- Home

- »

- Plastics, Polymers & Resins

- »

-

Liquid Crystal Polymer 3D Printing Market Size Report, 2033GVR Report cover

![Liquid Crystal Polymer 3D Printing Market Size, Share & Trends Report]()

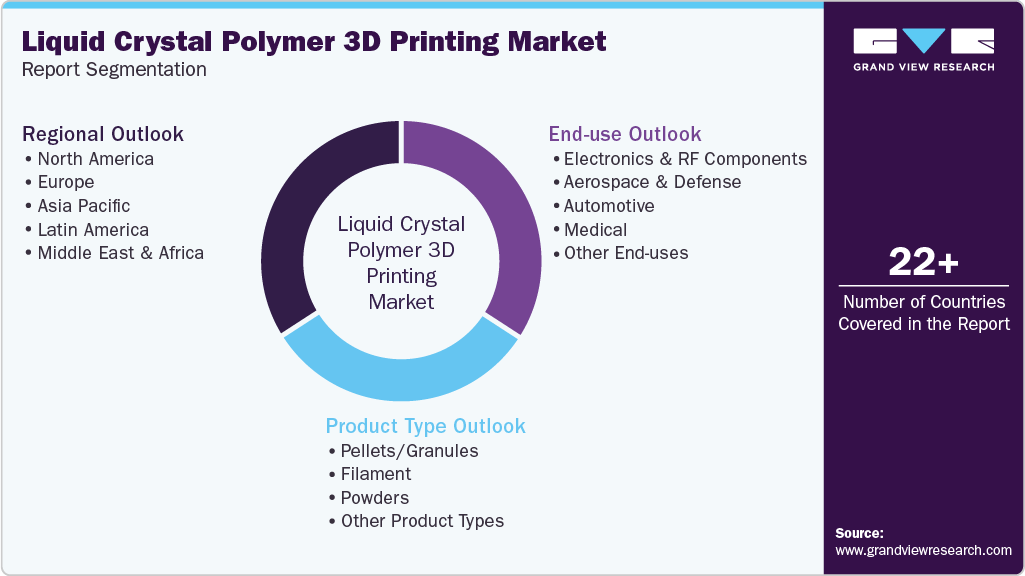

Liquid Crystal Polymer 3D Printing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Pellets/Granules, Filament, Powders), By End-use (Electronics & RF Components, Aerospace & Defense, Automotive, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-788-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Crystal Polymer 3D Printing Market Summary

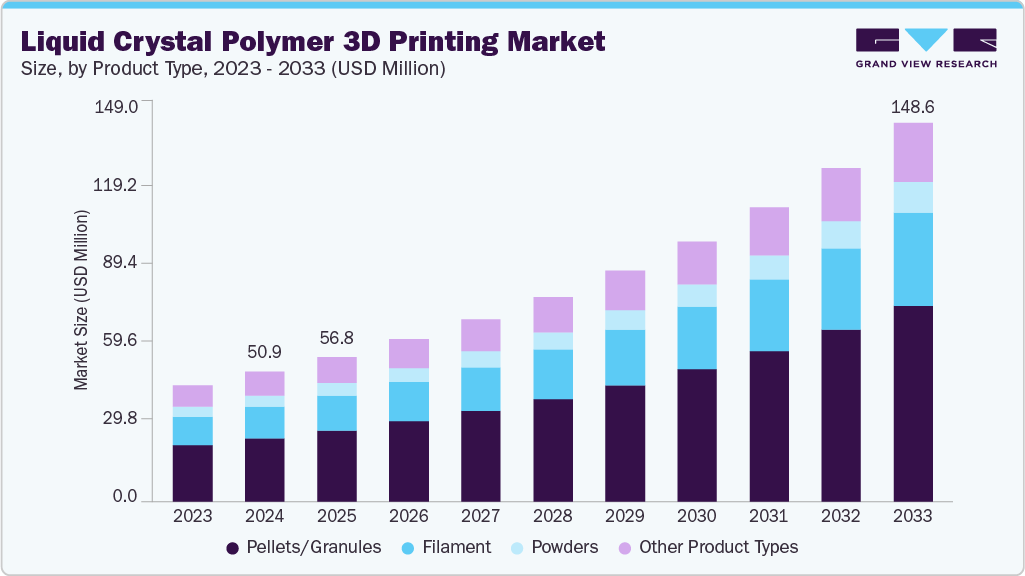

The global liquid crystal polymer 3D printing market size was estimated at USD 50.9 million in 2024 and is projected to reach USD 148.6 million by 2033, growing at a CAGR of 12.8% from 2025 to 2033. Growing demand for lightweight and heat-resistant components in aerospace, automotive, and electronics sectors is driving the use of liquid crystal polymer (LCP) 3D printing.

Key Market Trends & Insights

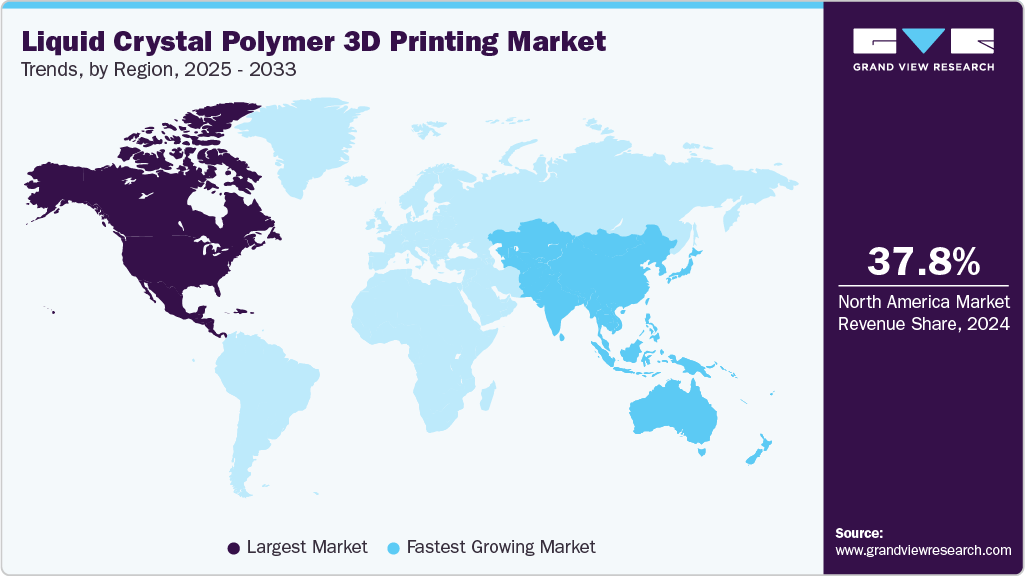

- North America dominated the LCP 3D printing market with the largest revenue share of 37.82% in 2024.

- The LCP 3D printing market in Canada is expected to grow at the fastest CAGR of 12.9% from 2025 to 2033.

- By product type, the pellets/granules segment is expected to grow at the fastest CAGR of 13.5% from 2025 to 2033 in terms of revenue.

- By end use, the aerospace & defense segment is expected to grow at the fastest CAGR of 13.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 50.9 Million

- 2033 Projected Market Size: USD 148.6 Million

- CAGR (2025-2033): 12.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Companies are adopting it to reduce part-weight, improve reliability, and streamline production of complex geometries. The most discernible trend in the LCP 3D printing market is its migration from prototyping into functional part production for high-frequency electronics and precision connectors. As device form factors shrink and signal speeds climb, manufacturers are adopting LCP-based additive processes to produce integrated antenna housings, RF transition parts and compact interconnects that previously required complex assemblies. This shift is being reinforced by co-development between resin suppliers and printer OEMs to tune formulations for low dielectric loss and dimensional fidelity, enabling end-use parts rather than just design verification pieces.

Drivers, Opportunities & Restraints

The primary commercial driver is LCP’s unique combination of electrical, thermal and chemical performance: low dielectric constant and loss tangent at GHz frequencies, high glass transition temperature, and solvent resistance. These properties make liquid crystal polymer the material of choice for telecom 5G components, aerospace sensors and automotive high-temperature connectors, applications where traditional thermoplastics or metal assemblies add weight, complexity or signal degradation. Buyers are therefore willing to pay a premium for LCP 3D printing when it reduces assembly steps, improves electrical performance, or shortens time-to-market for critical subsystem designs.

A substantial opportunity lies in using LCP 3D printing to collapse multi-part assemblies into monolithic, tuned components for RF front-ends, phased-array subcomponents, and compact power electronics. Service bureaus and OEMs can monetize this by offering design-for-additive libraries, certified material-process pairings, and short-run production contracts for high-mix, low-volume programs. There is additional upside in licensing material recipes and qualification workflows to defense and medical supply chains where traceability and rapid reconfiguration create competitive advantage.

Widespread scale-up is constrained by three interlocking issues: raw material and powder/resin costs that are substantially higher than commodity thermoplastics, the need for specialized high-temperature processing platforms to control crystallinity and shrinkage, and lengthy qualification cycles for regulated sectors.

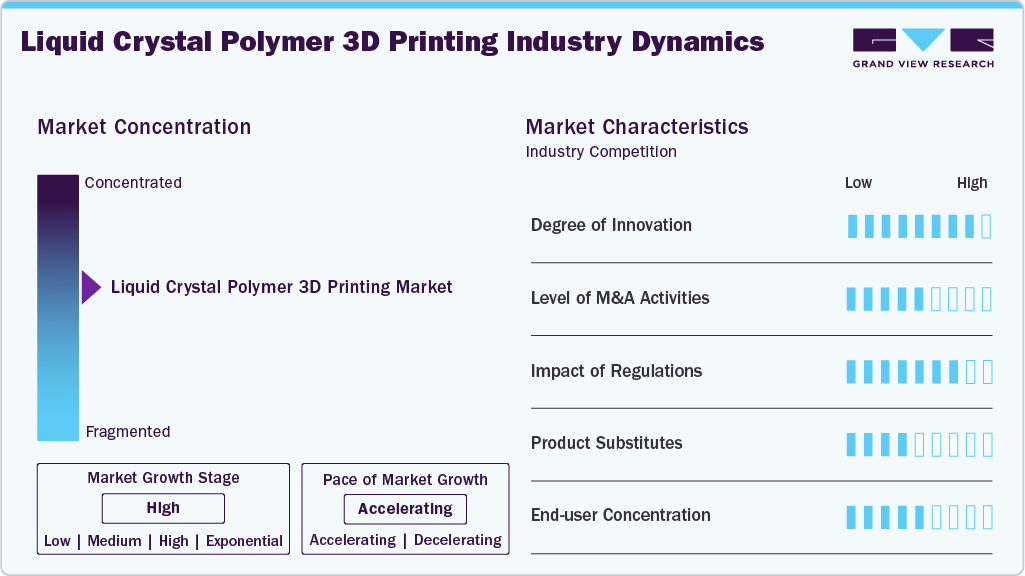

Market Concentration & Characteristics

The market growth stage of the LCP 3D printing market is high, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies like Celanese Corporation, Polyplastics Co., Ltd., Sumitomo Chemical Co., Ltd., Syensqo, RTP Company, Ensinger, Avient, NematX, Zeus, Toray Industries Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

Liquid crystal polymers are moving beyond niche prototyping into a genuinely innovative platform because their molecular order enables stable, low-loss electrical behavior at GHz frequencies while still being adaptable to additive processing; this combination is unlocking single-step fabrication of electrically functional parts (antennas, RF housings) that previously required multi-material assemblies. On the process side, innovation is coming from co-optimization of feedstock chemistry and high-temperature extrusion platforms to control crystallinity, dimensional shrinkage and surface plateability, which together create repeatable end-use performance rather than one-off prototypes.

LCP faces direct substitution pressure from other high-performance thermoplastics such as PEEK, PEKK and polyetherimide (ULTEM) where buyers trade printability and cost against mechanical toughness and regulatory provenance; these polymers already have mature extrusion ecosystems and aerospace/medical certifications. For electrical or thermal-critical parts, metal additive manufacturing and machined metal components remain substitutes when structural stiffness or thermal conduction outweigh dielectric needs; conversely, commodity polymers and engineered films compete on cost for non-critical applications.

Product Type Insights

Pellets/granules dominated the LCP 3D printing market across the product segmentation in terms of revenue, accounting for a market share of 48.85% in 2024, and is forecasted to grow at the fastest CAGR of 13.5% from 2025 to 2033. The dominant commercial driver for pellets and granules is their cost efficiency at scale and compatibility with industrial pellet extrusion and high throughput screw-based 3D printers. Large OEMs and contract manufacturers prefer pellet feedstock because it lowers per kilogram material cost, shortens supply chains through direct resin-to-feedstock conversion, and allows easier blending of additive fillers and flame retardants to meet certifications. This makes pellets the preferred route for qualifying supply chains and moving LCP from lab trials into serial part production.

The filament segment is anticipated to grow at a substantial CAGR of 12.9% over the forecast period. Filament-based LCP printing is gaining traction where part complexity and distributed manufacturing matter more than raw material cost. Filament enables desktop and industrial fused deposition workflows with lower capital outlay than specialized pellet extruders, shortening iteration cycles for design validation and small batch production. Service bureaus and electronics OEMs are adopting filament to rapidly qualify material-process pairs and to support geographically dispersed prototyping hubs while managing inventory across networks.

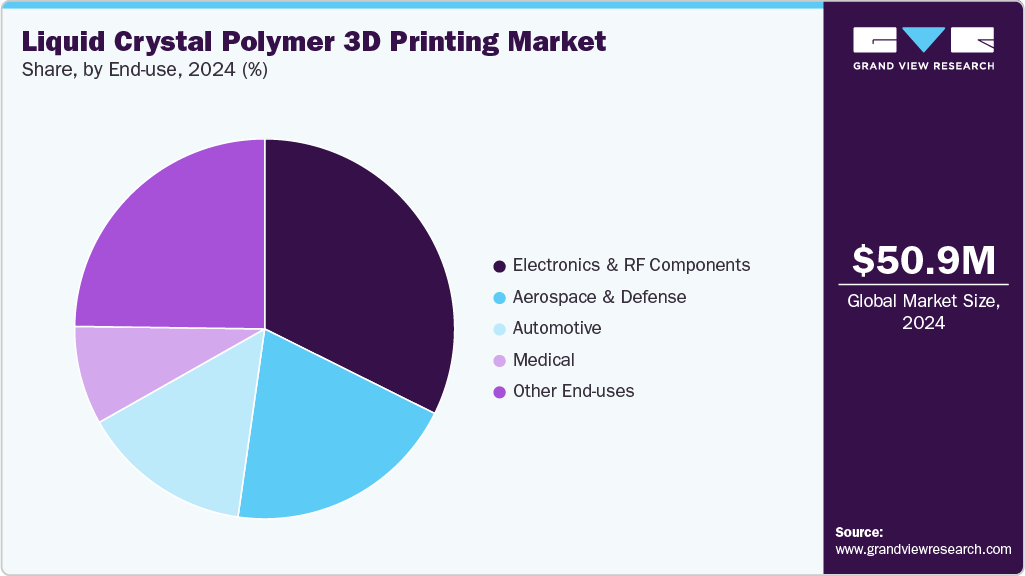

End Use Insights

Electronics & RF components segment dominated the LCP 3D printing market with a revenue share of 32.35% in 2024 and is forecasted to grow at a CAGR of 13.0% CAGR from 2025 to 2033. The electronics market is uniquely motivated by LCP’s ultra-low dielectric loss and stable behavior at gigahertz frequencies, which directly improves antenna efficiency, substrate performance and signal integrity for 5G and beyond. Designers are consolidating multi-piece RF assemblies into single printed parts to reduce connector interfaces and parasitic effects, and suppliers are responding with LCP grades tailored for precise dielectric control and traceability required by module manufacturers. This performance-led substitution is accelerating LCP qualification across RF front ends and high density interconnects.

The aerospace & defense segment is expected to expand at the fastest CAGR of 13.4% over the forecast period. LCP 3D printing is driven less by price and more by verified benefits in weight, thermal stability and chemical resistance under extreme environments. Programs target structural RF components, sensor housings and small ducts where additive consolidation reduces fasteners and inspection points, while research into LCP behavior under space conditions is creating a pathway for certification in orbital and high altitude applications. The combination of demonstrable in-service performance and ongoing material validation is converting experimental use into procurement-ready specifications.

Regional Insights

North America liquid crystal polymer 3D printing marketheld the largest revenue share of 37.82% in 2024 and is expected to grow at the fastest CAGR of 12.0% over the forecast period. Adoption in North America is driven by defense and homeland security requirements for on-demand traceable manufacture of mission-critical components where LCP’s electrical stability and thermal resilience reduce integration risk. Federal and prime-contractor initiatives to shorten supply chains and certify additive workflows are funding materials qualification and pilot lines that de-risk LCP for field-deployable RF housings and sensor modules. This procurement focus creates upstream demand for validated material-process pairings and accredited service bureaus.

Meanwhile, large contract manufacturers and tier-one OEMs in North America favor pellet-based LCP feedstocks because they enable lower per-unit costs and tighter integration with extrusion-based high-throughput printers. These buyers are investing in downstream process control, in-house material compounding, and supplier partnerships to industrialize LCP printing for medium-volume runs, shifting the technology from lab demonstrations to factory-floor production.

U.S. Liquid Crystal Polymer 3D Printing Market Trends

In the U.S., concentrated public and private investment in additive manufacturing-backed by standards development and events such as RAPID+TCT-accelerates LCP adoption by funding interoperability, qualification research, and workforce training. The combined effect is faster certification cycles for aerospace and defense subcomponents, and a growing ecosystem of equipment vendors, materials developers, and service bureaus that can commercialize LCP for regulated sectors.

Europe Liquid Crystal Polymer 3D Printing Market Trends

European momentum for LCP 3D printing is anchored in an aerospace and automotive supplier network that prizes certified materials and sustainable manufacturing footprints; regional players are investing in validated workflows and plateable or dielectric-tuned grades to meet EU procurement and recyclability expectations. Public-private R&D consortia and specialist materials startups are therefore prioritizing LCP formulations that can meet stringent qualification regimes while enabling part consolidation for premium segments.

Asia Pacific Liquid Crystal Polymer 3D Printing Market Trends

The region’s dominant position in electronics manufacturing creates immediate demand for LCP because of its superior GHz-frequency performance and suitability for compact RF assemblies used in 5G and high-density connectors. Local supply-chain depth in China, Japan, and South Korea, combined with rapid commercial 5G rollouts and large-scale contract manufacturing, shortens adoption cycles for LCP grades tailored to antenna and molded interconnect device applications.

Key Liquid Crystal Polymer 3D Printing Company Insights

The Liquid Crystal Polymer (LCP) 3D Printing market is highly competitive, with several key players dominating the landscape. Major companies include Celanese Corporation, Polyplastics Co., Ltd., Sumitomo Chemical Co., Ltd., Syensqo, RTP Company, Ensinger, Avient, NematX, Zeus, and Toray Industries Inc. The LCP 3D printing market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Liquid Crystal Polymer 3D Printing Companies:

The following are the leading companies in the liquid crystal polymer 3D printing market. These companies collectively hold the largest market share and dictate industry trends.

- Celanese Corporation

- Polyplastics Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Syensqo

- RTP Company

- Ensinger

- Avient

- NematX

- Zeus

- Toray Industries Inc.

Recent Developments

-

In October 2024, a multi-institution research collaboration (including TU Delft and ETH Zürich) published a study demonstrating reliable 3D printing of liquid crystal polymers for space and high-frequency applications. The work validated printable Vectra-based filaments and outlined process-control strategies to manage crystallinity and anisotropy for qualification in demanding environments.

-

In July 2024, POLYPLASTICS announced a strategic investment and R&D alliance with NEMATX to co-develop next-generation 3D-printable LCP grades and scale manufacturable feedstocks. The partnership combines Polyplastics’ LCP processing expertise with NEMATX’s extrusion platform to accelerate commercialization of certified LCP additive solutions for electronics and automotive markets.

Liquid Crystal Polymer 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.8 million

Revenue forecast in 2033

USD 148.6 million

Growth rate

CAGR of 12.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Celanese Corporation; Polyplastics Co., Ltd.; Sumitomo Chemical Co., Ltd.; Syensqo; RTP Company; Ensinger; Avient; NematX; Zeus; Toray Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Crystal Polymer 3D Printing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, grand view research has segmented the global liquid crystal polymer 3D printing market report based on product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Tons, 2021 - 2033)

-

Pellets/Granules

-

Filament

-

Powders

-

Other Product Types

-

-

End Use Outlook (Revenue, USD Million; Volume, Tons, 2021 - 2033)

-

Electronics & RF Components

-

Aerospace & Defense

-

Automotive

-

Medical

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global liquid crystal polymer 3D printing market size was estimated at USD 50.9 million in 2024 and is expected to reach USD 56.8 million in 2025.

b. The global liquid crystal polymer 3D printing market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2033 to reach USD 148.6 million by 2033.

b. Electronics & RF components dominated the LCP 3D printing market across the end use segmentation in terms of revenue, accounting for a market share of 32.35% in 2024 and is forecasted to grow at 13.0% CAGR from 2025 to 2033.

b. Some key players operating in the LCP 3D printing market include Celanese Corporation, Polyplastics Co., Ltd., Sumitomo Chemical Co., Ltd., Syensqo, RTP Company, Ensinger, Avient, NematX, Zeus, and Toray Industries Inc.

b. Growing demand for lightweight and heat-resistant components in aerospace, automotive, and electronics sectors is driving the use of LCP 3D printing. Companies are adopting it to reduce part weight, improve reliability, and streamline production of complex geometries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.