- Home

- »

- Pharmaceuticals

- »

-

Keytruda Market Size & Share, Industry Report, 2033GVR Report cover

![Keytruda Market Size, Share & Trends Report]()

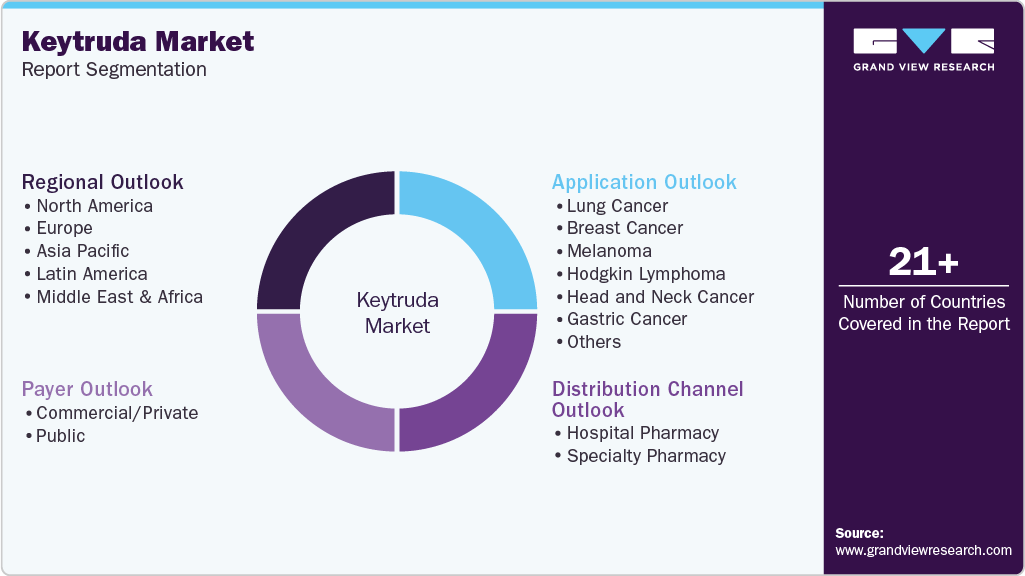

Keytruda Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Lung Cancer, Breast Cancer, Melanoma, Hodgkin Lymphoma), By Payer (Commercial/Private, Public), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-539-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Keytruda Market Summary

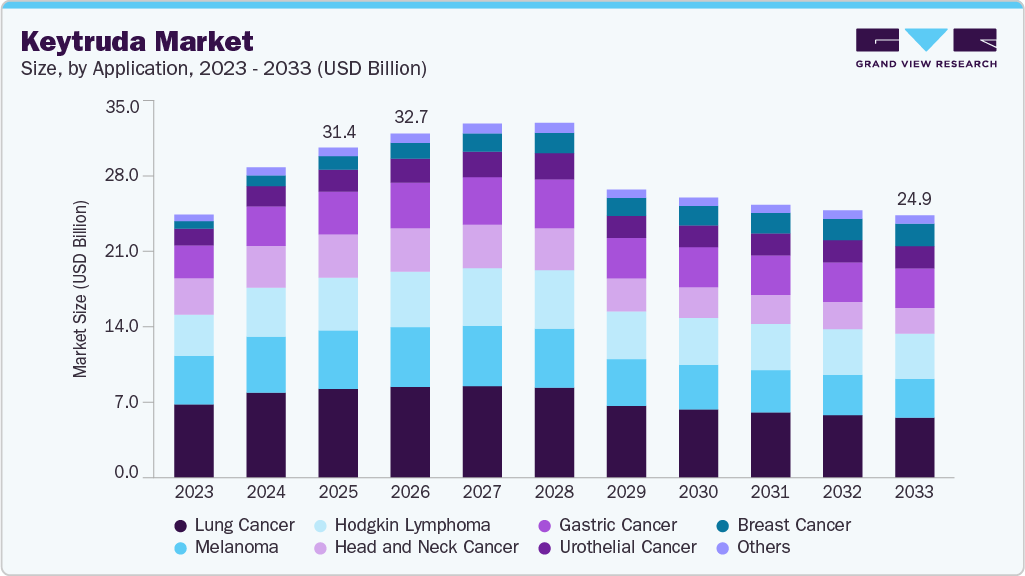

The global Keytruda market size was estimated at USD 31.38 billion in 2025 and is projected to reach USD 24.95 billion by 2033, declining at a CAGR of -3.80% from 2026 to 2033. The market outlook for Keytruda (pembrolizumab) is expected to soften after its patent expiry due to rising biosimilar competition and pricing pressures.

Key Market Trends & Insights

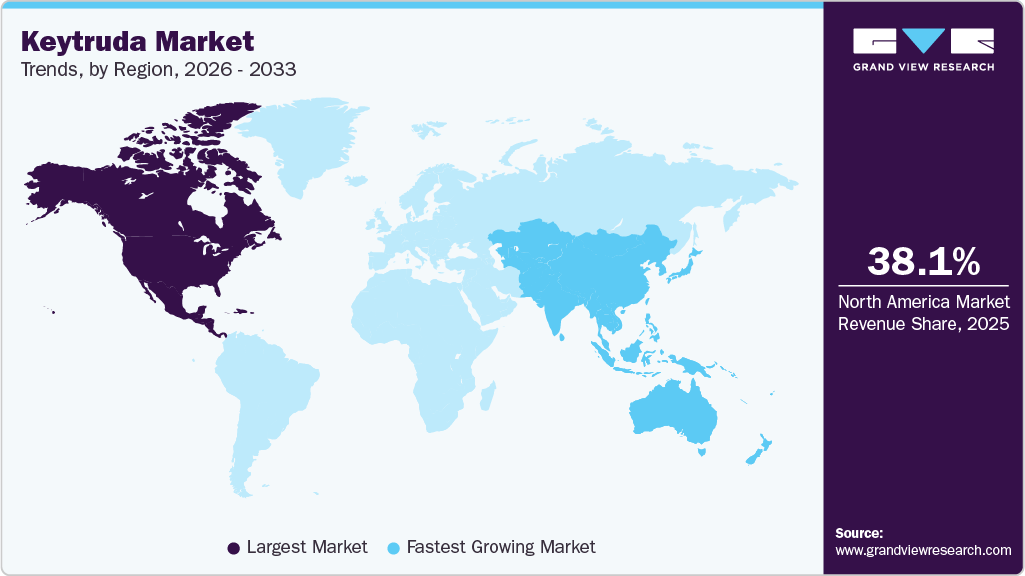

- North America Keytruda market held the largest global share of 38.08% in 2025.

- The Keytruda industry in the U.S. led North America in 2025.

- By application, the lung cancer segment dominated the market, with the largest share of 26.91% in 2025.

- By payer, the commercial/private insurance segment dominated the market, with a share of 90.74% in 2025.

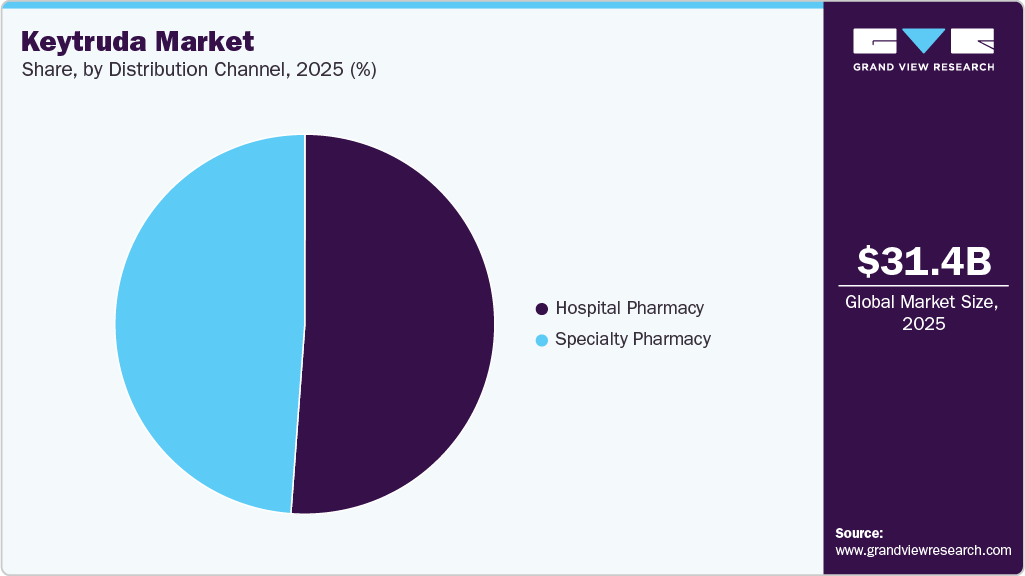

- By distribution channel, the hospital pharmacies segment led the market with a share of 51.18% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 31.38 Billion

- 2033 Projected Market Size: USD 24.95 Billion

- CAGR (2026-2033): -3.80%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Despite the impending challenges, Keytruda continues to strengthen its global presence, including in South America and the Gulf Cooperation Council (GCC), supported by its broad adoption across numerous cancer indications. In both regions, the increasing prevalence of cancer, growing investment in oncology infrastructure, and wider access to advanced immunotherapies are driving uptake. As a leading immune checkpoint inhibitor, Keytruda has demonstrated strong efficacy in non-small cell lung cancer, melanoma, head and neck cancers, and several other malignancies, leading to a consistent expansion of regulatory approvals worldwide. Its market resilience is further supported by a growing volume of clinical trials, particularly those evaluating combination therapies, as well as sustained global investment in immuno-oncology research.

Keytruda’s expansion across international markets, including developing regions such as South America, where healthcare modernization is accelerating, and the GCC, where governments are prioritizing premium cancer care, has been driven largely by its increasing number of approved indications. These approvals, covering conditions such as non-small cell lung cancer, melanoma, head and neck squamous cell carcinoma, and urothelial carcinoma, have substantially broadened its eligible patient base. Its demonstrated effectiveness in monotherapy and combination regimens supports use in first-line, advanced, and adjuvant settings across diverse healthcare environments. Continued clinical research exploring new uses in colorectal cancer, triple-negative breast cancer, and hepatocellular carcinoma provides further growth potential. The drug’s incorporation into biomarker-driven strategies, including PD-L1 expression and tumor mutational burden, enhances targeted patient selection and solidifies its position within precision oncology across mature and emerging markets.

Combination therapy remains a pivotal driver of Keytruda's industry performance, especially in regions such as South America and the GCC, where oncologists are increasingly adopting modern, multimodal treatment approaches. Its synergy with chemotherapy, targeted agents, and other immunotherapies has shown strong clinical results in aggressive and late-stage cancers. Strategic partnerships aimed at advancing combination trials continue to reinforce Keytruda’s competitive advantage. As more of these regimens gain regulatory approval and real-world acceptance, they extend the drug’s lifecycle and help mitigate the impact of future biosimilar competition. This focus on combination approaches ensures Keytruda remains clinically relevant and commercially resilient across diverse global markets.

Keytruda’s rising use in earlier treatment lines is another major catalyst, with similar trends emerging across South America and the GCC, where healthcare systems are increasingly adopting immunotherapy for early-stage disease management. Originally reserved for metastatic settings, Keytruda now carries approvals for first-line, neoadjuvant, and adjuvant use, helping reduce recurrence risk and improve survival outcomes. Approvals for early-stage non-small cell lung cancer, triple-negative breast cancer, and melanoma have significantly expanded its patient population across both developed and developing markets. As oncologists worldwide shift toward the earlier integration of immunotherapy, demand for Keytruda continues to grow, strengthening its market position ahead of the anticipated competitive pressures following patent expiry.

Merck’s development of a subcutaneous (SC) formulation of Keytruda represents a significant opportunity to extend the drug’s lifecycle and maintain its dominance in the oncology market. With regulatory filings already submitted in the U.S. and Europe, the anticipated approval by 2025 could lead to a projected 30-40% conversion rate from intravenous to SC administration. In January 2025, during the JP Morgan Healthcare Conference, Merck & Co. CEO Rob Davis announced plans to expedite the development of a subcutaneous (SC) formulation of Keytruda (pembrolizumab). The company anticipates filing for regulatory approval and launching the SC version within the year, aiming to enhance patient convenience and extend Keytruda's market exclusivity. This shift enhances patient convenience, reduces healthcare resource utilization, and potentially extends exclusivity beyond the expiration of Keytruda’s intravenous formulation patent. Additionally, SC Keytruda may serve as a critical defense against biosimilar competition, reinforcing Merck’s position in immuno-oncology. However, the ongoing patent dispute with Halozyme over this formulation introduces a degree of uncertainty, making successful resolution crucial for uninterrupted market adoption.

Patent Expiry Challenges and Market Sustainability

The looming patent expiration of Keytruda poses a significant challenge to Merck’s long-term revenue stream. Given that Keytruda has been a primary driver of Merck’s financial performance, the entry of biosimilars could lead to substantial pricing pressures and market share erosion. To counteract this, Merck is focusing on lifecycle management strategies such as expanding Keytruda’s use in earlier-line treatments and combination therapies. Additionally, the success of SC Keytruda could play a pivotal role in delaying revenue decline. The company’s broader oncology portfolio and ongoing clinical trials evaluating Keytruda in new indications may further cushion the impact of patent loss.

Combination Therapy and Expanded Indications

The Keytruda market’s expansion has been significantly driven by its integration into combination therapies and the approval of new treatment indications. Merck continues to explore the use of its product alongside chemotherapy, targeted therapies, and other immune checkpoint inhibitors to enhance treatment outcomes. Recent partnerships, including collaborations with Hansoh Pharma, aim to strengthen Keytruda’s presence in combination regimens, particularly in markets where competition is intensifying. Additionally, ongoing clinical trials assessing its efficacy in new cancer types, including gastrointestinal and genitourinary malignancies, could provide fresh avenues for market growth. These strategies are essential in maintaining Keytruda’s relevance amid rising competition and the patent cliff.

Competitive Pressures and Future Market Positioning

The oncology market is becoming increasingly competitive, with multiple PD-1/PD-L1 inhibitors entering the space. Companies such as Bristol-Myers Squibb (Opdivo) and Roche (Tecentriq) continue to challenge Keytruda’s market share, while new entrants and biosimilars post-patent expiry will further intensify pricing pressures. To mitigate these risks, Merck is investing heavily in next-generation immunotherapies, such as novel checkpoint inhibitors and personalized medicine approaches. Strategic acquisitions and pipeline diversification into non-oncology segments, including cardiovascular and metabolic diseases, will also play a crucial role in sustaining Merck’s overall growth as it transitions beyond the exclusivity period of Keytruda.

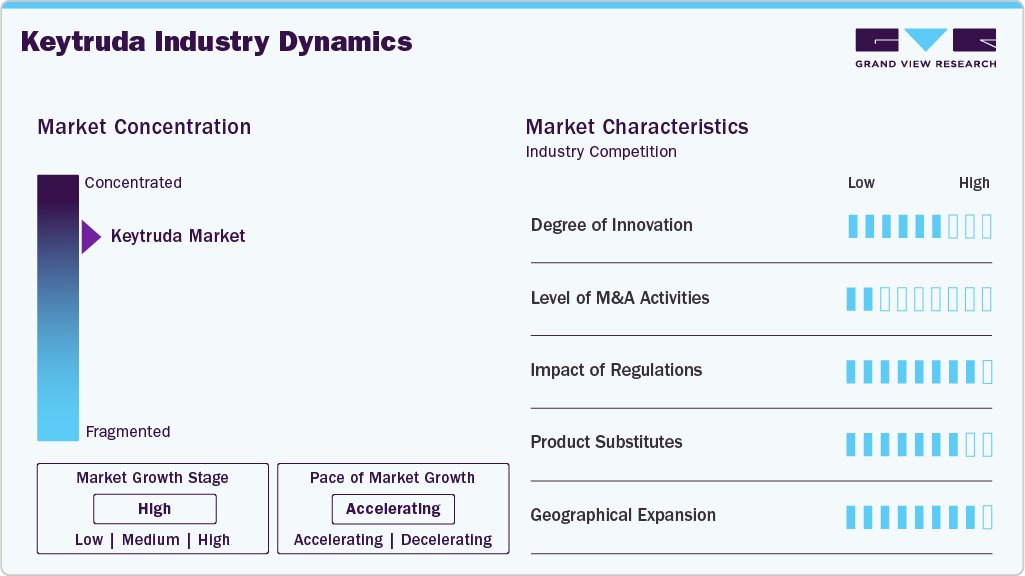

Market Characteristics

The immuno-oncology landscape continues to evolve, with ongoing advancements in biomarker-driven therapies, combination regimens, and novel drug formulations. Keytruda remains at the forefront of innovation, with research focusing on expanding indications, optimizing treatment sequencing, and integrating next-generation immunotherapy strategies. The development of a subcutaneous (SC) formulation represents a key innovation aimed at improving patient convenience and treatment accessibility. Additionally, combination trials exploring Keytruda with targeted therapies, chemotherapy, and other immune checkpoint inhibitors are enhancing therapeutic efficacy across various cancer types.

Mergers and acquisitions play a crucial role in strengthening Merck’s oncology pipeline and maintaining its competitive position following the expiration of the Keytruda patent. The company has pursued strategic acquisitions and partnerships to enhance its immuno-oncology portfolio, including agreements for combination therapies with emerging biotech firms. Industry-wide, pharmaceutical companies are leveraging M&A activities to expand into new cancer indications, secure promising pipeline assets, and develop novel formulations that extend product lifecycles. As competition intensifies in the PD-1/PD-L1 inhibitor space, consolidation efforts are expected to increase, focusing on innovative immunotherapy solutions.

Regulatory approvals significantly influence Keytruda industry’s trajectory, with agencies such as the FDA and EMA expanding its indications based on robust clinical evidence. The approval process for immunotherapies involves rigorous clinical trials, long-term safety monitoring, and biomarker validation, contributing to extended development timelines and substantial R&D investments. Reimbursement policies play a crucial role in market adoption, as high treatment costs necessitate robust insurance coverage and favorable pricing negotiations. Additionally, regulatory challenges, including intellectual property disputes over the SC formulation, may impact commercialization strategies and market access in key regions.

Keytruda faces competition from alternative cancer therapies, including other PD-1/PD-L1 inhibitors such as Opdivo (nivolumab) and Tecentriq (atezolizumab), as well as chemotherapy, targeted therapies, and emerging cell-based immunotherapies. While biosimilars are expected to enter the market post-patent expiration, Keytruda’s established efficacy, extensive clinical data, and combination therapy potential continue to reinforce its market position. The shift toward personalized medicine and biomarker-driven treatment selection further differentiates Keytruda from traditional therapies, supporting its continued adoption in various oncology indications.

Merck is actively expanding Keytruda’s presence in high-growth regions, including Asia-Pacific, Latin America, and the Middle East, where rising cancer prevalence and improving healthcare infrastructure drive demand. Regulatory approvals in emerging markets, along with increased investment in cancer treatment accessibility, are driving market penetration. However, regional growth is influenced by pricing pressures, reimbursement constraints, and competition from local pharmaceutical players. Merck’s strategy includes strengthening partnerships with healthcare providers, enhancing distribution networks, and leveraging real-world data to optimize Keytruda’s adoption across diverse healthcare systems.

Application Insights

The lung cancer segment dominated the Keytruda market, accounting for the largest share of 26.91% in 2025. The strong market presence is driven by Keytruda’s established role as a first-line and adjuvant treatment for non-small cell lung cancer (NSCLC), supported by extensive clinical evidence demonstrating superior survival benefits over chemotherapy. Its approval across different stages of lung cancer, including metastatic and early-stage disease, has expanded its patient base. The widespread adoption of immunotherapy in lung cancer management, combined with continued research into novel combination regimens, reinforces the segment’s market leadership. Favorable reimbursement policies and increasing awareness among oncologists further drive demand.

Breast cancer represents the fastest-growing segment in the Keytruda industry, fueled by its expanding approval for triple-negative breast cancer (TNBC) and ongoing trials in hormone receptor-positive subtypes. The high unmet need for effective immunotherapy in breast cancer has led to increasing adoption of Keytruda in combination with chemotherapy for high-risk early-stage and metastatic TNBC. Emerging clinical data on the role of immunotherapy in breast cancer treatment, coupled with regulatory endorsements, are accelerating market penetration. Growing investments in biomarker-driven approaches, particularly PD-L1 testing, enhance patient selection, driving rapid adoption and segment growth.

Payer Insights

The commercial/private insurance segment dominated the Keytruda market, accounting for a 90.74% share in 2025, primarily due to the strong coverage for immunotherapies across developed healthcare systems. Private insurers play a significant role in reimbursing high-cost oncology treatments, ensuring patient access to Keytruda in both early and advanced-stage cancers. The segment benefits from established agreements between pharmaceutical companies and insurers, enabling broader adoption of treatments. As immunotherapy becomes a standard-of-care treatment, private payers continue to support its integration into cancer management, reinforcing the segment’s leadership.

The public insurance segment holds the second-largest market share, driven by government-backed reimbursement programs, such as Medicare and Medicaid, as well as national healthcare systems in regions like Europe and Canada. As public health agencies expand coverage for immunotherapies, particularly for life-threatening cancers, Keytruda’s accessibility has improved. However, pricing negotiations and cost-effectiveness assessments by health authorities impact reimbursement rates, which in turn influence market growth. Expanding immunotherapy guidelines and government funding for oncology treatments continue to drive demand within the public payer segment.

Distribution Channel Insights

Hospital pharmacies lead the Keytruda industry with a 51.18% share in 2025, due to the complex nature of cancer treatment, which often requires administration in controlled clinical settings. Hospitals ensure proper dosing, patient monitoring, and management of adverse effects associated with immunotherapy. Given that Keytruda is frequently used in combination with chemotherapy and other systemic treatments, hospital pharmacies play a crucial role in ensuring the coordination of cancer care. Strong supply chain networks and direct procurement agreements further reinforce hospital pharmacies’ dominant position in the distribution landscape.

Specialty pharmacies are the fastest-growing distribution channel for Keytruda, driven by the increasing adoption of outpatient treatment models and patient preference for convenient medication access. As immunotherapy becomes more integrated into long-term cancer care, specialty pharmacies enable streamlined distribution to oncology clinics and outpatient infusion centers. Advances in at-home administration, including the upcoming subcutaneous formulation of Keytruda, are expected to further boost specialty pharmacy sales. Additionally, dedicated patient support programs and reimbursement assistance offered by specialty pharmacies enhance treatment adherence and accessibility, fueling rapid growth in this segment.

Regional Insights

North America le the Keytruda market with a share of 38.08% in 2025, due to high cancer prevalence, widespread adoption of immunotherapy, and strong R&D investments. The region benefits from early regulatory approvals and extensive clinical research, particularly in the treatment of lung cancer and melanoma. Ongoing trials exploring Keytruda’s use in earlier treatment stages, as well as combination therapies, further support market expansion. However, pricing pressures, regulatory scrutiny, and impending biosimilar competition pose challenges to sustained growth.

U.S. Keytruda Market Trends

The U.S. dominates the North America Keytruda industry, driven by high biopharmaceutical investments, strong healthcare infrastructure, and broad insurance coverage. The anticipated launch of subcutaneous Keytruda could enhance patient accessibility and extend market exclusivity. However, the market faces challenges from reimbursement complexities, cost-effectiveness assessments, and growing competition from alternative immunotherapies.

Europe Keytruda Market Trends

Europe’s Keytruda industry is expanding, led by Germany, France, and the UK, supported by strong oncology research, favorable reimbursement policies, and regulatory approvals for new indications. The increasing adoption of biomarker-driven treatment approaches is enhancing the effectiveness of immunotherapy. However, government-imposed drug pricing regulations, stringent reimbursement criteria, and competition from local manufacturers may limit growth potential.

The Keytruda market in the UK is supported by NHS-backed funding for immunotherapy, increasing focus on personalized medicine, and clinical trials exploring new cancer indications. Expanding use in breast cancer and earlier-stage lung cancer is driving adoption. However, cost-effectiveness assessments by the National Institute for Health and Care Excellence (NICE) and budget constraints in public healthcare may impact broader market penetration.

The Germany Keytruda market is a key area in Europe, benefiting from robust biotech investments and advanced clinical research. Strong government support for oncology innovations and rapid approval of immunotherapies enhance market growth. However, pricing pressures from healthcare authorities and the increasing preference for locally manufactured oncology drugs may create market challenges.

The Keytruda market in France is growing due to increasing adoption in lung, gastric, and bladder cancers, as well as government initiatives promoting immunotherapy. Regulatory approvals and expanded public healthcare coverage support market growth. However, cost-containment policies, stringent drug pricing negotiations, and competition from emerging biologics could hinder long-term expansion.

Asia Pacific Keytruda Market Trends

China, Japan, and India lead the expansion of the Asia Pacific Keytruda industry. Rising cancer prevalence, improving healthcare infrastructure, and increasing regulatory approvals are driving demand. Growing investments in local immunotherapy production and biomarker-based patient selection are further supporting market expansion. However, high treatment costs, pricing negotiations with government payers, and the need for stronger reimbursement frameworks present challenges.

Japan’s Keytruda market is expanding due to government-backed oncology research, increasing adoption of immunotherapy, and approvals for new cancer indications. A rapidly aging population and high lung cancer incidence further fuel demand. However, strict pricing controls imposed by Japan’s healthcare system and competition from domestic pharmaceutical companies pose market challenges.

The Keytruda market in China is growing rapidly, supported by strong government initiatives, rising investment in biotech manufacturing, and expanding access to cancer immunotherapies. Increasing awareness and participation in global clinical trials strengthen market penetration. However, pricing restrictions, domestic immunotherapy competitors, and challenges in public insurance coverage remain key hurdles.

In the India Keytruda market, the high cost of Keytruda restricts patient access, as it is approved for 17 indications across 10 tumor types. With patents set to expire soon, Indian pharmaceutical companies are actively developing more affordable biosimilar versions to improve accessibility.

Latin America Keytruda Market Trends

Latin America is witnessing an increase in the adoption of Keytruda, particularly in Brazil, as healthcare investments and awareness of immunotherapy expand. The expansion of regulatory approvals and the development of oncology infrastructure are contributing to market growth. However, economic instability, limited access to high-cost treatments, and reimbursement challenges hinder widespread adoption.

Brazil’s Keytruda market is growing due to rising cancer cases and government-backed initiatives improving healthcare access. Local investments in oncology research and immunotherapy partnerships are supporting market expansion. However, high treatment costs, limited reimbursement options, and reliance on public healthcare funding present barriers to market penetration.

Middle East & Africa Keytruda Market Trends

The Middle East & Africa region is experiencing increased demand for Keytruda, driven by improving healthcare infrastructure and rising cancer prevalence. Countries like Saudi Arabia are leading the market with government-driven investments in cancer care. However, limited healthcare accessibility, high treatment costs, and regulatory delays persist as significant challenges.

Saudi Arabia’s Keytruda market is expanding due to healthcare modernization initiatives, increased funding for cancer treatments, and growing patient access to immunotherapy. The government’s focus on biotechnology research further supports market growth. However, affordability concerns, reimbursement constraints, and regional pricing policies pose challenges to broader adoption.

Key Keytruda Company Insights

Merck & Co., Inc. dominates the Keytruda market, as it is the exclusive manufacturer and patent holder of the blockbuster PD-1 inhibitor. Keytruda’s strong clinical efficacy, broad indications, and continuous expansion into new treatment areas have made it the leading immunotherapy in oncology. However, as the drug approaches patent expiration, the market landscape is expected to shift, with biosimilar competition and alternative immunotherapies challenging its dominance.

Competitive Landscape & Emerging Players

-

Bristol-Myers Squibb (BMS) - Opdivo (nivolumab): Keytruda’s primary competitor in the PD-1/PD-L1 space, Opdivo, continues to secure regulatory approvals across various cancers, challenging Keytruda in lung, renal, and melanoma treatments.

-

Roche - Tecentriq (atezolizumab): A key player in immuno-oncology, Tecentriq competes with Keytruda in lung cancer and bladder cancer, leveraging a differentiated mechanism and combination approaches.

-

Regeneron/Sanofi - Libtayo (cemiplimab): Although a smaller player, Libtayo has gained approvals in skin cancers and is expanding into lung cancer, intensifying competition in the PD-1/PD-L1 segment.

-

Pfizer/Seagen - Novel Immunotherapy Combinations: Pfizer’s acquisition of Seagen has bolstered its oncology pipeline, with a focus on antibody-drug conjugates that could emerge as competitors to checkpoint inhibitors like Keytruda.

-

Upcoming Biosimilars: As Keytruda’s patent nears expiration, biosimilar manufacturers, including major generic and biotech firms, are preparing to enter the market. Companies such as Amgen, Samsung Bioepis, and Bio-Thera Solutions are exploring biosimilar versions, which could reshape the market landscape post-2028.

Key Keytruda Companies:

The following are the leading companies in the keytruda market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- Regeneron Pharmaceuticals, Inc. & Sanofi S.A.

- Pfizer Inc. & Seagen Inc.

- Amgen Inc.

- Samsung Bioepis Co., Ltd.

- Bio-Thera Solutions, Ltd.

Recent Developments

-

In March 2025, BioCity Biopharmaceutics Co., Ltd. announced a clinical collaboration to evaluate BC3195 in combination with Keytruda (pembrolizumab) for patients with locally advanced or metastatic solid tumors. The partnership aims to assess the safety and efficacy of BC3195, an innovative immunotherapy candidate, in conjunction with Merck’s blockbuster PD-1 inhibitor. This trial reflects the growing trend of combination immunotherapy strategies to enhance treatment outcomes in oncology.

-

In February 2025, the U.S. Food and Drug Administration (FDA) granted Priority Review to Merck's supplemental Biologics License Application (sBLA) for Keytruda (pembrolizumab) in combination with standard care as a perioperative treatment for patients with resectable locally advanced head and neck squamous cell carcinoma (LA-HNSCC). This decision is based on the Phase 3 KEYNOTE-689 trial, which demonstrated a statistically significant improvement in event-free survival (EFS) and major pathological response (mPR) for patients receiving the Keytruda regimen compared to standard treatment alone. The FDA has set a target action date of June 23, 2025, for this application.

-

In January 2025, China's National Medical Products Administration (NMPA) approved the combination of Padcev (enfortumab vedotin) with Keytruda (pembrolizumab) for treating adult patients with locally advanced or metastatic urothelial cancer. This marks the first non-platinum-based first-line treatment option for Chinese patients with advanced urothelial carcinoma. The approval is based on the Phase 3 EV-302/KEYNOTE-A39 trial, which demonstrated that the combination nearly doubled median overall survival and improved progression-free survival, overall response rate, and complete response rate compared to platinum-based chemotherapy.

-

In November 2024, Merck & Co. announced that a Phase 3 clinical trial demonstrated that a new subcutaneous (under-the-skin) injection formulation of Keytruda (pembrolizumab) showed similar pharmacokinetics, efficacy, and safety profiles compared to the existing intravenous version when combined with chemotherapy in patients with non-small cell lung cancer. This development aims to offer a more convenient administration method for patients and potentially extend Keytruda's market exclusivity as it approaches patent expiration in 2028. Merck plans to discuss these findings with regulatory authorities to seek approval for this new formulation.

-

In August 2024, the European Commission approved the combination of Astellas' Padcev (enfortumab vedotin) with Keytruda (pembrolizumab) for the first-line treatment of adult patients with unresectable or metastatic urothelial cancer eligible for platinum-containing chemotherapy. This approval was based on the Phase 3 EV-302 clinical trial, which demonstrated that the combination significantly extended overall survival and progression-free survival compared to standard platinum-based chemotherapy.

Keytruda Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 32.72 billion

Revenue forecast in 2033

USD 24.95 billion

Growth rate

CAGR of -3.80% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, Payer, Distribution Channel, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Merck & Co., Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; Regeneron Pharmaceuticals, Inc. & Sanofi S.A.; Pfizer Inc. & Seagen Inc.; Amgen Inc.; Samsung Bioepis Co., Ltd.; Bio-Thera Solutions, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Keytruda Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Keytruda market report based on application, payer, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Lung Cancer

-

Breast Cancer

-

Melanoma

-

Hodgkin Lymphoma

-

Head and Neck Cancer

-

Gastric Cancer

-

Urothelial Cancer

- Others

-

-

Payer Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial/Private

-

Public

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Keytruda market size was estimated at USD 31.38 billion in 2025 and is expected to reach USD 32.72 billion in 2026.

b. The global Keytruda market is expected to grow at a compound annual growth rate of -3.80% from 2026 to 2033 to reach USD 24.95 billion by 2033.

b. Based on application, the lung cancer segment dominated the Keytruda market with a revenue share of 26.91% in 2025. The strong market presence is driven by Keytruda’s established role as a first-line and adjuvant treatment for non-small cell lung cancer (NSCLC), supported by extensive clinical evidence demonstrating superior survival benefits over chemotherapy.

b. Merck & Co., Inc. dominates the Keytruda market, as it is the exclusive manufacturer and patent holder of the blockbuster PD-1 inhibitor.

b. The market is driven by its increasing adoption across multiple cancer indications. As a leading immune checkpoint inhibitor, Keytruda has demonstrated strong efficacy in treating non-small cell lung cancer, melanoma, head and neck cancers, and other malignancies, leading to broader regulatory approvals worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.