- Home

- »

- Medical Devices

- »

-

Leadless Pacemakers Market Size, Industry Report, 2033GVR Report cover

![Leadless Pacemakers Market Size, Share & Trends Report]()

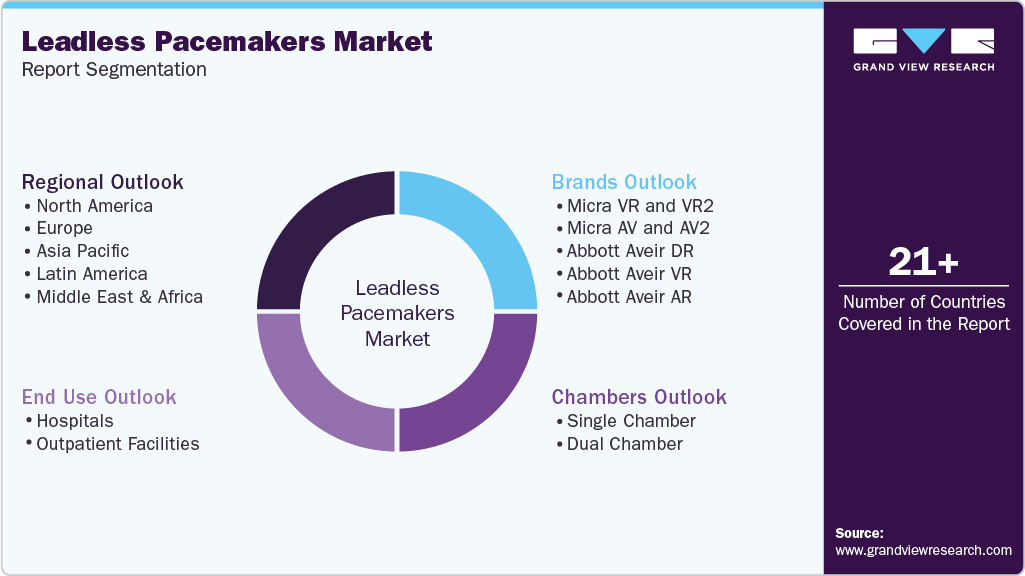

Leadless Pacemakers Market (2025 - 2033) Size, Share & Trends Analysis Report By Chambers (Single Chamber, Dual Chamber), By Brands (Micra VR and VR2, Micra AV and AV2, Abbott Aveir DR, Abbott Aveir VR, Abbott Aveir AR), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-138-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Leadless Pacemakers Market Summary

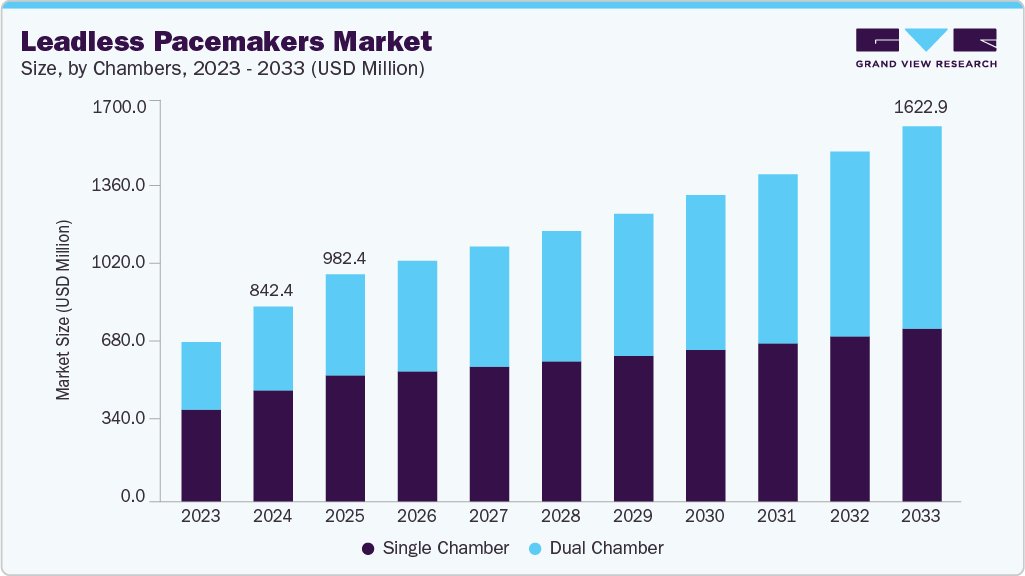

The global leadless pacemakers market size was estimated at USD 842.37 million in 2024 and is projected to reach USD 1,622.87 million by 2033, growing at a CAGR of 6.48% from 2025 to 2033. The increasing prevalence of cardiac disorders and associated risk factors is expected to drive demand for advanced device-based therapies.

Key Market Trends & Insights

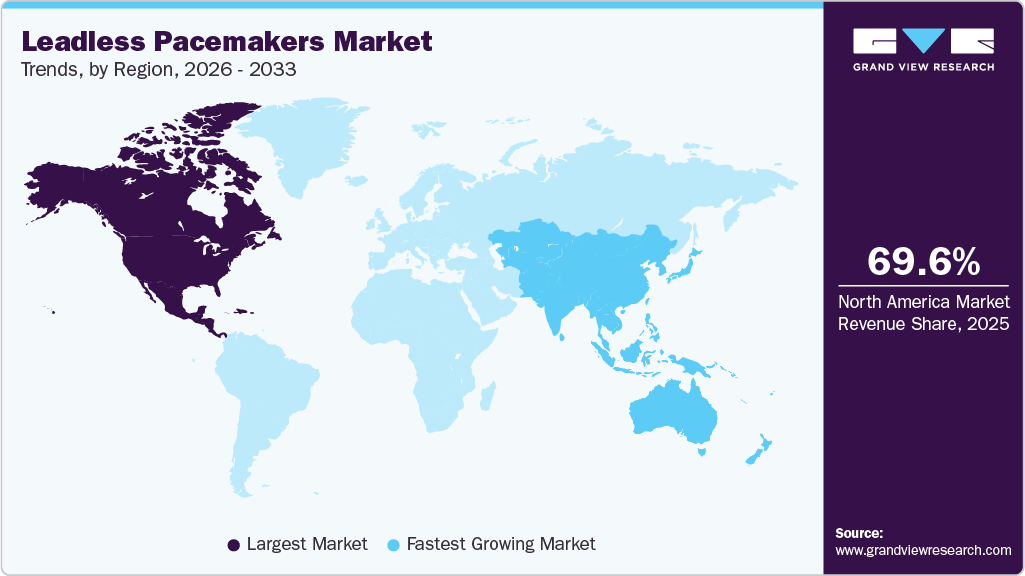

- North America leadless pacemakers market dominated the global market in 2024 with a revenue share of 60.04%.

- The U.S. leadless pacemakers market accounted for the largest share in North America in 2024.

- Based on chambers, the single chamber segment held the largest share in 2024.

- Based on brands, the Micra VR and VR2 segment held the largest share in 2024.

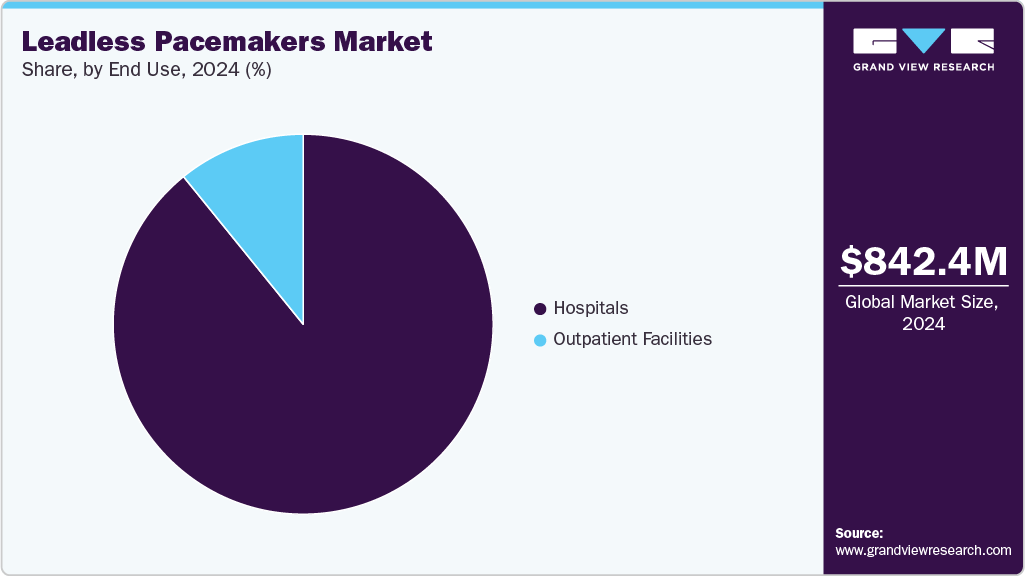

- Based on end use, the hospitals segment held the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 842.37 Million

- 2033 Projected Market Size: USD 1,622.87 Million

- CAGR (2025-2033): 6.48%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

According to an Oxford Academic article published in January 2025, globally, the age-standardized prevalence of cardiovascular disease is estimated at approximately 7,179 cases per 100,000 people, emphasizing the significant and growing burden of cardiac conditions. This high prevalence has amplified the need for innovative pacing solutions to manage rhythm disorders more safely and effectively. Leadless pacemakers have emerged as a transformative advancement in this field, offering a minimally invasive alternative to traditional pacemakers by eliminating the need for leads and surgical pockets.Leadless pacemakers (PMs) have become a well-established therapeutic option over the past decade, offering significant advantages over traditional transvenous pacemakers. According to the NCBI article published in April 2025, eliminating leads and subcutaneous pockets, leadless devices such as Micra and Aveir substantially reduce the risk of infections and long-term complications such as electrode dislocation, pocket hematomas, pneumothorax, endocarditis, and venous obstruction. Data from the Micra PAR registry, which followed 1,809 patients for a mean of 51 months, reported a five-year major complication rate of only 4.5%, with most occurring within 30 days of implantation. Notably, no infections required device removal, and system revisions were rare, primarily for device upgrades or battery depletion.

Technological advances have further expanded the use of leadless pacemakers. VDD(R) pacing in Micra AV and DDD(R) pacing in Aveir DR enable synchronized atrioventricular pacing, allowing treatment of a broader patient population, including those with high infection risk, limited vascular access, or prior device infections. Long-term data also demonstrate stable electrical performance and battery longevity, with over 95% of devices remaining functional at five years. Compared with historical transvenous cohorts, leadless PMs show a 53% reduction in major complications and system revisions, making them a safer and increasingly preferred choice for patients requiring long-term pacing therapy.

Table 1 The 5-year results and clinical insights of Micra Leadless PM

Category

Micra Leadless PM (5-Year Data)

Patients

1,809; mean age 79 yrs; 38.8% female

Implant Success

99.1%; most common site: RV septum (65.1%)

Major Complications

4.5% (85 events); mostly within 30 days; long-term: elevated threshold, PM syndrome, PM-induced cardiomyopathy

Infections

9 cases; none required device removal

Mortality

39.5% (all-cause)

System Revisions

4.9%; mainly device upgrade, elevated threshold, battery depletion

Device Longevity

95.2% devices still active; mean residual battery life: 6.8 yrs

Pacing Parameters

Stable thresholds (0.67 → 0.70 V), impedance decreased (727 → 533 Ω), R-wave sensing increased (10.7 → 13.1 mV)

Comparison to Transvenous PM

53% reduction in major complications and revisions

Clinical Insights

Fewer infections, lower complications, stable long-term performance; ideal for high-risk patients

Source: NCBI & GVR

Moreover, the latest advancement in leadless pacing comes from Abbott’s AVEIR DR system, the world’s first dual-chamber leadless pacemaker. This innovative device, featuring separate atrial and ventricular units communicating wirelessly, represents a major step toward physiological pacing without traditional leads. According to The New England Journal of Medicine (NEJM) in May 2023, the AVEIR DR dual-chamber leadless pacemaker developed by Abbott Medical, designed to provide both atrial and ventricular pacing. The trial enrolled 300 patients with indications for dual-chamber pacing. The implantation success rate was exceptionally high at 98.3%, confirming reliable communication between the atrial and ventricular devices.

The safety goal of freedom from device or procedure-related serious adverse events at 90 days was achieved in 90.3% of patients, surpassing the benchmark of 78%. The performance goal, assessing adequate atrial pacing and sensing, was met in 90.2% of patients. Additionally, 97.3% achieved over 70% atrioventricular synchrony, demonstrating effective dual-chamber coordination. These results confirm that the AVEIR DR system offers safe and reliable pacing for a broader patient population than single-chamber systems.

Table 2 Key Outcomes of the AVEIR DR Study (NEJM 2023)

Parameter

Result

Total Patients Enrolled

300

Implant Success Rate

98.3%

Freedom from Serious Adverse Events (90 days)

90.3%

Adequate Atrial Pacing & Sensing

90.2%

≥70% AV Synchrony Achieved

97.3%

Source: NEJM & GVR

Furthermore, recent advances have expanded the use of leadless pacemakers (LPMs) into pediatric cardiology, showing encouraging results for younger patients with bradyarrhythmia. According to the Children's Hospital of Philadelphia article published in April 2023, a multicenter study led by the Children's Hospital of Philadelphia (CHOP) found that leadless pacemakers are safe and effective for children with irregular heartbeats. The study emphasized that LPMs eliminate the need for transvenous leads and subcutaneous pockets, significantly reducing the risks of infection and lead-related complications that are more problematic in growing children. However, the researchers also noted a technical limitation: the current delivery systems and catheters used for implantation are designed for adults, which restricts use in smaller pediatric patients. The CHOP investigators highlighted the need for miniaturized delivery catheters to make these devices more accessible to a wider pediatric population. These devices highlight the growing safety, efficacy, and applicability of leadless pacemakers across diverse patient populations.

Market Concentration & Characteristics

The industry is witnessing rapid innovation, driven by technological progress in cardiac rhythm management and the integration of complementary therapeutic modalities such as ablation. For instance, in November 2023, Medtronic received CE Mark approval for its advanced PulseSelect Pulsed Field Ablation System and Nitron CryoConsole, marking a pivotal milestone in expanding its electrophysiology portfolio. This achievement underscores the industry's shift toward developing multifunctional cardiac devices that enhance treatment precision, streamline procedures, and improve outcomes for patients with atrial fibrillation (AF).

The industry is seeing moderate merger and acquisition activity as companies focus on expanding technological capabilities and global reach. Key deals target the integration of AI-based analytics, remote monitoring, and next-generation device features, supporting faster product development and enhanced clinical validation. Collaborations with regional partners also provide regulatory guidance and established distribution networks, facilitating smoother market entry in emerging regions. These strategic alliances and consolidations are reshaping competition and accelerating the adoption of advanced, connected leadless pacing solutions.

The industry operates under moderate regulatory oversight, requiring FDA clearance in the U.S., CE marking in Europe, and adherence to local medical device standards worldwide. These regulations safeguard device safety, clinical performance, and reliability, while influencing development costs and time-to-market. Regulatory bodies are increasingly updating guidelines to address AI-enabled features, software-based diagnostics, and remote monitoring capabilities, enabling innovation while ensuring patient safety and compliance.

The industry is witnessing rapid product expansion through targeted device launches and technological advancements. Manufacturers are developing solutions that enhance therapy effectiveness, patient comfort, and clinical performance. In 2023, Abbott launched the AVEIR DR dual-chamber leadless pacemaker in the UK, following CE marking in Europe and FDA approval. The device allows communication between two independent pacemakers, enabling synchronized dual-chamber pacing without leads, and is designed for improved retrievability and patient-centered therapy. This launch highlights the industry’s focus on innovative, connected, and minimally invasive pacing solutions.

The industry is witnessing moderate regional expansion, with leading manufacturers extending their presence across Asia-Pacific, the MEA, and Latin America to tap into growing demand driven by the rising incidence of heart failure and cardiac disorders. Companies are focusing on building local distribution partnerships, clinician education programs, and remote monitoring infrastructure to enhance therapy accessibility and patient management. These initiatives not only improve device adoption and treatment adherence in underserved areas but also strengthen global market reach and support long-term growth in emerging healthcare systems.

Chambers Insights

By chambers, the single chamber segment accounted for the largest revenue share of 57.02% in 2024 due to technological advancements and the rising demand for minimally invasive cardiac devices. These pacemakers are specifically designed to provide pacing to either the atrium or ventricle, offering a simpler alternative to traditional dual-chamber devices. One of the key advantages of single-chamber pacemakers is their smaller size, which reduces the risk of complications associated with lead placement and potentially lowers the costs compared to dual-chamber models. In November 2024, a 74-year-old woman, suffering complications from an infected pacemaker, was successfully treated with a single-chamber leadless pacemaker through a minimally invasive, incision-free procedure. The patient was discharged within a day, and the device, designed for safety and comfort, can be removed or upgraded if needed.

The dual chamber segment is expected to grow at the fastest CAGR over the forecast period. The dual-chamber functionality of leadless pacemakers is revolutionizing cardiac care by offering a comprehensive solution for a wide range of heart rhythm conditions. This innovative approach improves the synchronization of cardiac contractions and enhances hemodynamic performance, leading to significantly better patient outcomes. For instance, in September 2023, the FDA approved Abbott's AVEIR DR Dual Chamber Leadless Pacemaker System, a world-first in cardiac rhythm management. This dual-chamber leadless system offers therapy for all common pacemaker indications without relying on cardiac leads, marking a significant advancement in the field. The AVEIR DR system is designed to be implanted directly into the heart through a minimally invasive procedure, reducing the risk of lead and infection-related complications and offering a shorter recovery period post-implantation.

Brands Insights

By brands, the Micra VR and VR2 segment accounted for the largest revenue share of 48.96% in 2024. The Micra VR and Micra VR2 are single-chamber leadless pacemakers developed by Medtronic to manage bradycardia. Both devices are implanted directly into the heart via a minimally invasive, percutaneous approach, eliminating the need for leads and reducing complications associated with traditional pacemakers. They are among the world’s smallest pacemakers, with a mass of 1.75 g and a volume of 0.8 cc, and are MRI-conditional for 1.5T and 3T scans. The Micra VR2 offers enhanced longevity, with 89% of patients expected to experience more than 10 years of device life, and features an improved delivery system for safer implantation. In April 2024, an article published in the European Heart Journal reported 5-year real-world outcomes of the Micra VR leadless pacemaker from a global post-approval registry. No Micra removals were required due to infection, highlighting the device’s long-term safety, reliability, and low complication profile.

The Abbott Aveir DR segment is expected to grow at the fastest CAGR over the forecast period. The AVEIR DR is the world’s first dual-chamber leadless pacemaker system, combining an atrial (AVEIR AR) and ventricular (AVEIR VR) device to provide beat-to-beat synchrony across both chambers. It uses proprietary i2i communication technology to enable true DDD(R) pacing, ensuring continuous atrioventricular synchrony regardless of patient posture. The system is upgradeable, allowing therapy to start with a single-chamber device and expand to dual-chamber pacing as the patient's needs evolve. AVEIR DR supports long-term retrieval of devices, features electrical mapping prior to fixation to minimize repositioning, and has demonstrated high procedural success, with over 95% AV synchrony across various postures and a dual-chamber implant success rate of 98%. In December 2024, Heart Rhythm published a review of dual-chamber leadless pacemaker implantation techniques for Abbott’s AVEIR DR system. The article highlighted the use of two leadless pacemakers with implant-to-implant (i2i) communication to achieve AV synchronous pacing, detailing optimized atrial and ventricular implantation workflows, electrical mapping, fixation strategies, and post-deployment assessment.

End Use Insights

By end use, the hospitals segment accounted for the largest revenue share of 89.16% in 2024. Hospitals recognize the advantages of these devices for cardiac care. Leadless pacemakers offer several benefits, including a reduced risk of infections compared to traditional pacemakers that require leads to be implanted into the heart. Hospitals serve as crucial centers for the implementation and evaluation of new technologies, such as the dual-chamber leadless pacemaker system, which has been a significant focus of R&D efforts. In March 2025, Mercyhealth hospitals in Janesville and Rockford performed their first dual leadless pacemaker procedures, offering a minimally invasive alternative to traditional pacemakers. The devices reduce complications like infections and lead issues, supporting faster recovery. This milestone highlights the growing adoption of advanced cardiac technologies in outpatient settings.

The outpatient facilities segment is expected to grow at the fastest CAGR over the forecast period. Outpatient facilities play a significant role in the growth of the leadless pacemakers market by providing accessible, cost-effective, and patient-friendly settings for device implantation. These facilities contribute to market expansion by enabling shorter procedure times, reducing hospitalization needs, and offering convenience for both patients and healthcare providers, which encourages wider adoption of leadless pacemakers. In March 2024, the Heart Rhythm Society (HRS) met with CMS officials to advocate for outpatient access to dual-chamber leadless pacemakers, focusing on reimbursement challenges under the Hospital Outpatient Prospective Payment System. The meeting requested pass-through payment recognition to ensure patient access while permanent outpatient payment policies are established.

Regional Insights

North America leadless pacemakers market dominated with a revenue share of 60.04% in 2024, driven by technological innovation. Advanced devices, including MRI-compatible and smaller-profile models, minimize procedural complications and enhance patient outcomes. Their minimally invasive design facilitates safer and more efficient implantation, increasing adoption among healthcare providers and patients. In April 2024, UCHealth performed Colorado’s first commercial dual-chamber leadless pacemaker implant using Abbott’s Aveir DR system. The minimally invasive procedure synchronized two independent devices in the atrium and ventricle, providing precise pacing without transvenous leads. The patient recovered quickly, highlighting the clinical advantages of dual-chamber leadless pacing in complex cardiac cases.

U.S. Leadless Pacemakers Market Trends

The U.S. leadless pacemakers market accounted for the largest market share in North America in 2024. The growing prevalence of cardiac arrhythmias and an aging population are key factors driving demand for leadless pacemakers. While more adults experience bradycardia, atrioventricular block, and other conduction disorders, there is an increasing need for minimally invasive and reliable pacing solutions. Increasing awareness among physicians and patients about the benefits of leadless devices over traditional pacemakers further supports adoption, while patient preference for less invasive procedures drives uptake. In August 2024, the Journal of Medicine, Surgery, and Public Health published an article examining arrhythmia-related deaths among older adults in the U.S. from 1999 to 2020. The study, using CDC WONDER data, reported that age-standardized mortality rates rose from 38.0 to 47.0 per 10,000, with men (45.2) higher than women (33.0). Non-Hispanic Whites had the highest rates (40.5), and Midwestern and nonmetropolitan areas were notably affected (41.2 and 42.1), revealing key demographic and regional disparities.

Europe Leadless Pacemakers Market Trends

The leadless pacemakers market in Europe is expected to grow over the forecast period. The rising prevalence of cardiac conduction disorders across Europe and an aging population are driving demand for leadless pacemakers. Patients and physicians are increasingly seeking minimally invasive options that reduce complications and improve quality of life, leading to greater adoption in both specialized and general cardiology centers. Growing patient awareness and physician familiarity with leadless pacing further reinforce the shift away from traditional pacemakers. In March 2025, the European Society of Cardiology (ESC) reported that 1 in 3 people worldwide are at risk of developing a serious heart rhythm disorder.

The UK leadless pacemakers market is growing over the forecast period. Increasing CVD cases drive the growth of the market. Rising awareness of cardiovascular health and patient preference for minimally invasive procedures are key growth drivers in the UK leadless pacemaker market. Many patients are opting for technologies that reduce hospitalization time, lower complication rates, and support faster return to daily activities. In October 2025, Russells Hall Hospital in the West Midlands completed its first leadless pacemaker implantation locally, placing the device in the patient’s right ventricle via catheterization. The patient was discharged the same day, highlighting the minimally invasive procedure and safety outside specialist centres. Developed by Medtronic, the device is smaller, wire-free, and reliable, with a battery life up to 12 years, offering a comfortable, discreet alternative to traditional pacemakers.

The leadless pacemakers market in Germany is growing over the forecast period. Germany’s aging population and the increasing prevalence of cardiac conduction disorders, including bradycardia and atrioventricular block, are major factors driving demand for leadless pacemakers. Patients are increasingly seeking minimally invasive therapies that reduce procedural risks, shorten hospital stays, and minimize post-operative complications. In December 2023, the European Heart Journal Supplements highlighted that Germany leads in pacemaker implantation with 927 per million, underscoring the gap in access to advanced therapies such as leadless pacemakers in lower-income regions.

Asia Pacific Leadless Pacemakers Market Trends

The leadless pacemaker market in Asia Pacific is expected to grow over the forecast period. Rapid urbanization and growing middle-class populations across the Asia-Pacific region are increasing demand for advanced cardiac care, including leadless pacemakers. Patients are becoming more aware of the benefits of minimally invasive procedures that reduce hospitalization and accelerate recovery, driving preference for modern pacing solutions. In June 2025, the National Heart Institute (IJN) in Malaysia successfully implanted the world’s first dual-chamber leadless pacemaker, Abbott AVEIR DR, in 18 patients, marking a Southeast Asia first. The miniaturized devices are implanted directly into the right atrium and ventricle, enabling synchronized pacing without traditional leads and reducing procedural risks.

China leadless pacemakers market accounted for the largest market share in the Asia Pacific region in 2024. The rising prevalence of cardiovascular diseases, particularly bradycardia and conduction disorders, is increasing the demand for leadless pacemakers in China. Patients are seeking less invasive treatment options that minimize hospitalization and post-procedure complications, while cardiologists are gradually integrating advanced pacing solutions into clinical practice. In September 2025, Taiwan’s Yuan Rung Hospital implanted a leadless pacemaker in a 74-year-old man with chronic atrial fibrillation and atrioventricular block, whose heart rate had dropped to 30 beats per minute. The minimally invasive procedure stabilized his condition, and he was discharged after three days. This case highlights the hospital’s capability in using advanced cardiac pacing technology for critical arrhythmia management.

The leadless pacemakers market in Australia is expected to grow at a significant CAGR over the forecast period. Government healthcare policies and investments in cardiovascular care infrastructure are supporting market growth. Upgrades to electrophysiology labs, interventional cardiology units, and cardiac rehabilitation programs across major cities such as Sydney, Melbourne, and Brisbane are improving access to state-of-the-art devices. Training partnerships with global cardiac technology providers are also enhancing local physician expertise. In February 2025, Epworth HealthCare in Victoria performed its first leadless dual chamber pacemaker implantations, placing seven AVEIR devices. The technology reduces pain, avoids scarring, improves recovery, and minimizes complications. A grant will support research and broader access.

Latin America Leadless Pacemakers Market Trends

The leadless pacemakers market in Latin America is expected to witness significant growth over the forecast period, due to the increasing prevalence of cardiovascular diseases, particularly bradycardia and conduction disorders, which is driving demand for leadless pacemakers across Latin America. Patients are seeking minimally invasive solutions that reduce infection risks and accelerate recovery, while cardiologists are increasingly trained in advanced implantation techniques, encouraging adoption in leading hospitals and specialized cardiac centers. In January 2025, the Heart Rhythm Society (HRS) Committee published in Heart Rhythm O2, Volume 6, Issue 1, a statement on the state of arrhythmia care in Latin America. The report highlighted significant disparities in access to electrophysiology services, devices, and trained specialists across countries, with atrial fibrillation as the most common arrhythmia and Chagas disease prevalent in several regions.

Brazil leadless pacemakers market is expected to grow over the forecast period. Increasing CVD incidence drives the growth of the market. Rising awareness among Brazilian patients about innovative cardiac treatments is contributing to the growth of the leadless pacemaker market. Patients are increasingly motivated by options that reduce hospital stay duration and procedural complications, while cardiologists are seeking alternatives to traditional pacemakers that lower infection risks and improve procedural efficiency. This patient-centric approach is supporting adoption in private and tertiary care hospitals. According to the Elsevier Ltd. article published in July 2025, in Brazil, cardiovascular diseases (CVDs) remain a leading public health concern, accounting for approximately 30% of all deaths.

Middle East & Africa Leadless Pacemakers Market Trends

The leadless pacemaker market in the Middle East & Africa is expected to grow over the forecast period. The increasing prevalence of cardiovascular diseases, including bradycardia and arrhythmias, is a primary factor driving demand for leadless pacemakers across the MEA region. Patients are increasingly seeking minimally invasive treatment options that reduce surgical risks and shorten recovery times, while physicians are gaining expertise in advanced cardiac procedures, supporting wider adoption. Awareness campaigns and professional training programs are further reinforcing physician confidence in these devices.

South Africa leadless pacemakers market is expected to grow over the forecast period. Technological advancements in leadless pacemakers are encouraging adoption across the country. Modern devices offer longer battery life, dual-chamber pacing, and inter-device communication, reducing risks associated with traditional pacemakers. The availability of minimally invasive, retrievable, and upgradeable systems aligns with global best practices, driving procedural confidence and broader uptake in South African healthcare facilities. In November 2023, Africa’s first implant of the Biotronik Amvia Sky smart pacemaker was successfully performed at Netcare Milpark Hospital in Johannesburg, marking a milestone in cardiac care. The dual-chamber leadless device improves heart function, adapts automatically during MRI scans, and significantly enhances the patient’s quality of life within weeks.

Key Leadless Pacemakers Company Insights

Key players operating in the leadless pacemakers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Leadless Pacemaker Companies:

The following are the leading companies in the leadless pacemakers market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Medtronic

- EBR Systems, Inc.

- Boston Scientific Corporation

- MicroPort Scientific Corporation.

Recent Developments

-

In April 2025, EBR Systems, Inc. received FDA approval for its WiSESystem, the first leadless left ventricular endocardial pacing device for CRT, offering a physiological alternative for patients unable to receive conventional lead-based therapy.

-

In June 2025, EBR Systems, Inc. raised an additional USD 13 million, bringing its total 2025 funding to nearly USD 50 million, to support the commercialization of its WiSE CRT System. The FDA-approved, rice-sized leadless left ventricular pacing device is scheduled for limited release in 2025, with a full launch planned in 2026.

-

In April 2025, Abbott shared data from its AVEIR CSP feasibility study, showing successful leadless pacemaker implantation in the left bundle branch area, and began enrolling patients in the ASCEND CSP trial to assess its investigational CSP ICD lead.

-

In January 2024, Medtronic obtained CE Mark for its Micra AV2 and VR2 leadless pacemakers, providing longer battery life and simplified programming while preserving the advantages of leadless pacing.

Leadless Pacemakers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 982.42 million

Revenue forecast in 2033

USD 1,622.87 million

Growth rate

CAGR of 6.48% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Chambers, brands, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Medtronic; EBR Systems, Inc.; Boston Scientific Corporation; MicroPort Scientific Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leadless Pacemakers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global leadless pacemakers market report based on chambers, brands, end use, and region:

-

Chambers Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Chamber

-

Dual Chamber

-

-

Brands Outlook (Revenue, USD Million, 2021 - 2033)

-

Micra VR and VR2

-

Micra AV and AV2

-

Abbott Aveir DR

-

Abbott Aveir VR

-

Abbott Aveir AR

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global leadless pacemakers market size was estimated at USD 842.37 million in 2024 and is expected to reach 982.42 million in 2025.

b. The global leadless pacemakers market is expected to grow at a compound annual growth rate of 6.48% from 2025 to 2033 to reach USD 11,622.87 million by 2033.

b. North America dominated the leadless pacemakers market with a share of 60.04% in 2024. This is attributable to technological advancements, increasing heart diseases, the availability of skilled professionals, and the strong presence of industry players in the region.

b. The key players currently operating in this market are Abbott; Medtronic; EBR Systems, Inc.; Boston Scientific Corporation; MicroPort Scientific Corporation.

b. Key factors driving the leadless pacemakers market growth are the growing geriatric population susceptible to cardiovascular diseases, increasing incidence of bradyarrhythmia, growing product approvals in developed countries, lucrative product pipeline, and its benefits over the traditional pacemakers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.