- Home

- »

- Agrochemicals & Fertilizers

- »

-

Isoprene Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Isoprene Market Size, Share & Trends Report]()

Isoprene Market (2023 - 2030) Size, Share & Trends Analysis Report By Grade (Polymer, Chemical), By Application (Tires, Adhesives, Industrial Rubber, Others), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-1-68038-564-9

- Number of Report Pages: 76

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Isoprene Market Summary

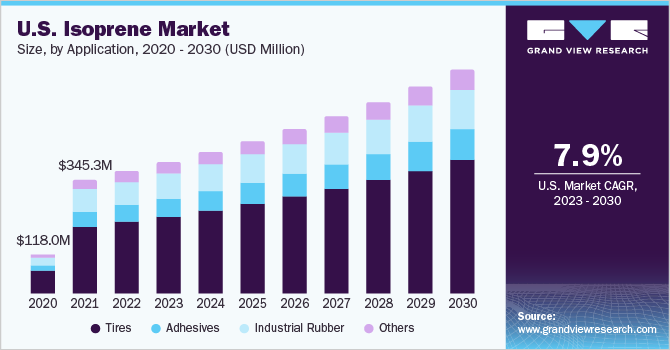

The global isoprene market size was valued at USD 4,615.8 million in 2022 and is projected to reach USD 8,437.8 million by 2030, growing at a CAGR of 7.8% from 2023 to 2030. This growth is attributable to its vast use in tire manufacturing, which is an integral part of automotive manufacturing.

Key Market Trends & Insights

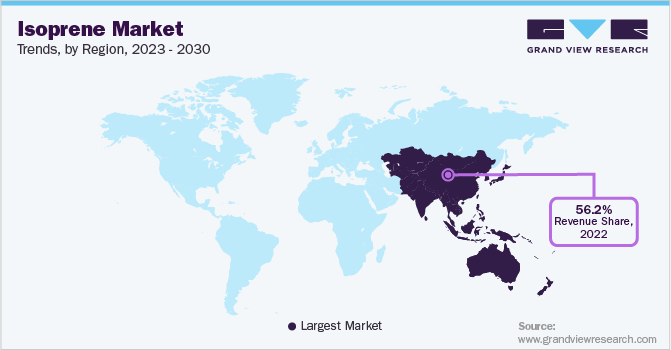

- Asia Pacific dominated the isoprene market with the largest revenue share of 56.2% in 2022.

- By application, the tires segment held the largest revenue share of 58.15% in 2022.

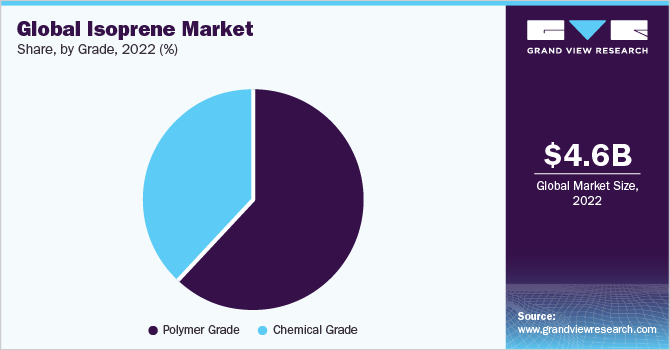

- By grade, the polymer grade segment held the largest revenue share of 62.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4,615.8 Million

- 2030 Projected Market Size: USD 8,437.8 Million

- CAGR (2023-2030): 7.8%

- Asia Pacific: Largest market in 2022

Growing demand for automobiles propelled by increasing individual income is the key factor behind the growth of the tire market. Growth in the demand for tires is expected to further escalate the product demand in the upcoming years. The growth in demand for isoprene is majorly propelled by its rising consumption in the production of rubber, tires, and adhesives. The product is characterized as a hydrocarbon compound, which is largely manufactured for its use in synthetic rubber production.

Isoprene is a colorless and flammable gas that is important for the production of a range of products such as tires and synthetic rubbers. Apart from synthetic rubbers, isoprene is also utilized as a fuel additive and as a prominent feedstock in plastic production. Growing consumption of isoprene in a range of industrial applications is anticipated to be the key driving force for the product market over the forecast period.

Industrial rubber and plastics are used in a wide range of industries including automotive, consumer goods, electrical & electronics, and others. The automotive industry is the prominent consumer of industrial rubber and plastics. Most of the parts in the sitting area of automobiles, and are made up of either rubber or plastic. Plastics are commonly used in the dashboard of passenger cars, while rubber is highly used in the doors, seats, clutch & gear panels, steering, and others. Electrical & electronic devices are mostly produced with rubber and plastics. Growing automotive and electrical & electronics industries are anticipated to fuel the demand for the product in the coming years.

According to the Society of Indian Automobile Manufacturers (SIAM), about 3,792,356 passenger vehicles were sold in India in 2022 compared to 3,082,421 passenger vehicles sold in 2021. Growing purchase of automobiles is expected to drive the demand for tires and industrial rubbers, thereby, significantly contributing to the growth of the product market.

Application Insights

Tires dominated the application segment with the highest revenue share of 58.15% in 2022 This is attributable as it is extensively utilized in tire manufacturing for all types of vehicles. Isoprene is utilized in small quantities and formulated with isobutylene for the production of isobutylene-isoprene rubber, which was formally known as butyl rubber. These rubbers are mainly used in the inner lines of tires.

The product offers various robust mechanical properties at a very low cost, which has propelled its consumption in a range of engineering applications. Therefore, tire manufacturers rely heavily on isoprene to build strong and durable tires for vehicles. Growing automotive industry in strong economies such as China, India, the U.S., Germany, France, and others is the major driver propelling the demand for tires, thereby, positively influencing the growth of the product market

Isoprene is a vital ingredient used in the manufacturing of isoprene-styrene black polymers. These products are commonly used for the production of pressure-sensitive adhesives. The isoprene-based hydrocarbon resin offers excellent heat stability and is extensively consumed in the production of adhesives.

Adhesives are highly utilized in a range of industries including construction, automotive, consumer goods, textiles, electronics, and more. Isoprene-based adhesives provide better stability and a strong bond to the objects.

The product also provides water resistance to its adhesives, which offers a long-lasting effect on adhesives. Growing applications of adhesives from end-use industries are expected to augment the product demand in near future.

Grade Insights

The polymer grade segment dominated the market with the highest revenue share of 62.0% in 2022. This is attributable to owing to its applications similar to natural rubber. Polyisoprene is formed by joining multiple isoprene molecules, yielding four isomers, the most important of which are cis- and trans-isoprene. The rising demand for the product due to its various properties such as cold resistance, high resilience, and good tensile strength, is fueling the market for the polymer-grade product market. Isoprene is a clear and colorless liquid that contains 99.3% of its concentration and is commonly used in different industries.

Polymer-grade isoprene is used to make polyisoprene, which is then used to make tires, mechanical molded goods, motor mounts, shock-absorber bushings, and pipe gaskets. The increasing use of polyisoprene in a wide range of industrial goods is expected to drive the market demand for polymer grade in the coming years

The automobile tire is the major end-use application of isoprene owing to the increasing demand for vehicles. The global motor vehicle production reached 8,01,45 units in 2021, as per OICA. Increasing the production of automobiles will increase the production of tires. This will further result in increasing demand for the product.

Isoprene is used in the production of chemical compounds as an intermediate. Renewable energy can be generated with isoprene, which provides an alternative to fossil fuels that are rapidly depleting. The chemical grade of the product is also used in automotive adhesives such as hot melt, latex sealants, solutions, and crosslink.

The chemical-grade global product market will benefit from rising demand for adhesives and sealants. Other applications of the chemical-grade and liquid grade of the product include printing plates, coating, lubricants, and binders

Regional Insights

Asia Pacific dominated the product market with the highest revenue share of 56.2% in 2022. This is attributed to the growth of various end-use industries wherein it is used as a tire adhesive and an industrial rubber. An increase in the production of vehicles in the region fueled the demand for producing tires at a large scale, thereby surging the consumption of the product in Asia Pacific.

China is a prominent producer and consumer of rubber in the Asia Pacific owing to the presence of a large number of its manufacturers in the country. Moreover, according to the Government of West Bengal (India), among the major rubber-consuming countries India ranks fourth in rubber consumption globally, after China, the U.S., and Japan.

Rubber consumption per capita in India is currently at 1.2 kilograms, compared with a global average of 3.2 kilograms. Synthetic rubber consumption in the country surged at 15-20% year over year over the past five years. This reflects the potential for the growth of the rubber industry in India. Surging rubber production and consumption in India are increasing the market demand for the product in the country.

Key Companies & Market Share Insights

The market is fragmented and competitive with more companies operating and trying to enter the market. To meet the rising demand from the end-use industries, manufacturers are concentrating more on increasing the capacity of isoprene production. These manufacturers are continuously involved in R&D activities to create a variety of high-quality product lines.

The market is competitive owing to major players capturing the maximum market share while emerging players are constantly striving to increase their market share by engaging in innovation and new product launches. Some prominent players in the global isoprene market include:

-

Shell Plc

-

LyondellBasell Industries Holdings B.V.

-

Kuraray Co., Ltd.

-

ExxonMobil Corporation

-

Shandong Yuhuang Chemical Group Co., Ltd

-

Braskem

-

Chevron Phillips Chemical Company LLC

-

China Petrochemical Corporation

-

LOTTE Chemical Corporation

Isoprene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,960.0 million

Revenue forecast in 2030

USD 8,437.8 million

Growth Rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Russia; China; India; Japan; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Shell Plc; LyondellBasell Industries Holdings B.V.; Kuraray Co., Ltd.; ExxonMobil Corporation; Shandong Yuhuang Chemical Group Co., Ltd; Braskem; Chevron Phillips Chemical Company LLC; China Petrochemical Corporation; LOTTE Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

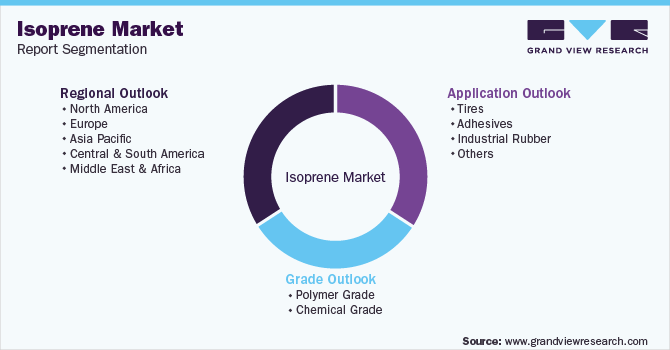

Global Isoprene Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global isoprene market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polymer Grade

-

Chemical Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tires

-

Adhesives

-

Industrial Rubber

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global isoprene market size was estimated at USD 4,615.8 million in 2022 and is expected to reach USD 4,960.0 million in 2023.

b. The global isoprene market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 8,437.8 million by 2030.

b. Asia Pacific dominated the isoprene market with a share of 56.2% in 2022. This is attributed to the growth of various end-use industries wherein it is used as a tire adhesive and an industrial rubber.

b. Some key players operating in the isoprene market include Shell Plc, LyondellBasell Industries Holdings B.V., Kuraray Co., Ltd., ExxonMobil Corporation, Shandong Yuhuang Chemical Group Co., Ltd, Braskem, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, LOTTE Chemical Corporation

b. Key factors that are driving the market growth include excessive use of isoprene in tire manufacturing, which is an integral part of automotive industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.