- Home

- »

- Next Generation Technologies

- »

-

LEO Satellite Market Size & Share, Industry Report, 2030GVR Report cover

![LEO Satellite Market Size, Share & Trend Report]()

LEO Satellite Market (2025 - 2033) Size, Share & Trend Analysis Report By Satellite Mass (Small Satellite, Cube Sats, Medium Satellite, Large Satellite), By Frequency Band, By Propulsion Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

LEO Satellite Market Summary

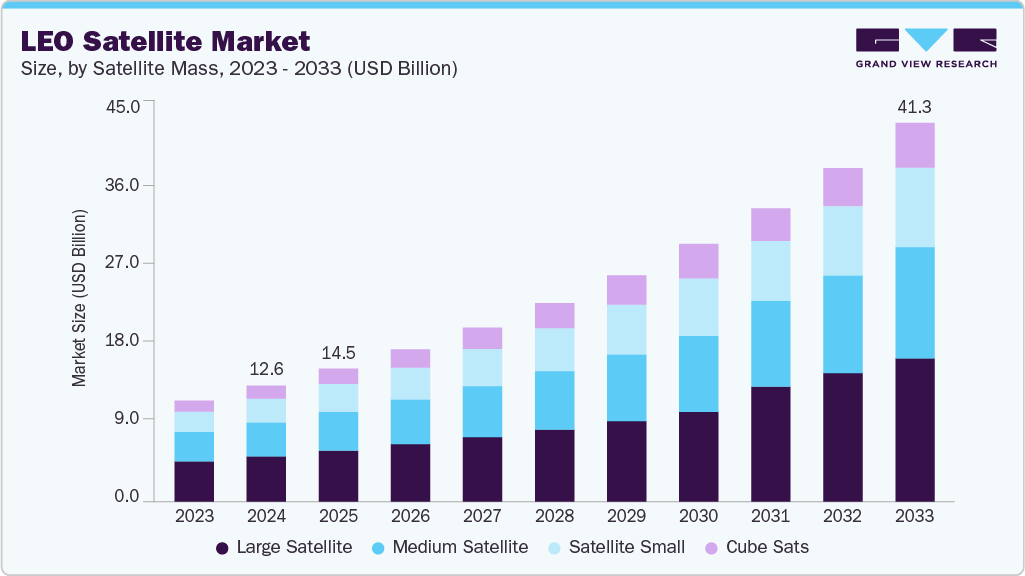

The global LEO satellite market size was estimated at USD 12.64 billion in 2024 and is projected to reach USD 41.31 billion by 2033, growing at a CAGR of 14.0% from 2025 to 2033. The market is growing rapidly, driven by growing investments from private space companies and national space agencies aiming to build resilient LEO satellite constellations for strategic communication and surveillance.

Key Market Trends & Insights

- North America dominated the global LEO satellite market with the largest revenue share of 55.1% in 2024.

- The LEO satellite market in the U.S. led the North America market and held the largest revenue share in 2024.

- By satellite mass, the large satellite segment led the market and held the largest revenue share of 39.2% in 2024.

- By propulsion type, the liquid fuel segment held the dominant position in the market and accounted for the leading revenue share of 40.5% in 2024.

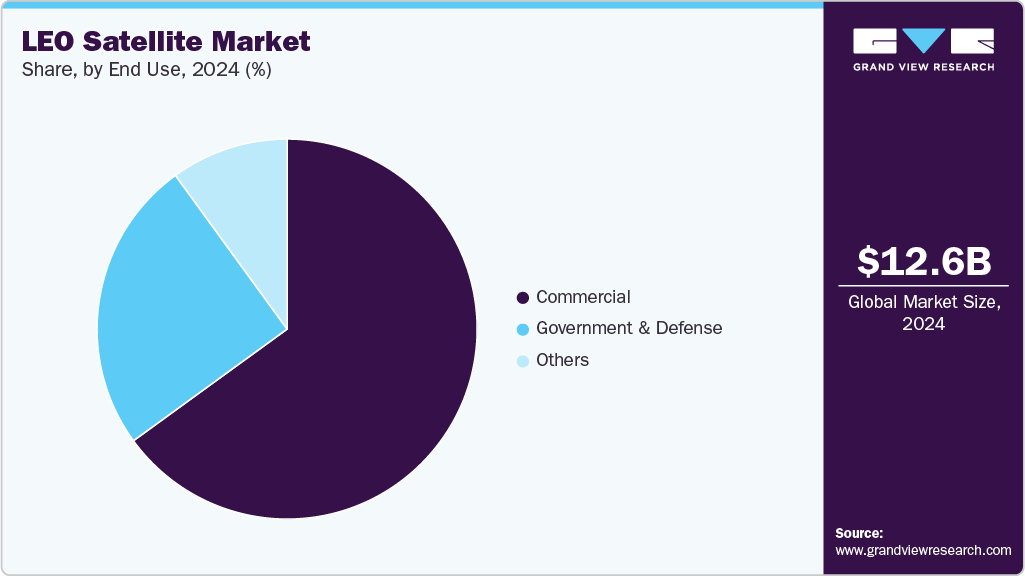

- By end use, the commercial segment is expected to grow at the fastest CAGR of 14.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 12.64 Billion

- 2033 Projected Market Size: USD 41.31 Billion

- CAGR (2025-2033): 14.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing demand for real-time Earth observation, environmental monitoring, and disaster response capabilities propels investments in LEO satellite infrastructure. Governments and private organizations leverage high-resolution imaging and rapid revisit capabilities to support climate analytics, urban planning, and emergency services. The enhanced agility of LEO satellites allows for frequent data updates, offering significant advantages over traditional geostationary systems. These capabilities and the rising availability of satellite-based geospatial intelligence are expected to fuel sustained market growth over the forecast period.

The growing use of LEO satellite constellations to provide global internet coverage is reshaping the telecommunications landscape. Major tech and aerospace firms are deploying fleets of interconnected satellites to deliver seamless, high-speed broadband to rural, maritime, and in-flight users. This shift is driven by increasing global internet penetration goals and the need for redundancy in terrestrial networks. As bandwidth and network resiliency demand accelerate, the LEO satellite industry is expected to experience exponential expansion.

The increasing demand for satellite-based services across the defense, maritime, and aviation sectors drives the development of versatile and responsive LEO platforms. These sectors require secure, real-time connectivity and situational awareness in areas beyond the reach of terrestrial infrastructure. LEO satellites offer the flexibility and rapid deployment capabilities needed for dynamic mission environments. Coupled with enhanced collaboration between defense agencies and commercial satellite operators, this demand is poised to support significant long-term market growth.

Satellite Mass Insights

The large satellite segment led the largest market share of 39.2% of the global revenue in 2024, driven by the rising need for high-capacity data transmission, Earth observation, and defense-related missions. The large satellite segment is gaining strong traction within the LEO satellite industry. These satellites can carry advanced payloads and offer enhanced imaging, communication, and surveillance capabilities. Governments and large enterprises are increasingly investing in large LEO platforms to support broadband infrastructure, strategic intelligence, and environmental monitoring on a large scale. As demand for robust, multi-functional space systems grows, the Large Satellite segment is expected to witness steady expansion over the forecast period.

The cube sats segment is expected to register the fastest CAGR of over 14% from 2025 to 2033, owing to their low cost, rapid deployment capabilities, and modular design. The CubeSats segment is witnessing strong market growth. These miniature satellites are increasingly used for Earth observation, technology demonstration, and educational missions by startups, research institutions, and space agencies. Their scalability and compatibility with rideshare launch programs make them highly attractive for commercial and scientific applications. As payload miniaturization and propulsion advancements continue, CubeSats are expected to play a vital role in expanding access to space-based services.

Frequency Band Insights

The Ka-band segment accounted for the largest market revenue share in 2024, owing to its capacity to support high-data-rate transmissions. The Ka-band segment is gaining significant traction across commercial and government satellite applications. Its suitability for broadband connectivity, especially in high-throughput LEO satellite constellations, makes it a preferred choice for real-time communication services. Market players increasingly invest in Ka-band technology to enable seamless internet access in remote, maritime, and aviation environments. This trend is further reinforced by antenna design and signal processing advancements to enhance performance and mitigate weather-related signal degradation.

The Q/V-band segment is predicted to foresee significant growth in the forecast period, owing to the increasing need for higher frequency spectrum to meet rising data demands in next-generation satellite communication systems. These bands offer significantly larger bandwidths, enabling ultra-high-capacity links ideal for future LEO constellations supporting 5G backhaul and high-speed data transfer. Although challenges such as atmospheric attenuation remain, advancements in adaptive modulation, beamforming, and phased-array antennas are improving the reliability of Q/V-band communications. As spectrum congestion intensifies in lower frequency bands, satellite operators and technology providers are turning to Q/V-band solutions to unlock new levels of connectivity and performance.

Propulsion Insights

The liquid fuel segment accounted for the largest market revenue share in 2024, driven by its high thrust efficiency and precise controllability for satellite launch and orbital maneuvering. This propulsion type is preferred for heavy payload missions and long-duration space operations, especially in LEO satellite deployments. Key industry players invest in next-generation liquid propulsion systems to enhance reliability, reusability, and cost-effectiveness. As demand intensifies for flexible and high-performance launch capabilities, liquid fuel technologies play a critical role in supporting satellite constellations' growing scale and complexity.

Electric is predicted to foresee significant growth in the forecast period, driven by the growing demand for fuel-efficient, lightweight, and long-duration satellite operations. This technology offers significant advantages in terms of reduced launch mass and extended mission lifespans, making it ideal for LEO constellations and deep-space missions. Leading aerospace companies are investing in advanced electric thrusters, including Hall-effect and ion propulsion systems, to meet the evolving needs of commercial and government space programs. Electric propulsion is becoming a critical enabler of next-generation satellite deployment strategies as the satellite industry shifts toward cost optimization and operational sustainability.

Application Insights

The communication segment accounted for the largest market revenue share in 2024, driven by the rising demand for high-speed, low-latency data transmission across commercial, government, and defense sectors. LEO satellites are increasingly leveraged to expand broadband coverage, support 5G backhaul, and enable real-time global connectivity. Major telecom providers and satellite operators are forming strategic alliances to deploy large-scale LEO constellations that address underserved and remote regions. As digital infrastructure becomes central to economic competitiveness, communication-focused satellite systems play a pivotal role in shaping the future of global connectivity.

The Earth observation & remote sensing segment is predicted to foresee the largest growth in the forecast period, driven by increasing demand for high-resolution, real-time geospatial data across industries such as agriculture, defense, environmental monitoring, and disaster management. LEO satellites offer enhanced imaging capabilities with reduced revisit times, enabling more frequent and precise data collection. Governments and commercial entities are investing in advanced optical and radar payloads to support applications ranging from climate analysis to urban planning. As data-driven decision-making becomes a strategic priority, satellite-based Earth observation is emerging as a vital asset for operational intelligence and sustainable development.

End Use Insights

The commercial segment accounted for the largest market revenue share in 2024, driven by the rising demand for satellite-enabled services across telecommunications, media, transportation, and energy sectors. Private companies rapidly deploy LEO satellite constellations to provide broadband connectivity, real-time tracking, and data analytics solutions. Increased investments from venture capital and strategic partnerships with tech firms are accelerating innovation and market entry. As businesses prioritize global coverage, speed, and scalability, commercial adoption of LEO satellites is becoming a key driver of industry expansion and competitiveness.

The government & defense segment is projected to grow significantly over the forecast period, driven by the growing need for real-time surveillance, secure communication, and strategic intelligence. The government & defense segment is witnessing robust growth in the LEO satellite industry. LEO satellites offer low-latency data transmission and frequent revisit rates, making them ideal for defense operations, border monitoring, and military communications. Governments increasingly invest in LEO constellations to enhance national security and maintain space-based situational awareness. As geopolitical tensions rise and modern defense systems become more data-reliant, demand from this segment is expected to remain strong over the forecast period.

Regional Insights

North America LEO satellite market dominated and accounted for over 55% share in 2024, driven by strong public and private sector investments. North America continues to lead in deploying LEO satellite constellations for broadband connectivity, defense applications, and Earth observation. The presence of key industry players and supportive regulatory frameworks is fostering innovation and accelerating satellite launches. Growing demand for low-latency communication and data services further fuels the region’s market dominance.

U.S. LEO Satellite Market Trends

The LEO satellite market in the U.S. dominated the market with a share of over 93% in 2024, primarily driven by large-scale government initiatives and aggressive commercialization by private space companies. The U.S. remains at the forefront of LEO satellite development. Programs from NASA, the Department of Defense, and ventures like SpaceX are expanding communication, navigation, and reconnaissance capabilities. The country’s focus on space dominance and digital infrastructure modernization drives continuous advancements in LEO satellite technologies.

Europe LEO Satellite Market Trends

The LEO satellite market in Europe is expected to grow at a CAGR of over 13% from 2025 to 2033, owing to rising investments in space-based infrastructure and increasing demand for secure communication networks. Europe is scaling its LEO satellite activities. Initiatives such as the EU’s IRIS² constellation and collaborative R&D efforts are positioning the region as a strong contender in global satellite innovation. Regulatory support for sustainability and digital sovereignty further accelerates market growth across European countries.

Germany LEO satellite market is driven by strong government initiatives in space-based Earth observation and climate monitoring; Germany is emerging as a key player in the LEO satellite landscape. The country invests in advanced imaging technologies and supports public-private partnerships to enhance data-driven policy and security measures. Additionally, Germany’s robust industrial base enables the development of high-precision satellite components, driving domestic innovation and export opportunities.

The LEO satellite market in the UK is owed to increasing investments in commercial space ventures and sovereign satellite navigation capabilities. Government support through the UK Space Agency and initiatives like OneWeb propel the deployment of LEO constellations for global broadband coverage. This momentum is further supported by advancements in small satellite manufacturing and spaceport development across the country.

Asia Pacific LEO Satellite Trends

The LEO satellite market in Asia Pacific is anticipated to register the fastest CAGR of over 17% from 2025 to 2033. The increasing demand for universal broadband access, national security, and disaster management solutions propels LEO satellite adoption in the Asia Pacific. Countries like China, India, and Japan are significantly ramping up satellite production, launch capabilities, and constellation planning. Rapid digital transformation and regional cooperation in space technology are key drivers behind the region’s expanding LEO satellite footprint.

China LEO satellite market is aggressively expanding its LEO satellite capabilities to support national broadband coverage, surveillance, and space-based navigation systems. Backed by strong government funding and state-led programs such as the "Guowang" LEO constellation, the country is positioning itself as a dominant force in global satellite infrastructure. Technological self-reliance and rapid launch capabilities are further accelerating China’s market expansion.

The LEO satellite market in Japan is driven by its focus on disaster management, Earth observation, and maritime surveillance. In collaboration with JAXA and private companies, the government is enhancing its space-based infrastructure to address regional security and climate change challenges. Japan’s miniaturized satellite technology advancements and precision sensors also contribute to its competitiveness in the global LEO sector.

Key LEO Satellite Company Insights

Some key players operating in the market include Lockheed Martin Corporation, SpaceX, and others.

-

SpaceX is a dominant force in the market, primarily through its Starlink satellite constellation, which aims to deliver global broadband coverage. The company specializes in vertically integrated satellite manufacturing, reusable launch systems (Falcon 9), and satellite network deployment. With its high launch frequency and cost-effective deployment model, SpaceX has significantly lowered the entry barrier for LEO infrastructure. Its aggressive pace in building a satellite mega-constellation positions it as a technological and commercial leader in the market.

-

Lockheed Martin Corporation is a key defense-focused company involved in space systems, satellite payload integration, and national security LEO missions. The company supports the U.S. government and allied nations with communication, navigation, and reconnaissance satellite systems. It is pivotal in developing resilient satellite constellations and supporting military-grade payload deployment in LEO. Lockheed’s focus on cybersecurity, precision targeting, and space-based ISR (Intelligence, Surveillance, and Reconnaissance) underscores its strategic importance in the market.

Astrocast and NanoAvionics are emerging market participants.

-

Astrocast is an emerging Swiss satellite company specializing in nanosatellite IoT connectivity via LEO orbits, targeting remote and underserved areas. Its constellation enables low-power, cost-efficient communication for agriculture, maritime, logistics, and environmental monitoring industries. The company offers end-to-end services including hardware, satellite links, and data platforms. Astrocast is gaining traction as a key enabler of global IoT networks through its scalable and affordable satellite solution.

-

NanoAvionics, headquartered in Lithuania, is a fast-growing company that provides small satellite buses and mission services for LEO deployments. It focuses on building scalable platforms for Earth observation, remote sensing, and scientific missions. The company has established a global customer base by offering rapid manufacturing, modular design, and in-orbit demonstration services. With strategic partnerships and flight heritage, NanoAvionics is positioning itself as a trusted supplier for emerging LEO operators.

Key LEO Satellite Companies:

The following are the leading companies in the LEO satellite market. These companies collectively hold the largest market share and dictate industry trends.

- SpaceX

- Airbus Defenses & Space

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- L3Harris Technologies Inc.

- Astrocast

- China Aerospace Science & Technology Corporation (CASC)

- German Orbital Systems

- GomSpaceApS

- Nano Avionics

- Planet Labs Inc.

- ROSCOSMOS

- Space Exploration Technologies Corp.

- SpaceQuest Ltd.

- Thales Alenia Space

Recent Developments

-

In June 2025, Orange partnered with Eutelsat Group on a multi‑year agreement to extend its low Earth orbit (LEO) satellite communications capabilities using Eutelsat’s OneWeb constellation. The collaboration will enhance Orange’s enterprise and government offerings, providing high‑throughput, low‑latency, secure connectivity worldwide, including mobile backhaul support in remote and underserved areas. By integrating OneWeb’s satellite coverage with its terrestrial networks, Orange aims to ensure seamless service continuity and bolster its sovereign and resilient digital infrastructure.

-

In April 2025, SpinLaunch announced a strategic investment of USD 12 million from Kongsberg Defence & Aerospace to fund the development and commercialization of its Meridian Space low-Earth orbit (LEO) satellite broadband constellation. The deal includes selecting Kongsberg NanoAvionics as the exclusive supplier for the initial deployment of 280 microsatellites, featuring prototypes and an in-orbit demonstrator slated for 2026. This partnership positions SpinLaunch to offer high-capacity global connectivity with efficient launch economics and scalable architecture, delivered via a single traditional rocket mission deploying hundreds of satellites.

-

In March 2025, Orange partnered with Telesat to deploy and integrate Telesat Lightspeed LEO satellite capacity into its terrestrial infrastructure. The agreement includes hosting a Lightspeed Landing Station at Orange’s Bercenay‑en‑Othe teleport in France, with ground connectivity to Telesat’s Paris PoP via Orange Wholesale’s private line. By incorporating secure, low‑latency satellite services into its wholesale portfolio, Orange aims to bolster resilient, enterprise‑grade connectivity, particularly for mobile backhaul, crisis response, and underserved regions across Europe, Africa, and beyond.

-

In February 2025, MEASAT partnered with Shanghai Spacesail Technologies (SPACESAIL) by signing a memorandum of understanding to jointly develop and market low-Earth orbit (LEO) satellite services. The collaboration will focus on research and development of next-generation LEO solutions and promotional activities, leveraging MEASAT’s extensive satellite infrastructure and Spacesail’s innovative technologies. This partnership aims to accelerate the delivery of global, resilient connectivity through expanded LEO capabilities.

LEO Satellite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.49 billion

Revenue forecast in 2033

USD 41.31 billion

Growth rate

CAGR of 14.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Satellite mass, frequency band, propulsion type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

SpaceX; Airbus Defenses & Space; Lockheed Martin Corporation; Northrop Grumman Corporation; L3Harris Technologies Inc.; Astrocast; China Aerospace Science & Technology Corporation (CASC); German Orbital Systems; GomSpace ApS; Nano Avionics; Planet Labs Inc.; ROSCOSMOS; Space Exploration Technologies Corp.; SpaceQuest Ltd.; Thales Alenia Space.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LEO Satellite Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global LEO satellite market report based on satellite mass, frequency band, propulsion type, application, end use, and region:

-

Satellite Mass Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Satellite

-

Cube Sats

-

Medium Satellite

-

Large Satellite

-

-

Frequency Band Outlook (Revenue, USD Million, 2021 - 2033)

-

L-band

-

S-band

-

C-band

-

X-band

-

Ku-band

-

Ka-band

-

Q/V-band

-

HF/VHF/UHF band

-

Laser/Optical

-

-

Propulsion Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Gas based

-

Liquid Fuel

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Communication

-

Earth Observation & Remote Sensing

-

Scientific Research

-

Technology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global LEO satellite market size was estimated at USD 12.64 billion in 2024 and is expected to reach USD 14.49 billion in 2025.

b. The global LEO satellite market is expected to grow at a compound annual growth rate of 14.0% from 2025 to 2033 to reach USD 41.31 billion by 2033.

b. North America accounted for the highest market revenue share of 55.1% in 2024. The market is driven by technological innovation, strong government investments in space and defense, and a robust private sector. The focus is on enhancing satellite capabilities, leveraging advanced manufacturing, and fostering public-private partnerships.

b. Some key players operating in the LEO satellite market include Key companies profiled SpaceX, Airbus Defenses & Space, Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc., Astrocast, China Aerospace Science & Technology Corporation (CASC), German Orbital Systems, GomSpaceApS, Nano Avionics, Planet Labs Inc., ROSCOSMOS, Space Exploration Technologies Corp., SpaceQuest Ltd., and Thales Alenia Space.

b. Key factors that are driving the market growth include growing demand for high-speed, low-latency internet connectivity, increasing deployment of satellite constellations by private players, and rising applications in remote sensing and global communication services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.