- Home

- »

- Display Technologies

- »

-

Large Format Display Market Size, Industry Report, 2030GVR Report cover

![Large Format Display Market Size, Share & Trends Report]()

Large Format Display Market (2025 - 2030) Size, Share & Trends Analysis Report By Display Type (Video Walls, Standalone Displays, Interactive Displays), Technology, Display Size, End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-571-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Large Format Display Market Size & Trends

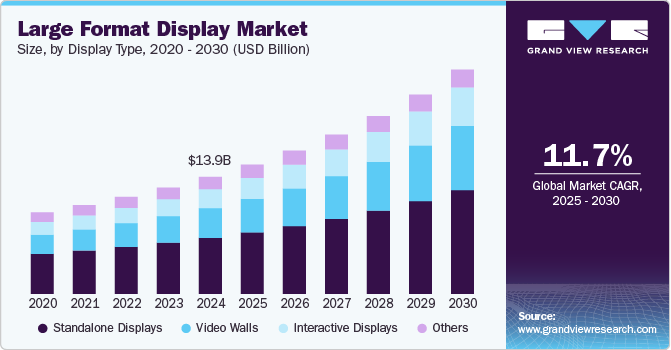

The global large format display market size was estimated at USD 13.92 billion in 2024 and is projected to grow at a CAGR of 11.7% from 2025 to 2030.This growth is driven by the widespread adoption of signage and interactive displays across the commercial sector, continuous technological advancements in large format display solutions, rising demand for 4K and 8K high-resolution commercial-grade screens in sectors such as education, healthcare, and sports & entertainment, as well as growing investments in real estate and public infrastructure projects by emerging economies.

The emergence of advanced display technologies such as OLED, microLED, and electronic paper displays (EPDs) has significantly accelerated the growth of the global display industry. Leading companies like Samsung Electronics and LG Electronics (South Korea), along with Sharp (Japan), are at the forefront of designing and producing cutting-edge solutions including microLED and OLED displays. The development of direct-view fine-pixel pitch large format LED displays-which offer bright, ultra-high-definition (UHD) visuals along with enhanced stability, flexibility, energy efficiency, and durability-has further fueled demand in this market. Key manufacturers such as Leyard, Sony, and Samsung Electronics are actively providing high-end LED displays tailored for signage and commercial applications.

Major Key initiatives, for instance, in January 2024, Sharp NEC Display Solutions Europe launched the new generation Sharp-branded MultiSync ME Series, designed for professional environments with high haze panels, native USB-C connectivity, and rapid input detection for effortless BYOD collaboration. Available in 43”, 50”, 55”, and 65” sizes, the ME Series features a slim, robust design, secure remote management, and an Android 13-based SoC for advanced signage and meeting applications. The series supports 4K content playback and offers seamless integration into AV infrastructures.

Display Type Insights

The standalone display segment led the market in 2024, accounting for a share of over 47.9% of the global revenue. Standalone displays in the Large Format Display market are witnessing strong growth driven by rising demand for digital signage in retail, hospitality, and public spaces. Their ease of installation and lower cost than video walls make them attractive for corporate boardrooms, educational institutions, and small businesses. The surge in smart city projects and public infrastructure developments is creating new opportunities for deployment in wayfinding and information systems. Advancements in display technologies are further enhancing image quality and durability. Additionally, increased adoption in emerging economies is expanding the market base.

Video walls segment accounted to hold a significant CAGR in the forecast period. The momentum in the Large Format Display market due to their scalability and high visual impact, making them ideal for control rooms, transportation hubs, and large event venues. The growing need for real-time data visualization in surveillance, traffic management, and emergency response drives adoption. Advancements in fine-pixel pitch LED and seamless bezel-less designs are enhancing image clarity and display continuity. Increased investments in public safety, smart infrastructure, and immersive advertising are further fueling demand. The ability to customize layouts offers flexibility for high-end commercial and mission-critical applications.

Technology Insights

The LED segment accounted for the largest market revenue share in 2024. The LED display market is experiencing strong growth due to increasing demand for high-resolution, energy-efficient screens across consumer electronics, automotive displays, and digital signage. Mini-LED and Micro-LED technologies are gaining traction, offering better brightness, contrast, and longevity. The rise of smart TVs, gaming monitors, and foldable devices further fuels adoption. Additionally, LED's eco-friendly profile aligns with global sustainability goals, encouraging wider integration. Advances in manufacturing techniques and cost reductions also support market expansion. key initiatives for instance, January 2024, Sharp/NEC's 3rd-gen dvLED FE Series introduces Flip-Chip SMD tech, cutting energy use by 60% while enhancing heat dissipation and durability. Designed for indoor corporate, education, and broadcast settings, it offers bezel-free visuals, 8000:1 contrast, and EMC Class-B safety.

The OLED segment is anticipated to exhibit the highest CAGR over the forecast period. Growth opportunities for OLED (Organic Light Emitting Diode) in technology displays lie in its increasing adoption across smartphones, TVs, wearables, and automotive displays due to its superior image quality and flexibility. The rise in demand for energy-efficient and thinner display panels further accelerates its market potential. Flexible and foldable display applications present emerging opportunities in next-gen consumer electronics. Advancements in materials and manufacturing processes are reducing costs, making OLEDs more commercially viable. Additionally, growing investment in AR/VR technologies is expected to boost OLED integration due to their high contrast and fast response times.

Display Size Insights

The 32”-65” segment accounted for the largest market revenue share in 2024. The growth is attributed to the rising demand for mid-sized televisions and monitors in both residential and commercial sectors. Increasing adoption of smart TVs, enhanced display resolutions like 4K, and affordable pricing are key drivers. The hospitality and education sectors are also boosting demand for medium-sized displays for digital signage and collaborative tools. E-commerce penetration and frequent promotional offers further support market expansion. Additionally, consumer preference for balanced screen size and space efficiency contributes to sustained growth.

The 66”-100” segment is anticipated to exhibit the fastest CAGR over the forecast period. The segment is experiencing robust growth driven by increasing demand for immersive viewing experiences in home entertainment, corporate boardrooms, and educational institutions. Advancements in 4K/8K resolution and LED/OLED technologies enhance image clarity and color performance, making larger displays more attractive. The rise of hybrid work models and digital classrooms boosts demand for collaborative and interactive displays. Falling panel costs and improved manufacturing efficiencies also contribute to broader adoption. Additionally, digital signage applications in retail and public spaces further fuel market expansion.

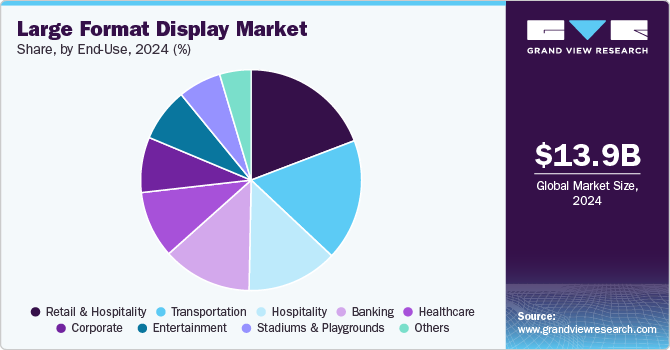

End Use Insights

The retail segment accounted for the largest market revenue share in 2024. The rise in omnichannel retailing also creates a need for seamless in-store integration of digital solutions. Furthermore, advancements in LFD technology, such as better resolution, energy efficiency, and ease of installation, are driving adoption. Retailers are also leveraging LFDs for real-time inventory updates, promotions, and customer engagement, making them vital tools for modern retail strategies. Major initiatives by key players for instance in February 2025, Samsung Electronics America launched its next-generation interactive displays and smart signage, including the WAF Interactive Display, a 105-inch 5K UHD Smart Signage, and a 115-inch 4K Smart Signage. Unveiled at ISE 2025, these new displays offer cutting-edge AI tools, ultra-clear visuals, and versatile mounting options, empowering retailers, educators, and businesses to create more engaging, collaborative, and dynamic environments.

The transportation segment is expected to exhibit a significant CAGR over the forecast period. The growth of large format displays (LFDs) in transportation is driven by increasing demand for enhanced passenger experience, real-time information sharing, and improved safety measures. Key opportunities include the integration of LFDs for digital signage in public transport, airports, and train stations, as well as for in-vehicle entertainment and navigation systems. Additionally, the rising need for contactless communication and digital solutions in response to health and safety concerns further boosts LFD adoption.

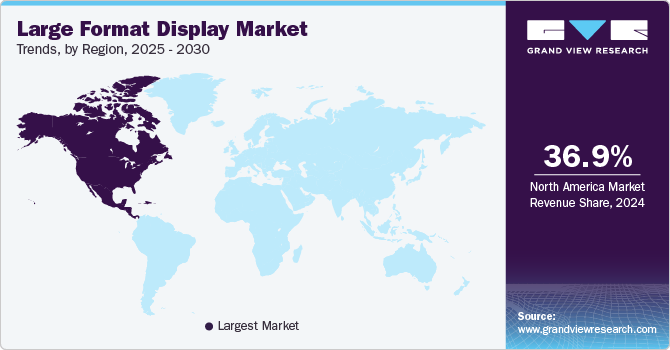

Regional Insights

North America large format display market dominated the global market with a revenue share of over 36.9% in 2024. The growth of large format displays (LFDs) in this region is driven by strong demand across retail, transportation, and corporate sectors for high-impact digital signage and real-time communication. The region's advanced infrastructure and early adoption of emerging technologies create significant opportunities for 4K and interactive LFD solutions. Increased investment in smart cities and public information systems further supports market expansion. Additionally, the rise of experiential marketing and digital out-of-home (DOOH) advertising fuels demand.

U.S. Large Format Display Market Trends

Large format display market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. The U.S. large format display (LFD) market benefits from a mature digital ecosystem and high consumer engagement with visual media. Growth is fueled by the expansion of hybrid workplaces, where LFDs are used for collaboration and virtual meetings. The entertainment industry also drives adoption, using immersive displays for events, arenas, and cinemas. Increased focus on energy-efficient and sustainable display technologies presents new opportunities. Moreover, rising demand for real-time analytics and AI-powered content delivery systems enhances LFD value across industries.

Europe Large Format Display Market Trends

The large format display market in the Europe region is expected to witness significant growth over the forecast period. The large format display (LFD) market in Europe is witnessing notable growth, driven by several distinct opportunities and regional trends. One of the primary drivers is the expanding demand for digital out-of-home (DOOH) advertising, as brands across Europe increasingly seek dynamic and high-visibility campaigns in public spaces. Additionally, modernization of transportation hubs such as airports and railway stations is leading to higher adoption of LFDs for real-time passenger information and commercial content.

Asia Pacific Large Format Display Market Trends

The large format display market in the Asia Pacific region is expected to register the fastest CAGR over the forecast period. Countries like India and China are expected to experience substantial expansion, fueled by the growing use of digital displays in retail outlets, corporate environments, healthcare facilities, and the hospitality sector. Rising disposable incomes in emerging Asia Pacific economies have led to a surge in foot traffic to malls and multiplexes, presenting businesses with a valuable opportunity to engage potential customers through large format displays. As a result, enterprises are increasingly utilizing these solutions to effectively target and attract audiences. Furthermore, the ongoing development of shopping centers and entertainment complexes is set to boost further the adoption of digital signage in the region’s hospitality industry over the forecast period.

Key Large Format Display Company Insights

Key large format display companies include Samsung Electronics; LG Electronics; Sharp Corporation; Sony Corporation; Panasonic Corporation are active in the large format display market and are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in February 2025, Samsung Electronics America unveiled its next-generation display lineup, including the WAF Interactive Display, 105-inch 5K UHD Smart Signage, and 115-inch 4K Smart Signage, at ISE 2025. The 105-inch QPD-5K offers ultra-clear visuals, a slim profile, and flexible installation for modern workspaces, retail, and transportation hubs, while the 115-inch QHFX features a borderless 16:9 screen and multi-view functionality. The WAF Interactive Display, powered by AI tools and Android 14, enhances classroom engagement with features like AI Summary and Live Transcript.

-

Samsung is a global player in technology and innovation, with a diverse business portfolio spanning consumer electronics, IT & mobile communications, and device solutions. The company is renowned for its advanced display technologies, offering a wide range of products including large format displays (LFDs) designed for business and commercial environments. Samsung’s LFDs are used in digital signage, control rooms, hospitality, education, and retail, delivering high-resolution visuals, durability, and smart connectivity features. With a strong commitment to research and development, Samsung continues to set industry standards in large format display solutions, empowering businesses to communicate and engage more effectively. The company’s global presence and cutting-edge technology make it a trusted partner for organizations seeking impactful visual communication tools.

-

Sony Corporation of America (SCA) is the U.S. headquarters of Sony Corporation, a global leader in entertainment, technology, and innovation. SCA oversees a diverse portfolio including electronics, gaming, music, movies, and professional solutions. In the large format display segment, Sony offers advanced visual technologies such as Crystal LED and professional BRAVIA displays, catering to business, education, and entertainment environments. Their large format displays are renowned for exceptional image quality, reliability, and innovative features, supporting impactful visual experiences across various industries.

Key Large Format Display Companies:

The following are the leading companies in the large format display market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics

- LG Electronics

- Sharp Corporation

- Sony Corporation

- Panasonic Corporation

- NEC Corporation

- Leyard Optoelectronic Co., Ltd.

- Barco NV

- TPV Technology Ltd

- Prysm Inc.

- STERIS PLC

- ViewSonic Corporation

Recent Developments

-

In March 2025, ViewSonic unveiled the world’s first Rack-mount All-in-One Control Box (LD-SCB-023) and its 3rd Generation Foldable All-in-One LED Display (LDS138-151) at ISE 2025. These innovations simplify installation, boost energy efficiency, and offer unmatched adaptability for large-scale display solutions. The LD-SCB-023 integrates power and control in a compact rack-mount design, while the foldable LDS138-151 enables easy mobility and durability for diverse environments. With these advanced solutions, ViewSonic continues to redefine LED display technology for impactful business communication and branding.

-

In May 2023, Sharp NEC Display Solutions of America launched the new NEC MultiSync M751, a 75-inch large format display designed for high-end corporate conferencing and large-scale digital signage. Featuring ultra-high-definition resolution, a slim bezel, and robust metal chassis, the M751 offers advanced features like Multi Picture Mode, SpectraView Engine, and 24/7 operation. Its anti-glare panel, flexible orientation, and extensive connectivity options make it ideal for demanding commercial environments. The display also supports Intel® Smart Display Module expandability and integrated cooling for long-lasting performance.

Large Format Display Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.37 billion

Revenue forecast in 2030

USD 26.68 billion

Growth rate

CAGR of 11.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Display type, technology, display size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Samsung Electronics; LG Electronics; Sharp Corporation; Sony Corporation; Panasonic Corporation; NEC Corporation; Leyard Optoelectronic Co., Ltd.; Barco NV; TPV Technology Ltd; Prysm Inc.; STERIS PLC; ViewSonic Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Large Format Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global large format display market report based on the display type, technology, display size, end use, and region:

-

Display Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video Walls

-

Standalone Displays

-

Interactive Displays

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

OLED

-

Others

-

-

Display Size Outlook (Revenue, USD Million, 2017 - 2030)

-

32”-65”

-

66”-100”

-

100” above

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & Hospitality

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Transporation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global large format display market size was estimated at USD 13,923.4 million in 2024 and is expected to reach USD 15,369.3 million in 2025.

b. The global large format display market is expected to grow at a compound annual growth rate of 11.7% from 2025 to 2030 to reach USD 26,685.0 million by 2030.

b. North America dominated the large format display market with a share of 36.0% in 2024. The growth of large format displays (LFDs) in this region is driven by strong demand across retail, transportation, and corporate sectors for high-impact digital signage and real-time communication.

b. Some key players operating in the large format display market include Samsung Electronics; LG Electronics; Sharp Corporation; Sony Corporation; Panasonic Corporation; NEC Corporation; Leyard Optoelectronic Co., Ltd.; Barco NV; TPV Technology Ltd; Prysm Inc.; STERIS PLC; ViewSonic Corporation

b. Key factors like the emergence of advanced display technologies such as OLED, microLED, and electronic paper displays (EPDs) has significantly accelerated the growth of the global display industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.