- Home

- »

- IT Services & Applications

- »

-

Law Enforcement Software Market, Industry Report, 2033GVR Report cover

![Law Enforcement Software Market Size, Share, & Trend Report]()

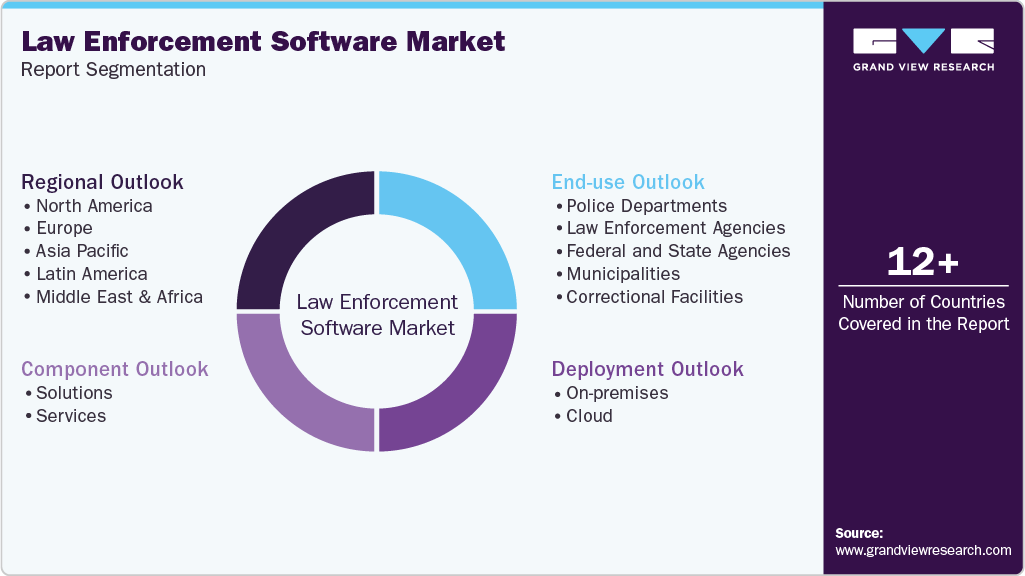

Law Enforcement Software Market (2026 - 2033) Size, Share, & Trend Analysis By Component (Solutions, Services), By Deployment (On-premises, Cloud), By End Use (Police Departments, Law Enforcement Agencies, Municipalities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-373-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Law Enforcement Software Market Summary

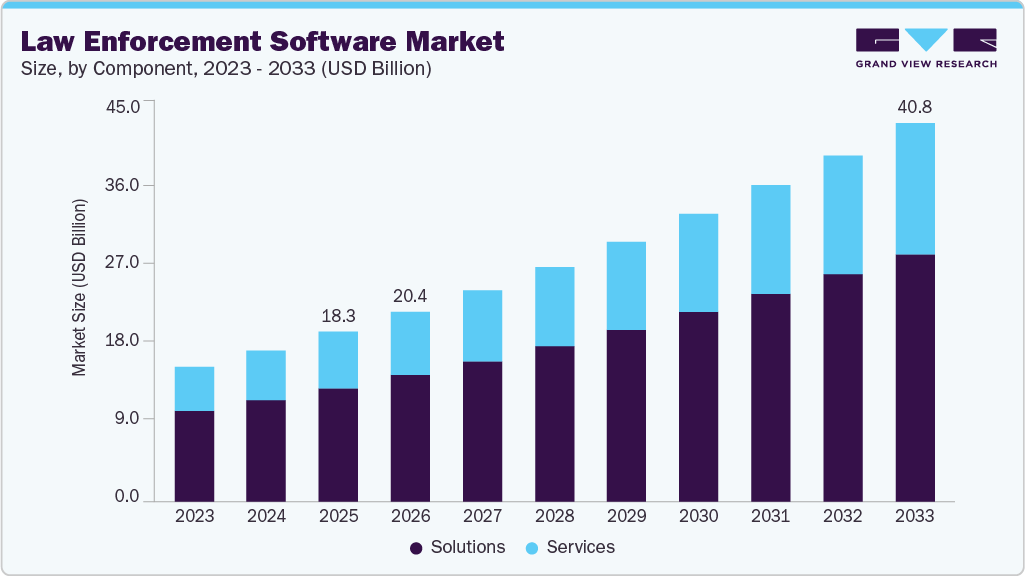

The global law enforcement software market size was estimated at USD 18.26 billion in 2025 and is projected to reach USD 40.76 billion by 2033, growing at a CAGR of 10.4% from 2026 to 2033. The market growth is driven by the increasing need for advanced digital solutions to enhance public safety, streamline criminal investigations, and improve operational efficiency.

Key Market Trends & Insights

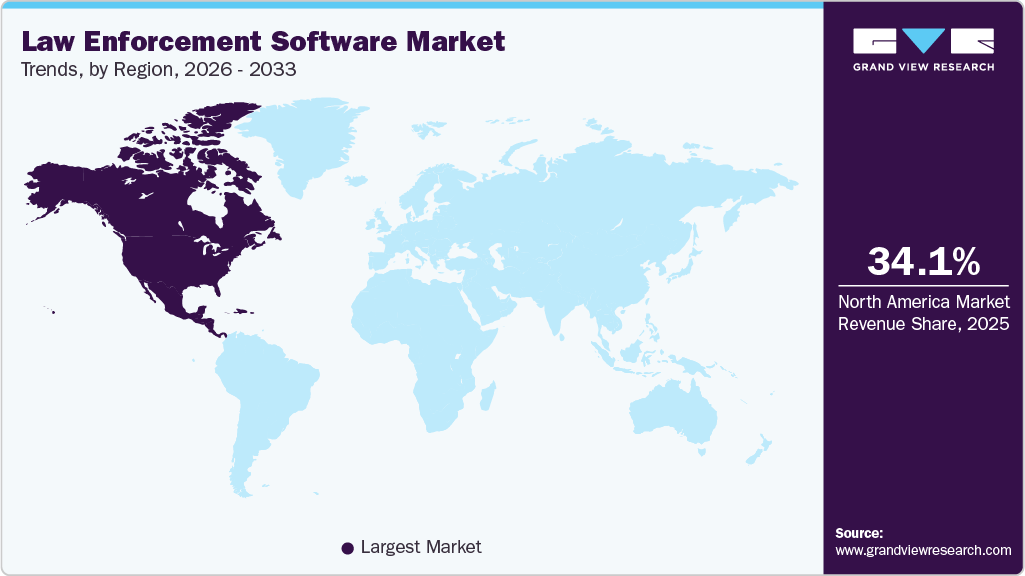

- The North America law enforcement software market dominated with the largest global revenue share of 34.1% in 2025.

- The law enforcement software industry in the U.S. is expected to grow significantly at a CAGR of 12.1% from 2026 to 2033.

- By component, the solutions segment held the largest revenue share of 67.0% in 2025.

- By deployment, the cloud segment held the largest revenue share in 2025.

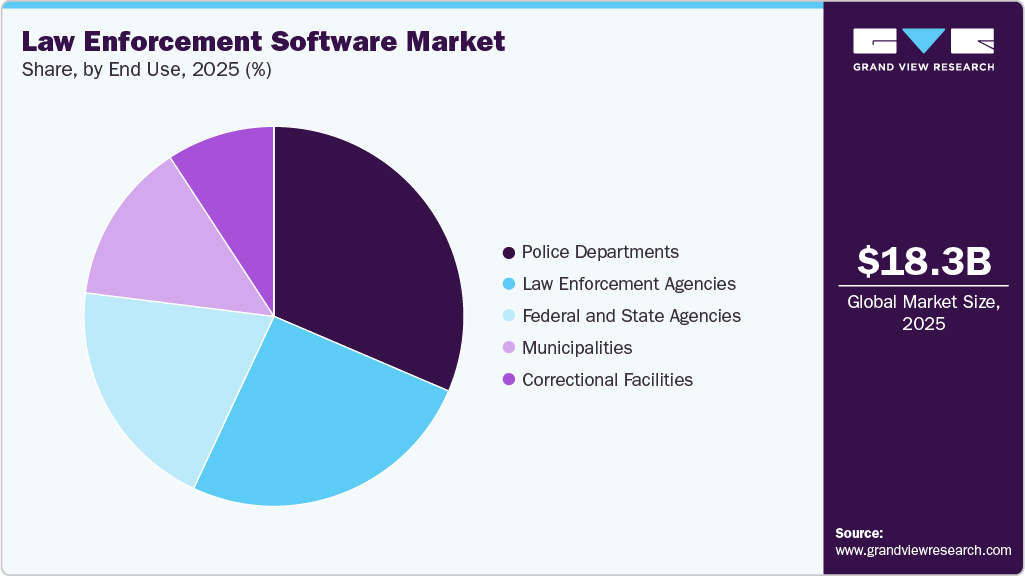

- By end use, the municipalities segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 18.26 Billion

- 2033 Projected Market Size: USD 40.76 Billion

- CAGR (2026-2033): 10.4%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

Rising crime rates, growing adoption of digital evidence management, and the integration of AI, analytics, and cloud technologies in policing are accelerating demand for such software. As crime becomes more sophisticated, law enforcement agencies are rapidly adopting advanced software solutions, including records management systems (RMS), computer-aided dispatch (CAD), and digital evidence management tools, to enhance operational efficiency, data accuracy, and real-time decision-making. For instance, in October 2025, West Midlands Police in the UK advanced its digital transformation by integrating secure AI capabilities through Android Enterprise devices, marking a major step toward smarter, more efficient policing. The initiative aims to enhance officer and staff productivity by replacing traditional, time-consuming procedural workflows with intuitive AI-driven guidance and real-time access to critical police records. This seamless integration of AI and custom Android applications will enable officers to securely retrieve information and procedural support on the go, reducing their administrative workload and allowing them to dedicate more time to community engagement and public safety.

In addition, governments across the world are also investing heavily in modernizing public safety infrastructure through smart policing initiatives, which is significantly fueling the demand for integrated law enforcement software. For instance, in March 2024, the Port Authority Police Department of New York and New Jersey launched a USD 15 million modernization program to upgrade its law enforcement technology, including a data analytics platform for crime insights, mobile-first reporting tools, and enhanced dispatch systems to boost response efficiency. The increasing use of cloud-based and AI-driven analytics solutions that facilitate predictive policing and improve incident response is also driving growth in the law enforcement software industry. Artificial intelligence, big data analytics, and IoT technologies are increasingly being utilized to analyze large volumes of crime data, identify patterns, and predict potential threats. This trend is particularly strong in North America and Europe, where digital policing reforms are being prioritized. Additionally, the integration of mobile applications and body-worn camera systems with law enforcement software helps ensure transparency, accountability, and effective evidence management, further supporting market expansion.

Moreover, the growing concern for public safety amid increasing urbanization and geopolitical tensions has led to a surge in demand for real-time surveillance and crime analysis tools. The shift toward interoperable and scalable software platforms allow agencies to share intelligence securely across jurisdictions, improving collaboration and crime-solving capabilities. The private sector’s involvement in developing advanced cybersecurity and data protection features also contributes to market growth by ensuring compliance with strict data privacy regulations.

Component Insights

The solutions segment dominated the market and accounted for the revenue share of 67.0% in 2025, driven by the growing demand for customized and modular software platforms that cater to the diverse operational needs of different law enforcement agencies. Agencies are increasingly seeking integrated solutions that combine functionalities such as case management, incident tracking, and digital forensics into a single unified interface to streamline workflows and reduce administrative burdens.

The services segment is anticipated to grow at the highest CAGR during the forecast period due to the increasing need for continuous system support, software customization, and training services to ensure effective deployment and utilization of complex law enforcement platforms. As agencies adopt more advanced digital systems, they rely heavily on professional and managed services for implementation, integration, and maintenance to minimize downtime and optimize system performance. The surge in demand for consulting services to align technology adoption with evolving regulatory standards and operational requirements is also propelling market growth.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share in 2025, driven by the growing need for scalable, flexible, and cost-efficient infrastructure that supports remote accessibility and inter-agency collaboration. Cloud-based solutions enable law enforcement agencies to securely store and process vast amounts of data, including video evidence, incident reports, and analytics, without the limitations of on-premise hardware. The increasing adoption of hybrid and multi-cloud environments allows agencies to maintain control over sensitive data while benefiting from the agility and real-time accessibility of cloud platforms.

The on-premises segment is expected to grow at a significant CAGR during the forecast period due to the increasing need for greater control, customization, and data sovereignty among agencies handling highly sensitive information. Many law enforcement bodies, particularly in regions with strict data privacy regulations or limited cloud infrastructure, prefer on-premises systems to ensure that critical intelligence and investigative data remain within secure internal networks. This deployment model also appeals to organizations requiring advanced customization to meet specific operational, jurisdictional, or security requirements.

End Use Insights

The police departments segment dominated the market and accounted for the largest revenue share in 2025, driven by the increasing focus on improving field-level coordination, operational transparency, and rapid incident response. Police forces are adopting advanced digital tools to enhance patrol management, automate reporting, and support evidence-based decision-making, thereby improving overall efficiency. The rise in urban crime, traffic violations, and emergencies is prompting departments to rely on integrated platforms that connect dispatch systems, mobile devices, and command centers in real time.

The municipalities segment is expected to grow at a significant CAGR over the forecast period, owing to the rising emphasis on smart city initiatives and integrated public safety management. Local governments are increasingly investing in digital platforms that enable seamless coordination among emergency services, law enforcement units, and civic departments, thereby enhancing situational awareness and incident response. The need to manage urban challenges such as traffic control, community safety, and disaster response through data-driven systems is further accelerating adoption.

Regional Insights

North America dominated the global market, accounting for the largest revenue share of 34.1% in 2025, due to the region’s early adoption of advanced technologies, including artificial intelligence, predictive analytics, and biometrics, in policing. Strong government funding toward modernizing public safety infrastructure and enhancing interoperability between federal, state, and local law enforcement agencies is a major catalyst. The growing focus on reducing manual reporting, combined with the rise of cybercrime and the increasing need for digital evidence management, has further accelerated software adoption.

U.S. Law Enforcement Software Market Trends

The law enforcement software industry in the U.S. is expected to grow significantly at a CAGR of 12.1% from 2026 to 2033, due to the growing emphasis on community policing, accountability, and transparency amid rising public scrutiny of law enforcement practices. Agencies are increasingly investing in integrated platforms for body-worn camera management, real-time crime mapping, and digital forensics to improve operational visibility and evidence integrity.

Europe Law Enforcement Software Market Trends

The law enforcement software industry in Europe is anticipated to register considerable growth from 2026 to 2033, as governments across the region prioritize data standardization, interoperability, and cross-border intelligence sharing in line with EU security directives. The growing need for collaborative digital systems to combat organized crime, terrorism, and human trafficking is fueling the adoption of integrated law enforcement solutions.

The UK law enforcement software market is expected to grow rapidly in the coming years, driven by the rapid digitalization of policing under initiatives such as the Home Office’s Digital Policing Strategy 2030, which emphasizes data-driven decision-making, cloud migration, and national data interoperability. Police forces are increasingly investing in advanced analytics, automated reporting, and digital case management systems to streamline investigations and reduce administrative workloads.

The law enforcement software market in Germany held a substantial market share in 2025 due to the country’s strong focus on cybersecurity, data protection, and advanced forensic technologies. The government’s investment in digital policing infrastructure, especially for counterterrorism and cybercrime prevention, has significantly boosted demand for secure, on-premises, and hybrid law enforcement systems.

Asia Pacific Law Enforcement Software Industry Trends

Asia Pacific law enforcement software held a significant share in the global market in 2025, due to the increasing urbanization, population density, and the corresponding need for efficient public safety management systems. Governments in the region are investing heavily in digital transformation and smart city projects that integrate law enforcement software for real-time surveillance, crime tracking, and emergency response. The increasing adoption of mobile policing solutions and cloud-based platforms in emerging economies, such as India and Southeast Asian countries, is also driving market growth.

The Japan law enforcement software market is expected to grow rapidly in the coming years due to the country’s strong commitment to public safety, precision technology, and data analytics integration in law enforcement operations. The government’s initiatives to enhance disaster response, cybercrime prevention, and urban surveillance systems have significantly increased demand for reliable and secure law enforcement software.

The law enforcement software market in Japan held a substantial market share in 2025, due to the government’s large-scale investments in public safety digitization and national security infrastructure. The integration of big data analytics, facial recognition, and AI-powered surveillance systems has significantly enhanced policing efficiency in major cities. China’s emphasis on building centralized databases for real-time intelligence and citizen monitoring supports a strong demand for domestic law enforcement software solutions.

Key Law Enforcement Software Company Insights

Key players operating in the law enforcement software industry are Tyler Technologies, Axon Enterprise, Hexagon, Wolters Kluwer N.V., Datamaran, and OneTrust, LLC. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2025, Axon Enterprise, Inc. upgraded its public safety ecosystem with new AI and real-time features, integrating 911 intelligence, community collaboration, and officer connectivity. Key additions include Axon Assistant, Axon Air Drone as First Responder via Axon Body 4, and the Community Shield and Community Link programs to enhance cooperation between agencies, residents, and businesses.

-

In September 2025, TRULEO expanded its AI Analyst tool to support police chiefs and administrative teams. Building on its proven use among investigators, the enhanced tool now streamlines key administrative functions by automating report generation, compliance documentation, and records management. It also enables agency leaders to track performance trends, analyze crime patterns, and prepare accreditation and budget materials through intuitive data visualizations, strengthening operational efficiency and transparency across departments.

-

In February 2025, Flock Safety introduced two new AI-powered tools, Flock Nova and FreeForm, to help law enforcement agencies accelerate investigations and improve data-driven decision-making. Flock Nova serves as a unified data platform that consolidates information from Flock devices, CAD, Record Management Systems (RMS), and open-source intelligence into a single interface, enabling faster analysis and case resolution. It also supports secure, opt-in data sharing across jurisdictions to enhance collaboration in multi-agency investigations.

Key Law Enforcement Software Companies:

The following are the leading companies in the law enforcement software market. These companies collectively hold the largest Market share and dictate industry trends.

- Axon Enterprise, Inc.

- Datamaran

- EcoVadis

- FactSet

- Hexagon

- LSEG

- NAVEX Global, Inc.

- NEC Corporation

- TRULEO

- OneTrust, LLC.

- SAS Institute Inc.

- Sustainalytics

- Tyler Technologies, Inc.

- Verisk Analytics, Inc.

- Wolters Kluwer N.V.

Law Enforcement Software Report Scope

Report Attribute

Details

Market size in 2026

USD 20.41 billion

Revenue forecast in 2033

USD 40.76 billion

Growth rate

CAGR of 10.4% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Axon Enterprise, Inc.; Datamaran; EcoVadis; FactSet; Hexagon; LSEG; NAVEX Global, Inc.; NEC Corporation; TRULEO; OneTrust, LLC.; SAS Institute Inc.; Sustainalytics; Tyler Technologies, Inc.; Verisk Analytics, Inc.; Wolters Kluwer N.V.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Law Enforcement Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the law enforcement software market report based on component, deployment, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Computer-Aided Dispatch

-

Record Management

-

Case Management

-

Jail Management

-

Incident Response

-

Digital Policing

-

Others

-

-

Services

-

Implementation

-

Training and Support

-

Consulting

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Police Departments

-

Law Enforcement Agencies

-

Federal and State Agencies

-

Municipalities

-

Correctional Facilities

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global law enforcement software market size was estimated at USD 18.26 billion in 2025 and is expected to reach USD 20.41 billion in 2026.

b. The global law enforcement software market is expected to grow at a compound annual growth rate of 10.4% from 2026 to 2033 to reach USD 40.76 billion by 2033.

b. North America dominated the law enforcement software market with a market share of 34.1% in 2025. In North America, the law enforcement software market is characterized by integrating advanced technologies such as artificial intelligence, machine learning, and big data analytics. Agencies increasingly adopt predictive policing tools, digital evidence management systems, and real-time data-sharing platforms to enhance operational efficiency and crime-solving capabilities

b. Some key players operating in the law enforcement software market include CSRware, Inc., Datamaran, EcoVadis, OneTrust, LLC., Refinitiv, SAS Institute Inc., Sustainalytics, TruValue Labs, Verisk Analytics, Inc., and Wolters Kluwer N.V.

b. Several key factors drive the growth of the law enforcement software market. Foremost among these is the increasing need for efficient and effective crime prevention and investigation tools as law enforcement agencies strive to enhance public safety amid rising crime rates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.