- Home

- »

- Automotive & Transportation

- »

-

Light Car Trailer Market Size, Share & Growth Report, 2030GVR Report cover

![Light Car Trailer Market Size, Share & Trends Report]()

Light Car Trailer Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Utility Light Car Trailer, Recreational Light Car Trailer), By Axle, By Product, By Design, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global light car trailer market size was valued at USD 1.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030. The growth of the market is primarily attributed to the expansion of the logistics industry, coupled with the increasing use of light car trailers for the door-to-door transportation of motorcycles and cars. Factors such as the increasing use of light car trailers for recreational activities, transportation, and travel, and increasing manufacturers’ investment in research of new techniques for developing light car trailers are contributing to the growth. In addition, the rising focus of light car trailer manufacturers on working on the modification of lightweight car trailers is boosting the growth of the market. The rising government focus on the travel and tourism sector, majorly in developing nations of the world, is expected to have a cascading effect on the growth of recreational light car trailers in the market.

The COVID-19 pandemic has negatively impacted the manufacturing sector and several businesses worldwide. Disruption of the global supply chain and halt in manufacturing activities have affected the automotive sector at large. The automotive industry incumbents had to suspend operations. The market was not an exception and was equally affected by travel restrictions and dwindling demand for automobiles. During the pandemic, the demand for light car trailers plummeted in line with the dwindling automobile sales and the restrictions on the movement of people that restricted outdoor sports and traveling. However, as the lockdowns were gradually lifted in different parts of the world and various governments started providing economic relief packages, several industries began showing signs of recovery. The automobile demand gained significant traction and the tourism industry started recovering. Even though the supply chain continued to recover gradually and aluminum prices remained volatile, signs of recovery for the market were clear.

Due to technological advancements, light car trailers are gaining traction among travel enthusiasts and the population. To enhance the functionality of light car trailers, manufacturers are developing technology that will offer users efficient trailers. For instance, in July 2021, Felling Trailers enhanced the EZ-Tilt trailer design. The trailers are equipped with the improved feature; the fender top is attached using a series of hinges concealed and protected inside the fender body. Thus, each fender is equipped with one front and rear spring that holds the lid closed during travel and transport. Additionally, these trailers are provided with rubber bumpers absorbing shocks, reducing the vibration during transits.

Sport and travel enthusiasts often hire light car trailers on a per-day basis. Apart from the number of days the trailer is hired for, the rent also tends to vary depending on the cost, distance and carrying capacity. The rent can also vary depending on the place and the season. Owning a light car trailer outright rather than renting it for every trip allows frequent travelers to save costs. Besides, they can customize the trailer based on their requirements. Modern trailers are also designed to offer enhanced operational efficiency, wider space, and diamond floor decks that are sturdier to increase durability.

Light vehicle trailers have high maintenance expenses, now recognized as a significant barrier to market expansion. Over the course of their useful lives, trailers need recurring maintenance and repairs. The brakes, electrical systems, hydraulics, suspensions, and tires of trailers generally sustain significant wear and tear from heavy and lengthy use on uneven terrains. These components must be maintained, repaired, or replaced to guarantee effective functioning. Additionally, the aluminum body of a trailer is prone to rusting if it is kept inactive for an extended period, necessitating routine maintenance to stop corrosion. Additionally, light car trailers depend entirely on the powered vehicle pulling them and lack their power source, reducing the powered vehicle's fuel efficiency. The impact that light car trailers may have on the fuel economy of the towing vehicle may eventually limit market expansion.

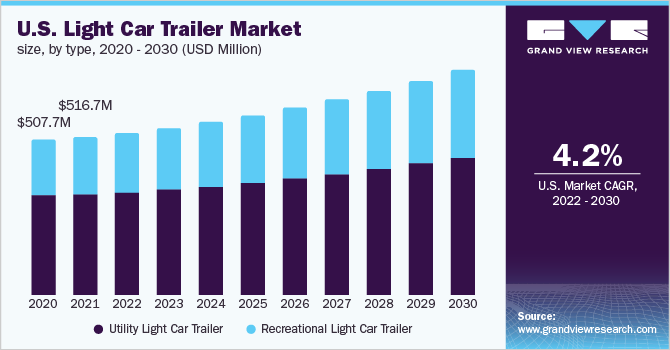

Type Insights

The utility light car trailer segment held the largest revenue share of over 60.0% in 2021 owing to the advancements in the utility light vehicle trailer. In case of unfavorable road terrain, these trailers are used to transport vehicles from one place to another. Utility light car trailers are available in different sizes and are easy to load and unload.

The recreational light car trailer segment is expected to expand at a significant CAGR of 4.2% during the forecast period. This can be attributed to the rising levels of disposable income and, subsequently, the growing popularity of traveling among the urban population. Recreational trailers offer a larger floor space while reducing the overall trailer weight because of an aluminum body. Besides, manufacturers are adding aesthetic features, such as LED lighting, loading lights on the ramp, and lights on the entry door as part of their efforts to enhance safety. The improved design and advanced features guarantee a more luxurious experience, hence fueling the growth of the segment.

Axle Insights

Single axle light car trailers held the largest share of over 50.0% in 2021 as they have lesser weight than multi-axle and are easier to maneuver and more economical. Additionally, single-axle light car trailers are very cost-effective, have lower ownership and maintenance costs, and require less fuel; thus, these features increase single-axle lightweight car trailers' preference over others.

Multi-axle light car trailers are anticipated to expand at a significant CAGR of 4.0% during the forecast period. Multi-axle light car utility trailers can carry more weight than single-axle light car trailers. Furthermore, the increased stability provided by dual axle trailers lessens the chance of the trailer losing grip or swaying when toed on rough terrain. This reason positions dual axle trailers as a better option for long-distance hauling, thus propelling the market growth.

Design Insights

The open trailer held the largest share of over 50.0% in 2021. Open trailers are lightweight, allow for quick bends and easy parking, are easily adjustable, save on fuel, and provide greater flexibility, which is further boosting the usage of open-light car trailers across the globe. In addition, open light car trailer has better aerodynamic features, allows easy loading and unloading, and facilitates easy transport of material and heavy goods at longer distances, thus the advantageous features of light car trailers are driving the market.

The enclosed trailer segment is anticipated to expand at a CAGR of 3.9% over the forecast period. Increasing application of enclosed light car trailers for the safe and secure transportation of cargo from sunlight and inclement weather conditions is majorly contributing to the growth of the enclosed segment. Additionally, the lock-up feature of an enclosed cargo trailer offers improved security during transport, which is further fueling the growth of the enclosed light car trailers market.

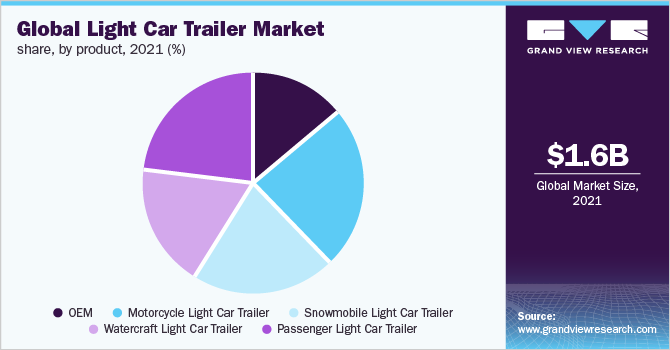

Product Insights

Motorcycle light car trailers held the largest share of over 20.0% in 2021 owing to a rise in demand for motorbikes, which is indirectly increasing the demand for motorcycle light car trailers. The motorcycle trailer is of two kinds: open and closed. The enclosed trailer provides a more secure way of locking up, keeping it out of sight while protecting it from all kinds of weather.

The snowmobile segment is expected to expand at a CAGR of 4.3% over the forecast period. The snowmobile light car trailer is becoming increasingly popular in North America, Europe, and the Nordic region as these regions experience heavy snowfall and have popular sports such as snowmobiling. There are two variations of snowmobiles available: open and enclosed trailers. In contrast to enclosed light car trailers, which protect automobiles over rough terrain and from hostile environments, open trailers are lightweight, need little towing effort, and are simpler to load and unload. As a result, the demand for snowmobile light vehicle trailers is likely to witness an increase due to the growing popularity of the sport.

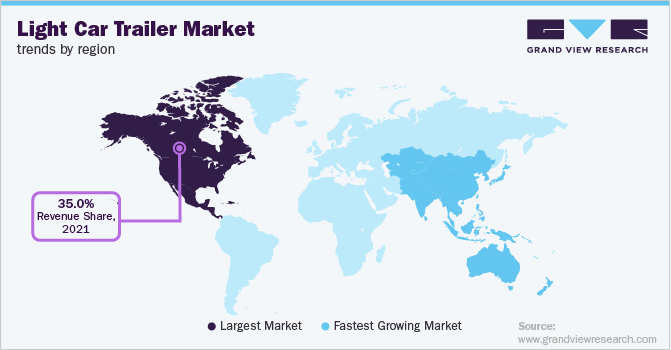

Regional Insights

North America held the largest revenue share of over 35.0% in 2021 owing to the increase in automobile sales, growing tourist spots, and rising preference for solo travel throughout the North American region. Furthermore, prominent players such as Aluma Ltd.; ATC Trailers Holdings, Inc.; Felling Trailers, Inc.; and Haulmark Industries are focused on developing advanced trailers. For instance, the manufacturers are incorporating tie-down pockets on the sides of the trailers for better cargo security. The trailers are also designed to have a high load-bearing capacity, more expansive decks, and removable fenders. These car trailer advancements are expected to create new growth opportunities for the market in this region.

Asia Pacific is anticipated to expand at a CAGR of 4.7% over the forecast period. The growth can be attributed to the developing tourism industry, increasing demand for luxury commodities, and rising disposable income in the region. This is eventually driving the demand for commercial and passenger vehicles and two-wheelers. Therefore, the subsequent growth of the market for four and two-wheelers in the region is expected to encourage the demand for light car trailers in Asia Pacific countries.

Key Companies & Market Share Insights

Major players have adopted strategies such as geographic expansion, mergers & acquisitions, and partnership activities to strengthen their market presence in various geographies. Organic growth remains the key strategy for most of the market's incumbents. As such, light car trailer manufacturers are focused on enhancing their existing product offerings and brand awareness to gain a competitive edge in the market.

These companies make investments in R&D to develop innovative trailer technology. In addition, prominent players in the market are focusing on working on the modification of lightweight car trailers and are upgrading components such as axles and fenders. For instance, in July 2021, Felling Trailers, a light car trailer manufacturer, enhanced the wheel’s fender design and incorporated the modified fender in its ground-level tilt-loading trailers. Thus, the updated design reduces the possibility of wear and tear on the trailers and aids in reducing the maintenance cost of light car trailers. Some prominent players in the global light car trailer market include:

-

Aluma Ltd.

-

ATC Trailers Holdings, Inc.

-

Felling Trailers, Inc.

-

Haulmark Industries, Inc.

-

Kaufman Trailers, Inc.

-

Pace American, Inc.

-

Woodford Trailers Ltd.

-

Sylvansports

-

Sundowner Trailers, Inc.

-

Diamond C Trailer (RoadClipper Enterprise, Inc.)

Light Car Trailer Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.58 billion

Revenue forecast in 2030

USD 2.12 billion

Growth rate

CAGR of 3.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative Units

Revenue in USD million and CAGR from 2022 - 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, axle, product, design, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan

Key Company Profiled

Aluma Ltd.; ATC Trailers Holdings, Inc.; Felling Trailers, Inc.; Haulmark Industries, Inc.; Kaufman Trailers, Inc.; Pace American, Inc.; Woodford Trailers Ltd.; Sylvansports; Sundowner Trailers, Inc.; Diamond C Trailer (RoadClipper Enterprise, Inc.)

Customization scope

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Car Trailer Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global light car trailer market report based on type, axle, product, design, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility Light Car Trailer

-

Recreational Light Car Trailer

-

-

Axle Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Axle Light Car Trailer

-

Multi Axle Light Car Trailer

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Motorcycle Light Car Trailer

-

Snowmobile Light Car Trailer

-

Watercraft Light Car Trailer

-

Passenger Light Car Trailer

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Enclosed Trailer

-

Open Trailer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Rest of World

-

Frequently Asked Questions About This Report

b. The global light car trailer market size was estimated at USD 1.55 billion in 2021 and is expected to reach USD 1.58 billion in 2022.

b. The global light car trailer market is expected to grow at a compound annual growth rate of 3.7% from 2022 to 2030 to reach USD 2.12 billion by 2030.

b. North America dominated the light car trailer market with a share of 39.5% in 2021.

b. Some key players operating in the light car trailer market include Aluma Ltd., ATC Trailers Holdings, Inc., Felling Trailers, Inc., Haulmark Industries, Inc., and Kaufman Trailers, Inc. among others.

b. Key factors that are driving the market growth include the inclination toward the development of automotive and manufacturing sectors and improved road networks over the years have led to the adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.