- Home

- »

- Advanced Interior Materials

- »

-

Liquid Desiccant HVAC Systems Market, Industry Report 2033GVR Report cover

![Liquid Desiccant HVAC Systems Market Size, Share & Trends Report]()

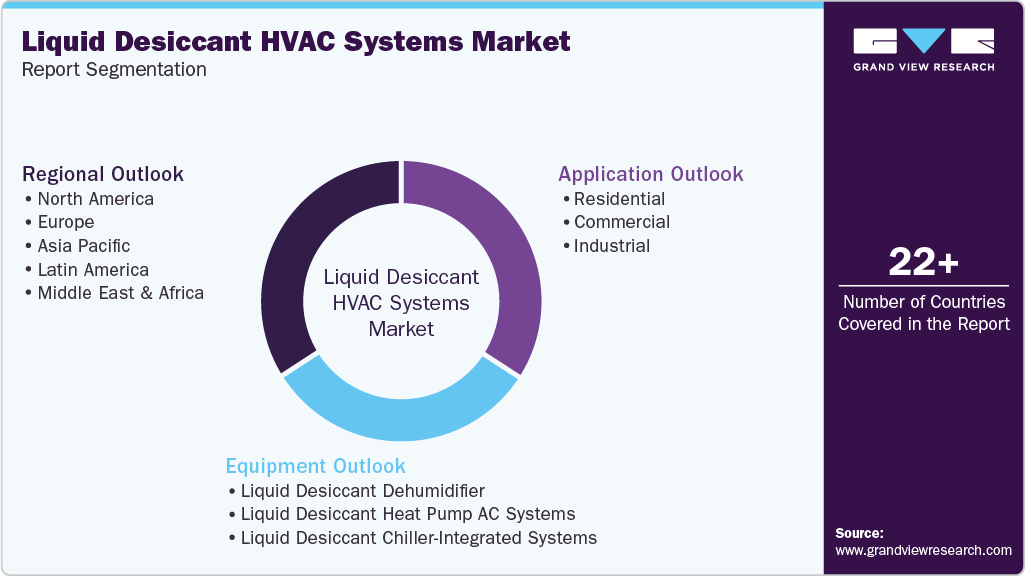

Liquid Desiccant HVAC Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Liquid Desiccant Dehumidifier, Liquid Desiccant Heat Pump AC Systems) By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-771-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Desiccant HVAC Systems Market Summary

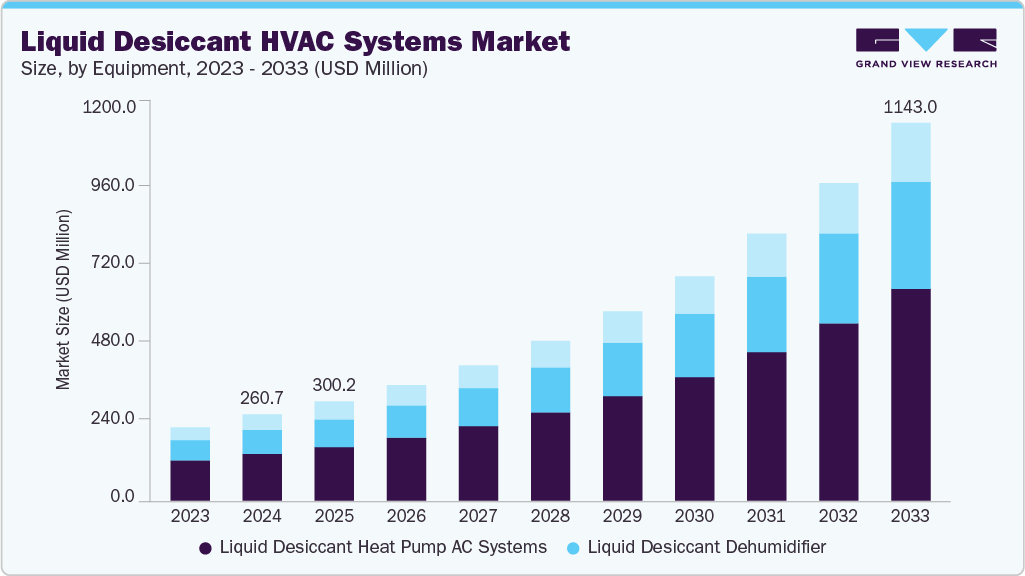

The global liquid desiccant HVAC systems market size was estimated at USD 260.7 million in 2024 and is projected to reach 1,143.0 million by 2033, growing at a rapid CAGR of 18.2% from 2025 to 2033.The market is primarily driven by the increasing need for energy-efficient and sustainable cooling solutions across various sectors.

Key Market Trends & Insights

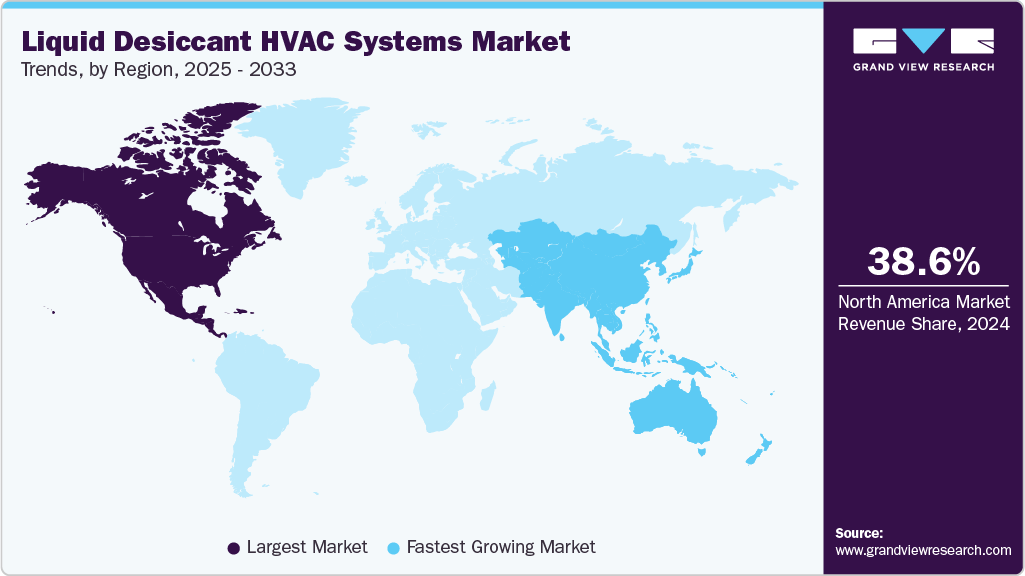

- North America dominated the global liquid desiccant HVAC systems industry with the largest revenue share of 38.6% in 2024.

- The U.S. liquid desiccant HVAC systems industry is projected to grow at a CAGR of 17.8% over the forecast period.

- By equipment, the liquid desiccant heat pump AC systems segment dominated the market in 2024 by accounting for a share of 54.2%.

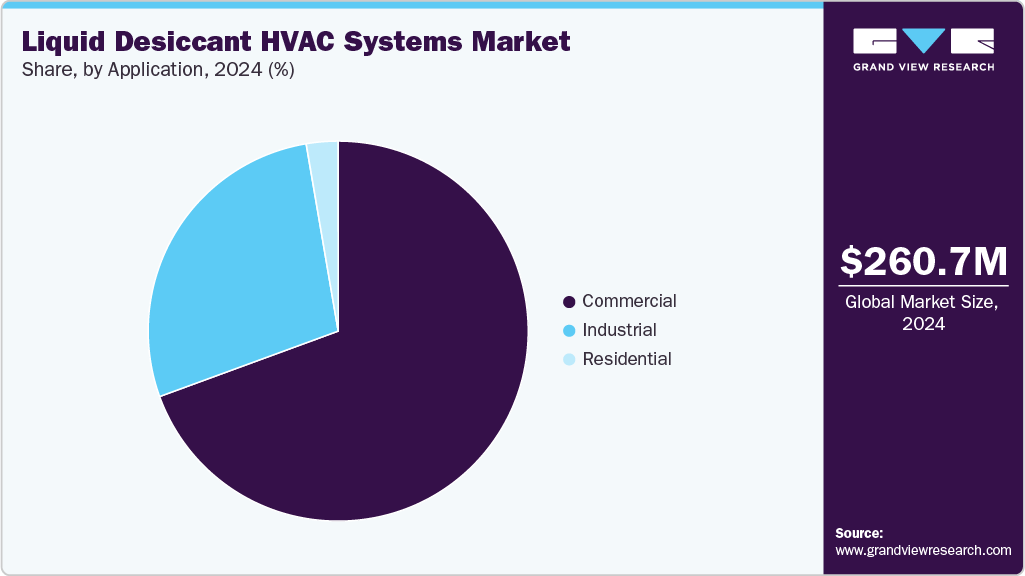

- By application, the commercial segment dominated the market in 2024 accounting for 69.4% of the revenue share.

Market Size & Forecast

- 2024 Market Size: USD 260.7 Million

- 2033 Projected Market Size: USD 1,143.0 Million

- CAGR (2025-2033): 18.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Governments and industry bodies worldwide are implementing stringent regulations to curb energy consumption and reduce greenhouse gas emissions, prompting the adoption of advanced HVAC technologies.

Liquid desiccant systems stand out for their ability to achieve precise humidity control and significantly enhance energy efficiency when compared to traditional HVAC options, especially in large commercial and industrial applications where operational costs and environmental impact are crucial considerations.

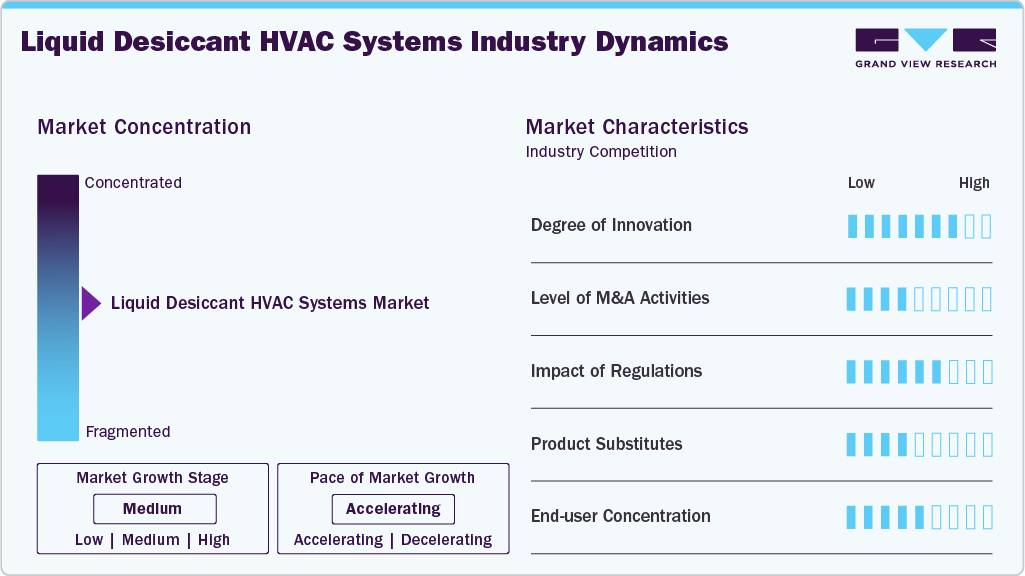

Market Concentration & Characteristics

The market is relatively concentrated and demonstrates a high degree of innovation, with ongoing advancements in material science, smart connectivity, and energy system integration transforming the product landscape. The sector witnesses active collaborations, numerous strategic mergers, and steady R&D investment as companies strive to differentiate their offerings and achieve compliance with evolving regulations that guide energy efficiency and air quality standards.

Regulatory frameworks play a decisive role, with environmental mandates, health codes, and industry-specific requirements driving product upgrades and adoption rates. Product substitutes such as conventional dehumidifiers and mechanical HVAC units remain prevalent, but liquid desiccant systems are increasingly capturing market share, especially among end users seeking advanced moisture control and sustainability credentials. Concentration among commercial building operators, healthcare facilities, and data center managers is relatively high, while residential uptake remains in its early stages, poised for growth as awareness and cost-effectiveness improve.

Drivers, Opportunities & Restraints

A significant market driver is the expansion of high-value industries such as healthcare, pharmaceuticals, data centers, and food processing, which demand stringent moisture control for operational stability and product quality. In these environments, liquid desiccant HVAC systems demonstrate excellent performance by delivering consistent dehumidification and air quality management, meeting both regulatory and process-related requirements. This alignment with critical end-user needs is fostering sectoral adoption and opening new application avenues that extend beyond conventional building cooling.

Opportunities in the global market arise from the evolving integration of liquid desiccant HVAC systems with real-time analytics, smart building technologies, and renewable energy solutions. Enhanced automation, combined with expanded government incentives for energy-efficient technologies, is expected to accelerate deployment in new sectors and regions. Strategic partnerships among manufacturers and service providers further support the evolution of customized solutions that target emerging application needs in modern urban environments.

Market restraints center on high initial investment costs and maintenance complexities, particularly for retrofitting in existing infrastructures. Specialized equipment, installation expertise, and ongoing upkeep, including regular desiccant replacement, contribute to affordability challenges for many potential users, especially in the residential segment, where consumer awareness is still limited. These factors slow the pace of adoption, despite recognized performance advantages.

Product Insights

The liquid desiccant heat pump AC systems segment dominated the market in 2024 by accounting for a share of 54.2% primarily due to the rising demand for solutions that combine energy efficiency with effective dehumidification in both commercial and industrial settings. Heat pump-assisted liquid desiccant systems offer superior humidity control, improved indoor air quality, and substantial operational cost savings, making them an attractive choice for end-users facing stringent regulatory and sustainability requirements.

The projected increase in demand for liquid desiccant dehumidifiers is based on a sharp rise in demand for energy-efficient humidity control across industries such as data centers, healthcare, and food processing, driven by stricter environmental regulations and sustainability initiatives. Technological advancements, including improved desiccant materials and integration with smart building systems, have substantially enhanced product performance and operational cost-efficiency. The combined effect of regulatory pressure, expanding industrial applications, and ongoing innovation is setting the stage for robust revenue growth well above the average HVAC segment rate.

Application Insights

The commercial segment dominated the market in 2024 accounting for 69.4% of the revenue share, driven by an increasing demand for precise humidity control in office buildings, data centers, museums, and other commercial spaces. Energy efficiency regulations and the need to protect sensitive equipment drive adoption. Technological advancements and sustainability goals are also fueling growth in this segment.

The industrial segment is expected to grow at a rapid CAGR of 17.5% from 2025 to 2033 in terms of revenue. The industrial segment’s growth is driven by rising demand for precise humidity control in critical manufacturing sectors such as pharmaceuticals, food and beverage, and electronics. Stringent quality and regulatory standards compel industries to invest in reliable liquid desiccant systems to ensure product quality and operational efficiency.

Regional Insights

The North America liquid desiccant HVAC systems industry dominated a 38.6% global market share in 2024. The market is driven by stringent energy efficiency regulations and high demand from the pharmaceutical and data center sectors, with strong adoption of green building practices accelerating market traction. The region’s climate extremes further increase the need for advanced humidity control solutions, making liquid desiccant HVAC systems critical for sustainability goals.

The U.S. liquid desiccant HVAC systems industry is projected to grow at a CAGR of 17.8% over the forecast period, expanding steadily with strong momentum from stringent energy efficiency mandates and rising demand in pharmaceuticals and data centers. Adoption of innovative, energy-saving HVAC systems is increasingly common in commercial and industrial sectors. Government incentives further encourage the transition to advanced liquid desiccant systems. Overall, sustainability and operational cost reduction priorities drive robust market growth.

Europe Liquid Desiccant HVAC Systems Market Trends

Europe liquid desiccant HVAC systems industry benefits from comprehensive regulatory frameworks focused on carbon reduction and green building certifications, driving growth in commercial and healthcare HVAC applications. Investments in sustainable infrastructure and energy-efficient technologies are key growth enablers. The shift to smart building standards further supports increased adoption of liquid desiccant systems.

Spain’s liquid desiccant HVAC systems industry growth is supported by government initiatives to enhance energy efficiency in buildings and reduce carbon emissions. Increasing construction and retrofit activities in commercial and healthcare sectors create demand for liquid desiccant HVAC solutions. Public and private investments focused on green building certifications are fueling adoption. Rising awareness of indoor air quality is also a key factor.

Italy liquid desiccant HVAC systems industry experiences market growth driven by stringent environmental regulations and the drive for energy-efficient HVAC solutions in commercial and industrial settings. Projects emphasizing sustainable infrastructure and modernization in urban centers stimulate demand. Adoption is further supported by government subsidies for clean energy technologies. Awareness of energy-saving HVAC systems grows among end users.

Asia Pacific Liquid Desiccant HVAC Systems Market Trends

The liquid desiccant HVAC systems industry in the Asia Pacific experiences rapid growth fueled by urbanization, industrialization, and government incentives for energy-efficient cooling technologies. Large-scale infrastructure projects and smart city initiatives in countries such as China, India, and Japan contribute significantly. Rising awareness of indoor air quality enhances demand in residential and commercial sectors.

The liquid desiccant HVAC systems industry in China is driven by rapid urbanization, industrial expansion, and government policies promoting energy-efficient technologies, supporting a rapid market growth. Large-scale smart city and infrastructure projects incorporate liquid desiccant HVAC systems for enhanced air quality and energy savings. Environmental regulations and sustainability commitments strongly influence adoption. Increasing industrial applications foster continual expansion.

India's liquid desiccant HVAC systems industry, growing commercial real estate market and industrial sector, combined with supportive government energy efficiency programs, drive demand. Rising awareness of indoor air quality and climate adaptability needs to reinforce interest. Large urban centers embrace smart building and green technology integration. Investment in clean energy initiatives propels market potential.

Middle East & Africa Liquid Desiccant HVAC Systems Market Trends

The Middle East & Africa liquid desiccant HVAC systems industry grows gradually, driven by climatic challenges and increased focus on sustainability in the hospitality, healthcare, and food processing industries. Modernization of urban infrastructure and government initiatives for energy conservation reinforce growth. The region’s need for reliable, energy-efficient humidity control systems is steadily increasing.

Saudi Arabia’s liquid desiccant HVAC systems industry growth is fostered by extreme climatic conditions, driving demand for advanced cooling and dehumidification. Government initiatives promoting sustainable development and smart cities encourage adoption. The hospitality and healthcare sectors increasingly require reliable humidity control. Investments in energy-efficient urban infrastructure underpin steady market expansion.

Latin America Liquid Desiccant HVAC Systems Market Trends

The liquid desiccant HVAC systems industry growth stems from emerging energy efficiency regulations and expanding commercial infrastructure, particularly in Brazil and Mexico. Increasing focus on sustainable development and eco-friendly HVAC solutions supports market expansion. Adoption is also supported by rising construction activity and modernization efforts.

Argentina's liquid desiccant HVAC systems industry grows steadily with the modernization of commercial infrastructure and increased focus on sustainability. Energy efficiency regulations are gradually strengthening and driving demand for liquid desiccant HVAC systems. Expansion in urban developments and government support for eco-friendly solutions contribute.

Key Liquid Desiccant HVAC Systems Company Insights

Some of the key players operating in the market include Mojave Energy Systems and 7AC Technologies, Inc. (Emerson Electric Co):

-

Alfa Laval designs and manufactures equipment for heat transfer, separation, and fluid handling. Its core product range includes plate heat exchangers, centrifugal separators, pumps, valves, and tubular heat exchangers, supported by aftermarket services such as spare parts supply and performance audits. The company is publicly listed on Nasdaq Stockholm.

-

7AC Technologies, Inc., designs membrane-based liquid desiccant HVAC systems for commercial and industrial buildings. The company, formerly known as 7Solar Technologies, created a highly efficient liquid desiccant air-conditioning approach that enables independent control of temperature and humidity within a single device, eliminating the energy losses associated with overcooling and reheat cycles.

Key Liquid Desiccant HVAC Systems Companies:

The following are the leading companies in the liquid desiccant HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval

- AirGreen, Inc.

- Blue Frontier

- Mojave Energy Systems

- Copeland LP

- Ventilex

- AOLAN

- 7AC Technologies,Inc. (Emerson Electric Co)

Recent Developments

-

In June 2025, Mojave Energy Systems announced it expanded its sales partner program across 16 U.S. states and five Latin American countries, adding over 20 new partners. These partners will exclusively represent Mojave for commercial air conditioning customers in their regions.

-

In March 2025,Copeland LP partnered with KCC Companies HVAC to develop a new commercial dedicated outdoor air system (DOAS) incorporating Copeland’s HMX liquid desiccant module. The collaboration allows KCC to leverage Copeland’s R&D and innovation capabilities, positioning both companies at the forefront of advanced liquid desiccant technology in the commercial HVAC market.

Liquid Desiccant HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 300.2 million

Revenue forecast in 2033

USD 1,143.0 million

Growth rate

CAGR of 18.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Alfa Laval; AirGreen, Inc.; Blue Frontier; Mojave Energy Systems; Copeland LP; Ventilex; AOLAN; 7AC Technologies Inc (Emerson Electric Co)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Desiccant HVAC Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global liquid desiccant HVAC systems market report based on equipment, application, and region.

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Desiccant Dehumidifier

-

Liquid Desiccant Heat Pump AC Systems

-

Liquid Desiccant Chiller-Integrated Systems

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global liquid desiccant HVAC systems market size was estimated at USD 260.7 million in 2024 and is expected to be USD 300.2 million in 2025.

b. The global liquid desiccant HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 18.2% from 2025 to 2033 to reach USD 1,143.0 million by 2033.

b. The North America market dominated the market in 2024, accounting for a 38.6% share driven by stringent energy efficiency regulations and strong demand from pharmaceutical and data center sectors.

b. Some of the key players operating in the global liquid desiccant HVAC systems market include Alfa Laval, AirGreen, Inc., Blue Frontier, Mojave Energy Systems, Copeland LP, Ventilex, AOLAN, and 7AC Technologies.

b. The key factors driving the global liquid desiccant HVAC systems market are the increasing demand for energy-efficient and sustainable cooling solutions and the rising need for precise humidity control in commercial and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.