- Home

- »

- IT Services & Applications

- »

-

Life Cycle Assessment Market Size, Industry Report, 2030GVR Report cover

![Life Cycle Assessment Market Size, Share & Trends Report]()

Life Cycle Assessment Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Type (Cradle to Cradle, Cradle to Grave, Gate to Gate), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-544-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Cycle Assessment Market Summary

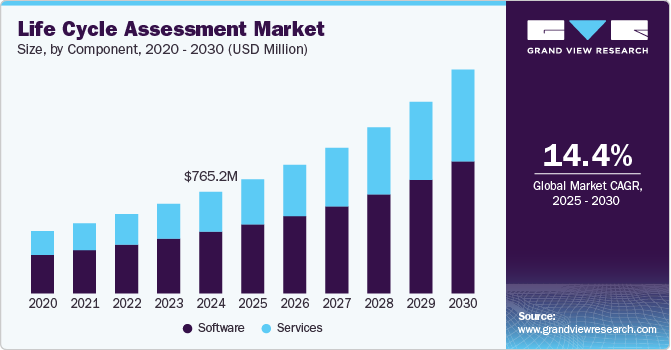

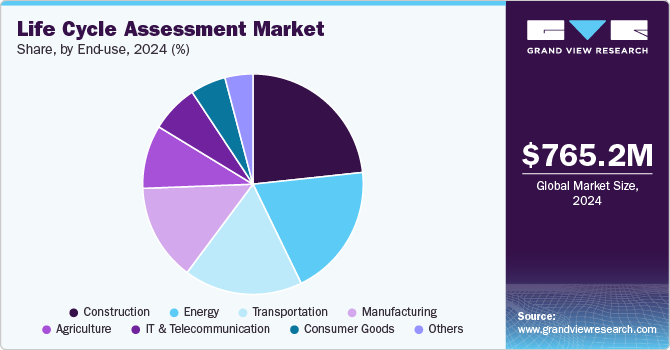

The global life cycle assessment market size was estimated at USD 765.2 million in 2024 and is projected to reach USD 1690 million by 2030, growing at a CAGR of 14.4% from 2025 to 2030. The growing global emphasis on environmental sustainability and carbon footprint reduction is driving the life cycle assessment (LCA) market growth.

Key Market Trends & Insights

- North America life cycle assessment market held a significant revenue share of around 30.0% in 2024.

- The life cycle assessment industry in the U.S. dominated in 2024.

- Based on component, the software segment dominated the industry with a revenue share of 60.8% in 2024.

- Based on type, the cradle to grave segment dominated the industry with a revenue share of over 46.0% in 2024.

- Based on deployment, the cloud segment dominated the industry with a revenue share of over 73.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 765.2 Million

- 2030 Projected Market Size: USD 1690 Million

- CAGR (2025-2030): 14.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As governments, corporations, and consumers become increasingly aware of the environmental impact of products and services, there is a rising demand for tools that can measure and manage these effects across the entire life cycle from raw material extraction to production, use, and disposal. LCA provides a comprehensive framework for quantifying environmental impacts, enabling organizations to identify inefficiencies and areas for improvement. The push for sustainability reporting, driven by climate change concerns and international climate agreements, is further encouraging companies across industries to adopt LCA tools to ensure transparency and accountability in their environmental practices.

The stringent environmental regulations and compliance requirements worldwide are driving the adoption of the life cycle assessment market. Governments in regions like Europe, North America, and parts of Asia are mandating environmental impact disclosures and setting strict limits on emissions, resource consumption, and waste generation. Businesses are increasingly adopting LCA tools to meet regulatory demands, avoid penalties, and maintain their licenses to operate. This regulatory pressure is fostering the growth of the LCA market across various sectors, including manufacturing, energy, chemicals, and consumer goods.

Additionally, the shift towards circular economy models is another important driver of the life cycle assessment market. Governments and industries are increasingly embracing circular economic principles, which prioritize resource efficiency, recycling, and sustainable product design. Life cycle assessment plays a crucial role in supporting circular economy initiatives by providing data-driven insights into material flows, product end-of-life scenarios, and the environmental impact of different recycling or reuse strategies. Companies looking to implement circular practices rely on LCA to identify the most sustainable options for product design, supply chain management, and waste reduction, thereby driving demand for these tools. According to an article published by the European Environment Agency, Europe achieved a circular rate of 11.8% in 2023, indicating that it uses a greater share of recycled materials compared to other regions globally. Advancing the shift toward a circular economy has emerged as a key policy priority.

Furthermore, the growing emphasis on green building certifications and sustainable architecture is another driver of the life cycle assessment (LCA) market, particularly in the construction sector. Certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM, and WELL often require or recommend LCA-based assessments to evaluate the environmental performance of building materials and designs. Architects, engineers, and construction firms are increasingly using LCA tools to select materials with the least environmental impact and to design buildings that meet sustainability benchmarks. This trend is especially strong in regions with stringent energy and environmental building codes, such as Europe, North America, and parts of Asia, thereby expanding the LCA market within the construction and real estate industries.

Component Insights

The software segment dominated the industry with a revenue share of 60.8% in 2024. The integration of LCA software with enterprise-level systems such as Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Computer-Aided Design (CAD) platforms is driving the segment growth. These integrations enable seamless data sharing across departments and functions, reducing duplication and improving the accuracy of sustainability data. As companies seek to embed environmental metrics into their decision-making processes, from product design to end-of-life disposal, integrated life cycle assessment (LCA) software solutions become essential tools. This integration also allows for more informed decision-making and supports the development of sustainable products right from the conceptual stage, fueling market growth for LCA software.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The growing demand for expert consultation and customization in sustainability assessments is driving segment growth. Many organizations, especially small and medium-sized enterprises (SMEs), lack the in-house expertise to conduct complex LCAs, interpret data accurately, and align results with global sustainability standards. As a result, they turn to specialized service providers for end-to-end support ranging from data collection and impact analysis to report generation and compliance advice. These services are often tailored to specific industries and regulatory environments, making them highly valuable for businesses that require customized solutions to meet their unique environmental and operational needs.

Type Insights

The cradle to grave segment dominated the industry with a revenue share of over 46.0% in 2024. The global push for circular economic initiatives and the need to understand a product’s life cycle in its entirety is driving the adoption of cradle to grave in the market. Cradle-to-grave LCAs help organizations identify inefficiencies and environmental burdens at each stage, offering valuable insights into where interventions can be made to improve sustainability. By understanding impacts not just during production but also during use and end-of-life phases, companies can redesign products for durability, recyclability, and reduced emissions, aligning with circular economy goals. Governments and industry bodies are increasingly mandating such assessments to support policy development and innovation in sustainable product design, thereby boosting demand for cradle-to-grave assessments.

The cradle to cradle segment is anticipated to register the highest CAGR of 16.2% over the forecast period. The economic benefits of material efficiency and resource recovery are also driving the adoption of cradle to cradle LCA. By designing products for reuse and recyclability, companies can reduce dependency on virgin raw materials, lower production costs, and create new revenue streams from reclaimed materials or product-as-a-service models. Cradle-to-cradle LCAs provide actionable insights into how businesses can close material loops and capture these economic gains, making them a strategic tool for cost reduction and profitability. In a competitive landscape where resource prices are volatile and environmental risks are escalating, the ability to create resilient and efficient supply chains through circular strategies is a powerful incentive.

Deployment Insights

The cloud segment dominated the industry with a revenue share of over 73.0% in 2024. The increasing adoption of cloud technologies across industries for digital transformation is driving segment growth. Many businesses are migrating operations, customer management, and analytics to the cloud, and sustainability functions are following suit. Cloud-based LCA tools align seamlessly with existing enterprise systems (e.g., ERP, CRM, and supply chain software), enabling integrated reporting, streamlined workflows, and automated data input. This interoperability helps companies more efficiently conduct life cycle assessments and link them with broader environmental, social, and governance (ESG) reporting, making cloud LCA solutions an attractive investment for sustainability-focused enterprises.

The on-premises segment is anticipated to grow at the fastest CAGR over the forecast period. The long-term cost predictability and return on investment (ROI) associated with on-premise deployment also drive adoption in certain organizations. While cloud-based solutions typically involve recurring subscription fees, on-premise software is often a one-time capital investment with predictable maintenance costs. Companies that anticipate high-volume or long-term use of LCA tools may find on-premise solutions more cost-effective over time, particularly when evaluating ROI across multiple years. This financial predictability appeals to businesses with established IT infrastructure and budget strategies focused on capital expenditures.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. The growing adoption of corporate sustainability goals, including net-zero emissions and circular economy targets, contributes to market growth. Large enterprises are increasingly setting ambitious climate targets, and LCA serves as a key tool to measure progress, identify hotspots, and guide strategic decisions. For instance, in industries such as automotive, electronics, and consumer goods, companies are using LCA data to redesign products for sustainability, select low-impact materials, and optimize production processes. These efforts support regulatory compliance and risk mitigation and drive innovation and cost savings, reinforcing the value of LCA in large-scale corporate sustainability initiatives.

The SMEs segment is expected to grow significantly with a CAGR of over 15.0% from 2025 to 2030. Public funding, incentives, and support programs for sustainability initiatives are encouraging SMEs to adopt LCA practices. Governments and development agencies across regions like the EU, North America, and parts of Asia offer grants, subsidies, and technical assistance to help SMEs transition to greener practices, including conducting life cycle assessments. Participation in such programs helps SMEs not only reduce their environmental impact but also improve efficiency, reduce costs, and enhance resilience. These support mechanisms are playing a crucial role in driving LCA adoption across the SME landscape, especially in resource-constrained settings.

End-use Insights

The construction segment dominated the market and accounted for a revenue share of over 23.0% in 2024. The increasing digitization of the construction industry through Building Information Modeling (BIM) and digital twins also supports LCA adoption. LCA tools are increasingly being integrated with BIM platforms, allowing for real-time environmental impact analysis during the design and planning phases. This integration enables architects, engineers, and contractors to make informed decisions early in the project lifecycle, optimizing for sustainability without compromising functionality or cost. The synergy between LCA and BIM enhances project efficiency, reduces rework, and streamlines compliance, making environmental assessment a seamless part of the construction workflow.

The agriculture segment is expected to grow at the highest CAGR over the forecast period. The growing focus on climate-smart agriculture and regenerative farming also supports LCA adoption. Farmers and agricultural companies are exploring innovative practices that sequester carbon, improve soil health, and enhance biodiversity. LCA helps measure the environmental benefits of such practices, providing data to support their adoption and to validate their impact on policymakers, investors, and customers. This is especially relevant in the context of emerging markets for carbon credits from agriculture, where accurate life cycle assessment assessments are critical for quantifying and monetizing carbon sequestration efforts.

Regional Insights

North America life cycle assessment market held a significant revenue share of around 30.0% in 2024. The increasing importance of regulatory compliance and data protection drives the demand for secure and compliant DNS anycast networks in North America. Many industries in the region, such as healthcare, finance, and government, are subject to stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Managed DNS providers offer compliance-ready anycast networks that help businesses meet these regulatory requirements by implementing secure DNS encryption, data logging, and reporting capabilities. This allows companies to maintain data privacy and security while meeting the necessary compliance standards, further fueling the adoption of managed DNS distributed denial of service (DDoS) protection.

U.S. Life Cycle Assessment Industry Trends

The life cycle assessment industry in the U.S. dominated in 2024. The growth of green building initiatives and sustainable infrastructure development is also accelerating LCA adoption in the U.S. construction sector. Programs like LEED (Leadership in Energy and Environmental Design) and WELL Building Standard incorporate LCA-based Environmental Product Declarations (EPDs) into their certification criteria. Moreover, public procurement guidelines in states such as California and New York often require or incentivize the use of low-carbon construction materials, which necessitate LCA analysis to verify their environmental performance. The integration of LCA into Building Information Modeling (BIM) and digital construction platforms further enhances its usability and adoption among architects, engineers, and contractors seeking to design environmentally optimized structures.

Europe Life Cycle Assessment Industry Trends

The Europe life cycle assessment market is anticipated to register considerable growth from 2025 to 2030. Europe's advanced LCA research institutions, robust databases, and strong industry-academic collaborations support market growth. Initiatives such as the European Platform on Life Cycle Assessment (EPLCA) and databases like ELCD (European Reference Life Cycle Database) and ecoinvent provide access to high-quality life cycle inventory data, making LCA more accurate and accessible for businesses. Additionally, numerous EU-funded research projects are exploring innovations in LCA methodology, digital tools, and sector-specific applications, ensuring that Europe remains at the forefront of LCA development and standardization.

The life cycle assessment industry in the UK held a substantial market share in 2024. Consumer awareness and demand for sustainable, transparent products in the U.K. are prompting companies to adopt LCA methodologies. U.K. consumers are increasingly seeking eco-friendly and ethically produced goods, and businesses are responding by offering carbon footprint labeling and sustainability disclosures based on LCA data. Retail giants, food producers, and consumer brands are using LCA to validate their environmental claims and differentiate their offerings in a competitive, environmentally conscious market.

Germany life cycle assessment market is expected to grow rapidly during the forecast period. Germany’s export-oriented industrial base, especially in automotive, machinery, and electronics, also drives the adoption of LCA. International markets increasingly demand sustainable, transparent supply chains and products with documented environmental performance. German manufacturers use LCA to generate Environmental Product Declarations (EPDs) and carbon footprint analyses that meet both EU and global standards, enabling them to maintain competitiveness and meet customer expectations. Automakers, in particular, leverage LCA to assess the full lifecycle impact of vehicles, including electric vehicles (EVs), as part of their commitments to sustainable mobility.

Asia Pacific Life Cycle Assessment Industry Trends

The life cycle assessment industry in the Asia Pacific region is expected to achieve the fastest growth rate during the forecast period. The rise of corporate ESG reporting in Asia Pacific, driven by both regulatory pressure and investor demand, is propelling LCA adoption. Countries like Japan and South Korea are advancing mandatory ESG disclosures, while stock exchanges in Hong Kong, Singapore, and India have introduced sustainability reporting requirements. LCA supports these efforts by offering credible, quantitative data on environmental performance, helping companies comply with ESG frameworks such as GRI, TCFD, and SASB. In addition, sustainability-linked financing and green bonds often require LCA-backed impact assessments, further driving demand for LCA services.

China life cycle assessment market held a substantial market share in 2024. The growth of renewable energy and clean technology industries in China is stimulating LCA demand. As China continues to invest heavily in solar, wind, hydro, and electric vehicle (EV) technologies, manufacturers and developers are employing LCA to validate the environmental benefits of renewable solutions compared to traditional energy systems. LCA allows companies to identify potential trade-offs, such as resource intensity or end-of-life impacts, ensuring that clean technologies are truly sustainable across their entire lifecycle. This aligns with China's broader goals of energy transition and leadership in green technology innovation, fostering the integration of LCA into design and production processes.

The life cycle assessment market in India is expected to grow rapidly during the forecast period.The expansion of green building and infrastructure initiatives is also fueling LCA demand. India’s green construction market is growing rapidly, supported by certification programs like the Indian Green Building Council (IGBC) and GRIHA (Green Rating for Integrated Habitat Assessment). These programs require comprehensive assessments of embodied energy, material sustainability, and lifecycle emissions, encouraging construction firms, architects, and material manufacturers to adopt LCA tools for certification and compliance. Furthermore, government incentives for green buildings and sustainable urban development programs such as Smart Cities Mission are amplifying the importance of life cycle assessment in the construction ecosystem.

Key Life Cycle Assessment Company Insights

Some key players operating in the market include Dassault Systèmes, Sphera, and SimaPro, among others.

- SimaPro is a life cycle assessment (LCA) software developed by PRé Sustainability, a company dedicated to advancing sustainability through robust metrics and tools. SimaPro has been instrumental in enabling organizations to analyze and improve the environmental performance of their products and services. One of the notable offerings within the SimaPro suite is SimaPro Craft. This robust LCA software is trusted by sustainability professionals, product designers, engineers, and decision-makers worldwide. SimaPro Craft provides advanced capabilities to transform raw data into clear, actionable insights. SimaPro facilitates the collection, analysis, and monitoring of sustainability performance data. Its applications are diverse, encompassing sustainability reporting, carbon and water footprinting, product design optimization, and the generation of environmental product declarations.

Hedgehog, Inc. and Ecochain Technologies are some of the emerging market participants in the target market.

- Ecochain Technologies specializes in sustainability management software. Ecochain focuses on providing tools and services that enable businesses to measure, analyze, and reduce the environmental impact of their products and operations. Ecochain's offerings are two primary software solutions: Ecochain Mobius and Ecochain Helix. These tools empower businesses to conduct detailed LCAs, identify environmental hotspots, and implement strategies for sustainable product design and supply chain management. By integrating Ecochain's software, companies can align their operations with environmental standards and respond effectively to increasing regulatory and consumer demands for sustainability. Through its innovative software solutions, Ecochain plays a pivotal role in guiding businesses toward more sustainable and environmentally friendly practices.

Key Life Cycle Assessment Companies:

The following are the leading companies in the life cycle assessment market. These companies collectively hold the largest market share and dictate industry trends.

- TÜV Rheinland

- Dassault Systèmes

- SCS Global Services

- Sphera

- SimaPro

- Ecochain Technologies

- Hedgehog

- Valpak

- Anthesis Group Ltd.

- RINA S.p.A.

- Makersite

- One Click LCA

- iPoint-systems gmbh

- Minviro Ltd

- WAP Sustainability, LLC

Recent Developments

-

In September 2024, One Click LCA acquired ENVI-met in a strategic move that merges ENVI-met’s cutting-edge urban climate modeling with One Click LCA’s robust environmental impact assessment capabilities. This combination offers a comprehensive solution for decarbonization and climate-resilient urban design, bringing together two forward-thinking approaches to tackling climate change in urban environments. By integrating ENVI-met’s environmental simulations with One Click LCA’s life-cycle assessment tools, the partnership sets a new benchmark for sustainable urban planning.

-

In May 2024, One Click LCA acquired Buildrz, a generative AI platform specializing in real estate opportunity analysis and feasibility studies. Through this acquisition, the companies will offer users an integrated solution that combines feasibility studies, cost analysis, and carbon analysis powered by generative AI. Buildrz’s capabilities align with and accelerate One Click LCA’s vision of becoming the leading end-to-end sustainability software platform for the construction and manufacturing industries. Both companies will enable users to identify low-carbon project opportunities even before design begins, ensuring both sustainability and regulatory compliance.

-

In December 2023, TÜV Rheinland signed a strategic agreement with Shenzhen EXENCELL New Energy Technology Co., Ltd. Both companies will broaden their collaboration in areas including Environmental, Social, and Corporate Governance (ESG) strategic planning, Life Cycle Assessments (LCA), and evaluating Environmental Product Declarations (EPD). This partnership aims to contribute significantly to the development of a clean, low-carbon energy system and to advance the ongoing energy transformation further.

Life Cycle Assessment Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 858.9 million

Revenue Forecast in 2030

USD 1.69 billion

Growth Rate

CAGR of 14.4% from 2025 to 2030

Actual Data

2018 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, type, deployment, enterprise size, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

TÜV Rheinland; Dassault Systèmes; SCS Global Services; Sphera; SimaPro; Ecochain Technologies; Hedgehog; Valpak; Anthesis Group Ltd.; RINA S.p.A.; Makersite; One Click LCA; iPoint-systems gmbh; Minviro Ltd; WAP Sustainability, LLC

Customization Scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Cycle Assessment Market Report Segmentation

This report forecasts revenue growth at global, regional, and at country levels and offers a qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global life cycle assessment market based on component, type, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cradle to Cradle

-

Cradle to Grave

-

Cradle to Gate

-

Gate to Gate

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Energy

-

Transportation

-

Manufacturing

-

Agriculture

-

IT & Telecommunication

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global life cycle assessment market size was estimated at USD 765.2 million in 2024 and is expected to reach USD 858.9 million in 2025.

b. The global life cycle assessment market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 1.69 billion by 2030.

b. The software segment dominated the industry with a revenue share of 60.8% in 2024. The integration of LCA software with enterprise-level systems such as Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Computer-Aided Design (CAD) platforms is driving the segment growth.

b. Some key players operating in the market include TÜV Rheinland, Dassault Systèmes, SCS Global Services, Sphera, SimaPro, Ecochain Technologies, Hedgehog, Valpak, Anthesis Group Ltd., RINA S.p.A., Makersite, One Click LCA, iPoint-systems gmbh, Minviro Ltd, WAP Sustainability, LLC.

b. The growing global emphasis on environmental sustainability and carbon footprint reduction is driving the life cycle assessment (LCA) market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.