- Home

- »

- Medical Devices

- »

-

Kidney Transplant Market Size & Share, Industry Report, 2030GVR Report cover

![Kidney Transplant Market Size, Share & Trends Report]()

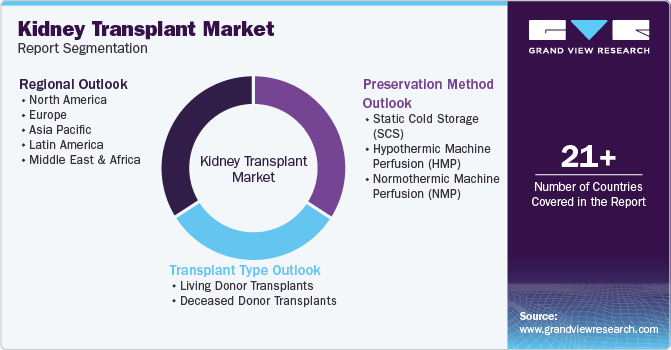

Kidney Transplant Market (2025 - 2030) Size, Share & Trends Analysis Report By Transplant Type (Living Donor, Deceased Donor), By Preservation Method (Static Cold Storage, Hypothermic Machine Perfusion, Normothermic Machine Perfusion), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-509-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kidney Transplant Market Summary

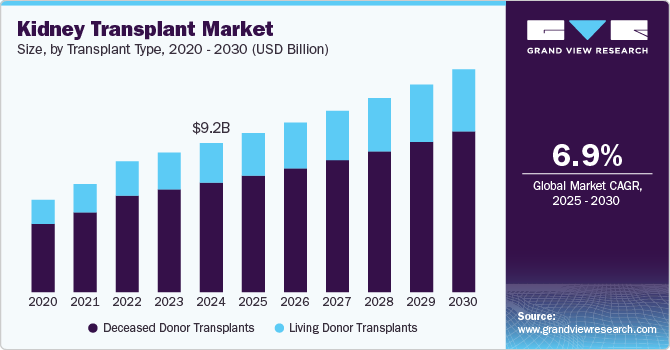

The global kidney transplant market size was estimated at USD 9,235.7 million in 2024 and is projected to reach USD 13,790.7 million by 2030, growing at a CAGR of 6.98% from 2025 to 2030. The market is driven by the increasing prevalence of end-stage renal disease (ESRD) and chronic kidney conditions worldwide, which heighten the demand for transplants.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Denmark is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, deceased donor transplants accounted for a revenue of USD 7,203.6 million in 2024.

- Living Donor Transplants is the most lucrative transplant type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,235.7 Million

- 2030 Projected Market Size: USD 13,790.7 Million

- CAGR (2025-2030): 6.98%

- North America: Largest market in 2024

Advancements in surgical techniques, immunosuppressive drugs, and organ preservation technologies have significantly improved outcomes, further boosting the market. Rising awareness of organ donation, government initiatives, and supportive healthcare policies encourage higher transplant rates. However, challenges like organ shortages and high treatment costs persist.

The kidney transplant market is characterized by increasing demand due to the rising prevalence of chronic kidney disease (CKD) and end-stage kidney disease (ESKD), driven by underlying conditions such as diabetes and hypertension. According to the Centers for Disease Control and Prevention, 1 in 7 Americans, or 37 million people, suffer from CKD. Many are unaware of their condition until it progresses to a critical stage, requiring dialysis or a kidney transplant. Dialysis, while life-sustaining, is not a cure and comes with severe side effects, such as infection and cardiovascular strain. For these patients, kidney transplantation remains the only curative option.

However, the demand for kidneys far exceeds supply, creating a critical shortage. In the U.S. alone, over 90,000 people are currently on the kidney transplant waiting list, yet a thousand patients are removed from the list monthly because they either succumb to their illness or become too sick for transplantation. While most transplants (approximately two-thirds) come from deceased donors, living donors account for around 6,000 transplants annually. Altruistic donors, who donate to strangers, contribute only 300 to 400 kidneys each year, highlighting the challenge of finding compatible living donors. As of 2020, only 14.2% of ESKD patients had access to a living donor, further underscoring the scarcity of suitable donors.

In regions like Jordan, the shortage is exacerbated by the lack of a functional brain death donation program and limited living donors. Patients face prolonged wait times and uncertainty. To address this challenge, innovative strategies like Kidney Paired Exchange (KPE) are being implemented. KPE allows living donors who are incompatible with their intended recipient to donate their kidney to another recipient in need, creating a chain of compatible transplants. This system expands transplant opportunities for patients who would otherwise remain on the waiting list.

The kidney transplant market continues to evolve, with research and development efforts focused on alternative solutions such as xenotransplantation and 3D bioprinting to address long-term challenges. These advancements, coupled with collaborative global initiatives, aim to reduce the disparity between organ supply and demand, offering hope to millions of patients worldwide.

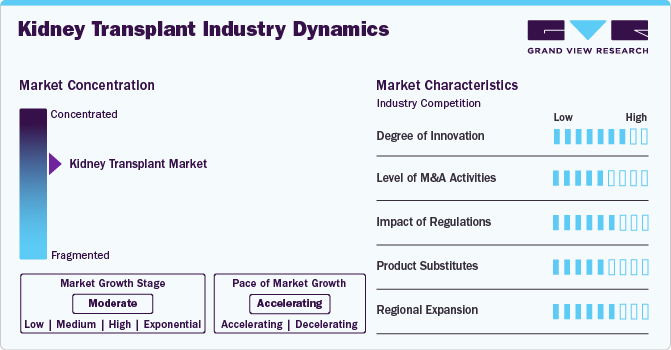

Market Concentration & Characteristics

The kidney transplant market exhibits moderate industry concentration, with key players driving innovation and adoption of advanced organ preservation and transplantation technologies. TransMedics Group, Inc. is renowned for its Organ Care System, enabling optimized organ preservation and viability during transport. XVIVO specializes in advanced organ preservation solutions, enhancing organ functionality for transplantation. OrganOx Limited develops normothermic perfusion devices like metra, improving the preservation and assessment of kidneys before transplant. These companies address challenges like organ shortages and optimize transplant success rates. Their contributions significantly influence market growth by improving outcomes and accessibility in the global kidney transplant ecosystem.

The kidney transplant industry saw a significant advancement in May 2024, as a study revealed a potential treatment for antibody-mediated rejection (AMR), a primary cause of transplant failure. Led by Georg Böhmig and Katharina Mayer from MedUni Vienna, the trial involved 22 patients treated with felzartamab, a monoclonal antibody initially designed for multiple myeloma. The randomized, placebo-controlled study demonstrated promising outcomes, showing that felzartamab effectively improved kidney transplant results. After six months, biopsy and molecular analyses confirmed the drug’s potential as a safe and efficient solution for combating AMR in kidney transplants.

Regulations are essential in the kidney transplant industry, ensuring patient safety, transplant efficacy, and ethical practices. They govern organ procurement, allocation, and transplant procedures, setting standards for donor matching, preservation, and post-transplant care. Strict regulations help minimize the risk of transplant-related complications and prevent organ trafficking. They also promote research and innovation, ensuring that new treatments and technologies, such as gene editing and immunotherapies, undergo rigorous testing before approval. By fostering transparency and accountability, regulations contribute to the sustainability of the kidney transplant market and improve patient outcomes globally.

Mergers and acquisitions (M&A) play a crucial role in shaping the kidney transplant industry by allowing companies to diversify their portfolios, expand their market presence, and drive innovation. For instance, in September 2021, Sanofi finalized a merger with Kadmon Holdings, Inc., a biopharmaceutical company focused on developing therapies for unmet medical needs. This acquisition aligns with Sanofi’s strategy to grow its General Medicines assets and enhance its transplant portfolio by adding Rezurock (belumosudil).

In the kidney transplant industry, alternatives to traditional transplant procedures are emerging. One key substitute is the development of bioengineered kidneys and advanced dialysis technologies, which aim to reduce reliance on organ donations. Research into stem cell therapies and xenotransplantation, such as transplanting genetically modified pig kidneys, also offers potential solutions to address the organ shortage. Additionally, wearable artificial kidneys and implantable devices are being explored as substitutes to enhance patients' quality of life and provide temporary or long-term renal function support. These innovations are gradually shaping the future of kidney transplant alternatives.

The kidney transplant market is witnessing significant growth globally, with advancements in medical technology and increased access to transplant services. For example, Nizam’s Institute of Medical Sciences (NIMS) in Hyderabad completed 1,000 kidney transplants over the past decade. In 2024, they performed 101 transplants, including 55 from living donors and 46 from deceased donors. These procedures were provided free of charge through the Aarogyasri program, funded by the Telangana government. Established in 1989, the NIMS renal transplant program has accelerated since 2015 with the Jeevandan cadaver transplant initiative, significantly expanding its reach and impact in the region.

Transplant Type Insights

The deceased donor kidney transplant segment accounted for the largest revenue share of 73.4% in 2024. This is due to the rising prevalence of end-stage renal disease (ESRD), expanded organ donation programs, and advancements in organ preservation technologies. The adoption of hypothermic and normothermic machine perfusion (HMP & NMP) has significantly improved organ viability, reducing discard rates and enhancing transplant success. Additionally, the increasing use of Donation after Circulatory Death (DCD) kidneys, AI-driven organ matching, and innovative biomarker-based viability assessments are expanding the donor pool. With continued policy initiatives, technological innovations, and regenerative medicine advancements, the market is expected to witness steady growth, improving accessibility and outcomes for patients in need of kidney transplants.

The living donor transplants segment is projected to grow at the fastest CAGR during the forecast period. The segment is driven by the increasing demand for transplants due to the rising prevalence of end-stage renal disease (ESRD) and long waiting times for deceased donor kidneys. Advancements in minimally invasive donor nephrectomy (including robotic-assisted surgery) have made donation safer and more appealing. Additionally, growing public awareness, government incentives, and post-donation support programs are encouraging more individuals to become living donors, improving transplant success rates and long-term patient outcomes.

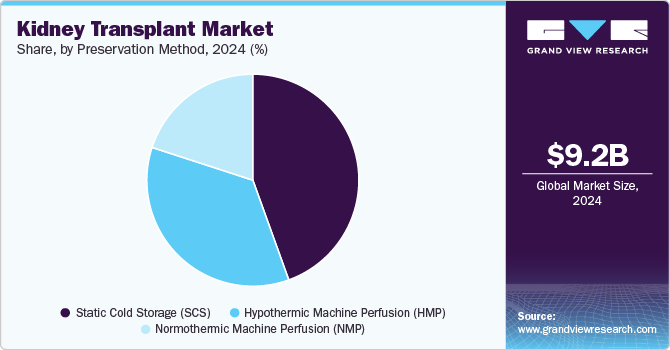

Preservation Method Insights

The static cold storage (SCS) segment dominated the market and accounted for a 44.5% share in 2024. This is primarily owing to its cost-effectiveness, simplicity, and ability to maintain organ viability for up to 24-36 hours. It is the preferred choice for long-distance organ transportation, ensuring broad accessibility for transplant centers. Advancements in preservation solutions like UW (University of Wisconsin), HTK (Histidine-Tryptophan-Ketoglutarate), and Celsior have improved kidney viability by minimizing ischemic damage. Research into oxygenation-enhanced storage and metabolic support additives is further refining SCS efficiency. Despite the rise of perfusion-based alternatives, SCS remains dominant due to its low infrastructure requirements and proven reliability in kidney transplantation.

The normothermic machine perfusion (NMP) segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is majorly driven by its ability to enhance organ viability and improve post-transplant outcomes, especially for marginal and extended criteria donor (ECD) kidneys. Unlike cold storage, NMP maintains the kidney at physiological temperature, providing continuous oxygenation and nutrients, which helps reduce ischemia-reperfusion injury and allows for organ assessment before transplantation. The growing need to expand the donor pool, improve graft function, and reduce delayed graft function (DGF) is fueling NMP adoption. Advancements in real-time biomarker monitoring, portable perfusion devices, and AI-driven organ evaluation are further supporting its clinical integration.

Regional Insights

North America led the kidney transplant market in 2024, holding a significant share of global revenue. The region's dominance is attributed to advanced healthcare infrastructure and high surgical volumes. According to the American Hospital Association Statistics 2024, the U.S. has around 6,120 operational hospitals performing 40-50 million surgeries annually, including treatments for cardiovascular diseases, cancer, and trauma. These factors, coupled with increasing organ transplantation rates and innovative technologies, drive market growth. Additionally, strong support from organizations like UNOS and robust organ donation programs enhance transplant accessibility, further solidifying North America’s leading position in the global kidney transplant market.

U.S. Kidney Transplant Market Trends

The U.S. kidney transplant market is set to grow, supported by one of the world’s most effective organ donation and recovery systems. UNOS collaborates with the organ donation community to enhance outcomes and save lives. In 2023, over 6,900 living donor transplants occurred, with many donating kidneys and some contributing liver segments. Deceased donors exceeded 16,000, yet the demand remains high, with 104,799 people needing lifesaving transplants, including 59,029 active waiting list candidates. A total of 46,630 transplants and 23,286 donors (living and deceased) were recorded from January to December 2023, reflecting ongoing efforts to address this critical need.

Europe Kidney Transplant Market Trends

The European kidney transplant market is anticipated to expand in the forecast period, mainly due to the widespread prevalence of chronic diseases, which account for 80% of the total disease burden in the EU (as of December 11, 2024). LUMC became the first European hospital to administer reprogrammed stem cells to patients receiving new donor kidneys. The initial phase of the study aims to assess the safety of the therapy, while future research will explore its potential in preventing donor kidney rejection.

The UK kidney transplant market is growing significantly, driven by the rising prevalence of chronic diseases like diabetes and an aging population. The UK Department of Health & Social Care projects a one-million increase in individuals aged 85+ between 2021 and 2036. As of March 2024, 5,898 patients awaited kidney transplants, far exceeding those waiting for other organs. Liver transplant patients ranked second at 639, followed by 297 waiting for both kidney and pancreas transplants.

The kidney transplant market in France is growing, driven by significant healthcare investment ensuring high-quality, patient-centered services. In 2021, France allocated 12.31% of its GDP to healthcare (World Bank). With a population of 67 million (2020), France's universal healthcare system, funded through income-based taxation, reimburses 70% of general healthcare costs and 100% for costly or chronic conditions like chronic kidney disease (CKD). CKD affects nearly 3 million individuals, with a 2% annual increase in prevalence. Among these, 89,692 patients undergo dialysis or have received kidney transplants.

Germany kidney transplant market is supported by advancements like Oncocyte Corporation's October 2024 announcement regarding partnerships with top transplant hospitals in the U.S. and Germany. These institutions have adopted GraftAssure, a research-use-only assay detecting early graft damage through donor-derived cell-free DNA (dd-cfDNA). Oncocyte aims to commercialize its intellectual property by developing a kitted test and expanding its market presence. The “land-and-expand” strategy focuses on partnerships with transplant centers and research institutions to increase adoption of molecular diagnostics in the USD 1 billion transplant market. GraftAssure remains a research-use product, with FDA clearance sought for clinical application.

Asia Pacific Kidney Transplant Market Trends

The Asia Pacific kidney transplant market is expanding rapidly, driven by high healthcare expenditure and a growing aging population. North and East Asia, including Japan, South Korea, and Taiwan, have significant healthcare investments, with Japan spending 10.9% of its GDP on health. Taiwan leads globally in treated end-stage kidney disease (ESKD) prevalence. In South Korea, 108,873 patients received kidney replacement therapy (KRT) in 2019, with 19.4% undergoing kidney transplants. The region's shift from glomerulonephritis to metabolic diseases has increased ESKD cases. Government healthcare spending, comprising 50-60% of total expenditures, further supports the growing demand for kidney transplantation services.

The kidney transplant market in Japan is expanding as innovative approaches drive advancements. In October 2024, a Japanese medical team applied for approval to conduct a clinical study on temporary pig kidney transplants for unborn children with severe kidney disease. This groundbreaking procedure, the first in Japan, is slated for 2026. Led by Jikei University School of Medicine and the National Center for Child Development, the study involves injecting 2-millimeter pig kidneys into two unborn children diagnosed with Potter sequence, enabling urine production immediately after birth. Post-delivery, a tube will manage urine discharge, marking a significant step in transplant innovation.

The kidney transplant market in China is poised for growth in the Asia Pacific region. In December 2024, Chinese scientists achieved a breakthrough by successfully keeping a monkey alive for over six months with a single gene-edited pig kidney. The experiment, conducted at Tongji Hospital, involved transplanting the organ into a macaque monkey with removed kidneys. The kidney functioned normally for five months before complications arose due to immune rejection, highlighting challenges similar to human-to-human transplants, which require lifelong immunosuppressants. Led by Chen Gang, this achievement marks a benchmark for long-term survival, paving the way for clinical trials using pig organs, ideal due to their size and metabolic similarities to human organs.

India’s kidney transplant market is poised for significant growth. As of November 2024, the country has approximately 600 kidney transplant centers, with 75 in the public sector and the rest privately operated. In 2023, India performed 13,642 kidney transplants-11,791 from living donors and 1,851 from deceased donors, including three cardiac death (DCD) donations, according to Dr. Anil Kumar (NOTTO). However, with an end-stage kidney disease (ESKD) burden affecting at least 200,000 patients annually in a population of 1.5 billion, these figures reveal a substantial gap between demand and supply.

Latin America Kidney Transplant Trends

The kidney transplant market in Latin America is dominated by Brazil and Argentina. Between January and November 2021, Brazil conducted over 12,000 organ transplants, ranking second globally after the U.S. This achievement persisted despite pandemic challenges, supported by Brazil's SUS, which provides comprehensive transplant care. Similarly, Argentina has performed 15,774 kidney transplants since 1998, with 89% in adults and 11% in children. Most transplants involve deceased donors, with strokes (52%) and traumatic brain injuries being the primary causes, highlighting the market's growing importance.

Middle East & Africa Kidney Transplant Market Trends

The kidney transplant market in the Middle East and Africa is advancing, driven by King Faisal Specialist Hospital and Research Centre (KFSHRC). Since 1981, KFSHRC has performed 5,000 transplants, including 80 pediatric procedures in 2023, the highest globally. Over 3,000 transplants have been conducted since 2010, with 1,250 in the last three years alone. Its Kidney Paired Donation program has revolutionized transplantation by addressing donor-patient compatibility issues. Advanced minimally invasive robotic surgeries enhance precision, while one-year survival rates range from 97% to 99%. KFSHRC is the leading transplant center in the region and ranks 20th globally in academic medical centers.

The kidney transplant market in Saudi Arabia is anticipated to expand in the forecast period, supported by the Saudi Center for Organ Transplantation’s efforts. The second phase of the National Kidney Exchange Program aims to raise living donor rates from 10% to 30%, reducing wait times and enhancing transplant success rates. The "Minna W Feena" program is a crucial initiative, offering improved treatment options and alleviating the challenges faced by kidney failure patients in the Kingdom.

Key Kidney Transplant Company Insights

The competitive scenario in the kidney transplant market is highly competitive, with key players such as TransMedics Group, Inc., XVIVO, and OrganOx Limited holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Kidney Transplant Companies:

The following are the leading companies in the kidney transplant market. These companies collectively hold the largest market share and dictate industry trends.

- TransMedics Group, Inc.

- XVIVO

- OrganOx Limited

- Paragonix Technologies

- Waters Medical Systems

- Organ Recovery Systems

- Bridge to Life Ltd.

Recent Developments

-

In November 2024, the United Therapeutics Corporation announced the world's first successful transplant of a UKidney into a living human. This milestone follows previous successful xenotransplants, including two UHeart transplants in 2022 and 2023, and a UThymoKidney transplant earlier in 2024.

-

In September 2024, eGenesis secured USD 191 million in Series D funding to advance its lead product, EGEN-2784, into first-in-human kidney transplant studies. The financing, led by Lux Capital, will also support pipeline development and production scaling. This follows their March 2024 milestone of the first successful porcine kidney transplant in a living patient.

Kidney Transplant Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.84 billion

Revenue forecast in 2030

USD 13.79 billion

Growth rate

CAGR of 6.98% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transplant type, preservation method, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

TransMedics Group, Inc.; XVIVO; OrganOx Limited; Paragonix Technologies; Waters Medical Systems; Organ Recovery Systems; Bridge to Life Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kidney Transplant Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the kidney transplant market report based on transplant type, preservation method, and region:

-

Transplant Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Living Donor Transplants

-

Deceased Donor Transplants

-

Donation after Brain Death (DBD)

-

Donation after Circulatory Death (DCD)

-

-

-

Preservation Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Cold Storage (SCS)

-

Hypothermic Machine Perfusion (HMP)

-

Normothermic Machine Perfusion (NMP)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global kidney transplant market size was estimated at USD 9.24 billion in 2024 and is expected to reach USD 9.84 billion in 2025.

b. The global kidney transplant market is expected to grow at a compound annual growth rate of 6.98% from 2025 to 2030 to reach USD 13.79 billion by 2030.

b. North America dominated the kidney transplant market with a share of 35.7% in 2024. This is attributable to the increasing prevalence of End-Stage Renal Disease (ESRD) and a growing number of R&D collaborations carried out by major players in the region.

b. Some key players operating in the kidney transplant market include TransMedics Group, Inc., XVIVO, OrganOx Limited, Paragonix Technologies, Waters Medical Systems, Organ Recovery Systems, Bridge to Life Ltd.

b. Key factors that are driving the kidney transplant market growth include growing organ donation awareness and initiatives, advancements in transplant techniques and immunosuppressive therapies, expanding use of machine perfusion technologies, and government and private funding support.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.