- Home

- »

- Petrochemicals

- »

-

Liquid Synthetic Rubber Market Size, Industry Report, 2030GVR Report cover

![Liquid Synthetic Rubber Market Size, Share & Trends Report]()

Liquid Synthetic Rubber Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Liquid Isoprene Rubber (IR), Liquid Butadiene Rubber (BR), Liquid Styrene Butadiene Rubber (SBR)), By Region And Segment Forecasts

- Report ID: GVR-2-68038-769-8

- Number of Report Pages: 138

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Synthetic Rubber Market Trends

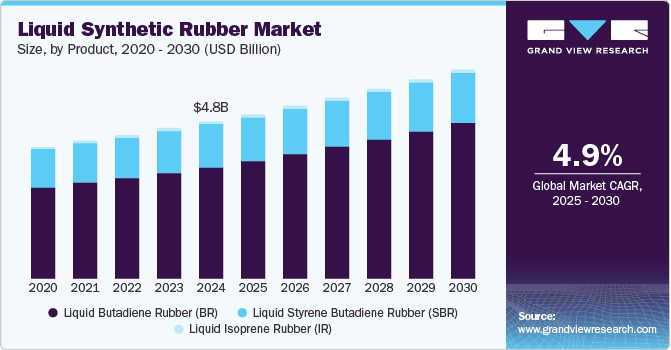

The global liquid synthetic rubber market size was valued at USD 4.81 billion in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030, attributed to expanding industrial applications and continuous technological advancements. Industries such as automotive, construction, and manufacturing benefit from its use in adhesives, coatings, and sealants, as it offers superior performance and adaptability. Application across different end-use sectors has boosted the growth of the synthetic rubber industry.

Technological innovations have further improved their durability, elasticity, and environmental friendliness, making them a preferred choice in high-demand sectors. These enhancements ensure the material can meet the evolving requirements of modern industries, contributing to its widespread adoption and increasing its significance in various applications.

Rising demand from the automotive industry and increasing preference for sustainable, high-performance materials are set to drive the liquid synthetic rubber industry. In the automotive sector, liquid synthetic rubber plays a vital role in manufacturing durable tires, seals, and hoses, enhancing efficiency and performance. Furthermore, the global shift toward eco-friendly solutions has driven the increased use of synthetic alternatives to traditional materials. Enhanced quality and sustainability advancements have enabled liquid synthetic rubber to meet these changing demands, strengthening its role across diverse applications and contributing to the liquid synthetic rubber industry growth.

Product Insights

The Liquid Butadiene Rubber (BR) segment held the largest revenue share of 70.8% in 2024, driven by its exceptional elasticity, durability, and abrasion resistance. These qualities make it essential material for the automotive and construction industries, where long-lasting performance is a priority. Its adaptability in adhesive and sealant formulations also boosts its appeal across various applications. Moreover, BR's cost-effectiveness compared to other options ensures its widespread adoption, reinforcing its prominence in the liquid synthetic rubber industry.

The Liquid Isoprene Rubber (LIR) segment is anticipated to grow at a significant CAGR of 3.5% over the forecast period, attributed to its unique properties and expanding application scope. LIR is known for its excellent elasticity, resilience, and low-temperature performance. It is increasingly used in manufacturing adhesives, sealants, and specialty rubbers. Its high demand in precision industries such as automotive, electronics, and medical devices highlights its versatility and reliability. The global shift toward sustainable and high-performance materials further supports the adoption of LIR and is expected to create immense market potential over the forecast period.

Regional Insights

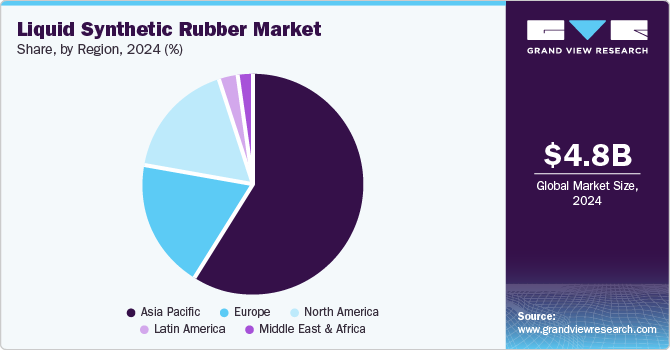

North America liquid synthetic rubber market is expected to grow at a significant rate from 2025 to 2030 due to the increasing demand for eco-friendly and high-performance materials and growing construction sector. Builders and manufacturers are prioritizing adhesives and sealants that offer durability while aligning with sustainability goals. Liquid synthetic rubber, known for its reliability and adaptability, perfectly fits these requirements. The ongoing surge in infrastructure projects in the region further amplifies the need for advanced materials, cementing synthetic rubber's role in construction and environment-conscious manufacturing processes.

U.S. Liquid Synthetic Rubber Market Trends

TheU.S. liquid synthetic rubber market held the largest share in 2024, fueled by the industry's shift toward high-performance materials and continuous innovations. Enhanced synthetic rubber formulations now offer greater durability, elasticity, and adaptability, making them vital for use in various applications in the automotive, construction, and manufacturing sectors. These advancements meet the demand for resilient and efficient materials and address environmental considerations, aligning with modern industry trends. The focus on superior performance and technological progress is expanding the demand for synthetic rubber in diverse applications, thereby reinforcing its importance in the U.S. market.

Europe Liquid Synthetic Rubber Market Trends

Europe liquid synthetic rubber market is set to witness significant expansion over the forecast period, propelled by the rising demand for lightweight materials and specialized rubber for electric vehicle (EV) production. Lightweight materials are critical in automotive design for enhancing fuel efficiency and reducing emissions. Furthermore, the expansion of EV manufacturing has created a need for advanced synthetic rubber materials that offer superior insulation, flexibility, and durability. These requirements are accelerating the adoption of liquid synthetic rubber in various automotive applications, reflecting the region’s push toward innovative, efficient, and eco-friendly solutions in mobility and engineering.

Asia Pacific Liquid Synthetic Rubber Market Trends

Asia Pacific liquid synthetic rubber market held the largest revenue share of 60.5% in 2024, owing to the surge in demand for synthetic rubber in tire production and vehicle components. Synthetic rubber, owing to its superior performance characteristics, plays a crucial role in the production of durable and high-performance tires, addressing the demands of key markets such as China and India. The increasing adoption of electric vehicles (EVs) across the region has also led to heightened demand for specialized synthetic rubber materials that contribute to energy efficiency and sustainability. These developments highlight the importance of synthetic rubber in transforming mobility solutions.

China liquid synthetic rubbe market is expected to grow at the fastest CAGR during the forecast period. The industry is growing steadily, supported by the expanding application scope of liquid synthetic rubber in medical devices and packaging solutions. In the medical field, synthetic rubber is increasingly used for equipment requiring precision, durability, and flexibility, such as surgical tools and seals, ensuring reliable performance. Moreover, the rapid growth of the packaging industry has created a demand for flexible and resilient materials for packaging industrial and consumer goods. These developments emphasize the importance of liquid synthetic rubber in the ever-advancing healthcare and packaging industries in China.

Key Liquid Synthetic Rubber Company Insights

Some of the key companies in the liquid synthetic rubber industry include Synthomer plc; Royal Adhesives & Sealants (H.B. Fuller Company); TER Chemicals GmbH & Co. KG (TER HELL & CO GMBH); Kuraray Co., Ltd.; Evonik Industries AG; NIPPON SODA CO., LTD.; Asahi Kasei Corporation; ENEOS Corporation; JSR Corporation; and China Petrochemical Corporation.

-

Synthomer plc specializes in high-performance polymers and ingredients for industries including adhesives, coatings, and construction. Its innovative solutions focus on sustainability, serving diverse sectors globally with tailored, reliable, and eco-friendly products.

-

Kuraray Co., Ltd delivers innovative solutions across various industries, offering high-performance materials such as resins, elastomers, synthetic fibers, textiles, and medical products. Its eco-friendly technologies cater to automotive, packaging, construction, and healthcare sectors.

Key Liquid Synthetic Rubber Companies:

The following are the leading companies in the liquid synthetic rubber market. These companies collectively hold the largest market share and dictate industry trends.

- Synthomer plc

- Royal Adhesives & Sealants (H.B. Fuller Company)

- TER Chemicals GmbH & Co. KG (TER HELL & CO GMBH)

- Kuraray Co., Ltd.

- Evonik Industries AG

- NIPPON SODA CO., LTD.

- Asahi Kasei Corporation

- ENEOS Corporation

- JSR Corporation

- China Petrochemical Corporation

Recent Developments

-

In May 2023, Idemitsu Kosan, Kumho Petrochemical, and Sumitomo Corporation agreed to jointly advance sustainable polymers and chemicals in Asia. Idemitsu will manufacture bio-SM via the mass balance method, while Kumho Petrochemical will develop bio-SSBR for high-performance tires.

-

In May 2021, ENEOS Corporation agreed to acquire JSR Corporation's elastomers business, renowned for producing high-quality synthetic rubber, including Solution Polymerization Styrene-Butadiene Rubber (SSBR). This move enabled ENEOS to strengthen its footprint in the synthetic rubber sector and utilize JSR's expertise in advanced tire materials, essential for fuel-efficient and high-performance tire treads.

Liquid Synthetic Rubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.03 billion

Revenue forecast in 2030

USD 6.39 billion

Growth Rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; France; Germany; Russia; U.K.; China; India; Japan; South Korea; Argentina; Brazil; South Africa

Key companies profiled

Synthomer plc; Royal Adhesives & Sealants (H.B. Fuller Company); TER Chemicals GmbH & Co. KG (TER HELL & CO GMBH); Kuraray Co., Ltd.; Evonik Industries AG; NIPPON SODA CO., LTD.; Asahi Kasei Corporation; ENEOS Corporation; JSR Corporation; and China Petrochemical Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Synthetic Rubber Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global liquid synthetic rubber market report based on product and region:

-

Product by Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid Isoprene Rubber (IR)

-

Adhesive

-

Sealants & coatings

-

Industrial rubber components

-

Tire manufacturing

-

Others

-

-

Liquid Butadiene Rubber (BR)

-

Industrial rubber manufacturing

-

Polymer modification

-

Tire manufacturing

-

Others

-

-

Liquid Styrene Butadiene Rubber (SBR)

-

Tire manufacturing

-

Polymer modification

-

Adhesives

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Russia

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.