Lenalidomide Market Size & Trends

The global lenalidomide market size is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. The lenalidomide market is driven by its proven efficacy in treating multiple myelodysplastic syndromes & myeloma, versatile applications across various hematological conditions, and ongoing research-led advancements. These factors collectively establish lenalidomide as a key drug in cancer therapeutics, sustaining demand for its impactful treatment solutions.

The lenalidomide market is significantly influenced by its proven efficacy in treating multiple myeloma. According to an article published by the American Association for Cancer Research and the Epidemiology and End Results (SEER) program of the National Cancer Institute, in 2022 alone, 34,470 individuals in the U.S. were diagnosed with multiple myeloma, emphasizing the growing demand for effective treatments. Furthermore, the FDA's accelerated approval of teclistamab-cqyv (Tecvayli), the first bispecific antibody targeting BCMA in October 2022, highlights the evolving landscape of multiple myeloma therapies. Remarkably, both CAR T-cell therapies and teclistamab are approved for patients whose multiple myeloma is refractory to or has relapsed following extensive prior therapy, reflecting the urgent need for advanced treatments and contributing to the momentum of the lenalidomide market.

According to an article published by the Leukemia & Lymphoma Society in 2023, the recent FDA approvals of talquetamab-tgvs (Talve) and elranatamab (Elrexfio) for treating refractory or relapsed multiple myeloma mark a significant milestone in immunotherapy. These bispecific antibodies, representing ongoing research-led advancements, are the first of their kind specifically designed for multiple myeloma. The introduction of novel treatment options, such as these bispecific antibodies, reflects the evolving landscape of multiple myeloma therapies. In the context of the lenalidomide market, these advancements emphasize the continual exploration and development of innovative solutions, enhancing the overall effectiveness and options available for managing multiple myeloma."

Type Insights

Based on type, the market is categorized into 5mg capsules, 10mg capsules, 15mg capsules, and 25mg capsules. The 10mg capsules segment dominated the market in 2023. These capsules are widely utilized in medical treatments, offering a standardized and effective dosage for patients. The dominance of this segment is attributed to the balance it strikes between potency and controlled administration, making it a preferred choice for healthcare providers and patients alike. The versatility of 10mg capsules allows for precise medication management, contributing to their prominence in the lenalidomide market.

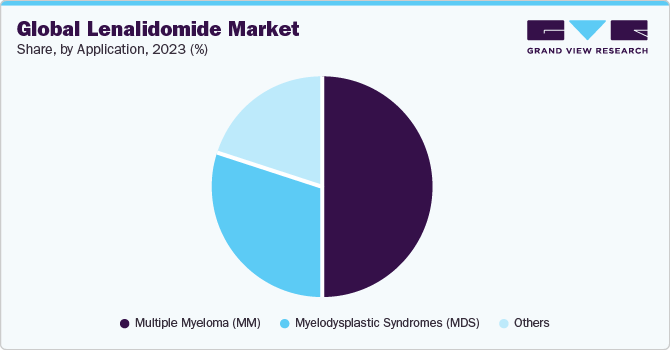

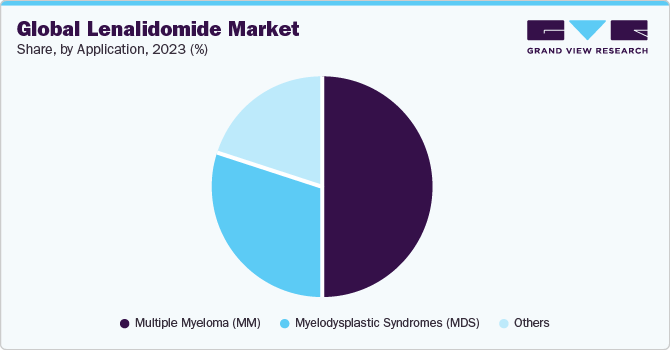

Application Insights

Based on application, the market is segmented into Multiple Myeloma (MM), Myelodysplastic Syndromes (MDS), and others. The Multiple Myeloma (MM) segment dominated the market in 2023. MM is a type of cancer that originates in plasma cells, and lenalidomide has been proven to be particularly effective in treating this condition. Consequently, the MM application holds a significant share of the lenalidomide market. The drug's therapeutic benefits and positive outcomes in managing multiple myeloma have positioned it as a key drug in the treatment landscape.

Regional Insights

North America dominated the market in 2023. According to the American Cancer Society, current statistics reveal a significant potential for prevention, with at least 42% of newly diagnosed cancer cases in the U.S. in 2022, totaling around 805,600 cases, being deemed avoidable. Notably, 19% of these cases are attributed to smoking, while a substantial 18% are linked to a combination of factors, including excess body weight, alcohol consumption, poor nutrition, and physical inactivity.

This landscape underscores the urgent need for comprehensive strategies addressing both treatment and prevention. In this scenario, lenalidomide emerges as a pivotal player, aligning with the overarching goal of improving cancer care outcomes. As a key therapeutic agent in the management of certain cancers, lenalidomide contributes to the ongoing battle against avoidable cancer cases. The market's relevance extends beyond treatment to actively participating in preventive measures and lifestyle interventions, making it an integral component in the continuum of cancer care in North America

Competitive Insights

Key players in the market include Dr. Reddy's Laboratories, Celgene, Cipla, Delphis Pharma, Sandoz, Reliance Life Sciences, Teva, Hetero Healthcare, Deva Pharma, and Synthon. These companies are actively involved in partnerships, collaborations, research and development (R&D) efforts, and other strategic alliances to enhance their market presence. Following are some recent initiatives undertaken by these key market players:

-

In September 2022, Dr. Reddy’s Laboratories Ltd. launched lenalidomide capsules, a generic equivalent of REVLIMID (lenalidomide) capsules, following approval from the U.S. Food and Drug Administration (USFDA). This strategic move granted Dr. Reddy’s first-to-market status and 180 days of exclusivity for the generic lenalidomide Capsules in 2.5 mg and 20 mg strengths.

-

In March 2023, Teva Pharmaceuticals, in collaboration with NATCO Pharma Limited, introduced new dosage options for the generic version of Revlimid (lenalidomide capsules) in the U.S. The newly available strengths are 2.5 mg and 20 mg.

-

In September 2022, Cipla Limited received final approval from the U.S. FDA for its Abbreviated New Drug Application (ANDA) for lenalidomide capsules in 5 mg, 10 mg, 15 mg, and 25 mg strengths. These capsules are recognized as the AB-rated therapeutic equivalent generic version of Bristol Myers Squibb’s Revlimid (lenalidomide) Capsules.