- Home

- »

- Biotechnology

- »

-

Large Molecule Bioanalytical Technologies Market Report 2030GVR Report cover

![Large Molecule Bioanalytical Technologies Market Size, Share & Trends Report]()

Large Molecule Bioanalytical Technologies Market (2025 - 2030) Size, Share & Trends Analysis Report By Products & Services, By Application (Biologics, Oligonucleotide Derived Drugs & Molecules), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-425-9

- Number of Report Pages: 258

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

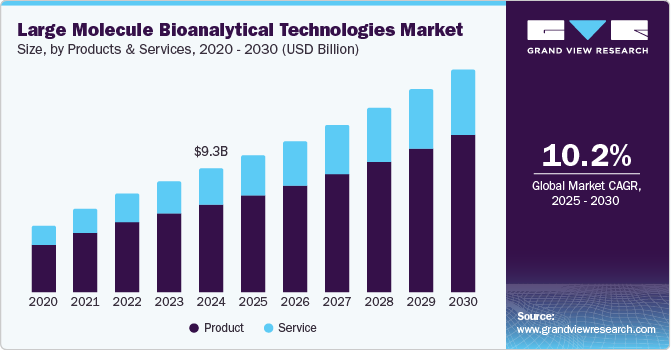

The global large molecule bioanalytical technologies market size was valued at USD 9.29 billion in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2030. This growth can be attributed to the increasing incidence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, and the rising demand for biopharmaceuticals. Biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies, require precise and advanced testing methods to ensure their safety, efficacy, and quality.

The increasing global demand for biologic drugs is driving the need for advanced bioanalytical technologies to analyze large molecules, which in turn fuels market growth and supports the development of new therapeutic solutions. Along with the ongoing shift toward R&D programs for large molecules, the increasing diversity in the therapeutic modalities being tested analytically is evident. This trend demands broader expertise to assess final product quality attributes, driving the market for large molecule bioanalytical technologies. Furthermore, regulatory pressure plays a crucial role in prompting a more detailed analysis of final products. These innovative drugs require a thorough biocompatibility, toxicology, and chemical characterization assessment to ensure efficacy and safety for human consumption. The integration of biochemical testing with digital technologies presents both opportunities and challenges for analytical testing laboratories.

The shift toward personalized medicine, coupled with advances in biotechnology and biomanufacturing, is anticipated to accelerate the large molecule bioanalytical technologies industry. Personalized medicine aims to tailor treatments to individual genetic profiles, increasing the demand for precise bioanalytical tools to support drug development and monitoring. In addition, breakthroughs in biotechnology and biomanufacturing enhance the production and scaling of biologic drugs, necessitating advanced analytical techniques for quality control, efficacy testing, and regulatory compliance, fueling market expansion.

Products & Services Insights

The product segment dominated the market with the largest revenue share of 71.5% in 2024, propelled by the growing demand for advanced tools and instruments used in the analysis of biologics. These products, including analytical instruments, reagents, and consumables, are essential for assessing the quality, stability, and efficacy of large molecule drugs. As the biopharmaceutical industry expands, driven by the increasing focus on biologics and personalized medicine, the need for reliable and precise bioanalytical solutions continues to rise, reinforcing the dominance of the product segment in the market.

The services segment is anticipated to emerge as the fastest-growing segment at a CAGR of 10.8% from 2025 to 2030, owing tothe increasing complexity of biologics and the rising demand for specialized testing. With advancements in biologics development, services such as analytical testing, validation, and regulatory support are becoming crucial for ensuring safety, efficacy, and compliance. The growing focus of pharmaceutical and biotech companies on biologics will drive the outsourcing of services to specialized providers, enabling streamlined operations, cost reduction, and access to advanced expertise. This trend is expected to further propel the growth of the services segment within the large molecule bioanalytical technologies industry.

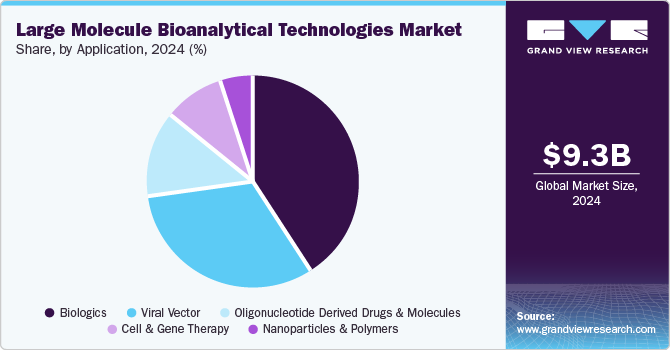

Application Insights

The biologics segment secured the largest revenue share in 2024 due to the rapid growth of biologics, including monoclonal antibodies, gene therapies, and biosimilars. These complex molecules require highly specialized analytical techniques for development, testing, and quality control, driving demand for advanced bioanalytical technologies. The increasing approval of biologics for a wide range of diseases, particularly oncology and autoimmune disorders, has further fueled this growth. As the biologics pipeline expands, the need for precise, reliable testing methods continues to dominate the large molecule bioanalytical technologies industry.

The cell and gene therapy segment is expected to grow at the fastest CAGR during the forecast period. The increasing demand for personalized medicine and advanced treatments for genetic disorders drives the need for specialized bioanalytical tools. Technologies such as gene sequencing, cell-based assays, and advanced molecular diagnostics are crucial for ensuring the safety and efficacy of these therapies. Ongoing innovations in bioanalysis will support the development and commercialization of cell and gene therapies, positioning this segment for substantial growth in the market.

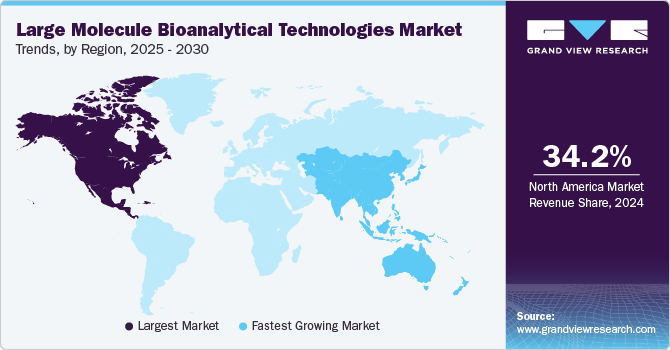

Regional Insights

North America large molecule bioanalytical technologies market held the largest revenue share of 34.2% in 2024, driven by the rising trend of regenerative medicine and the growing focus on cancer and rare diseases. As regenerative therapies, including stem cell treatments, gain momentum, the need for advanced bioanalytical tools is increasing to ensure the safety, potency, and quality of these innovative therapies. Moreover, biologic treatments for cancer and rare diseases demand precise bioanalytical testing to meet regulatory standards and optimize therapeutic efficacy, fueling regional market expansion.

U.S. Large Molecule Bioanalytical Technologies Market Trends

The U.S. large molecule bioanalytical technologies market held the largest share in 2024. The growing development and approval of biopharmaceuticals and a heightened focus on immunoassays are shaping the U.S. large molecule bioanalytical technologies industry. The expansion of the biopharmaceutical sector, particularly in biologics and monoclonal antibodies, drives the need for precise bioanalytical tools to ensure safety, efficacy, and quality. Immunoassays play a crucial role in evaluating the potency and structure of large molecules, fueling demand for advanced technologies that can meet the rigorous testing requirements of these complex therapeutics.

Europe Large Molecule Bioanalytical Technologies Market Trends

Europe large molecule bioanalytical technologies market is projected to record significant growth during the forecast period. The growth of biologics and biosimilars, coupled with the rising adoption of automated systems and digital platforms in bioanalysis, is set to propel the market. The increasing use of biologic therapies is impelling the demand for advanced, precise analytical tools to ensure their quality, efficacy, and regulatory compliance. Automation and digital platforms improve efficiency, accuracy, and data management, addressing the rising demand for high-throughput testing and faster drug development. These innovations fuel market growth by enhancing the scalability and reliability of bioanalytical processes in Europe. In September 2024, Thermo Fisher Scientific's PPD clinical research division announced the expansion of its bioanalytical laboratory services with a new facility in GoCo Health Innovation City, Gothenburg, Sweden. This lab will provide advanced services and cutting-edge instrumentation to support pharmaceutical and biotech clients throughout all phases of drug development.

Asia Pacific Large Molecule Bioanalytical Technologies Market Trends

APAC large molecule bioanalytical technologies market is anticipated to be the fastest-growing region with a CAGR of 11.7% from 2025 to 2030, propelled by the adoption of oligonucleotide therapies and the expansion of biomanufacturing. Oligonucleotide-based therapies, such as RNA and gene-editing treatments, require specialized bioanalytical technologies for precise analysis and quality control. The expansion of biomanufacturing capabilities in the region drives the demand for advanced tools to ensure consistent production and regulatory compliance of biologic drugs. This growth in therapeutic innovation and manufacturing infrastructure is fueling the demand for sophisticated bioanalytical solutions in Asia Pacific.

China large molecule bioanalytical technologies market is set to experience the fastest CAGR during the forecast period, driven by government support for biotechnology and the rise in personalized medicine. The Chinese government is heavily investing in biotechnology initiatives, promoting research and development in biologics, which increases the demand for advanced bioanalytical testing. Moreover, the growing focus on personalized medicine, which tailors treatments based on genetic profiles, impels the need for precise bioanalytical technologies to ensure efficacy and safety. Hence, a combination of governmental backing and demand for customized therapies propels the Chinese market growth.

Key Large Molecule Bioanalytical Technologies Company Insights

Some of the key companies in the large molecule bioanalytical technologies industry includeLabcorp; Merck KGaA; Charles River Laboratories; F. Hoffmann-La Roche Ltd; and Bio-Rad Laboratories, Inc.

-

F. Hoffmann-La Roche Ltd provides innovative healthcare solutions, including pharmaceuticals, diagnostics, and biotechnology products. The company specializes in oncology, immunology, infectious diseases, and neuroscience, offering cutting-edge treatments and diagnostic tools to improve patient outcomes.

-

Bio-Rad Laboratories, Inc. offers a broad range of life science research and clinical diagnostic products. These include instruments, reagents, and software for applications in genomics, proteomics, cell biology, and diagnostics across various research and healthcare fields.

Key Large Molecule Bioanalytical Technologies Companies:

The following are the leading companies in the large molecule bioanalytical technologies market. These companies collectively hold the largest market share and dictate industry trends.

- Intertek Group plc

- Solvias

- Bio-Techne

- Waters Corporation

- Cytiva

- Verder Scientific GmbH & Co. KG

- Halo Labs

- Charles River Laboratories

- Avomeen

- Merck KGaA

- Cergentis B.V.

- Labcorp

- SCIEX

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In November 2023, Halo Labs introduced 0.8µm black membrane plates for Fluorescence Membrane Microscopy (FMM), aimed at helping large molecule drug developers analyze particles in highly concentrated, viscous solutions. This new addition enhanced their consumables offerings for particle characterization.

-

In February 2023, Charles River Laboratories launched its first IgY-based ELISA kit for detecting and quantifying residual Host Cell Proteins (HCP) in CHO-based biotherapeutics. This novel tool enhances bioanalytical capabilities for evaluating biologic drug purity.

Large Molecule Bioanalytical Technologies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.32 billion

Revenue forecast in 2030

USD 16.76 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products & services, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Intertek Group plc; Solvias; Bio-Techne; Waters Corporation; Cytiva; Verder Scientific GmbH & Co. KG; Halo Labs; Charles River Laboratories; Avomeen; Merck KGaA; Cergentis B.V.; Labcorp; SCIEX; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Large Molecule Bioanalytical Technologies Market Report Segmentation

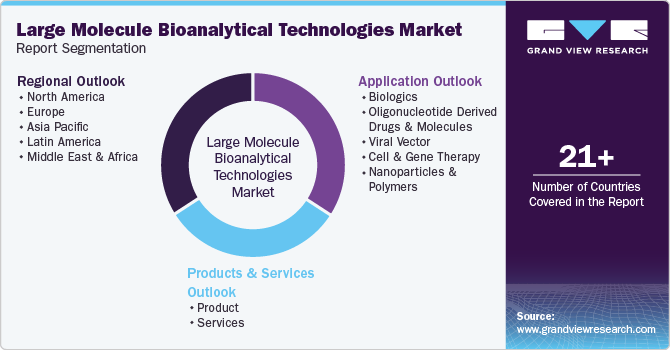

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global large molecule bioanalytical technologies market report on the basis of products & services, application, and region:

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Consumables & Accessories

-

Instruments

-

Reagents & Kits

-

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Oligonucleotide Derived Drugs & Molecules

-

Viral Vector

-

Cell & Gene Therapy

-

Nanoparticles & Polymers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The biologics segment dominated the global large molecule bioanalytical technologies market and accounted for the largest revenue share of 42% in 2022.

b. The global large molecule bioanalytical technologies market was valued at USD 7.47 billion in 2022 and is expected to reach USD 8.34 billion by 2023.

b. The global large molecule bioanalytical technologies market is projected to grow at a CAGR of 10.49% and is expected to reach USD 16.76 billion by 2030.

b. North America dominated the large molecule bioanalytical technologies market with a share of 34.4% in 2022. This can be attributed to the presence of strong research as well as the commercial base for biopharmaceutical manufacturing.

b. Some key technology suppliers operating in the large molecule bioanalytical technologies market include Agilent Technologies; PerkinElmer, Inc.; Bruker; Thermo Fisher Scientific, Inc.; and Shimadzu Corporation.

b. Key factors driving the market growth include technological advancements in life science tools & analytical instruments, the rising collaboration between operating stakeholders & rising advancements, automation & expansion in laboratory facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.