- Home

- »

- Homecare & Decor

- »

-

Kitchen Sinks Market Size & Share, Industry Report, 2030GVR Report cover

![Kitchen Sinks Market Size, Share & Trends Report]()

Kitchen Sinks Market (2025 - 2030) Size, Share & Trends Analysis Report By Number of Bowls (Single Bowl, Double Bowl, Multi Bowl), By Material, By Region (North America, Europe, Asia Pacific,Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-2-68038-951-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Kitchen Sinks Market Summary

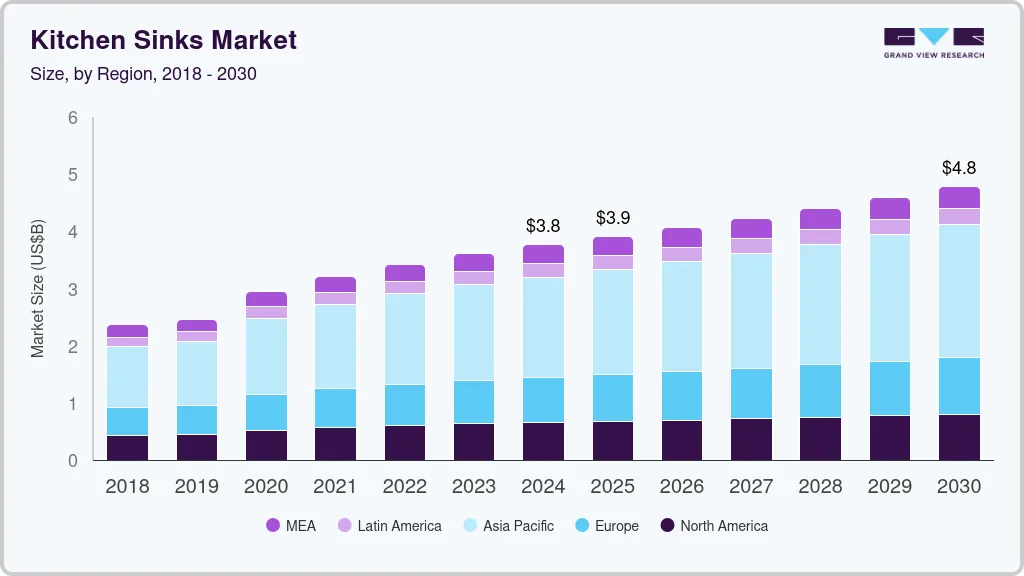

The global kitchen sinks market size was estimated at USD 3,761.1 million in 2024 and is projected to reach USD 4,781.4 million by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The kitchen sinks industry's growth is driven by multiple factors, including an increase in household formations across various regions, the global expansion of the hospitality sector, and rising disposable incomes among consumers.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

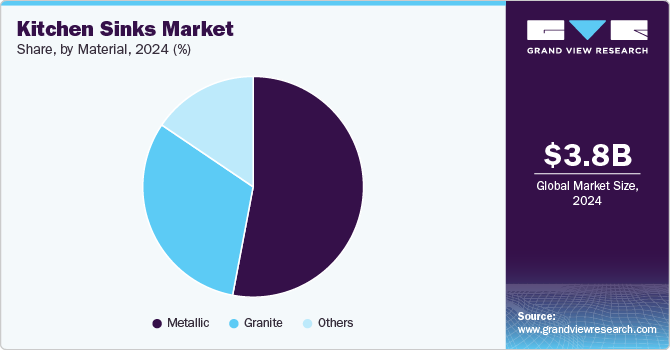

- In terms of segment, metallic accounted for a revenue of USD 2,079.8 million in 2024.

- Metallic is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,761.1 Million

- 2030 Projected Market Size: USD 4,781.4 Million

- CAGR (2025-2030): 4.1%

- Asia Pacific: Largest market in 2024

In addition, the growing preference for home cooking, fueled by health-consciousness and lifestyle changes, has significantly heightened the demand for well-equipped kitchens. As essential components, kitchen sinks serve versatile purposes and are increasingly integrated into smart and modular kitchen designs, where advanced features and innovative technologies enhance their utility. The market offers a broad array of sinks, varying in size, shape, material, and brand, to cater to a wide consumer base's diverse preferences and functional requirements.

The kitchen sinks industry has experienced significant innovation in recent years, driven by rising consumer demand for advanced and functional solutions. Modern sinks are now equipped with cutting-edge features such as integrated sprays, soap dispensers, and waste management systems, enhancing their appeal. For instance, Moen has introduced a motion-sensor touchless faucet, enabling activation through a simple hand gesture or utensil movement. This technology conserves water and streamlines tasks by eliminating the need to manually operate the faucet.

The market also sees the integration of Internet of Things (IoT) technology, enabling connectivity and seamless functionality in everyday kitchen fixtures. Notable advancements include motion-activated sinks and innovative designs such as convertible sink configurations that transform kitchen islands into visually striking landscapes, including sink channels mimicking flowing rivers. GROHE Limited, for example, offers premium kitchen sinks crafted from high-grade stainless steel, featuring technologies like the GROHE QuickFix system for simplified installation and GROHE Whisper technology to reduce noise during use.

The rising homeownership rate has further fueled investments in stylish and luxurious kitchen upgrades, with consumers increasingly opting for products that combine aesthetic appeal with technological sophistication. Renovation activity remains robust in 2023, with over half of homeowners (55%) undertaking projects, supported by an anticipated median expenditure of $15,000, rising to $85,000 for high-budget renovations, according to the 2023 U.S. Houzz & Home Study. This sustained focus on home improvement directly drives demand for kitchen sinks, which are integral to modern kitchen upgrades. Homeowners prioritizing functionality, design, and technology in their kitchen renovations increasingly seek premium sink solutions that align with their broader objectives of enhancing both utility and aesthetic appeal. This trend underscores the role of kitchen sinks as key fixtures in the growing market for home enhancement products.

The growing sustainability awareness is another key driver in the kitchen sinks industry. Manufacturers are exploring eco-friendly materials like recycled stainless steel, composite granite, and bamboo to cater to environmentally conscious consumers. For instance, Elkay's "Recycled Stainless Steel Sinks" and Blanco’s “Silgranit” sinks have gained popularity for their sustainable composition and durability. Furthermore, the increasing adoption of online retail channels transforms the purchasing experience, offering a wider variety of designs and brands. Platforms such as Wayfair and Home Depot are pivotal in enhancing product visibility and accessibility, enabling consumers to make informed decisions.

Consumers prioritize functionality alongside aesthetics, so the demand for premium and technologically advanced kitchen sinks is expanding. Features such as integrated faucets, soundproofing, and antimicrobial coatings are gaining traction, reflecting a shift toward multifunctional kitchen solutions. Moreover, the rise in smart homes has prompted manufacturers to innovate, offering sinks equipped with touchless technology and sensors to enhance user convenience. The global trend toward home renovation and remodeling projects, particularly in developed economies, further supports market growth as homeowners increasingly invest in high-quality kitchen fixtures.

Number of Bowls Insights

The single bowl segment led the market in 2024 and accounted for a market share of 48.24%. The global rise in nuclear families is reducing the demand for multi-bowl kitchen sinks traditionally used for cleaning and washing purposes. Key factors influencing kitchen sink installation decisions include spatial requirements, the frequency and number of users in the kitchen, and the preferred cleaning methods households adopt.

The demand for double-bowl kitchen sinks is projected to grow at a CAGR of 4.0% from 2025 to 2030. Due to their efficiency in streamlining the cleaning process, double-bowl sinks are a preferred choice among hotels, restaurants, and corporate organizations. Consumers commonly utilize one bowl for soapy water and the other for rinsing utensils, enhancing convenience and speed. Recognizing the space constraints associated with double-bowl sinks, manufacturers are innovating designs such as units featuring one smaller bowl or a shallow sink tailored for compact utensils.

Material Insights

The metal kitchen sinks accounted for a market share of 52.98% in 2024. The global demand for metal kitchen sinks is experiencing robust growth, driven by their superior durability, aesthetic appeal, and corrosion resistance. Metal sinks, particularly those made from stainless steel, are favored for their ease of maintenance, compatibility with modern kitchen designs, and ability to withstand high temperatures and heavy usage. In addition, their cost-effectiveness and recyclability align with sustainability trends, further contributing to their increasing adoption across residential, commercial, and hospitality sectors.

The demand for granite kitchen sinks is anticipated to grow with a CAGR of 3.8% from 2025 to 2030. Consumers increasingly favor granite sinks for their exceptional aesthetic appeal and reputation as a luxurious alternative to stainless steel counterparts. Available in various compositions, including pure marble, pure granite, granite composite (a blend of 85% quartz granite and 15% resin), and cultured marble (a mixture of marble dust, stone, and resin), these sinks offer a diverse range of premium options. While they command a higher price point than metallic sinks, their heavier build requires additional cabinet reinforcement during installation, ensuring long-term stability and safety.

Regional Insights

The kitchen sinks market in North America held a share of 17.39% of the global revenue in 2024. In North America, the kitchen sinks industry is growing due to urbanization and the proliferation of luxury housing developments. Canada, in particular, has seen a notable increase in demand, driven by rising disposable incomes and the growing inclination toward open-concept kitchens that require aesthetically appealing fixtures. Technological advancements, such as soundproofing features and antimicrobial surfaces, address consumer demands for durability and hygiene, with brands like Blanco and Franke leading innovation. Moreover, expanding e-commerce platforms such as Home Depot Canada have made premium and mid-range kitchen sinks more accessible to consumers across urban and suburban regions.

U.S. Kitchen Sinks Market Trends

The kitchen sinks market in the U.S. is expected to grow at a CAGR of 3.2% from 2025 to 2030. The demand for kitchen sinks in the U.S. is primarily driven by the increasing frequency of home renovation projects and rising consumer preference for modern, functional kitchen designs. The surge in single-family housing construction, supported by government incentives such as tax benefits for first-time homebuyers, has significantly boosted the market. Furthermore, product innovations, including touchless faucets and integrated sink systems, enhance premium offerings' appeal. For instance, Kohler's "Smart Divide" sinks, which provide dual functionality and space optimization, have gained traction among homeowners prioritizing efficiency. The rising trend of sustainability is further pushing manufacturers to adopt materials like recycled stainless steel and granite composites to meet the demands of eco-conscious consumers.

Asia Pacific Kitchen Sinks Market Trends

The kitchen sinks market in Asia Pacific accounted for a revenue share of around 46.77% in 2024. The Asia Pacific region is experiencing robust demand for kitchen sinks due to rapid urbanization and government-backed housing initiatives. In India, schemes like Pradhan Mantri Awas Yojana (PMAY) are increasing the adoption of mid-range sinks as part of affordable housing solutions, while in China, the rising middle class and urban population are driving investments in modular kitchens. Manufacturers are capitalizing on this demand by introducing competitively priced sinks with advanced features, such as scratch resistance and integrated water filtration systems. Moreover, local innovations, such as Teka’s stainless-steel sinks with advanced sound absorption technology, are addressing the needs of consumers in this rapidly growing market.

Europe Kitchen Sinks Market Trends

The kitchen sinks market in Europe is projected to grow at a CAGR of 3.9% from 2025 to 2030. In Europe, the demand for kitchen sinks is fueled by a strong focus on premium kitchen renovations and high standards for design and craftsmanship. Consumers in countries like Germany, France, and the UK increasingly opt for bespoke kitchen solutions, driving the popularity of customized and built-to-order sinks. Innovations in materials, such as Silgranit by Blanco, which offers scratch-resistant and non-porous surfaces, cater to the region's preference for high-quality, durable products. Furthermore, stringent environmental regulations have encouraged manufacturers to develop sinks made from sustainable or recyclable materials, aligning with the region’s commitment to reducing carbon footprints in home construction and renovation.

Key Kitchen Sinks Company Insights

The competitive landscape of the kitchen sinks industry is characterized by a high degree of fragmentation, with a diverse range of players spanning large multinational corporations, regional manufacturers, and specialized brands. Key market participants include established global leaders in home appliances and fixtures and emerging players focused on innovation in materials, design, and functionality. These companies differentiate themselves through product differentiation, technological advancements, pricing strategies, and brand positioning, catering to diverse consumer preferences such as aesthetic appeal, durability, ease of maintenance, and sustainability.

The product offerings in this market include a wide variety of sink configurations, including single-bowl, double-bowl, and multi-bowl models, available in various materials such as stainless steel, composite granite, ceramic, and fireclay. Competitive strategies often emphasize design innovation, with a focus on enhancing ergonomics, water efficiency, and noise reduction technologies. Leading companies are increasingly focusing on offering eco-friendly options, aligning with the growing consumer preference for sustainable products.

The competitive environment is also shaped by the rise of digital marketing strategies, including the utilization of social media, influencer collaborations, and targeted online advertising, which are playing an increasingly critical role in brand awareness and consumer engagement. As a result, companies must navigate the evolving trends in design, sustainability, and consumer behavior while maintaining profitability and securing market share in an increasingly crowded market space.

Key Kitchen Sinks Companies:

The following are the leading companies in the kitchen sinks market. These companies collectively hold the largest market share and dictate industry trends.

- Franke Group

- Kohler Co.

- Blanco America, Inc.

- Elkay Manufacturing Company

- Moen Incorporated

- Teka Group

- Reginox

- Duravit AG

- Ruvati USA

- Alveus d.o.o.

Recent Developments

-

In March 2024, Zurn Elkay Water Solutions, unveiled new additions to its Elkay Quartz sink line. These updates further elevate both the Quartz Classic and Quartz Luxe collections. Elkay Quartz combines elegance with durability, offering a versatile selection of vibrant hues. Engineered from a blend of natural quartz and high-performance acrylic resin, these sinks are designed to resist staining, smudging, and color fading, ensuring long-lasting aesthetics and functionality. The sinks are also heat resistant up to 535°F, providing exceptional durability. In addition, the inherent sound-dampening properties of the material reduce noise and vibration, contributing to a quieter, more pleasant kitchen experience.

-

In February 2024, Kohler introduced its Cairn kitchen sinks in India, marking a significant expansion into the Indian kitchen sinks industry. This strategic move underscored Kohler’s ongoing commitment to innovation and excellence in both bath and kitchen solutions. The launch of the Cairn collection was positioned to transform the kitchen experience for Indian consumers, reflecting the company’s dedication to enhancing everyday living through a combination of functionality and design. The Cairn kitchen sinks exemplified Kohler’s focus on delivering high-quality, stylish products that elevate the overall consumer experience.

Kitchen Sinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.91 billion

Revenue forecast in 2030

USD 4.78 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Number of bowls, material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Franke Group; Kohler Co.; Blanco America, Inc.; Elkay Manufacturing Company; Moen Incorporated; Teka Group; Reginox; Duravit AG; Ruvati USA; Alveus d.o.o.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kitchen Sinks Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the kitchen sinks market based on number of bowls, material, and region:

-

Number of Bowls Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Bowl

-

Double Bowl

-

Multi Bowl

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metallic

-

Granite

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kitchen sinks market was estimated at USD 3.76 billion in 2024 and is expected to reach USD 3.91 billion in 2025.

b. The global kitchen sinks market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030, reaching USD 4.78 billion by 2030.

b. Asia Pacific dominated the kitchen sinks market, with a share of 46.77% in 2024. This is attributable to the rising number of households and consumer preference for an elegant look for their kitchens, which attracts the installation of various innovative sinks in houses.

b. Some of the key players operating in the kitchen sinks market include Franke Group, Kohler Co., Blanco America, Inc., Elkay Manufacturing Company, Moen Incorporated, Teka Group, Reginox, Duravit AG, Ruvati USA, and Alveus d.o.o.

b. Key factors driving the kitchen sink market growth include the surge in the number of households in various countries, the increasing number of hotels and restaurants worldwide, and rising consumer expenditures on home care and decor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.