- Home

- »

- Advanced Interior Materials

- »

-

Lightweight Materials Market Size, Industry Report, 2030GVR Report cover

![Lightweight Materials Market Size, Share & Trends Report]()

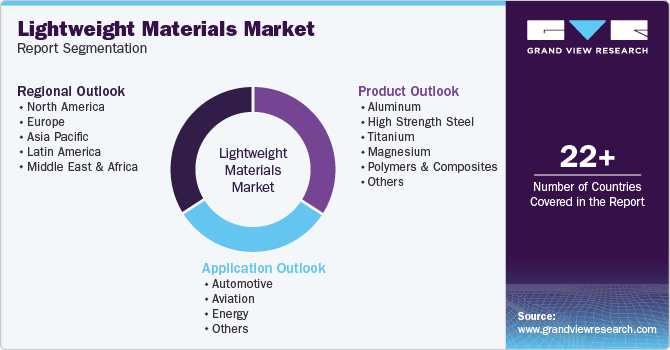

Lightweight Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Aluminum, High Strength Steel, Titanium, Magnesium), By Application (Automotive, Aviation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-257-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lightweight Materials Market Summary

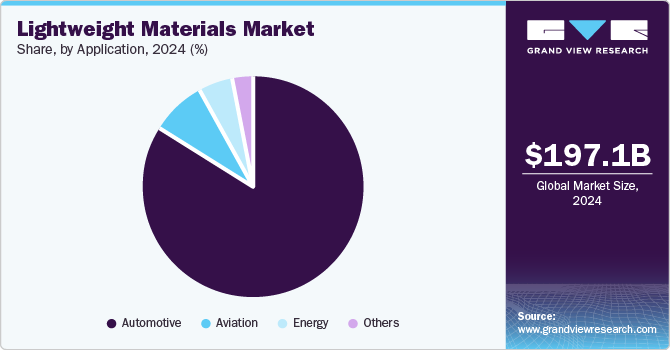

The global lightweight materials market size was estimated at 197.1 billion in 2024 and is projected to reach USD 339.8 billion by 2030, growing at a CAGR of 9.6% from 2025 to 2030. This growth is driven by multiple factors, including the increasing emphasis on fuel efficiency in transportation, the rise of eco-friendly construction practices, and innovations in material science.

Key Market Trends & Insights

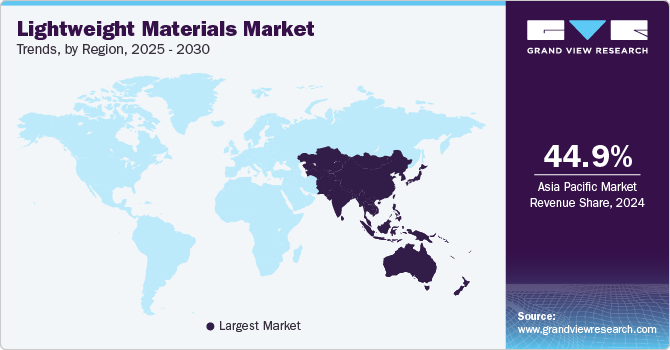

- Asia Pacific accounted for the highest revenue share of 44.9% in the global market in 2024Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- By product, the polymers & composites segment accounted for a dominant revenue share of 77.3% in 2024

- By application. the automotive segment accounted for the largest revenue share in the global market in 2024

Market Size & Forecast

- 2024 Market Size: USD 197.1 Billion

- 2030 Projected Market Size:USD 339.8 Billion

- CAGR (2025-2030): 9.6%

- Asia Pacific: Largest market in 2024

As industries evolve, lightweight materials are essential for meeting performance and regulatory standards. Lightweight materials in the automotive sector enhance fuel efficiency and reduce greenhouse gas emissions. As fuel costs are rising and strict emission regulations are imposed globally, manufacturers are seeking solutions that fulfill these standards and appeal to environmentally conscious consumers. In America, aluminum is a leading choice in the Ford F150, as it reduces weight by approximately 700 pounds, which eventually translates to better fuel economy and improved performance, showcasing how lightweight materials can drive marketability and sustainability in the automotive sector.In addition, the construction sector drives the demand for lightweight materials due to the need for sustainable building practices and efficient resource use. Lightweight materials meet the challenges of building sustainable and resilient infrastructure. Lightweight concrete and engineered wood products are becoming more popular as they reduce the overall weight of structures and quicker project completion times, leading to significant cost savings in foundation and structural support. Innovative materials such as insulated concrete forms (ICFs) aligning with modern energy standards provide thermal efficiency.

Moreover, the aerospace industry is a major contributor to the growth of the lightweight materials market. As aircraft require less weight to enhance fuel efficiency and increase operational efficiency, carbon fiber-reinforced polymers are used due to their strength-to-weight ratio and resistance to corrosion. A prime example is the Boeing 787 Dreamliner, made from 50% composite materials. So, as air travel demand continues to grow, the aerospace sector's dependence on lightweight materials is expected to boost.

Product Insights

The polymers & composites segment accounted for a dominant revenue share of 77.3% in 2024 due to properties these materials offer, such as high strength-to-weight ratios, corrosion resistance, and application versatility. Polymers reinforced with fibers such as glass or carbon have gained pull across various industries, including automotive, aerospace, and construction. Their ability to be molded into complex shapes, with advancements in techniques such as 3D printing and advanced molding processes, have made it easier to produce these materials in bulk, further developing their market appeal. In addition, innovations in bio-based polymers are opening new opportunities for sustainable lightweight solutions, where BASF company is developing bio-composites made from natural fibers that reduce the environmental impact and meet the performance requirements of these applications.

The High Strength Steel (HSS) segment is expected to advance at the fastest CAGR during the forecast period due to a surge in demand for materials that offer enhanced strength while maintaining a relatively low weight. HSS benefits automotive and construction industries, where strength-to-weight ratios are critical for improving performance and safety. Its ability to withstand extreme conditions while being lightweight has made it the material of choice for modern skyscrapers and bridges in construction. As industries seek innovative solutions that balance performance with weight efficiency, the High Strength Steel segment is set to gain momentum, driving advancements in design and manufacturing techniques.

Application Insights

The automotive segment accounted for the largest revenue share in the global market in 2024, highlighting the industry's focus on reducing vehicle weight to enhance fuel efficiency and lower emissions. The environmental regulations have become rigid, and automakers invest in lightweight materials to improve vehicle performance and meet needs. Materials such as aluminium, composites, and steel are utilized to replace materials that are quite heavier. For instance, Ford-150 is known to be the best-selling truck in the U.S., gaining high-strength aluminum in its body and frame. It improves fuel economy and performance, which results in substantial weight reduction.

The energy segment is estimated to witness the fastest growth over the forecast period, driven by increasing demand for renewable energy solutions and the need for energy generation and storage efficiency. Applications such as wind turbine blades and solar panels have lightweight materials, enhancing turbine blades to be larger and capture more wind energy while maintaining structural reliability. In addition, the shift of the market towards electric vehicles (EVs) and renewable energy storage solutions has contributed to the growth, enhancing their durability and efficiency,

Regional Insights

North America accounted for a significant revenue share in the global market in 2024, driven by strong demand by key industries such as aerospace and automotive. There is an increase in the adoption of lightweight materials as the region is home to major automotive manufacturers that are adopting to improve fuel efficiency and stringent emissions regulations. In addition, leading players in aerospace, such as Boeing and Lockheed Martin, are using materials such as carbon fiber composites to enhance performance and reduce weight. This sector is expected to drive innovation and investment in North America and lead in developing and applying advanced lightweight solutions within numerous industries.

U.S. Lightweight Materials Market Trends

The U.S. accounts for a dominant share of the regional market, aided by the rising importance of sustainability and efficiency across key industries, including automotive, aerospace, and construction. Due to the demand for fuel-efficient vehicles and environmentally friendly products, manufacturers are turning to lightweight materials such as aluminum, high-strength steel, and advanced composites. As U.S. manufacturers focus on innovation and sustainability, the country's lightweight materials market is expected to grow significantly, supporting its position in the regional landscape.

Asia Pacific Lightweight Materials Market Trends

Asia Pacific accounted for the highest revenue share of 44.9% in the global market in 2024, driven by big infrastructural investments, rapid urbanization, and industrialization in countries including China, Japan, and India. China, one of the largest markets in the automotive industry, has adopted materials such as aluminum and advanced composites, focusing on electric vehicles (EVs), where lightweight materials enhance performance and range. Companies such as BYD and NIO are leading in this segment by integrating these materials into their car designs. Moreover, the aerospace sector is driving up demand for lightweight materials. For instance, the Mitsubishi Regional Jet (MRJ), created by Japan, has a significant amount of carbon fiber-reinforced polymer in its structure, making it competitively advanced in the market.

China lightweight materials market has a significant revenue share in the regional lightweight materials market primarily due to strong production capacity and rising industrial demand. Lightweight materials such as aluminum, carbon fiber, and sophisticated composites have gained demand, resulting in large investments in national automobile, aerospace, and infrastructure industries. These materials enhance energy efficiency, improve performance, and achieve strict regulatory requirements. Furthermore, innovative materials and production techniques are used in many local businesses due to government policies and initiatives promoting innovation and technological advancement in this sector.

Middle East & Africa Lightweight Materials Market Trends

Middle East & Africa lightweight materials market is expected to grow at the fastest CAGR of 13.1% over the forecast period due to rapid industrialization, large infrastructure investments, and a strong focus on expanding economies away from oil dependency. To meet the demands of modern construction and transportation sectors, countries in this region are adapting to lightweight materials such as advanced polymers and composites. Saudi Arabia’s Vision 2030 initiative aims to transform the economy by investing in high-tech sectors and promoting the use of lightweight materials in manufacturing and construction, positioning the region as the hub for lightweight material innovation to enhance environmental sustainability and reduce carbon footprints.

Key Lightweight Materials Company Insights

Key companies in the lightweight materials market include SABIC, Cytec Solvay Group, Aleris International, Formosa Plastics Group, Alcoa Inc., PPG Industries Inc., Bayer AG, and many others. These companies invest heavily in research and development to create advanced lightweight materials, such as high-strength composites and alloys, which cater to the growing demands of industries such as automotive and aerospace. In addition, these firms are focusing on sustainability by adopting eco-friendly production processes and utilizing recycled materials, aligning with increasing environmental concerns. Strategic partnerships and collaborations with other businesses and research institutions further enhance their technological capabilities and product offerings.

-

SABIC provides a wide variety of advanced polymers and composite materials to enhance performance while reducing weight. With prominence on circular economy principles and the utilization of recycled materials in its products, SABIC has been at the forefront of creating sustainable solutions, and it is continuously investing in research and development to develop cutting-edge technologies that improve material properties, such as impact resistance and thermal stability.

-

Alcoa Inc. specializes in developing and manufacturing lightweight aluminum solutions, which play a crucial role in various industries, including aerospace, automotive, and construction. Alcoa introduced new alloy formulations that enhance strength and durability and reduce weight, making them perfect for energy-efficient applications. Beyond materials, Alcoa provides extensive support services, including technical assistance and training resources to help clients optimize their use of aluminum in manufacturing processes.

Key Lightweight Materials Companies:

The following are the leading companies in the lightweight materials market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- Cytec Solvay Group

- Aleris International

- Formosa Plastics Group

- Alcoa Inc.

- PPG Industries Inc.

- Toray Industries Inc.

- Precision Castparts Corp.

- Allegheny Technologies Incorporated

- Evonik Industries

- Novelis Inc.

- Bayer AG

Recent Developments

-

In October 2024, Toray Industries launched Toraysee cleaning cloths, by utilizing its branded polyester derived from recycled plastic bottles and other materials. The microfibers used in these cloths are remarkably fine, measuring just two microns in diameter, enabling superior cleaning performance that rivals conventional fibers.

-

In August 2024, Alcoa Corporation acquired Alumina Limited. With the acquisition, Alcoa now fully owns the Alcoa World Alumina and Chemicals (AWAC) joint venture, previously held at a 60% stake, which includes several bauxite mines and alumina refineries across key regions such as Australia, Brazil, and Guinea. The acquisition is expected to yield significant benefits, including increased market competitiveness and operational efficiencies through streamlined governance.

Lightweight Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 215.3 billion

Revenue forecast in 2030

USD 339.8 billion

Growth Rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030, Volume in Kilo Tons

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, KSA, South Africa, UAE

Key companies profiled

SABIC, Cytec Solvay Group, Aleris International, Formosa Plastics Group, Alcoa Inc., PPG Industries Inc., Toray Industries Inc., Precision Castparts Corp., Allegheny Technologies Incorporated, Evonik Industries, Novelis Inc., Bayer AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lightweight Materials Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lightweight materials market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030) (Kilo Tons)

-

Aluminum

-

High Strength Steel

-

Titanium

-

Magnesium

-

Polymers & Composites

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030) (Kilo Tons)

-

Automotive

-

Aviation

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030) (Kilo Tons)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.