Industry Insights

The Latin America adhesives market size was valued at USD 1.98 billion in 2017 and is expected to witness a CAGR of 5.8% from 2018 to 2025. Growing refurbishment and renovation coupled with a rising number of construction activities are the significant factors driving the market. Moreover, government initiatives towards sustainable construction designs are likely to contribute to market growth. Rapidly expanding end-use industries, such as automotive, construction, electrical and electronics, and packaging, owing to several economic reforms and recovery in emerging economies of Latin America are also expected to stimulate market growth.

On the other hand, the majority of raw materials used for producing adhesives are obtained from crude oil and petrochemicals, such as resins, synthetic rubber, and plastics. The volatility in these raw material prices leads to fluctuations in the production costs, which may restrict market growth. However, rising awareness regarding the benefits of sustainable manufacturing is expected to have a positive impact on market growth over the coming years.

There is a rise in demand for rigid foams with high insulation properties, especially in the building and construction industry on account of stringent energy-efficiency regulations. For instance, set limits on Volatile Organic Compounds (VOCs) emissions from adhesives and sealants. Such regulations are making companies invest extensively in R&D to develop bio-based, eco-friendly products.

Moreover, automotive manufacturers are increasingly replacing conventional heavy materials, such as metals, with lightweight, enhanced plastics. This trend is expected to propel the usage of high-performance adhesives owing to their ability to reduce the weight of automotive components and enhance fuel-efficiency. For instance, in August 2018, Braskem launched a new renewable resin made from sugarcane.

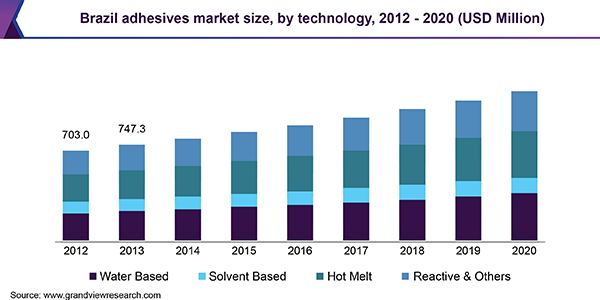

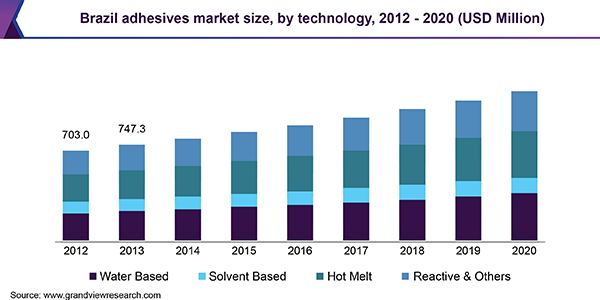

Product Insights

The water-based product segment captured the highest market revenue share of 46.90% in 2017 on account of its eco-friendly characteristics. The segment is expected to continue its dominance over the forecast years on account of the wide usage of water-based adhesives in the construction and packaging industries. Also, increasing environmental awareness is projected to boost the segment growth over the forecast period.

Hot-melts segment is anticipated to expand at 5.3% CAGR, in terms of volume, during the forecast period owing to the lower cost of hot-melts as compared to the solvent-based adhesives. Extensive utilization of these products in applications, such as furniture, electrical, transportation, packaging, and product assembly, owing to their high bonding speed is expected to drive the demand further.

Reactive adhesives are normally distinguished by the development of enduring bonds between substrates to provide resistance to moisture, chemicals, and heat. They exhibit long-term durability and high bond strength under severe environmental conditions. One of the key performance advantages of these products over other adhesives is that they cure to a substance that opposes melting.

Solvent-based adhesives are widely used in the automotive industry for vehicle interiors. The polymer system in its formulation determines the performance of solvent-based adhesives. These adhesives have high initial bonding and short fixing times. They also provide good adhesion on a plastic base, as well as on other substrates, depending on the type of raw materials used in its production.

Regional Insights

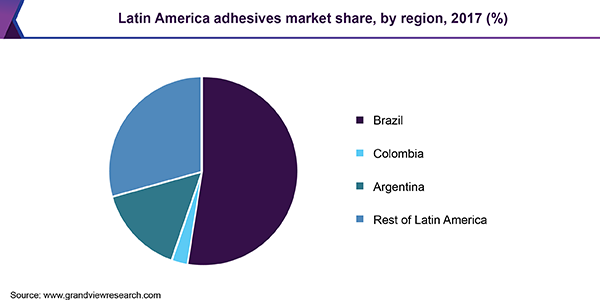

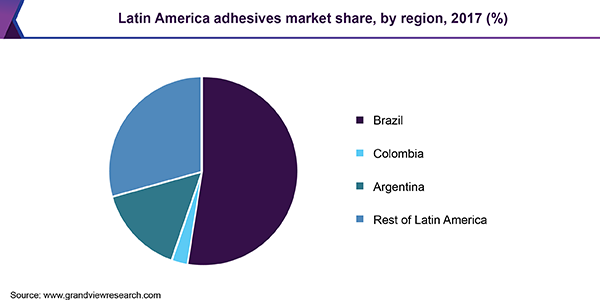

Brazil was leading the Latin America adhesives market and accounted for 52.8% of the overall industry in 2017. According to the World Bank, the industrial sector in Brazil contributed a significant output of 18.5% to its GDP in 2017. Brazil is the world’s seventh-largest economy and a major automotive producer. Various incentives and programs by the local governments to attract more foreign investments are expected to boost the automotive sector in the country, thereby propelling adhesives market growth. Moreover, the rapidly developing infrastructure is estimated to drive the market further.

In terms of revenue, Colombia is anticipated to witness significant growth over the forecast period with a CAGR of 6.5%. The market in Colombia is characterized by high demand growth in end-use industries, such as textiles, medical textiles, packaging, and household applications. The growing geriatric population coupled with initiatives to develop superior-quality sports apparel and to enhance agricultural yield is expected to spur the market development in this country.

Besides, increasing awareness regarding environmental protection and sustainable practices is driving industry growth across the region. The automotive sector has witnessed exponential growth in Argentina, which, in turn, has been boosting the product demand. Moreover, the construction segment is also at the forefront and accounts for a major share of the market in Argentina.

Latin America Adhesives Market Share Insights

Major companies in the market include Henkel Adhesives, 3M Company, BASF SE, The Dow Chemical Company, Bostik SA, Sika Corp., and BASF SE. Acquisitions and agreements are the key strategies adopted by most of these firms for business development.

For instance, in May 2018, Lubrizol entered into a strategic agreement with Apta and appointed Apta as the new distributor for their Thermoplastic Polyurethane (TPU) portfolio throughout Brazil. Also, companies are increasingly investing in R&D activities for product innovation. For instance, in the recent past, Hexion expanded its R&D facility for the development of next-generation bio-based resins for wood panels.

Report Scope

|

Attribute

|

Details

|

|

The base year for estimation

|

2017

|

|

Actual estimates/Historical data

|

2014 - 2016

|

|

Forecast period

|

2018 - 2025

|

|

Market representation

|

Revenue in USD Million, Volume in Kilotons, and CAGR from 2018 to 2025

|

|

Regional scope

|

Latin America

|

|

Country scope

|

Brazil, Colombia, and Argentina

|

|

Report coverage

|

Revenue and volume forecast, company share, competitive landscape, growth factors, and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the Report

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the Latin America adhesives market report based on product and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Natural

-

Water-based

-

Hot-melt

-

Reactive

-

Solvent-based

-

Emulsion

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Latin America

-

Brazil

-

Colombia

-

Argentina