends

The kapok fiber industry in China is driven by the robust growth in electrical, electronics, and building industries, where kapok fiber is increasingly utilized in insulation, upholstery, and composite materials. The country’s large-scale investment in green building standards and environmentally friendly manufacturing practices boosts demand. China’s leading position as a raw material supplier also supports its dominant market share. Governments’ policies encouraging sustainable raw material use and growing consumer awareness about natural products enhance the adoption of kapok fiber. Furthermore, increasing integration of kapok fiber in automotive interiors and home furnishing products sustains growth.

North America Kapok Fiber Market Trends

The North America kapok fiber industry is driven largely by a growing consumer focus on eco-friendly and sustainable products across textiles, automotive, and bedding industries. Increasing awareness about environmental impact and preference for natural fibers over synthetics stimulates market demand. Advanced manufacturing capabilities and innovations in fiber processing further enhance product quality and widen applications in this region. Additionally, regulatory encouragement for biodegradable materials in various sectors supports kapok fiber adoption. Growth in premium home furnishing markets and medical textile applications are also important drivers in North America.

The U.S. kapok fiber industry specifically benefits from increasing demand for cruelty-free and hypoallergenic materials in home furnishings and personal care products. Environmental consciousness, paired with lifestyle shifts towards organic and natural materials, encourages manufacturers to incorporate kapok fiber, boosting market penetration. Investments in sustainable agriculture to increase kapok tree cultivation and supportive policies contribute to a stable raw material supply, aiding market growth. The presence of key fiber processors focusing on R&D for enhanced fiber properties adds further momentum. Rising interest in outdoor and sports equipment utilizing kapok also drives niche demand.

Europe Kapok Fiber Market Trends

The Europe kapok fiber industry is shaped by stringent sustainability regulations and a well-established eco-conscious consumer base. Growing demand for biodegradable fibers in textiles, furnishings, and personal care products is boosting usage. The shift toward circular economy practices is encouraging manufacturers to adopt renewable fibers like kapok. Innovative applications in insulation materials, automotive padding, and luxury bedding are expanding the fiber’s relevance. European consumers’ preference for organic and hypoallergenic products further supports adoption. Investments in green technologies and ethical sourcing also contribute to long-term growth.

The kapok fiber industry in Germany is driven by strong sustainability standards and innovation in eco-friendly consumer goods. High awareness of environmental issues has led to increasing demand for natural fibers in bedding, furniture, and lifestyle products. The automotive sector is exploring kapok-based composites for lightweight insulation and padding solutions. German manufacturers are also focusing on research and development to enhance kapok’s blending capabilities with other fibers. Premium demand in urban centers for hypoallergenic and organic products supports steady market expansion. Partnerships with international suppliers ensure a reliable kapok supply chain.

Central & South America Kapok Fiber Market Trends

The Central & South America kapok fiber industry is fueled by the region’s growing focus on sustainable agriculture and natural fiber exports. Countries like Brazil and Colombia are exploring kapok’s potential in textiles, bedding, and insulation. Rising regional awareness of eco-friendly consumer goods is supporting domestic adoption. Additionally, governments are encouraging the use of renewable resources to reduce reliance on imported synthetic fibers. Kapok’s lightweight and buoyant nature also makes it suitable for unique local applications such as flotation devices. Expanding trade ties with North America and Europe are strengthening the region’s export potential.

Middle East & Africa Kapok Fiber Market Trends

The Middle East & Africa kapok fiber industry is driven by the increasing adoption of eco-friendly materials in textiles and household goods. The rising population and growing urbanization are boosting demand for affordable and sustainable bedding products. The hospitality sector, particularly in Gulf countries, is incorporating natural fibers into luxury furnishings to cater to eco-conscious tourists. In Africa, the availability of natural resources supports local kapok cultivation and processing. Growing global partnerships and trade routes are also enhancing export opportunities. Additionally, rising awareness of sustainable living practices is gradually driving consumer demand for kapok fiber in the region.

Key Kapok Fiber Company Insights

Some of the key players operating in the market include Lamitex Co. Ltd. and FibreFill Inc.

-

Lamitex Co. Ltd. is a leading global supplier specializing in natural fibers, including kapok. The company provides raw kapok fiber for use in bedding, cushions, and upholstery applications. Its focus lies in sustainable harvesting and eco-friendly processing techniques, offering consistent fiber quality for domestic and international markets.

-

FibreFill Inc. focuses on producing filling materials for the home furnishings and textile industries. Kapok fiber is among its key offerings, supplied as filling for pillows, mattresses, and stuffed furniture. The company emphasizes hypoallergenic and lightweight solutions, catering to the growing demand for natural fiber-based consumer products.

Paradise Fibers Ltd. and PT. Kapok Natural Fibers are some of the emerging participants in the market.

-

Paradise Fibers Ltd. is recognized for supplying specialty natural fibers, including kapok, to textile and apparel manufacturers. The company’s kapok products are used in spinning blends, insulation materials, and eco-friendly textile applications. With strong sourcing networks in Asia, Paradise Fibers ensures quality and timely delivery to global clients.

-

PT. Kapok Natural Fibers, based in Indonesia, is one of the largest kapok fiber producers in the Asia Pacific. The company offers raw and processed kapok for bedding, furniture, and insulation industries. It leverages abundant regional resources and modern processing facilities to deliver high-volume supply to both local and export markets.

Key Kapok Fiber Companies:

The following are the leading companies in the kapok fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Lamitex Co. Ltd.

- FibreFill Inc.

- Paradise Fibers Ltd.

- PT. Kapok Natural Fibers

- EuroFiber Solutions GmbH

- Green Earth Products Pvt. Ltd.

- Natural Fiber Company Ltd.

- Southeast Kapok Industries

- EcoFibre International Holdings

Recent Developments

-

In 2021, the Shanghai-based startup Flocus began converting the dried seed pods of the kapok tree into environmentally friendly yarns, fabrics, and fillings. The company believes the kapok tree has vast potential to transform the textile sector. By leveraging kapok’s natural features, Flocus aims to provide sustainable alternatives to traditional materials. Their innovations focus on using kapok’s unique qualities to develop eco-conscious textile products without compromising functionality.

Kapok Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 802.5 million

Revenue forecast in 2033

USD 1,203.9 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; India; China; Japan

Key companies profiled

Lamitex Co. Ltd.; FibreFill Inc.; Paradise Fibers Ltd.; P.T. Kapok Natural Fibers; EuroFiber Solutions GmbH; Green Earth Products Pvt. Ltd.; Natural Fiber Company Ltd.; Southeast Kapok Industries; EcoFibre International Holdings

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kapok Fiber Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global kapok fiber market report based on application, product, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Textiles & Apparel

-

Home Furnishings

-

Automotive

-

Industrial Uses

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Raw Kapok Fiber

-

Processed Kapok Fiber

-

Kapok Fiber Fillings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global kapok fiber market size was estimated at USD 762.8 million in 2024 and is expected to reach USD 802.5 million in 2025.

b. The kapok fiber market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 1,203.9 billion by 2033.

b. Raw kapok fiber segment dominated the global kapok fiber market, accounting for a revenue share of 34.8% in 2024, driven by efforts to scale cultivation through agricultural research and improved harvesting techniques.

b. Key players in the kapok fiber market include Lamitex Co. Ltd., FibreFill Inc., Paradise Fibers Ltd., PT. Kapok Natural Fibers, EuroFiber Solutions GmbH, Green Earth Products Pvt. Ltd., Natural Fiber Company Ltd., Southeast Kapok Industries, EcoFibre International Holdings

b. Key factors driving the kapok fiber market include growing consumer preference for natural and sustainable materials, increasing demand for eco-friendly textiles and home furnishings, technological advancements enhancing fiber processing and durability, supportive government regulations promoting biodegradable products, and expanding applications across industries such as automotive, bedding, and insulation

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.