- Home

- »

- Healthcare IT

- »

-

Life Science Analytics Market Size, Industry Report, 2030GVR Report cover

![Life Science Analytics Market Size, Share & Trends Report]()

Life Science Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Type (Descriptive, Predictive), By Delivery (On Demand, On Premise), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-172-6

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Science Analytics Market Summary

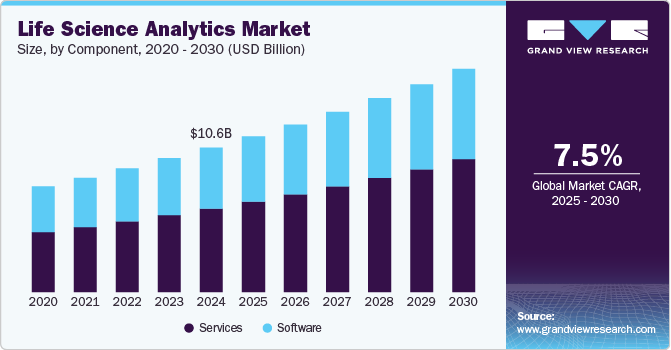

The global life science analytics market size was estimated at USD 10.55 billion in 2024 and is projected to reach USD 16.33 billion by 2030, growing at a CAGR of 7.50% from 2025 to 2030. The market's growth is driven by the increasing need to standardize and integrate diverse data sources, such as clinical trials, electronic health records, genomics, and real-world evidence, enabling seamless data exchange across platforms and regions.

Key Market Trends & Insights

- North America life science analytics market dominated the global market and accounted for a revenue share of 49.86% in 2024.

- The life science analytics market in the U.S. leads the North America market

- By component, the services segment held the largest revenue share of 57.66% in 2024.

- By type, the descriptive analytics segment held the largest revenue share in the market in 2024.

- By application, the sales and marketing support segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.55 Billion

- 2030 Projected Market Size: USD 16.33 Billion

- CAGR (2025-2030): 7.50%

- North America: Largest market in 2024

Technological advancements, including artificial intelligence, quantum computing, cognitive computing, and cloud-based analytics, have significantly simplified data analysis, allowing organizations to transform vast amounts of raw data into actionable insights. This has accelerated the adoption of analytics in drug discovery, clinical trials, regulatory compliance, and pharmacovigilance.

The technological landscape of data analytics in life sciences is advancing quickly, with AI and ML emerging as key drivers of innovation and progress. For instance, in March 2022, Databricks introduced a new Lakehouse platform tailored for the healthcare and life sciences sectors, marking a significant step forward in enhancing industry data management and analytics capabilities. The platform highlights the industry's move toward all-in-one solutions, handling basic data management and advanced AI analytics.

“The opportunity for healthcare to be transformed with data and AI cannot be overstated. As organizations fully transition to electronic medical records, new data types like genomics evolve, and IoT and wearables take off, the industry is awash in massive amounts of data. But this data is siloed, and teams don’t have the tools to properly use it.”

- Michael Hartman, SVP of Regulated Industries at Databricks.

In addition, these tools enhance operational efficiency by automating data processing and uncovering actionable insights, thus empowering data-driven decision-making across the healthcare ecosystem, thereby contributing to the growing market demand. Hence, market players are introducing new solutions and advancing the existing ones to cater to the market demand.

For instance, in September 2024, Komodo Health expanded its MapLab platform by introducing MapAI and MapExplorer to enhance healthcare and life sciences analytics workflows. MapAI is an AI-driven tool designed to improve collaborative analytics, enabling multiple users to efficiently create targeted, reliable, and contextual insights. MapExplorer provides users with streamlined, high-level insights into patient populations, healthcare providers, and payers through a no-code interface.

"With MapAI and MapExplorer, we are redefining what’s possible in healthcare analytics by drastically simplifying the path from data exploration to decision-making for healthcare and Life Sciences teams. These new GenAI-powered enhancements to our MapLab platform enable users to ask questions in plain language and instantly generate high-impact insights, breaking down barriers to data-driven intelligence and empowering companies to act faster, think bigger, and ultimately deliver better outcomes for patients.”

-Laurent Bride, Chief Technology Officer, Komodo Health

The pharmaceutical and clinical trial industries are undergoing significant changes as analytics is widely adopted in pharma and life sciences. This shift is driven by the demand for faster drug development and more efficient trials. Analytics tools help streamline clinical processes by examining key data such as patient demographics, historical records, remote monitoring inputs, and insights from previous trials.

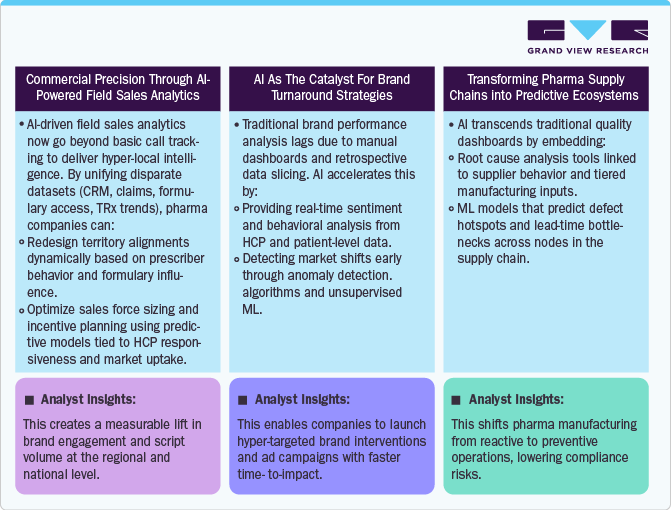

Case Study & Insights

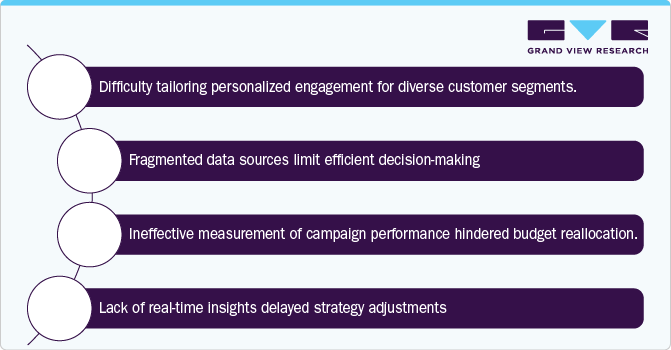

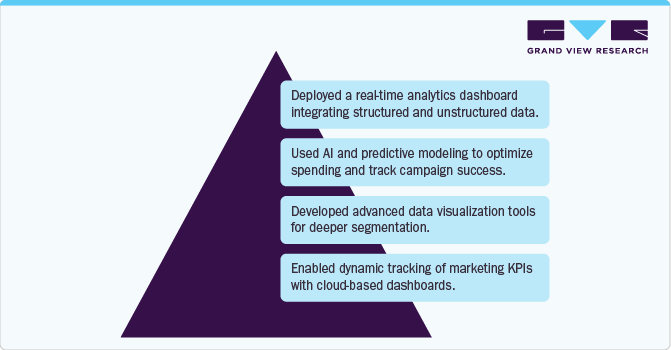

Case study: "Quantzig's Pharmaceutical Marketing Analytics: Achieving a 67% Increase in Marketing ROI for a German Drug Manufacturer," published in March 2025.

Overview: Quantzig collaborated with a leading German pharmaceutical company to enhance customer engagement and increase marketing return on investment (MROI). By implementing advanced analytics, they aimed to optimize omnichannel strategies and refine marketing communications using real-time, data-driven insights.

Challenges:

Solutions:

Outcome of the Study:

-

Achieved a 67% increase in MROI.

-

Improved precision in customer segmentation and budget allocation.

-

Enabled faster, informed decision-making with real-time insights.

-

Enhanced customer engagement and campaign effectiveness through AI-powered personalization.

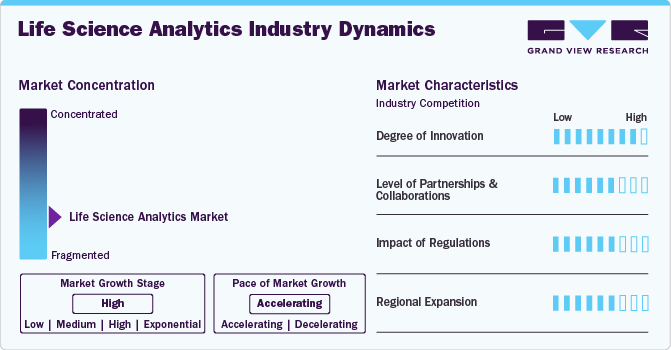

Market Concentration & Characteristics

The industry growth is high and accelerating. This industry is characterized by the adopting analytics and relies on descriptive and reporting analysis in building databases and uses prescriptive and predictive analysis in estimating future trends and results.

Innovation in life science analytics is high, driven by AI, cloud, and real-world evidence integration. For instance, in March 2024, Owkin’s AI model partnerships with Sanofi and BMS support predictive drug development. Companies adopt machine learning for clinical trial optimization and personalized medicine, enhancing treatment accuracy and development speed.

“The AI and multimodal data analysis approaches we are collaborating on will help to understand patient heterogeneity and to enable future precision medicine strategies in immunology. Our intent is for patients to receive the most effective therapy based on their specific molecular and cellular features driving their disease.”

- Emanuele de Rinaldis, VP, Global Head of Precision Medicine & Computational Biology at Sanofi

Collaborations are succeeding, with pharma-tech alliances such as in October 2024, Oracle partnered with EVERSANA to implement the Oracle Argus Cloud Service, aiming to improve pharmacovigilance by enhancing compliance, automating processes, and optimizing global drug safety operations through advanced analytics and streamlined workflows.

“Together with Oracle Argus Cloud Service, we will drive process improvement and increase our safety cases management capabilities with unmatched precision and agility to support patients across the world.”

- Jim Lang, CEO, EVERSANA

Regulations moderately impact the market; while the FDA supports RWE and AI/ML tools, Europe's fragmented frameworks and slow digital health adaptation pose hurdles. Nonetheless, reforms are underway to streamline data privacy (GDPR) and harmonize standards, as seen in the EU’s push for digital health interoperability.

The market is witnessing a rise in specialized analytics services, including consulting, implementation, and support, reflecting the need for tailored solutions and expertise. For instance, in November 2023, Wipro and AWS introduced “Lab of the Future,” a cloud-based platform leveraging generative AI and analytics to enhance life sciences labs by cutting costs, improving efficiency, and speeding up drug development processes.

Major players are expanding facilities across regions. For instance, in March 2024, Axtria Inc., a global provider of cloud software and data analytics for the life sciences sector, launched a new facility in Hyderabad, India. This center supports Axtria’s mission to enhance health outcomes by delivering advanced analytics and AI-powered solutions, including generative AI, tailored specifically for the needs of life sciences organizations.

Component Insights

The services segment held the largest revenue share of 57.66% in 2024 and is expected to grow fastest for the forecast period. The rising outsourcing of planning, staffing, implementation, training, and maintenance, driven by limited internal expertise in life science companies, is expected to drive market growth. In addition, the increasing digitalization of healthcare and improvements in healthcare IT infrastructure in developed and emerging regions are boosting the demand for analytics solutions and associated services.

The software segment is anticipated to grow at a significant CAGR in the life science analytics market, driven by increasing demand for real-time data processing, predictive modeling, and AI-powered decision-making in drug development and clinical trials. Cloud-based platforms are favored for scalability and remote accessibility, enabling efficient integration of EHRs, genomics, and patient-reported outcomes. For instance, companies such as SAS and Oracle offer strong analytics suites tailored for life sciences, supporting pharmacovigilance, trial optimization, and regulatory compliance.

Type Insights

The descriptive analytics segment held the largest revenue share in the market in 2024 due to its crucial role in summarizing historical data and generating actionable insights. It enables pharmaceutical and biotech companies to track clinical trial performance, patient demographics, and drug efficacy trends. This segment is widely used for regulatory reporting, sales forecasting, and operational benchmarking.

The predictive analytics segment is the fastest-growing life science analytics market, driven by the need to anticipate outcomes and optimize drug development and patient care decision-making. Using historical and real-time data, predictive models help forecast disease progression, trial success rates, and treatment responses. This enables pharmaceutical companies to reduce risks, cut costs, and improve R&D efficiency. For instance, in March 2024, UMass Memorial Health partnered with Google Cloud to enhance predictive analytics for advancements in cardiometabolic therapies.

“Our mission is to provide the best possible care to our patients, and this partnership with Google Cloud is a significant step forward.”

-Michael Hyder, M.D., MPH, Executive Director of the UMass Memorial Center for Digital Health Solutions and Associate Professor of Cardiovascular Medicine.

Application Insights

The sales and marketing support segment held the largest revenue share in 2024 due to its critical role in optimizing product positioning, targeting, and campaign effectiveness. Life sciences companies use analytics to assess physician prescribing behavior, patient demographics, and market trends, enabling more strategic. According to a study by ZS, Takeda Oncology collaborated with ZS Associates to develop an AI-powered application that analyzes real-world patient data. This tool provides sales representatives with personalized insights and next-best-action recommendations, enhancing engagement with healthcare providers and improving sales effectiveness.

The research and development (R&D) segment is expected to grow at the fastest CAGR for the forecast period, driven by the need for faster drug discovery, efficient clinical trial design, and cost reduction. Life sciences companies use advanced analytics to identify drug targets, predict trial outcomes, and streamline regulatory submissions. AI and real-world data integration further accelerate innovation by enhancing biomarker discovery and patient stratification. According to an article published in February 2025, Life sciences companies can significantly improve R&D, patient outcomes, and operational efficiency through data analytics. As AI-powered tools advance, they will influence precision medicine, refine treatment strategies, and enhance the quality and effectiveness of healthcare delivery.

Delivery Insights

The on-demand segment held the largest revenue share in 2024 and is expected to grow at the fastest CAGR for the forecast period. The growth is attributed to its scalability, cost-efficiency, and ease of access. Cloud-based, on-demand solutions allow pharmaceutical and biotech companies to access advanced analytics tools without heavy infrastructure investment, enabling real-time data analysis and collaboration across global teams. This model supports rapid deployment, remote data sharing, and seamless updates, making it ideal for fast-paced clinical trials and pharmacovigilance environments.

The on-premise segment is expected to grow significantly in the market, driven by the demand for enhanced data security, regulatory compliance, and internal control. Large pharmaceutical and biotech companies prefer on-premise solutions to manage sensitive clinical and patient data, particularly in regions with strict data localization laws. These systems offer high customization and integration with legacy infrastructure.

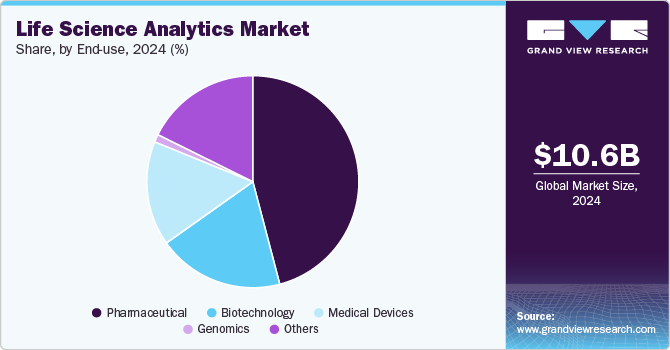

End Use Insights

The pharmaceutical segment held the largest revenue share in 2024 due to its extensive use of data analytics across drug discovery, clinical trials, regulatory compliance, and sales optimization. Pharma companies leverage analytics to reduce R&D costs, enhance clinical trial success rates, and accelerate time-to-market. Regulatory pressures and the need for precision medicine further drive analytics adoption, making it integral to improving efficiency, innovation, and patient outcomes across the pharmaceutical value chain.

The genomics segment is expected to grow at the fastest CAGR for the forecast period, driven by the rising demand for personalized medicine, advancements in sequencing technologies, and increased availability of genomic data. Life science companies utilize analytics to interpret complex genetic information, identify disease-associated variants, and guide targeted therapies. AI and big data tools enable faster and more accurate genomic insights, supporting early diagnosis and drug development.

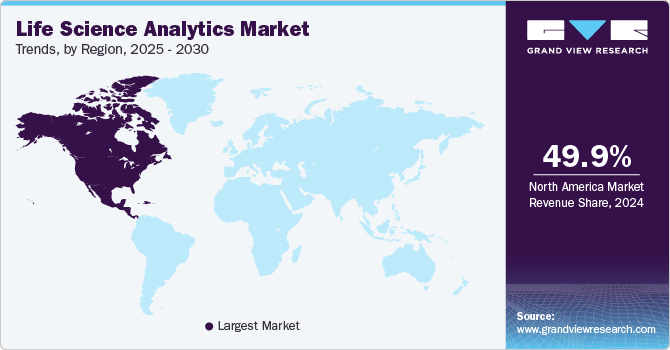

Regional Insights

North America life science analytics market dominated the global market and accounted for a revenue share of 49.86% in 2024 due to its well-established pharmaceutical and biotechnology industries, strong presence of leading analytics providers, and widespread adoption of advanced technologies such as AI, machine learning, and cloud computing. The region benefits from a high volume of clinical research activities, a mature healthcare IT infrastructure, and continuous investment in data-driven drug development and personalized medicine.

U.S. Life Science Analytics Market Trends

The life science analytics market in the U.S. leads the North America market due to its robust ecosystem of pharmaceutical, biotech, and healthcare technology companies that actively invest in data-driven research and development. The country has a high concentration of clinical trial activity and early adoption of advanced analytics methods, such as AI, machine learning, and real-world data integration.

Strategic collaborations and technological innovations continue to enhance clinical efficiency, drug discovery, and personalized medicine efforts, firming the U.S. position at the forefront of the market. For instance, in February 2023, Pfizer teamed up with precision medicine company Tempus to utilize AI-powered analytics and real-world data to optimize clinical trial patient selection and accelerate oncology drug development. By leveraging Tempus’ precision medicine platform and real-world data capabilities, this partnership enhances data-driven decision-making in clinical trials and accelerates therapeutic discovery.

Asia Pacific Life Science Analytics Market Trends

Asia Pacific life science analytics market is witnessing rapid advancement in life science analytics, driven by digital health adoption, growing clinical trial activity, and government support. Countries such as India and South Korea facilitate regulatory processes and align with international standards, significantly reducing drug approval timelines. Regional investments in cloud-based analytics platforms and AI-powered diagnostics drive innovation, especially in biopharma and population health management.

The life science analytics market in China is experiencing significant growth, driven by several key trends. One is the increasing adoption of advanced analytics solutions in pharmaceutical research and development. With a growing emphasis on accelerating drug discovery and improving clinical trial efficiency, pharmaceutical companies and research organizations in China are leveraging analytics to analyze vast datasets, identify potential drug candidates, and optimize trial processes. This includes using predictive analytics to forecast trial outcomes and identify patient segments that respond to specific treatments.

Europe Life Science Analytics Market Trends

Europe life science analytics market is witnessing steady advancement driven by the increasing adoption of real-world evidence (RWE), AI-powered analytics, and regulatory support for data-driven healthcare. Strategic collaborations in the European market are accelerating innovation and data integration. For instance, in April 2024, IQVIA and Salesforce expanded their partnership to integrate IQVIA’s OCE platform with Salesforce’s Life Sciences Cloud, creating a unified solution to enhance pharma engagement with healthcare professionals and patients using advanced analytics.

“Our collaboration with IQVIA marks a pivotal moment for Salesforce Life Sciences Cloud innovation. It will transform the future of HCP engagement, bringing together our combined capabilities in CRM, AI, data, and the thought leadership of IQVIA, all on the trusted Einstein 1 Platform. This collaboration will provide life science organizations with a single, intelligent end-to-end engagement platform to transform the customer experience to be orchestrated and personalized.”

- Frank Defesche, SVP and General Manager, Life Sciences at Salesforce

Latin America Life Science Analytics Market Trends

Life science analytics market in Latin America is expanding as countries modernize healthcare IT systems and adopt data-driven decision-making across pharma and public health. Governments are emphasizing real-world data collection and analytics for cost-effective drug approvals. Increased investments in healthcare IT infrastructure drive this expansion, a growing emphasis on data-driven decision-making, and the rising adoption of advanced analytics solutions across the pharmaceutical and biotechnology sectors.

Middle East & Africa Life Science Analytics Market Trends

The Middle East & Africa life science analytics market is significantly growing. Increasing government support for healthcare IT infrastructure development, rising healthcare expenditures, and a growing prevalence of chronic diseases such as diabetes and cancer drive this growth. The market benefits from government modernization initiatives, foreign investments, growing demand for specialty drugs, driving services, and regional expansion across MEA.

Key Life Science Analytics Company Insights

Some key participants in the market are developing advanced analytical solutions and systems. The companies are focusing on devising innovative product development strategies to expand their product offerings and revising their partnerships and collaborations across the market to expand their business footprint and cater to the growing demand for analytical solutions. For instance, in January 2025, Clarivate introduced DRG Fusion, a new life sciences analytics solution that leverages real-world data to deliver deeper insights.

“Fusion demonstrates the robustness of life sciences data from Clarivate and its wide-ranging commercial applications. Its scalable data architecture is carefully designed to rapidly deliver insights across patient diseases and sub-population cohorts. We are committed to investing in innovative technologies that empower our clients to address healthcare’s most pressing challenges. With new AI-driven and self-service features set to launch in Fusion in 2025, we remain focused on delivering user-centric solutions that drive meaningful value and impact for our customers.”

- Abeezer Tapia, Senior Vice President & General Manager, Real-World Data, Life Sciences & Healthcare

Key Life Science Analytics Companies:

The following are the leading companies in the life science analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle

- IQVIA

- SAS Institute Inc.

- Cognizant

- IBM

- Accenture

- Take Solutions Limited

- Wipro Limited

- Veradigm

- Optum

- Veeva Systems

- Axtria

- Komoda Health, Inc.

- Elsevier

Recent Developments

- In December 2024, Cognizant and Salesforce joined forces to increase innovation in the life sciences sector through Salesforce Life Sciences Cloud.

“Our partnership with Cognizant leverages their deep industry expertise and consultative approach to harness the power of Salesforce’s AI-driven Life Science Cloud solutions. Together, we’re working to transform the landscape by delivering personalized care journeys, enhancing patient outcomes, and driving innovation at scale in order to create a truly connected experience for all stakeholders in the life sciences ecosystem.”

- Frank Defesche, SVP & GM, Life Sciences, Salesforce.

- In October 2024, Oracle partnered with EVERSANA to implement the Oracle Argus Cloud Service, aiming to improve pharmacovigilance by enhancing compliance, automating processes, and optimizing global drug safety operations through advanced analytics and streamlined workflows.

“Together with Oracle Argus Cloud Service, we will drive process improvement and increase our safety cases management capabilities with unmatched precision and agility to support patients across the world.”

- Jim Lang, CEO, EVERSANA

Life Science Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.37 billion

Revenue forecast in 2030

USD 16.33 billion

Growth rate

CAGR of 7.50% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, delivery, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle; IQVIA; SAS Institute Inc.; Cognizant; IBM; Accenture; Take Solutions Limited; Wipro Limited; Veradigm; Optum; Veeva Systems; Axtria; Komoda Health, Inc.; Elsevier

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Science Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global life science analytics market report based on component, type, application, delivery, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reporting

-

Descriptive

-

Predictive

-

Prescriptive

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research and Development

-

Sales and Marketing Support

-

Regulatory Compliance

-

Supply Chain Analytics

-

Pharmacovigilance

-

-

Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

On-demand

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Devices

-

Pharmaceutical

-

Biotechnology

-

Genomics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global life science analytics market size was estimated at USD 10.55 billion in 2024 and is expected to reach USD 11.37 billion in 2025.

b. The global life science analytics market is expected to grow at a compound annual growth rate of 7.50% from 2025 to 2030 to reach USD 16.33 billion by 2030.

b. North America dominated the life science analytics market and accounted for the largest revenue share of 49.86% in 2024 due to robust adoption of AI-driven solutions, strong healthcare infrastructure, and the presence of key pharmaceutical and biotechnology companies driving innovation.

b. Some key players operating in the life science analytics market include Oracle, IQVIA, SAS Institute Inc., Cognizant, IBM, Accenture, Take Solutions Limited, Wipro Limited, Veradigm, Optum, Veeva Systems, Axtria, Komoda Health, Inc., Elsevier

b. Key factors that are driving the life science analytics market growth include the increasing need to standardize and integrate diverse data sources, such as clinical trials, electronic health records, genomics, and real-world evidence, enabling seamless data exchange across platforms and regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.