- Home

- »

- Next Generation Technologies

- »

-

Latin America Heavy Construction Equipment Market 2030GVR Report cover

![Latin America Heavy Construction Equipment Market Size, Share & Trends Report]()

Latin America Heavy Construction Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Machinery Type, By Application, By Propulsion Type, By Power Output, By Engine Capacity, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-552-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

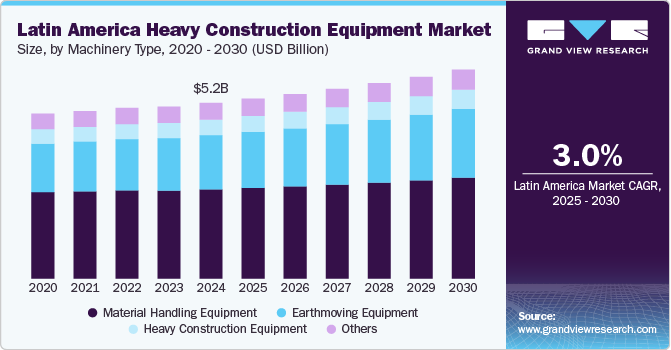

The Latin America heavy construction equipment market size was estimated at USD 5.16 billion in 2024 and is estimated to grow at a CAGR of 3.0% from 2025 to 2030. Latin America's heavy construction equipment market is mainly attributed to rapid urbanization, increasing infrastructure development, and substantial government investments in transportation, energy, and residential projects. The region's growing mining and agriculture sectors further fuel demand for robust machinery. Rising demand for eco-friendly construction, increasing interest in electric equipment, and support for green projects are key opportunities. However, the lack of skilled workers and technicians remains a major challenge, making it difficult to adopt and operate advanced machinery fully.

Rising investments in infrastructure development projects across Latin America are significantly propelling the region's heavy construction equipment market. Governments are channeling substantial funds into large-scale infrastructure initiatives to stimulate economic growth and enhance connectivity. For instance, Brazil's New Growth Acceleration Program (Novo PAC), launched in August 2023, commits BRL 1.7 trillion (approximately USD 347 billion) towards nationwide infrastructure projects, encompassing transportation, energy, and urban development sectors.

Similarly, Mexico's National Infrastructure Plan anticipates nearly USD 600 billion in combined public and private investments over the next five years, targeting critical areas such as energy, telecommunications, transportation, housing, and urban development. These expansive initiatives are expected to drive substantial demand for heavy construction equipment, including earthmoving machinery, cranes, and material handling equipment, as the region undertakes extensive development projects.

Rapid urbanization in countries including Colombia, Peru, and Brazil is driving strong growth in residential construction, particularly in major cities and expanding suburbs. This surge in housing demand is increasing the demand for heavy construction equipment such as earthmoving machines, cranes, and material handling tools to keep up with project timelines and large-scale developments. Also, government initiatives promoting affordable housing and incentives for public-private partnerships are further supporting construction activity. As urban populations grow, the push to build more homes and improve infrastructure continues to fuel demand for heavy equipment across the region.

Economic volatility and currency fluctuations pose significant challenges to the Latin American heavy construction equipment market. Frequent devaluations of local currencies, such as the Argentine peso's over 50% depreciation against the U.S. dollar in December 2023, increase the cost of importing machinery, making new equipment less affordable for contractors. Similarly, the Brazilian real and Colombian peso are prone to fluctuations, leading to financial uncertainty for businesses. High interest rates, like Brazil's 13.75% in 2023, further deter investment in new equipment, prompting many companies to opt for renting or purchasing used machinery instead.

The expansion of the mining sector is further supporting the demand for heavy construction equipment in Latin America. The region accounts for 40% of global copper production, with Chile, Peru, and Mexico leading the way. It also holds vast lithium reserves, mainly in the “Lithium Triangle” of Argentina, Bolivia, and Chile. With rising global demand for minerals like copper and lithium, which are crucial for electric vehicles and renewable energy, mining activity is growing rapidly. This has increased the demand for excavators, loaders, and other heavy machinery.

Machinery Type Insights

Based on machinery type, the material handling equipment segment dominated the Latin America heavy construction equipment market with a revenue share of 50.8% in 2024. The growth of material handling equipment is mainly attributed to the increasing infrastructure development, industrial expansion, and rising investments in logistics and warehousing. The growing need for efficient movement of materials across construction sites and industrial facilities has further boosted demand for cranes, forklifts, and conveyors.

The earthmoving equipment segment is expected to experience substantial growth over the forecast period, driven by large-scale infrastructure and mining projects across countries like Brazil, Chile, and Peru. Growing urbanization and increased investments in road, rail, and residential construction are also fueling demand for excavators, bulldozers, and loaders, particularly in developing economies within the region.

Application Insights

Based on application, the material handling segment dominated the Latin America heavy construction equipment market in 2024. The growth of the segment is attributed to the rapid infrastructure development, expansion of warehousing, and rising demand for efficient equipment to move, store, and manage heavy loads across construction, mining, and industrial sites. The transportation segment is expected to experience substantial growth over the forecast period. The growth of the segment is attributed to the rising investments in road, rail, and port development projects across countries such as Brazil, Mexico, and Colombia.

Propulsion Type

Based on propulsion type, the ICE segment dominated the Latin America heavy construction equipment market in 2024. The growth of the ICE segment is mainly driven by its high power output, reliability, and suitability for large-scale infrastructure and mining projects. The availability of spare parts and established servicing networks across Latin America further supports their dominance. Also, the region’s ongoing reliance on fossil fuels and delayed adoption of electric infrastructure keeps ICE equipment in high demand.

The electric segment is expected to experience substantial growth over the forecast period. Factors such as increasing environmental regulations, government support for cleaner technologies, and rising interest in reducing emissions, especially in urban and industrial zones are supporting the segment growth.

Power Output Insights

Based on power output, the <100 HP segment dominated the Latin America heavy construction equipment market in 2024. The growth of the segment is attributed to the increasing demand for compact and versatile machinery in urban construction, agriculture, and small-scale infrastructure projects. Their lower fuel consumption and cost-efficiency also make them a practical choice for small contractors and municipal applications.

The 201 - 400 HP segment is expected to experience substantial growth over the forecast period. The growth of the segment is attributed to increasing use of mid-powered equipment in large-scale mining operations, infrastructure upgrades, and industrial construction projects that require a balance between power, efficiency, and fuel economy.

Engine Capacity Insights

Based on engine capacity, the 5-10L segment dominated the Latin America heavy construction equipment market in 2024. The growth of the 5-10L segment is mainly attributed to the increasing demand for mid-range equipment in roadbuilding, utility installation, and mid-scale mining operations. These engines offer the ideal power-to-weight ratio for machines like backhoe loaders, wheel loaders, and compact excavators commonly used in urban infrastructure and agricultural expansion.

The >10L segment is expected to experience substantial growth over the forecast period. The growth of the segment is attributed to the rising deployment of high-capacity machinery in big mining operations, dam construction, and major road and rail expansion projects.

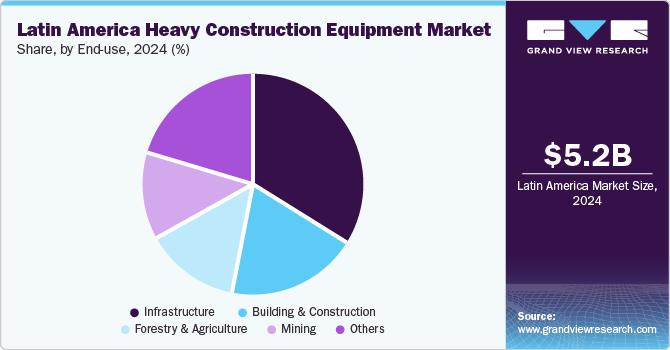

End Use Insights

Based on end use, the infrastructure segment dominated the Latin America heavy construction equipment market in 2024. The growth of the segment is attributed to the government increasing investments in transportation, energy, and urban development projects. Major initiatives include highway expansions in Colombia, metro system upgrades in Santiago, Chile, and renewable energy installations in Brazil and Argentina. These projects require extensive use of earthmoving, lifting, and paving equipment, driving demand across multiple equipment categories.

The mining segment is expected to experience substantial growth over the forecast period. The growth of the segment is attributed to the rising extraction of copper, lithium, and iron ore across Chile, Peru, and Brazil. In addition, supportive government policies in countries such as Argentina and Chile are attracting more foreign investment in mining, leading to higher demand for heavy machinery to expand operations.

Country Insights

Brazil Heavy Construction Equipment Market Trends

The Brazil heavy construction equipment industry held a dominant position in 2024. The market is witnessing significant transformation, driven by large-scale public and private investments in the country’s infrastructure. A key contributor is the New Growth Acceleration Program (Novo PAC), launched in August 2023, which pledged BRL 1.7 trillion (~USD 298 billion) in investments across all Brazilian states. This includes BRL 371 billion (~USD 65 billion) from the General Budget, BRL 343 billion (~USD 60 billion) from state-owned companies, BRL 362 billion (~USD 63 billion) through financing, and BRL 612 billion (~USD 107 billion) from the private sector. These funds are being directed toward road, rail, energy, and housing developments, boosting demand for heavy-duty equipment, particularly ICE-powered machines capable of handling intensive construction operations.

Argentina Heavy Construction Equipment Market Trends

The Argentina heavy construction equipment industry held a dominant position in 2024, supported by strategic infrastructure priorities and international funding. The Government of Argentina is focused on overhauling the country's aging infrastructure, with emphasis on sectors such as highways, railways, ports, energy, and water systems. Multilateral institutions, including the Inter-American Development Bank and the World Bank, have committed over USD 7.9 billion toward infrastructure development, reinforcing project momentum. Additionally, Argentina's Public Private Partnership (PPP) framework, though partially suspended, continues to support select projects such as toll roads. These ongoing investments are driving demand for heavy construction machinery, particularly in large-scale transport and utility-related works, as the country seeks to modernize critical infrastructure networks.

Peru Heavy Construction Equipment Market Trends

The Peru heavy construction equipment industry held a dominant position in 2024. The heavy construction equipment market in the Peru is witnessing significant transformation, driven by rising investment in the mining and infrastructure sectors. In February 2024, Peru’s environmental regulatory authority approved a USD 2 billion (7.64 billion Sol) expansion of the Antamina copper-zinc mine, which is expected to fuel demand for robust ICE-powered machinery used in excavation, hauling, and material handling. In addition, the country’s ongoing focus on upgrading roads, energy facilities, and water infrastructure is supporting the adoption of advanced construction equipment across multiple end-use segments.

Chile Heavy Construction Equipment Market Trends

The Chile heavy construction equipment industry held a dominant position in 2024. The heavy construction equipment market in Chile is witnessing significant transformation, driven by the country’s booming mining sector and ongoing public infrastructure investments. As the world’s largest copper producer, Chile continues to attract major mining expansion projects, which require large-scale excavation, drilling, and hauling equipment.

Key Latin America Heavy Construction Equipment Company Insights

Some of the key companies in the Latin America heavy construction equipment industry include Caterpillar, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., AB Volvo, and others. The key participants focus on adopting strategies such as service differentiation, inclusion of customization and personalization in service offerings, and improved customer assistance to address growing competition.

-

Caterpillar, global construction and mining equipment manufacturers primarily operate in three key segments: construction, industries, resource industries, and energy & transportation. Resource industries portfolio, mainly related to heavy equipment, features numerous offerings from electric rope shovels to large wheel loaders, mining trucks, autonomous ready vehicles, and more.

-

Komatsu Ltd. is primarily engaged in manufacturing and selling construction and mining equipment, forest machines, industrial machinery, utility equipment, and more. With its operations in Japan and China, it also has a significant global presence in regions such as North America, Europe, the Middle East and Africa, Asia/Oceania, and Latin America. Latin American operations include construction, utility, and mining equipment manufacturing facilities. Its key offerings in the heavy construction equipment category include hydraulic excavators, wheel loaders, bulldozers, electric rope shovels, motor graders, dump trucks, forklift trucks, and others.

Key Latin America Heavy Construction Equipment Companies:

- Caterpillar

- Komatsu Ltd.

- AB Volvo

- Hitachi Construction Machinery Co., Ltd

- Kobelco Construction Machinery Co., Ltd

- SANY Group

- CNH Industrial N.V.

- Liebherr

- XCMG Group

- Deere & Company

Recent Developments

-

In January 2025, Hitachi Construction Machinery Co., Ltd. announced its plan to establish Hitachi Construction Machinery Latin America SpA in Chile in April 2025 to facilitate the company's current and future operations in the region.

-

In January 2025, XCMG announced that it is investing USD 16.4 million in operation enhancements across Brazil and South America. The investment aims to incorporate new Enterprise Resource Planning (ERP) software and other software solutions to ensure process integration and improved management activities.

-

In November 2024, H-E Parts International LLC, a Hitachi Construction Machinery Co., Ltd. subsidiary, acquired Brake Supply Co., Inc. Acquiring a company engaged in remanufacturing mining machinery components is expected to strengthen Hitachi’s remanufacturing business across the Americas.

-

In April 2024, Vale, and Caterpillar collaborated for testing battery-electric large trucks and energy transfer systems by Caterpillar. Two plants also conducted studies on ethanol-powered trucks. The collaboration aims at supporting Vale in attaining its carbon emissions reduction goals by 2030.

Latin America Heavy Construction Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.28 billion

Revenue forecast in 2030

USD 6.13 billion

Growth rate

CAGR of 3.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Machinery, application, propulsion, power output, engine capacity, end use

Key companies profiled

Hitachi Construction Machinery Co., Ltd.; Kobelco Construction Machinery Co.; Deere & Company; CNH Industrial N.V.; Caterpillar; Komatsu Ltd.; AB Volvo; Liebherr, Ltd; SANY Group; XCMG Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Heavy Construction Equipment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America heavy construction equipment market report based on machinery type, application, propulsion type, power output, engine capacity, and end use:

-

Machinery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Earthmoving Equipment

-

Heavy Construction Equipment

-

Material Handling Equipment

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Excavation & Demolition

-

Material Handling

-

Tunneling

-

Heavy Lifting

-

Transportation

-

Recycling & Waste Management

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Power Output Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 HP

-

101-200 HP

-

201 - 400 HP

-

>400 HP

-

-

Engine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

<5L

-

5-10L

-

>10L

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Infrastructure

-

Forestry & Agriculture

-

Mining

-

Others

-

Frequently Asked Questions About This Report

b. The Latin America heavy construction equipment market size was estimated at USD 5.16 billion in 2024 and is expected to reach USD 5.28 billion in 2025.

b. The Latin America heavy construction equipment market is expected to grow at a compound annual growth rate of 3.0% from 2025 to 2030 to reach USD 6.13 billion by 2030.

b. The Brazil heavy construction equipment industry held a dominant position in 2024. The market is witnessing significant transformation, driven by large-scale public and private investments in the country’s infrastructure.

b. Some key players operating in the Latin America heavy construction equipment market include Hitachi Construction Machinery Co., Ltd., Kobelco Construction Machinery Co., Deere & Company, CNH Industrial N.V., Caterpillar, Komatsu Ltd., AB Volvo, Liebherr, Ltd, SANY Group, XCMG Group.

b. Key factors that are driving the market growth include rapid urbanization, increasing infrastructure development, and substantial government investments in transportation, energy, and residential projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.