- Home

- »

- Homecare & Decor

- »

-

Kickboxing Equipment Market Size, Industry Report, 2030GVR Report cover

![Kickboxing Equipment Market Size, Share & Trends Report]()

Kickboxing Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gloves, Protective Gear, Punching Bags), By Application, By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-710-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kickboxing Equipment Market Size & Trends

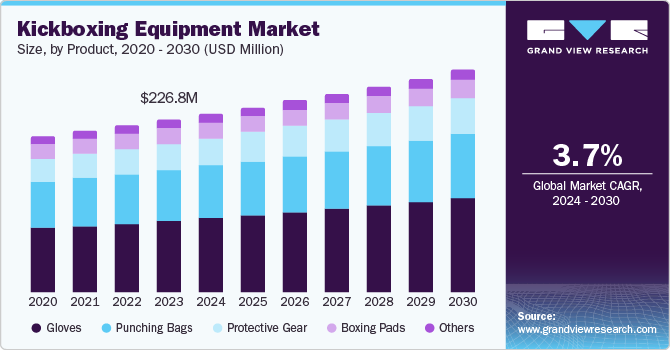

The global kickboxing equipment market size was valued at USD 226.8 million in 2023 and is projected to grow at a CAGR of 3.7% from 2024 to 2030. The increasing focus on health and well-being is the key factor driving market growth. Kickboxing is becoming popular as more health-conscious people look for varied exercise routines. A full-body workout targets cardio and strength training and resonates with people of all ages and fitness abilities. Furthermore, the increasing levels of obesity and chronic illnesses have led to a greater need for efficient weight management techniques. Kickboxing provides a fun and effective way to burn calories, making it attractive to many people.

The growing popularity of combat sports also fuels the rising demand for kickboxing gear. The worldwide interest in mixed martial arts (MMA) and boxing has created a ripple effect on sports such as kickboxing. As these combat sports gain mainstream acceptance, more individuals are drawn to the thrill and challenge of kickboxing. As a result, there has been a significant increase in the need for specialized gear including punching bags, gloves, and protective equipment. Furthermore, incorporating kickboxing in fitness centers and gyms has increased its availability, drawing in a broader range of people and increasing sales of kickboxing equipment.

Technological advancements have significantly influenced the kickboxing equipment industry. The development of innovative materials and designs has produced higher-quality, durable, and performance-enhancing equipment. Smart wearable technology, such as heart rate monitors and fitness trackers, has been incorporated into kickboxing training, offering athletes valuable information and knowledge. Additionally, the increase in e-commerce platforms has made it easier to find a variety of kickboxing equipment, contributing to market growth.

Product Insights

The gloves segment dominated the market and accounted for a revenue share of 41.4% in 2023. Gloves are essential for kickboxing, providing crucial hand protection and improving striking power and technique. The demand for kickboxing gloves has increased due to the sport's growing popularity at various skill levels, from beginners to professionals. Strict safety rules mandating gloves during competitions and training sessions have contributed to the industry growth. Additionally, advancements in glove technology, incorporating innovative materials and designs to enhance performance, comfort, and durability, have further fueled this growth.

The protective gear segment is expected to register the fastest CAGR of 4.4% during the forecast period. The increased focus on preventing injuries among kickboxing participants is mainly responsible for boosting the segment’s growth. The emphasis on protecting athletes from possible injuries has increased as the sport becomes more prevalent at amateur and professional levels. Furthermore, regulatory bodies and governing organizations increasingly demand protective gear, driving compliance and demand. Moreover, advancements in protective gear technology leading to enhanced comfort, performance, and safety attributes have also played a role in the sector's growth.

Application Insights

The commercial segment accounted for the largest revenue share in 2023. The increasing interest in group fitness activities such as kickboxing has created a demand for robust and high-quality equipment in commercial gyms and fitness studios. Furthermore, the advancement of kickboxing as a competitive sport has led to growing demand for specific gear in training centers and tournament locations. Moreover, the market for kickboxing equipment has grown beyond traditional boxing gyms due to the emphasis on holistic wellness and cross-training in commercial fitness settings. The collective impact of these factors plays a role in the significant market share and ongoing expansion of the commercial sector.

The individual segment is expected to register the fastest CAGR during the forecast period. A surge in inactive lifestyles and growing concerns about obesity are motivating individuals to embrace physical activities. The convenience of home workouts and the availability of affordable and compact kickboxing equipment have significantly contributed to the segment's growth. Additionally, the rising disposable income of the middle class in developing economies is fueling demand for premium home fitness setups, including kickboxing equipment. Moreover, the influence of fitness influencers and social media platforms increases the popularity of kickboxing as a trendy workout regimen, further driving the individual segment.

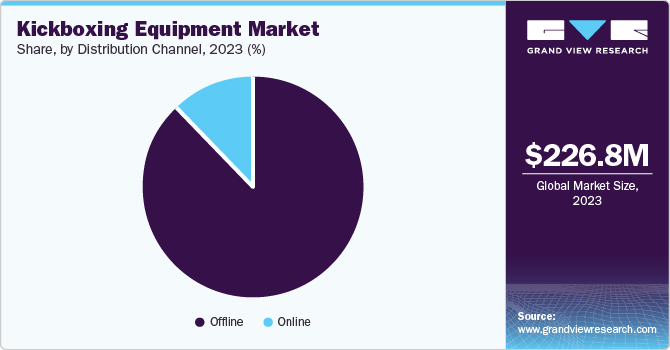

Distribution Channel Insights

Offline distribution channels accounted for the largest revenue share in 2023. The tangible nature of the products enables customers to physically examine and try equipment before purchase, reducing concerns about product quality and suitability. Furthermore, brick-and-mortar stores often provide expert advice and demonstrations, assisting decision-making when buying products. Moreover, having well-developed distribution channels and a strong physical presence allows for adequate shipping and quick order processing, increasing customer satisfaction. Moreover, providing personalized recommendations and post-purchase services through physical stores helps build customer loyalty and drive repeat sales.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The increasing internet penetration and smartphone adoption have widened the market reach for online retailers, enabling them to cater to a broader customer base. Moreover, e-commerce platforms offer a vast array of products, competitive pricing and convenient buying options, appealing to a significant portion of the target audience. Additionally, the ability to provide detailed product information, customer reviews, and comparisons online empowers consumers to make informed decisions. Furthermore, integrating social media and digital marketing strategies has facilitated effective brand-building and customer engagement, driving online sales. As consumer preferences shift towards digital platforms and e-commerce continues to evolve, the online distribution channel is expected to increase its market share significantly.

Regional Insights

North America kickboxing equipment market held the global market with a revenue share of 27.1% in 2023. The region is known for its established fitness and wellness community, focusing highly on exercise and personal well-being. This has created a favorable environment for developing combat sports, such as kickboxing. Moreover, a sizable and wealthy population with extra money to spend on exercise gear drives the market's growth. The existing sports facilities in the region, such as gyms, fitness studios, and boxing clubs, have also driven the demand for kickboxing equipment. Furthermore, the growing popularity of mixed martial arts (MMA) and boxing in North America has generated a crossover appeal in kickboxing, expanding the market for related equipment.

U.S. Kickboxing Equipment Market Trends

The U.S. dominated the North America kickboxing equipment market in 2023. A thriving culture of physical activity and an affluent population has created a robust market for kickboxing equipment. The U.S. boasts many commercial gyms, fitness studios, and boxing clubs that cater to diverse demographics, driving demand for high-quality equipment. Additionally, the popularity of mixed martial arts (MMA) and the influence of professional kickboxing leagues have further fueled the market's growth in the U.S.

Europe Kickboxing Equipment Market Trends

Europe kickboxing equipment market was identified as a lucrative region in 2023. The popularity of kickboxing has grown on the strong foundation of combat sports traditions, particularly boxing and martial arts. The region is home to a significant population that values health and fitness. With an increasing disposable income, there is a growing demand for high-quality workout equipment. Furthermore, the rising number of commercial gyms, fitness studios, and specialized kickboxing facilities has contributed to the expansion of the market.

The UK kickboxing equipment market is expected to grow rapidly in the coming years. The increase in kickboxing participation has been driven by the growing popularity of MMA and the rise in celebrity fitness endorsements. Additionally, the large number of health-conscious consumers in the UK and increasing disposable incomes fuel the demand for high-quality home workout gear, including kickboxing equipment. Moreover, the government's focus on promoting physical activity and addressing obesity has created a favorable environment for the sector.

Asia Pacific Kickboxing Equipment Market Trends

Asia Pacific kickboxing equipment market led the largest share of 43.01% in 2023 and is anticipated to grow with the fastest CAGR over the forecast period. A growing middle class with high purchasing power is expected to drive the demand for fitness and wellness products. The region's urban population is quickly growing and adopting fitness as part of their daily routine, causing a rise in gym memberships and at-home workout routines. Furthermore, the market's growth is driven by the impact of Western fitness culture and the increasing popularity of mixed martial arts (MMA). Additionally, government efforts to support sports and physical education fuel the growing demand for kickboxing equipment.

China kickboxing equipment market held a substantial market share in 2023. The country's large population and expanding middle class have driven the demand for fitness products. Moreover, China’s strong export capabilities have enabled it to supply kickboxing equipment to global markets, solidifying its position as a dominant player in the industry.

Key Kickboxing Equipment Company Insights

Some key companies in the kickboxing equipment market include Adidas, Century Martial Arts., EVERLAST WORLDWIDE INC., Hayabusa Fightwear Inc., TWINS SPECIAL, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Century Martial Arts offers a varied selection of products such as heavy bags, focus mitts, protective gear, and apparel. The company’s focus on developing products and a solid brand image have allowed them to gain a large portion of the market.

-

Everlast Worldwide Inc. has a strong background in boxing and fitness, the company has successfully transitioned into the industry, providing various products such as gloves, bags, protective gear, and clothing. Everlast's reputation as a leading competitor in the industry has been strengthened by its strong brand recognition and commitment to quality and innovation.

Key Kickboxing Equipment Companies:

The following are the leading companies in the kickboxing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Adidas

- Century Martial Arts.

- EVERLAST WORLDWIDE INC.

- Hayabusa Fightwear Inc.

- TWINS SPECIAL

- Combat Brands

- Fairtex Global

- KING PRO BOXING

- Revgear

- Ringside Boxing

Recent Developments

-

In April 2022, Fairtex, a globally renowned combat sports brand, announced a multi-year partnership with the Muay Thai Grand Prix. This collaboration involved creating co-branded merchandise and equipment, signifying a promising future for both entities in enhancing the sport's profile globally.

Kickboxing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 234.8 million

Revenue forecast in 2030

USD 291.9 million

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, South Africa

Key companies profiled

Adidas; Century Martial Arts.; EVERLAST WORLDWIDE INC.; Hayabusa Fightwear Inc.; TWINS SPECIAL; Combat Brands; Fairtex Global,; KING PRO BOXING; Revgear; Ringside Boxing

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kickboxing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kickboxing equipment market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gloves

-

Protective Gear

-

Punching Bags

-

Boxing Pads

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.